Armstrong Economics Blog/Interest Rates

RE-Posted Jan 25, 2018 by Martin Armstrong

QUESTION: AT the Institutional WEC session in 2016, you forecast that rates would rise but that the long-end would produce a positive yield for the next two years at least. Are we coming to an end of that forecast?

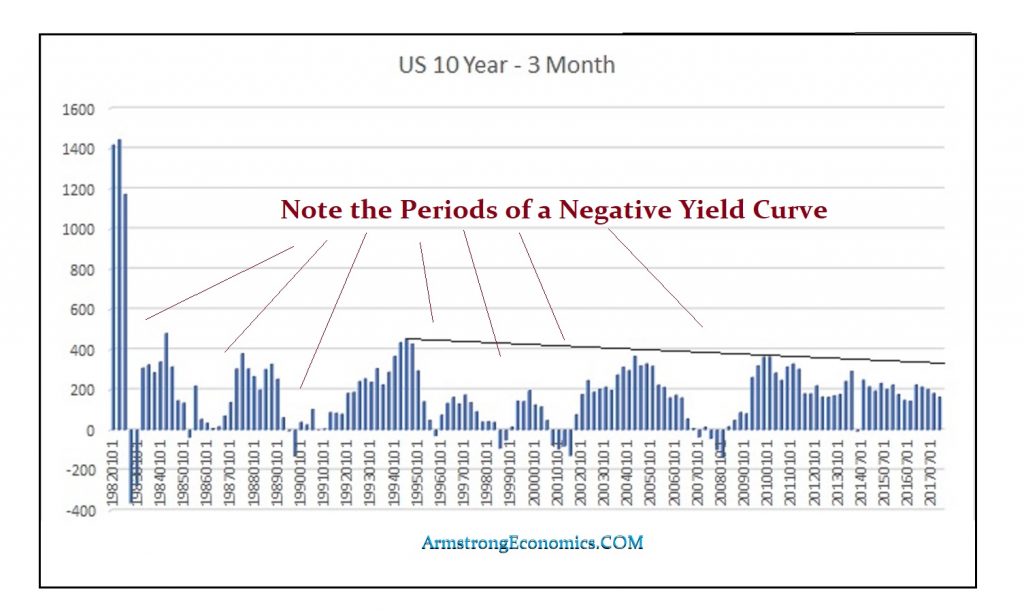

ANSWER: The new Institutional service is being expanded currently. Our hedging model positions have been added to the commentary. However, the consensus out there is that while the Fed is expected to raise rates 3 more times this year and 2 to 3 times next year, our models are projecting we are moving back toward a negative yield curve.

The last key high came at 3.65% premium for the 10-year during the first quarter 2010. The Quarterly Bearish Reversal rested at 2.61% and the next one presented a huge gap down to 0.87%. That first Quarterly Bearish was elected by the 3rd quarter 2010. The spread went negative in the 4th quarter 2013.

We will be adding the yield curve to the Institutional Levels. Those who have bought the long-term assuming that the short-term rate hikes will be modest for some time making a yield of about 2.65% attractive, may discover that the yield curve just may swing into a negative position again rather uncontrollably rather than intentionally.

We will be addressing this in more depth on the Institutional Blog.

On both the Professional Report for Individuals and for the Institutional Reports, Socrates writes a separate report for each time level in addition to a consolidated overview.

SAMPLE: INSTITUTIONAL REPORT FOR THE MONTHLY DOW JONES

This is not the complete report. Timing has been omitted in this version.

THE SOCRATES INSTITUTIONAL MONTHLY COMMENTARY, DOW JONES INDUSTRIALS AS OF THE CLOSE OF Fri. Jan. 19, 2018: Using our Monthly Hedging Model based on the Reversal System exclusively, we are currently long since Fri. Jan. 1, 2016 when we reversed our hedge position in this market.

The last Reversal elected was a Monthly Bullish during April 2017. From a speculative perspective, basis the Reversal System, we are currently hypothetically long 14 positions at this particular moment on the Monthly level. Closing support lies at 2245613. Only a daily closing below this level will signal a pause in the Monthly trend. This market is in a Breakout mode but is easing up right now yet it is still trading up year over year about 23.6%.

This market has been making new highs which has been a series of successive advances. The last 3 highs have been progressively making higher highs implying we have a bullish run in motion for the past 25 months. The Channel Technical Resistance stands at 2515199 for the next session. A closing above that will signal a breakout to the upside once again.

Regarding the near-term level, the market has closed up 21.2% from the last cycle low established April 2017, which has been only a 8-month rally as of last year. Nonetheless, turning to the long-term perspective, the market has still closed on the Monthly level up 60.8% from the strategic low established August 2015, which has been a 28-month rally from last year.

Our models for this month’s open on the monthly level was 2563170 which we opened below coming in at 2480935. We needed an opening print above that number to signal this was still in a strong breakout position. We have exceeded that number so far during the trading this month and we are still above it on the latest closing basis suggesting the market is still rather strong. The projected extreme target breakout resistance for this month stands at 2650939.

Critical support still underlies this market at 2170962 and a break of that level on a monthly closing basis would warn of a decline ahead becomes possible. Nevertheless, the market is trading above last month’s high showing some strength. On a broader perspective, this market remains in an uptrend posture on all our indicators looking at the monthly level. We see here the trend has been moving up for the past 28 months. The last monthly level low was 1537033, which formed during August 2015, and only a break of that high will see the market move high still. The last high on the monthly level was 2487607, which was created during December 2017, and has now been exceeded in the recent rally.

Currently, we have not elected any Monthly Bearish Reversals from this new high. The immediate Monthly Bearish Reversal to watch lies at 2170962. A closing beneath this level will signal a temporary high is in place. Additionally, a closing beneath 2392190 would also imply a pause, technically speaking, in the uptrend for now. Technical projected resistance for tomorrow stands at 2543813. Only exceeding that level would imply a runaway breakout to the upside.

Looking at our Pivot Points, the market is trading above one indicating pivot implying that this market is in a positive position with support at 2442269 and resistance at 2563170 and 2593155 this month.

ENERGY MODELS

Our Monthly Energy Models are still in a bullish mode given the fact that the market closed higher.

RISK

Turning to the monthly time level, we must respect that there is a 7.55% risk on the upside, where we show a clear downside risk factor at 16%. From a risk perspective, resistance on a closing basis stands at 2804252 whereas the risk on the downside begins at 2170962.

REVERSALS

The current overall tone on the Monthly level is very Bullish for right now electing four Monthly Bullish Reversals suggesting a strong trend move on this time level with the last Reversal being elected on April 2017.

The first key Monthly Bearish Reversal rests at 1601365. A bull market remains in play as long as that Reversal holds on a monthly closing basis. To confirm a mid-term change in trend to the downside, all four Monthly Bearish Reversals in this market would need to be elected meaning a monthly close beneath 2170962 is required. Our projected Bullish Reversals in this market are above beginning at 3373849. The Dow Jones Industrials is obviously in a full-blown bull market on the weekly to yearly levels of our model. Overall, the posture is quite bullish right now on the long-term perspective. Long-Term trend changes only when we elect monthly sell signals.

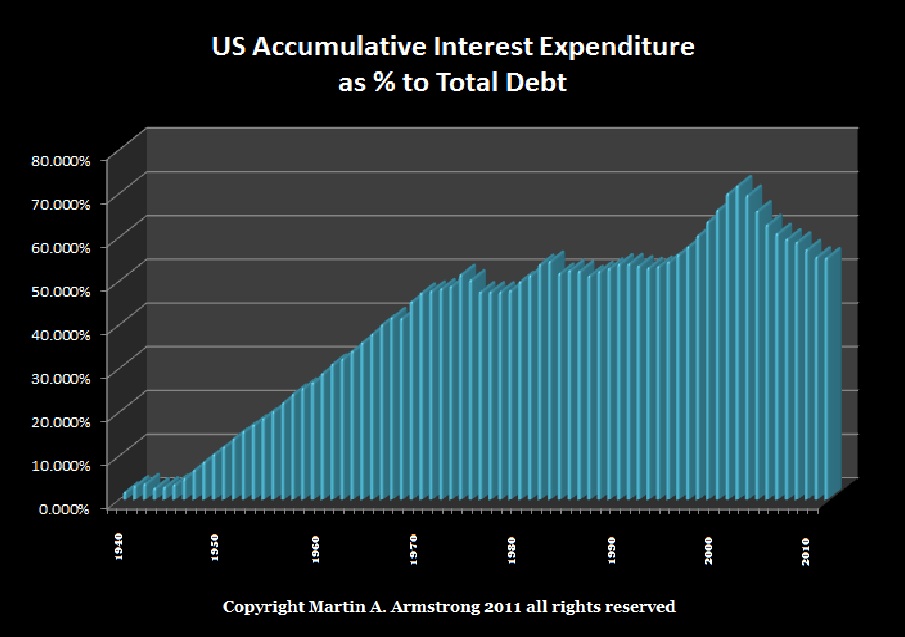

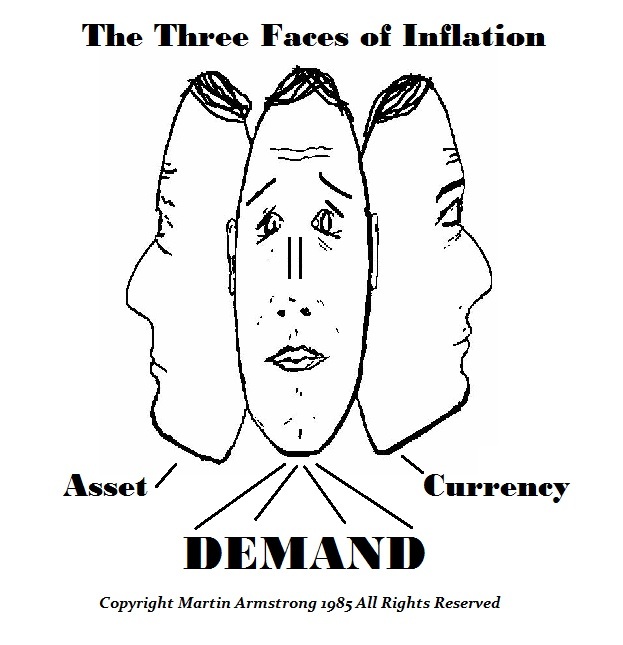

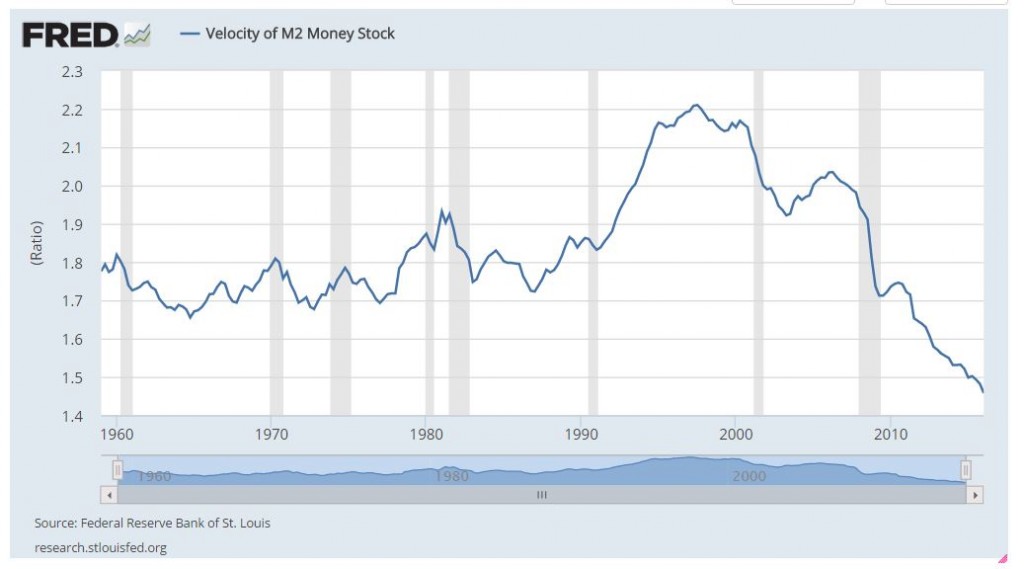

It comes down to a complex formula driven by CONFIDENCE. People are hoarding cash even though the quantity has increased in theory so the velocity of money has been declining. The higher the tax rate, the lower the economic growth as people hoard money (save) and that produces the decline in the velocity of money.

It comes down to a complex formula driven by CONFIDENCE. People are hoarding cash even though the quantity has increased in theory so the velocity of money has been declining. The higher the tax rate, the lower the economic growth as people hoard money (save) and that produces the decline in the velocity of money.