COMMENT: The Superbowl forecast is bigger than you think.

I’ve been an avid reader of your blog for over 3 years now and your insights cured me of my gold buggery. Thank You again.

The most important part of your Superbowl post in my opinion was the following:

“The Triple Crown was a piece of cake because it is the event I was forecasting, not the horse.”

Despite being an avid reader of the blog for some reason I never put together the 51.6year wave on the Superbowls – as a lifelong football fan this is SO fascinating to me!

Last year’s Superbowl was arguably the greatest ever played – The Patriots were down 28-3 and came back in the 4th quarter to win. Tom Brady passed Joe Montana and Terry Bradshaw by becoming the only QB to ever win 5 Superbowls.

In many ways, this was the peak or turning point for the NFL. Amazingly the anthem protests exploded onto the scene 7 months later – RIGHT AFTER WE WOULD HAVE PASSED the 51.6year mark from the start of the 1st Superbowl! The anthem issue has had a drastic impact on ratings – this year’s Superbowl posted the lowest ratings since 2009!

Even more interesting to me is the first 51 years of the Superbowl era was dominated by a handful of dynasties (Packers in the 60s, Steelers in the 70s, 49ers in the 80s, Cowboys in the 90s, Patriots ever since). During the 52nd Superbowl – which is the 1st one post 51.6yr – the Eagles (who had never won a Superbowl before) took down the greatest dynasty of the last era! They did so against the greatest QB-Head Coach tandem in history and did it with their BACKUP Quarterback who was only playing because the starter had torn his ACL.

The Eagles became the first team in Vegas history to be an underdog in all 3 playoff rounds and win every game!

I mean those are some really amazing “coincidences” in my mind!

But, again, I felt that you hit the nail on the head when you said you were FORECASTING the EVENT and not the HORSE! It makes so much more sense when you look at it that way. There’s too many teams, too many players/coaches/refs, it’s hard to predict THEM but predicting the EVENT does appear possible. Just amazing stuff! I can see now how this correlates to markets – you aren’t picking the people your seeing the event and using history as a guide to tell you how people will react when the event unfolds!

Every American institution including the FBI, Hollywood, US Gymnastics, US College Sports, and even the NFL is falling apart. It’s all about 2032 and the breakup! If you can forecast the event than the collapse of these institutions isn’t surprising. It’s just unbelievable what you’ve uncovered.

My mom was a follower of Gann and watching her work with that growing up allowed me to see how great your work is as an adult. I wish she was still alive so I could share your work with her. As a 28 year old I feel your insights have provided me a leg up on the rest of my generation just because of the mindset you’ve presented on the blog.

Thanks again for everything!

TC

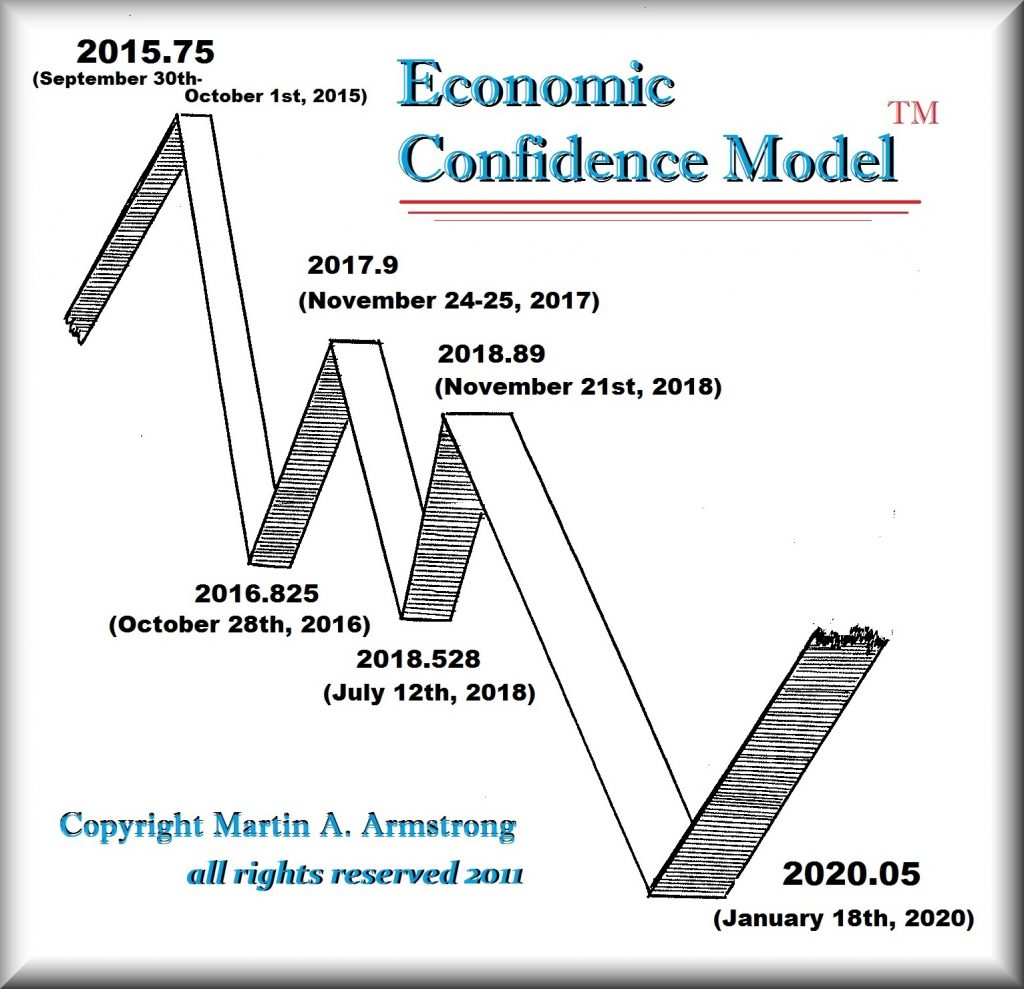

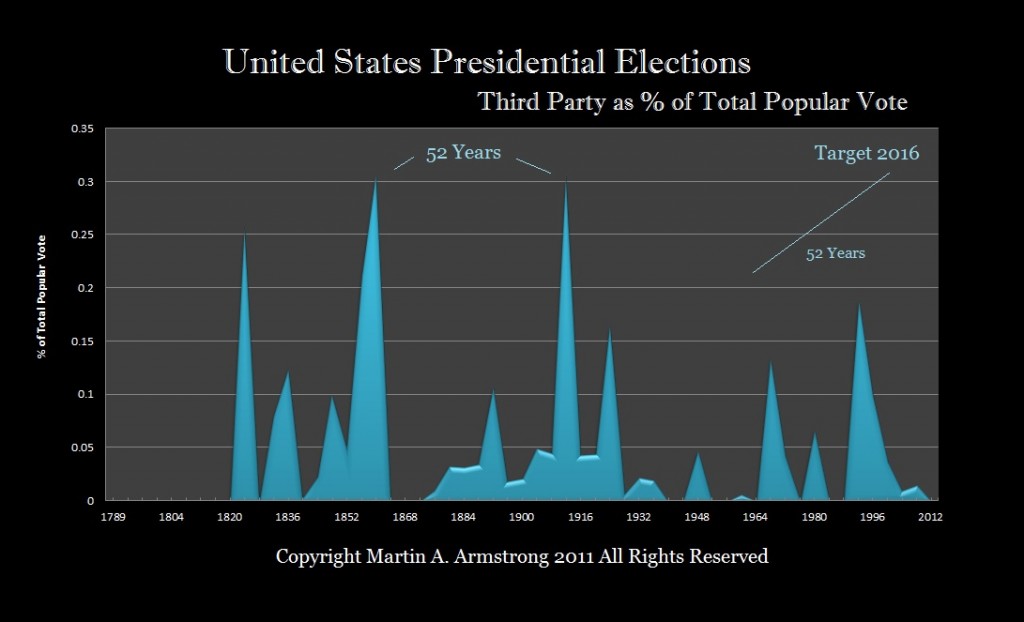

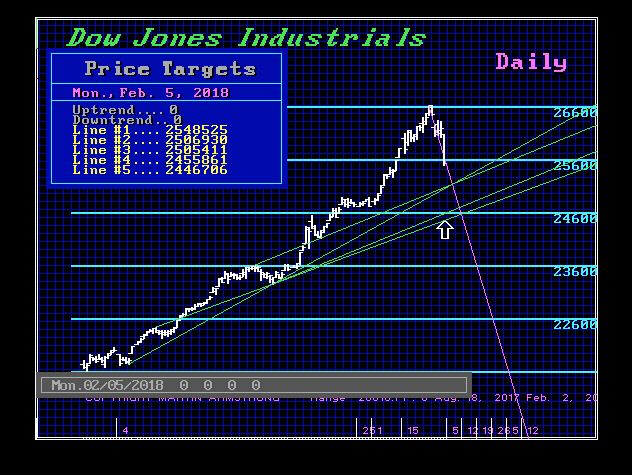

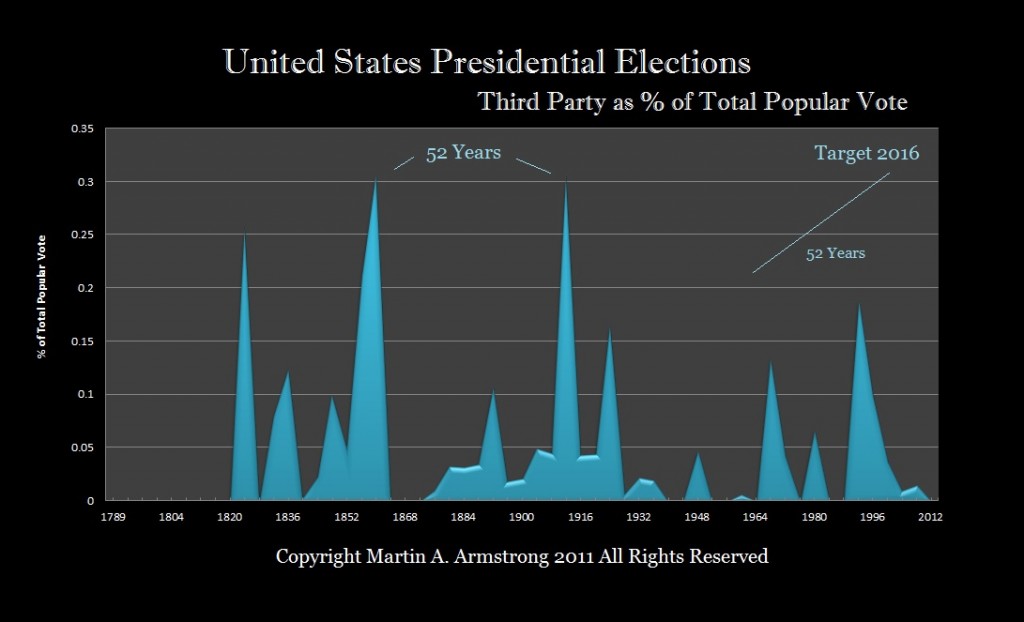

REPLY: Perhaps you are right. I have been doing this for a long-term so I am rarely surprised or impressed. I just expect it to unfold as shown. You are correct, I forecast the Presidential Election in 2016 back in 1985. I was forecasting the EVENT and not the people, such a Trump. Even when people criticise me, it is the person they are attacking, not the methodology. This is a cultural thing were we presume, quite strangely I might add, that humans are somehow capable to change the trend of the whole.

Politics always run for office promising something. They pretend as if they can change the trend irrespective of what is happening globally. The named shanty towns “Hoovervilles” during the Great Depression blaming President Hoover unfairly as if one man could have created such an event. He was unfortunately there at the wrong time. Trump became president simply because he was there at the right time.

It is not the people – it is the event.