Tag Archives: Panics

Hidden Order Inside the Chaos or “Noise”

Armstrong Economics Blog/AI Computers

Re-Posted Jul 14, 2018 by Martin Armstrong

QUESTION: Martin, I have been reading about machine learning recently and have come across a concept that I believe you might have figured out that no one else has. To quote Max Welling “The information we receive from the world has two components to it: there is the part of the information which does not carry over to the future, the unpredictable information. We call this “noise”. And then there is the information that is predictable, the learnable part of the information stream.” Have you through Socrates figured out a way to filter noise entirely from the system or something of this nature?

Kind regards,

Andrew

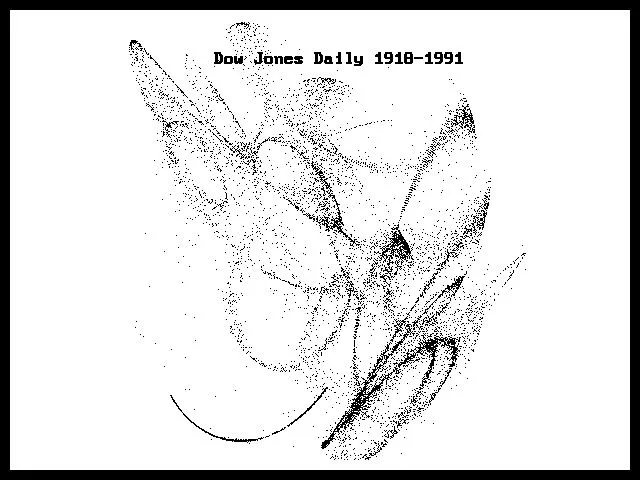

ANSWER: No. That statement is based upon the idea that the “noise” is just chaos. They cannot see behind the surface and look deep within. There is ALWAYS order to the “noise” and 99.9999% of the problem is that people do not understand how to deal with chaos. Here is a plot of a daily file of closing in the Dow Jones Industrial Index from 1918 to 1991, which we published long ago. There is a hidden order within that “noise” if you understand how to extract it

Interesting Way to Increase Sales During the Great Depression

Armstrong Economics Blog/Economics

Re-Posted Jul 14, 2018 by Martin Armstrong

How bad did it get in some segments of the population during the Great Depression? Actually, during the Great Depression, women began reusing the fabric from flour sacks to make dresses. When the flour companies woke up and suddenly realized the purpose their flour bags were providing, they began to print their bags with various floral and other designs to make them more attractive to consumers who would buy flour to be able to use the cloth for clothing. Interesting way to increase your sales.

They Want to Charge the Elderly for Needing Help After a Fall

Armstrong Economics Blog/The Hunt for Taxes

RE-Posted Jul 13, 2018 by Martin Armstrong

QUESTION: Hi Martin,

You are unique in your insight into the growing theft of our money and dignity by the increasingly draconian authorities. Sometimes it’s hard to tell in this era of clickbait and fake news whether something you read is real. In the case of Councils, however, which universally seem to be repositories for people with no skills and not enough guts or street smarts for real politics, anything is possible. How do we, especially the elderly, defend ourselves from these rapacious thieves?

Regards,

Pete

ANSWER: I wish I had an answer for you. For governments there in Britain to proposed to charge £25.92 to help an elderly person who has fallen is outrageous. This is beyond belief. As lawyers often say, “If you hit someone with your car, back up and make sure you kill them. It’s cheaper than to have to pay for the rest of their lives for an injury.” This seems to be the policy adopted by governments. As the crisis in finance builds, we will see more and more of this sort of thing to “save” money.

In the USA, all I can do is recommend moving to one of the 7 states without an income tax. If you are elderly and need medical services, Florida is probably the best spot. They also have Homestead, so nobody can take your house and throw you out on the street. The Florida homestead exemption is a Florida constitutional provision which protects Florida residents by providing them with legal benefits and protection. Thereby, a resident’s primary home is secure from levy and execution by their judgment creditors. A judgment creditor cannot force the sale of your homestead to satisfy a money judgment. Florida is THE BEST spot to protect property.

Oldest Version of Homer’s Iliad and The Odyssey was Just Discovered

Armstrong Economics Blog/Ancient History

Re-Posted Jul 12, 2018 by Martin Armstrong

A remarkable discovery has been made and reported by the BBC. A clay tablet recording the story of Odysseus after the fall of Troy by Homer who is the famous Greek poet who was born sometime between the 12th and 8th centuries BC. He is believed to have possibly been born somewhere on the coast of Asia Minor in Turkey rather than the mainland Greece. He is famous for the epic poems The Iliad and The Odyssey, which have had an enormous effect on Western culture, but very little is known about their author.

A remarkable discovery has been made and reported by the BBC. A clay tablet recording the story of Odysseus after the fall of Troy by Homer who is the famous Greek poet who was born sometime between the 12th and 8th centuries BC. He is believed to have possibly been born somewhere on the coast of Asia Minor in Turkey rather than the mainland Greece. He is famous for the epic poems The Iliad and The Odyssey, which have had an enormous effect on Western culture, but very little is known about their author.

This latest discovery of a clay tablet was found near the ruined Temple of Zeus in the ancient city of Olympia, during an excavation which has taken three years. The tablet has been dated to Roman times generally and was engraved with 13 verses from the poem The Iliad and The Odyssey. It has been argued that Homer was simply a tale for children because it was handed down in an oral tradition for hundreds of years before the tablet was inscribed. Far too often ancient history is disregarded as myth.

Heinrich Schliemann (1822 – 1890) was a German businessman and a major pioneer of field archaeology. He believed in the historical accuracy of Homer’s Iliad and The Odyssey and Virgil’s Aeneid and that they recorded stories that reflected actual historical events. Of course, all the academics pronounced Homer’s writing was a story for children. Schliemann was an amateur archaeological excavator. He took Homer at face value and believed it was history. To this day people still diminish his contributions because he dared to challenge the academics. Many hate his guts for proving them wrong since they pontificated Homer was a story for children without any proof because they never set foot out into the field to prove that statement was even correct.

Heinrich Schliemann (1822 – 1890) was a German businessman and a major pioneer of field archaeology. He believed in the historical accuracy of Homer’s Iliad and The Odyssey and Virgil’s Aeneid and that they recorded stories that reflected actual historical events. Of course, all the academics pronounced Homer’s writing was a story for children. Schliemann was an amateur archaeological excavator. He took Homer at face value and believed it was history. To this day people still diminish his contributions because he dared to challenge the academics. Many hate his guts for proving them wrong since they pontificated Homer was a story for children without any proof because they never set foot out into the field to prove that statement was even correct.

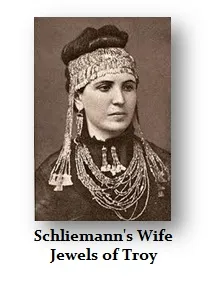

This picture of Schliemann’s wife wearing the jewels discovered in Troy was accused of being fake by academics while Schliemann called it Priam’s Treasure. The treasure was smuggled out of Turkey and the official assigned to watch the excavation was sent to prison as a result. The Ottoman government revoked Schliemann’s permission to dig and sued him for its share of the gold. Schliemann thereafter went on to Mycenae where he discovered another part of the Homer epic.

Eventually, Schliemann traded some treasure to the government of the Ottoman Empire in exchange for permission to dig at Troy again. That is located in the Istanbul Archaeology Museum. The rest of his discovery was acquired in 1881 by the Royal Museum of Berlin where it remained until 1945 when it disappeared from a protective bunker beneath the Berlin Zoo. The Russians seized the Treasure yet denied they had it until September 1993 when the treasure turned up at the Pushkin Museum in Moscow. Germany’s request to return it was rejected as Russia asserted that was compensation for the war destruction by Germany. Whether this Treasure was Priam’s is doubtful for it appears to be actually a thousand years older than Homer’s King Priam of Troy.

Schliemann not merely discovered Troy, he discovered much of ancient Greece including the Lions Gate pictured here as the entrance to Mycenae. disagreed. He was not an archaeologist, just a history enthusiast with money. He discovered Troy and most of the Greek cities of the Heroic Age, including Mycenae with its Lion’s Gate, described by Homer, not to forget the gold death mask of Agamemnon where Homer said he was buried.

This latest discovery of a clay tablet recording Homer’s tale is the oldest so far. This further demonstrates that the story was part of Greek history and not merely just a legend

Are Central Bankers Directing the Flow of Money without any Checks or Balances?

Armstrong Economics Blog/Capital Flow

Re-Posted Jul 11, 2018 by Martin Armstrong

QUESTION: Do you think that the central bankers influence has triggered a massive shift in the world order? Do you think the IMF and the BIS have gone beyond their mandates? Are central bankers directing the flow of money without any checks or balances? Do you also think that there is an open door between private and central banking that creates endless manipulation of the economy with government support?

These are some big questions. Do you care to tackle them?

PV

ANSWER: At the base of all your questions is the ASSUMPTION that they know what they are doing and that they conspire to create a specific outcome. With that assumption, I disagree. If that were true, nobody would ever want to talk to me. The mere fact that they do demonstrates that they are NOT in absolute control. They say if God did not exist, man would create him. This applies to markets as well. They assume that there is some dark force that lurks behind every event with the intent to create it. They would rather believe that this is the product of an intentional design for that means they can also intentionally reverse it. The far worse reality is that NOBODY is in control and this is simply the product of reaction and counter-reaction.

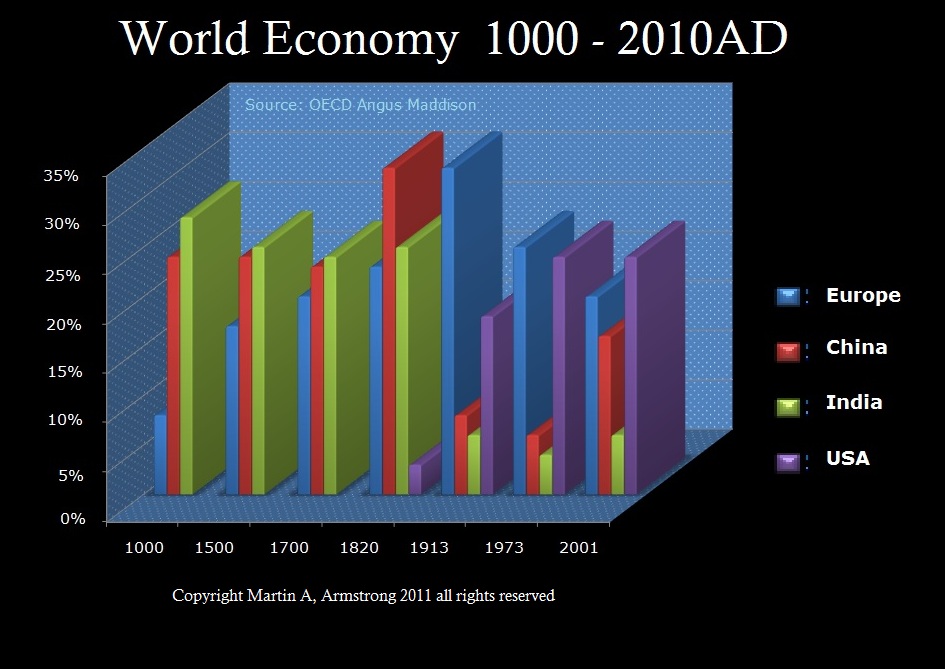

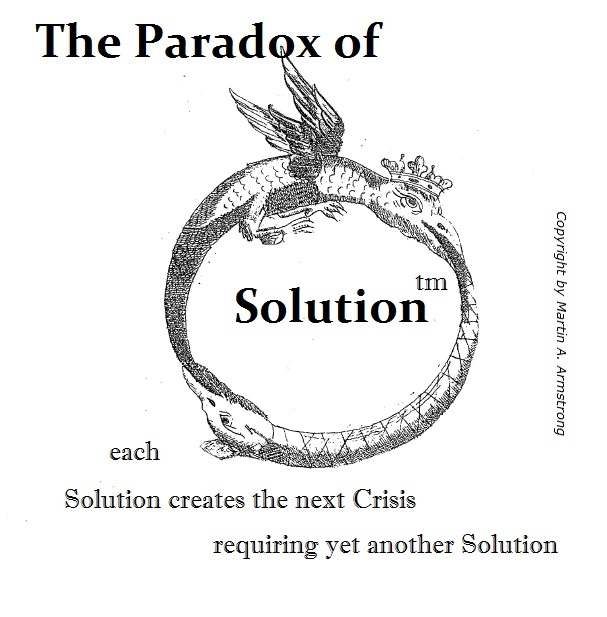

I have stated before that every crisis is met with an immediate solution which sets the stage for creating the next crisis. There is no master plan, for if there was then the USA would remain the Financial Capital of the World. Nobody has ever accomplished that feat permanently. The existence of a business cycle clearly establishes that the best plans will never conquer reality. Socialism is dying BECAUSE they made promises they cannot keep and they will default in the end. That was never the intent from the outset. It is simply that in a representative form of government as a Republic, politicians will say whatever it takes to win the next election. There is NO LONG-TERM plan and that proves there is also no such dark force lurking behind events in absolute control.

I have stated before that every crisis is met with an immediate solution which sets the stage for creating the next crisis. There is no master plan, for if there was then the USA would remain the Financial Capital of the World. Nobody has ever accomplished that feat permanently. The existence of a business cycle clearly establishes that the best plans will never conquer reality. Socialism is dying BECAUSE they made promises they cannot keep and they will default in the end. That was never the intent from the outset. It is simply that in a representative form of government as a Republic, politicians will say whatever it takes to win the next election. There is NO LONG-TERM plan and that proves there is also no such dark force lurking behind events in absolute control.

You ask if the central bankers triggered a massive shift in the world order. That is kind of ambiguous. Have they disrupted the world order? That is probably a better question. The answer to that must be yes because the European Central Bank (ECB) has created an absolute nightmare that endangers the entire world economy. Yellen was, in fact, yelling at Draghi for his stupidity in moving to negative interest rates. He assumed it would force people to spend and reinflate the economy. It backfired and furthered deflation, causing people to hoard their money. The ECB has not stimulated the economy, but instead it has kept governments on life support. Eventually, interest rates will rise exponentially because the ECB has destroyed the European bond market. No private investor will buy 10-year bonds at under 3%. Pension funds need 8% to break-even.

You ask if the central bankers triggered a massive shift in the world order. That is kind of ambiguous. Have they disrupted the world order? That is probably a better question. The answer to that must be yes because the European Central Bank (ECB) has created an absolute nightmare that endangers the entire world economy. Yellen was, in fact, yelling at Draghi for his stupidity in moving to negative interest rates. He assumed it would force people to spend and reinflate the economy. It backfired and furthered deflation, causing people to hoard their money. The ECB has not stimulated the economy, but instead it has kept governments on life support. Eventually, interest rates will rise exponentially because the ECB has destroyed the European bond market. No private investor will buy 10-year bonds at under 3%. Pension funds need 8% to break-even.

You then ask, “Do you think the IMF and the BIS have gone beyond their mandates?” The IMF has overstepped its authority and has interjected itself into the economic policies of Europe. This had made the IMF part of the unelected Troika. This is directly beyond its mandate and it has become an unelected entity that has influential power over policy – not dictatorial. The IMF disagreed with the actions of the EU against Greece. It did not have the power to overrule Brussels.

You then ask, “Do you think the IMF and the BIS have gone beyond their mandates?” The IMF has overstepped its authority and has interjected itself into the economic policies of Europe. This had made the IMF part of the unelected Troika. This is directly beyond its mandate and it has become an unelected entity that has influential power over policy – not dictatorial. The IMF disagreed with the actions of the EU against Greece. It did not have the power to overrule Brussels.

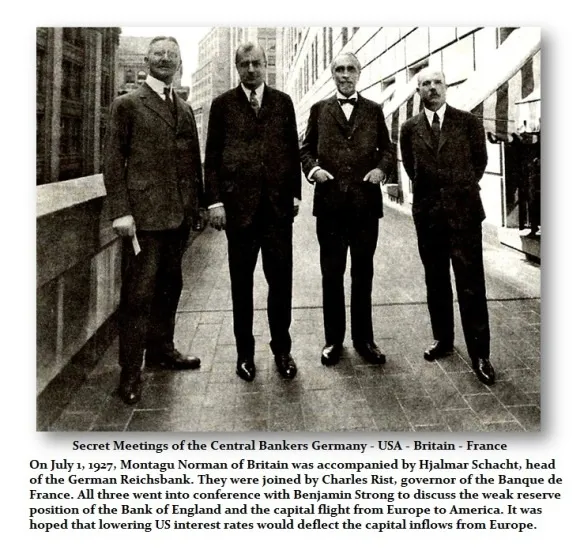

Your next question: “Are central bankers directing the flow of money without any checks or balances?” Central banks have been trying to accomplish that since 1927. They have utterly failed in actually altering the capital flows on any permanent basis. Their influence has been fleeting at best and only temporary.

Your next question: “Are central bankers directing the flow of money without any checks or balances?” Central banks have been trying to accomplish that since 1927. They have utterly failed in actually altering the capital flows on any permanent basis. Their influence has been fleeting at best and only temporary.

There was the attempt to alter the capital flows back in 1927 to deflect the capital back to Europe. The USA lowered it interest rates hoping that would send capital migrating back to Europe. It actually had the opposite effect and from that period onward, the US share market doubled in value and capital poured into the USA. Europe eventually defaulted on most of its national debts in 1931. Clearly, the attempt to influence the capital flows failed and it did not prevent the shortage of capital in Europe which resulted in the Sovereign Debt defaults of 1931.

Your last question: “Do you also think that there is an open door between private and central banking that creates endless manipulation of the economy with government support?” No, that is absurd. Just look at the LIBOR scandal and huge fines for allegedly manipulating interest rates by the private banks v central banks which is their power wirth short-term rates. The central banks at best try to prevent bank failures, but that has never succeeeded long-term.

The IRS Can Deny You A Passport?

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Jul 11, 2018 by Martin Armstrong

QUESTION: You said that if you owe taxes the government can deny you a passport? I never heard that one.

ANSWER: Oh yes. This has been in place for several years. The Wall Street Journal just reported that “at least 362,000” Americans will be unable to renew their passports because of back tax bills. They can take your homes, garnish your wages, and deny you the right to leave the country. Effectively, the IRS can actually starve you to death with all the rules they have and nobody on the other end will ever be there to look at the combined damage.

Judgment creditors can garnish your wages in order to collect the judgment up to a maximum of 25% of your disposable income. However, creditors of a few types of debts such as back taxes, child support, and student loans, can garnish your paycheck without a judgment. In other words, you have no right to actually contest this in a court of law. They can just garnish your wages on a whim or even on a mistake, placing the burden on you to argue with them.

The U.S. Department of Education or anyone collecting on its behalf can garnish up to 15% of your disposable income to collect on defaulted student loans. These agencies do not have to sue you first and get a judgment in order to garnish, but they must provide you with notice of the garnishment ahead of time. You can thank the Clintons for that one who eliminated the right to even go bankrupt from student loans even if a university charges you for a degree in which you cannot find employment, which today is over 60% of graduates. Universities could care less if you are getting a degree that is actually worth something. They just want the money.

Ever since 1988, child support orders include an automatic wage withholding order, even for child support that is not delinquent. The child support is withheld from your paycheck and your employer sends the money directly to the other parent. If you are required to maintain health insurance coverage for your child, the payment for that will be deducted from your paycheck as well. You can agree with the other parent to pay child support on your own, without resorting to wage withholding. The limit is up to 50% of your disposable earnings that may be garnished to pay child support if you are currently supporting a spouse or a child who isn’t the subject of the order. If you aren’t supporting a spouse or child, up to 60% of your earnings may be taken. An additional 5% may be taken if you are more than 12 weeks in arrears. Federally, child support payments and not considered taxable income. However, child support payments are also not deductible by the payer.

Taxing authorities, on the other hand, have their own limits for wage garnishment which is very subjective. The IRS bases the amount on how many dependents you have and your standard deduction amount. State taxing authorities may have their own formulas and they are all different. The IRS will send you a notice before it begins garnishing, but it does not have to get a judgment before doing so. They can take your funds BEFORE and you may not be able to afford a lawyer to help

Is Britain Committing Suicide?

Armstrong Economics Blog/BRITAIN

Re-Posted Jul 10, 2018 by Martin Armstrong

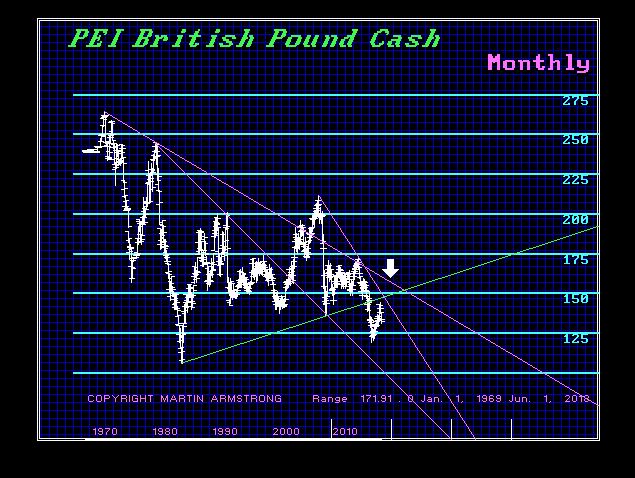

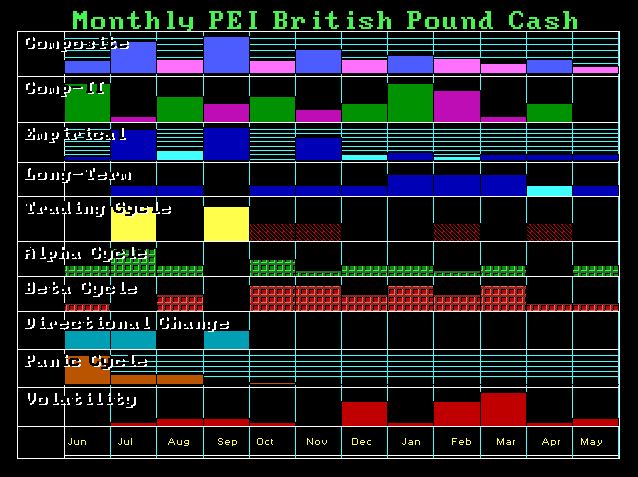

QUESTION: Mr. Armstrong, I thought you would be wrong on the pound. I will yield to your forecasts. I do not know how you do it forecasting so many things around the world and getting them right no less. Reading between the lines who have written, on the one hand, you have said that Brexit was critical to save Britain, yet at the same time you said the pound would drop sharply. It seems as though you were forecasting the collapse of Brexit. My question now is, will the Tory Party even survive?

PF

ANSWER: The first thing you have to come to grips with is a computer is VOID of human emotion. Virtually all human forecasting has an inherent bias, for people will forecast what they want to see even if they do not realize they are doing so. To be correct, it requires extracting ALL human judgment and emotion from the subject matter. This is why I say people ask me what SOCRATES has to say – NOT me! That is the way it should be.

I have to say that Boris Johnson’s comment that Britain is headed for the status of a “colony” is absolutely correct. There are “remainers” who have simply ignore ALL the economic data and will seriously end Britain as any sort of viable economy. Britain has ALWAYS been treated as a second-class European culture and it will end up subservient to that of the EU. It may simply be too much to expect rational political leadership any more from Britain. Instead of the cabinet stabbling the PM in the back as they did with Thatcher to also try to join the euro, this time it is the PM who is stabbing her cabinet and the people in the back trying to keep in by pretending she is leaving.

It may be just time to play the traditional funeral song and remove our hats.

Let us look at the arrays. Here we can see that July has been the target in the pound. The next one will be in September. Now look at the Weekly Array – it picked this week. So how does the computer pinpoint these political events that align with the top people in BREXIT resigning? I “think” we have to flip the question. In other words, it is not the computer forecasting the resignation of David Davis, who was the top negotiator for BREXIT, and Boris Johnson. There are people now calling for Nigel Farage to return. Quite frankly, Nigel is probably the ONLY hope for Britain. Unless they cut the umbilical cord to the EU, Britain cannot possibly survive.

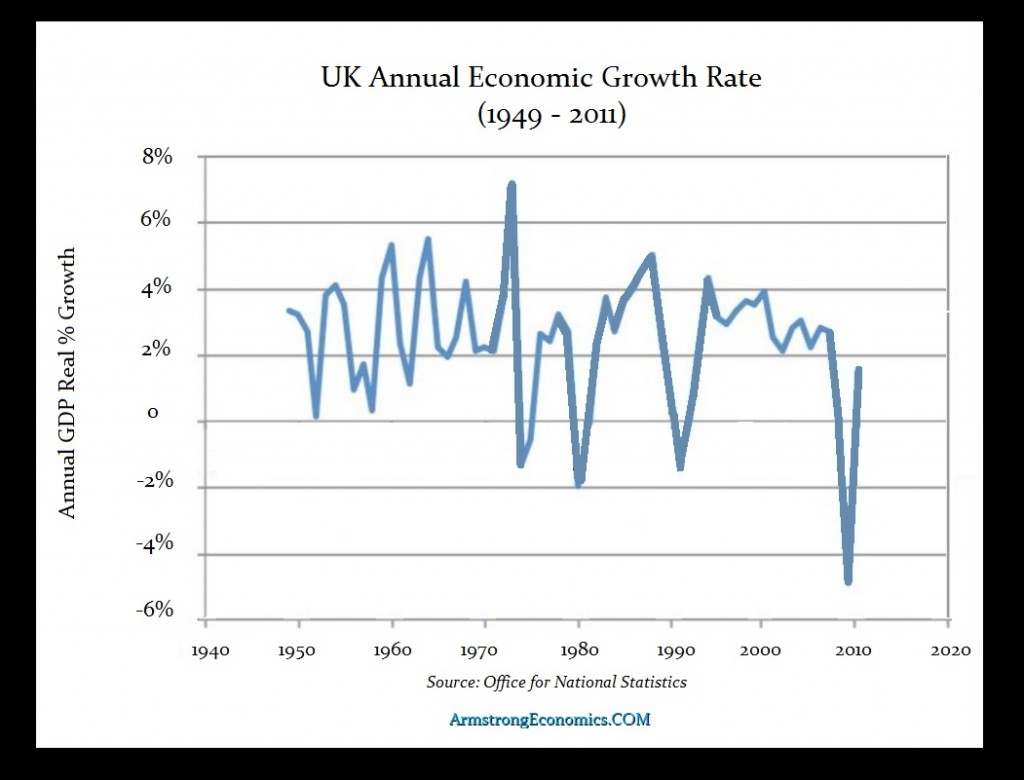

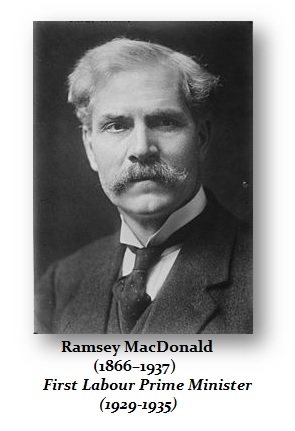

This is the government’s own data. The economic growth of Britain peaked before it joined the EU and has declined steadily ever since. Britain loses EVERY trade argument in the EU Court. It is baffling how and why anyone would still think that staying in the EU is better. Since 1832, the two major parties have been the Conservatives (Tory) and the Liberals/Liberal Democrats. The Labour government emerged in the 1890s following Karl Marx. James Ramsay MacDonald (1866–1937) was the first British statesman to found the Labour Party, preaching Marxism, and he eventually became Prime Minister. His appointment lead to minority Labour governments in 1924 and in 1929–31. MacDonald then headed a National Government from 1931 to 1935 that was dominated by the Conservative Party which was supported by only a few Labour members.

This is the government’s own data. The economic growth of Britain peaked before it joined the EU and has declined steadily ever since. Britain loses EVERY trade argument in the EU Court. It is baffling how and why anyone would still think that staying in the EU is better. Since 1832, the two major parties have been the Conservatives (Tory) and the Liberals/Liberal Democrats. The Labour government emerged in the 1890s following Karl Marx. James Ramsay MacDonald (1866–1937) was the first British statesman to found the Labour Party, preaching Marxism, and he eventually became Prime Minister. His appointment lead to minority Labour governments in 1924 and in 1929–31. MacDonald then headed a National Government from 1931 to 1935 that was dominated by the Conservative Party which was supported by only a few Labour members.

MacDonald presided at the world economic conference in London in June 1933. Nearly every nation was represented, but no agreement was possible. American President Franklin D. Roosevelt refused to stabilize the depreciating dollar. The failure marked the end of international economic co-operation for another decade. MacDonald was deeply impacted by the rising anger and bitterness caused by the fall of the Labour government during the 1935 election. He increasingly became an isolated figure. The collapse of free trade initiatives led to the resignation of a leading Labour figure, Philip Snowden, in 1932 following the introduction of tariffs after the Ottawa agreement. MacDonald was later expelled from the party he had helped to found.

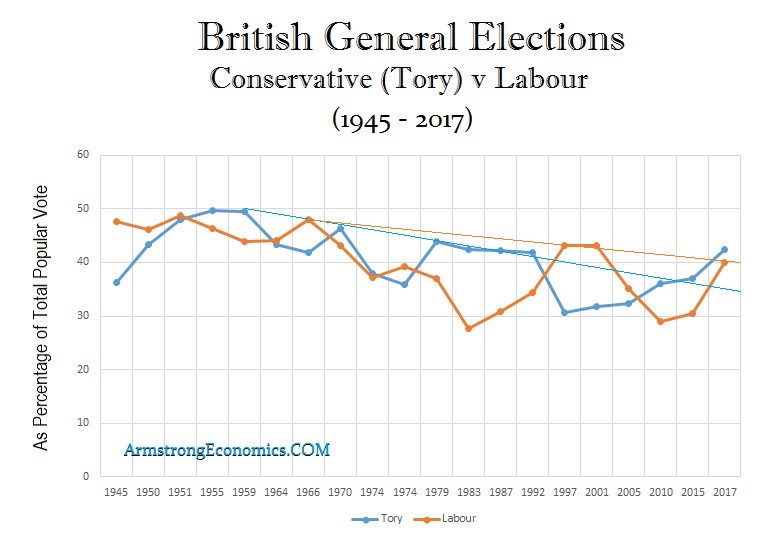

Since 1918, British elections have been dominated by the Conservatives and Labour. In 16 out of 26 general elections since 1918, the Conservative Party won most seats, while Labour won most seats on the other ten occasions. In all general elections between 1918 and 1945, the Conservatives received more votes than any other party (only in 1997 did they get less than 35% of the vote).

Yes, there has been a conflict whereby the political models have shown that support for the Conservatives was beginning to decline. While Labour was rising, it appeared to be more of a reactionary trend. Even technically speaking, Labour retests the Downtrend Line whereas the Conservatives appeared to rally after the coup against Margaret Thatcher to take the pound into the euro. This is not the END of the Conservatives, but the PM has to realize that any concern about leaving the EU is absolutely stupid. Europe is tearing itself apart. Nigel Farage should step back in, but he has paid a high price personally for trying to save his own country.

Doom & Gloom v Optimism – Is there a Middle Ground?

Armstrong Economics Blog/Economics

Re-Posted Jul 10, 2018 by Martin Armstrong

COMMENT: Dear Mr. Armstrong, The weather, politics, and life in general is getting a little more skewed month by month on the planet—and like everyone else in history who has experienced cyclical highs and lows, I sure wish I’d been able to skip this cycle altogether— I’m 64 and really trying to keep realistic and not succumb to Doom Porn, when trying to imagine my life when I am in my 80’s. There’s a lot of days those efforts don’t work, frankly, but I persevere—reading your blog helps so much, I needed to again say THANK YOU-thank you, thank you for being online every single blessed day- it means so very much to so many of us out here, struggling to try and make a plan to survive what’s coming.

Peace and good wishes to you and your family

C

REPLY: I look at this as Joseph forecasting 7 years of plenty and 7 years of drought. If we understand there is a cycle, then we can prepare for it and survive. Britain was the Financial Capital of the World up until World War I. It went through some hard times but it survived. We are in the eye of the storm coming out the other end. When we do, the turmoil will begin. While I would hope that at some point the political powers at large will listen, the likelihood of that is nil until the crisis happens. Government will never surrender power which is like a drug addiction. The question becomes how far they will go to retain that power. Will they be so blind like the government of Venezuela whose army continues to support a failed economic model by killing their own people to force submission? The longer the government wages war against its own people to retain power, the greater the fall into economic oblivion.

Rome fell because its army fragmented and troops would support one general v another, all for money. They then used that excuse to be paid and began sacking Roman cities who supported as rival general. Curiously, there were 31 emperors (not including their sons) during the course of 40 years between 244 AD and 284 AD when Diocletian comes to power. That astonishingly lined up with the number of pi.

I am off to Europe in August to shoot another documentary film on this very subject of a solution. Hopefully, this will establish a record in time of crisis as a viable solution to help reduce the volatility. We need the people to apply pressure for it will never comes from government.

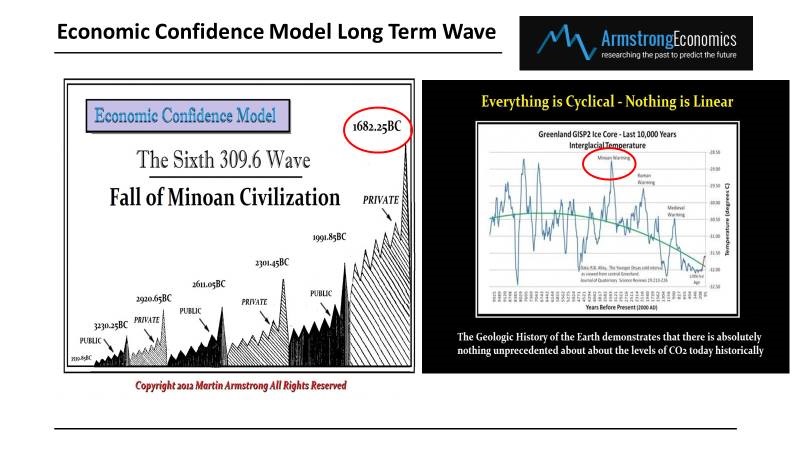

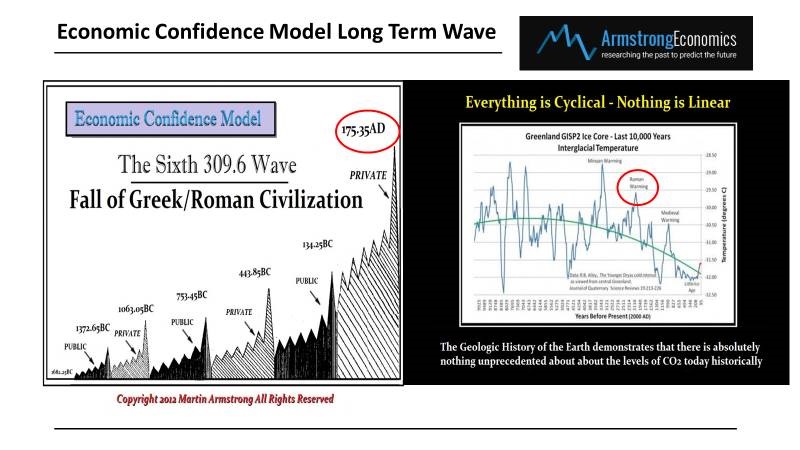

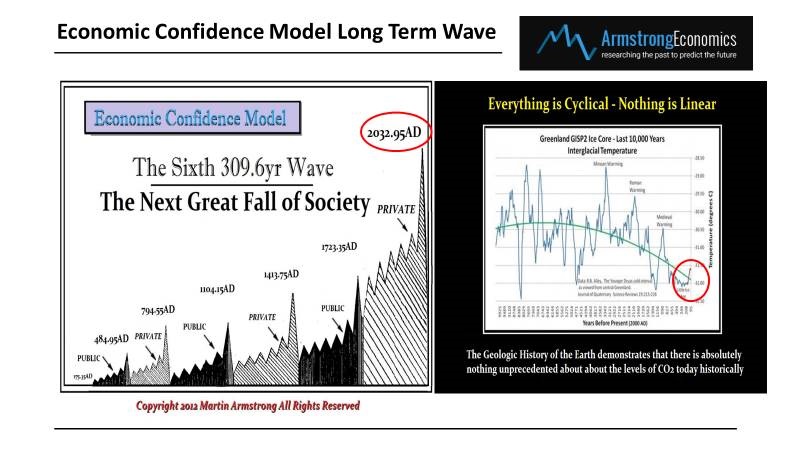

Economic Confidence Model – When One Nation Peaks Another Bottoms

Armstrong Economics Blog/ECM

Re-Posted Jul 10, 2018 by Martin Armstrong

QUESTION: Martin,

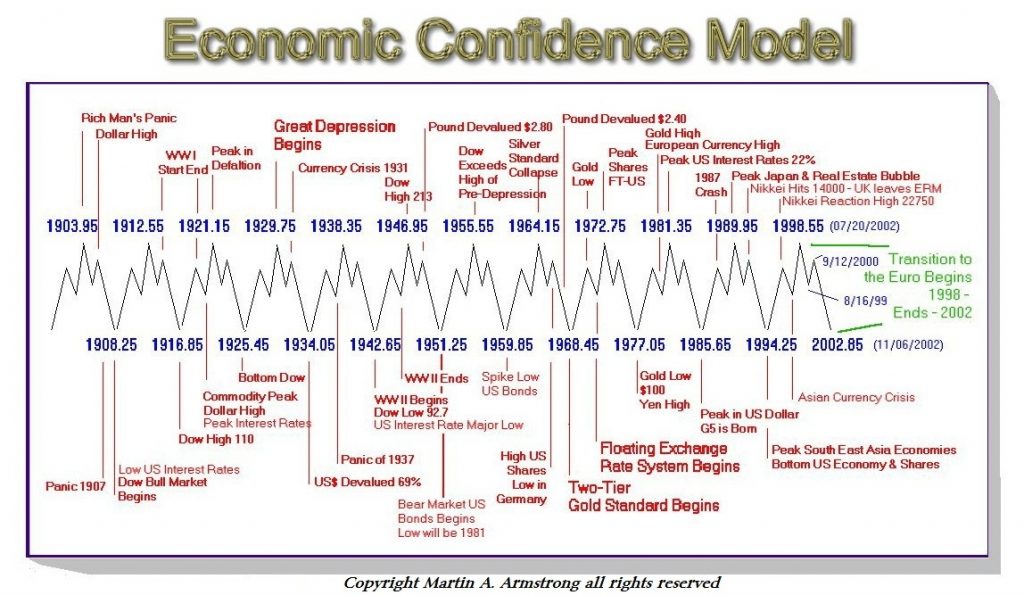

I know that the basic ECM cycle’s 4.3 year decline subdivides into a 1.075 year decline, 1.075 year rise, and 2.15 year decline. However, if I remember correctly, the 2.15 year decline also includes the Pi cycle turn 3.14 years from the top.

If I remember correctly for this ECM cycle, the 2.15 year decline began 2017.9, should turn up about July 12, top with the Pi cycle 2018.89, and finally bottom 2020.05.

I have always wondered, (1) what is the basis of determining this turn up into the Pi cycle, and (2) is this turn up ever significant, or simply a setup for the major event, the November 22 (2018.89) Pi cycle?

Of course, please feel free to correct any of errors in my interpretation of your ECM.

Thanks,

-DB

ANSWER: Keep in mind that this is the global business cycle and not based an individual country. Therefore, we have peaks in one country and bottoms in another on the same turning point. For example, the 1994.25 turning point was the peak in the economies of Southeast Asia. Even when things do not line up precisely to the day with the ECM, the trend changes regardless. The turning point was March 1994 and here we turned in February. The correction at the end of 1998 was the Long-Term Capital Management collapse that was instigated by the loss in emerging markets, namely Russian bonds. I warned them that emerging markets peaked in 1994 and the capital flows shifted. They would not listen, invested in Russia because they assumed they bought the IMF, and when it all blew up they blamed me.

ANSWER: Keep in mind that this is the global business cycle and not based an individual country. Therefore, we have peaks in one country and bottoms in another on the same turning point. For example, the 1994.25 turning point was the peak in the economies of Southeast Asia. Even when things do not line up precisely to the day with the ECM, the trend changes regardless. The turning point was March 1994 and here we turned in February. The correction at the end of 1998 was the Long-Term Capital Management collapse that was instigated by the loss in emerging markets, namely Russian bonds. I warned them that emerging markets peaked in 1994 and the capital flows shifted. They would not listen, invested in Russia because they assumed they bought the IMF, and when it all blew up they blamed me.

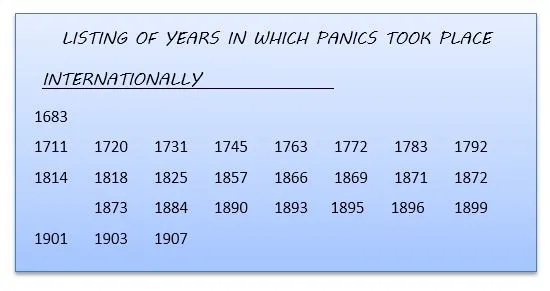

I have published this list of panics that I had discovered while doing research in the Firestone Library at Princeton University. Note that the first one listed was 1683, which was the Turkish invasion to conquer Veinna (the capital of the Holy Roman Empire at that time). It ended Austria as a financial center. Note 1720, which was the South Sea Bubble in Britain and the Mississippi Bubble in France. The list that led me to the discovery of the Economic Confidence Model was international. Therefore, the business cycle I discovered was INTERNATIONAL, and by that very nature it means that when one nation peaks, another bottoms.