Armstrong Economics Blog/Real Estate

RE-Posted Aug 17, 2018 by Martin Armstrong

QUESTION: Hi Mr. Armstrong,

QUESTION: Hi Mr. Armstrong,

California has joined the states with not just the highest taxes in America, but it has become one of those states that people are just leaving resulting i9n a net outward-migration. There is a logical consequence when a state becomes a place people are trying to flee from – real estate MUST decline in value. Already, sales of both new and existing houses and condominiums in Southern California has declined 11.8% year over year. Prices rallied and reached a record high in 2018. The median price paid for all Southern California homes that were sold in June 2018 was a record high reaching $536,250, according to CoreLogic. This was reported as a 7.3% increase compared to June of 2017. When you see such short-term surges in a market, that is often the sign of how every market peaks. Real estate is no exception.

Many have touted for years that California property leads the nation. Therefore, whatever trend appears they will spread to the rest of the nation. While we do not necessarily agree with that statement, nonetheless, real estate will be on the decline in most states where taxes are rising. Property is still going to rise in the 7 states without income tax. For those who are unfamiliar with Socrates, we have created indexes for real estate on a worldwide basis. Here is the page you can view what is available.

California may seem to be a leading indicator, but this appears to be with respect to direction only. While Southern California reached record highs in property values in 2018, this appears NOT to be a leading factor, but a lagging one. Our index for the nation as a whole with a limited focus to Residential peaked in August 2016. We have NOT yet elected a Monthly Bearish Reversal. Trump has clearly made a major economic difference. Capital has been returning home and this has helped to create jobs and soften the economic decline in the USA compared to Europe and Asia. This will also have a fundamental backdrop to the dollar.

QUESTION: Mr. Armstrong; You are obviously the person worth listening to when it comes to gold. Every fundamental these people have argued to support gold has proven completely false. Confusion in gold is really very high. You have to be really stupid at this point to listen to this nonsense. Can you express any opinion on gold?

It would be very helpful

PL

ANSWER: You are correct, that concerns over U.S.-Russian relations, coming talks on the Korean Peninsula, action in Syria over a suspected chemical weapons attacks and uneasiness over trade conflicts would normally be the battle cry to buy gold. Traditionally, this would form a cocktail of geopolitical uncertainty that would lead to screams buy gold! The uncertainty has not led to support for gold. They are proving to be a narrative that no longer seems to be factors for the bulls.

We have to understand one thing. The younger generations do not see gold as money as do the aging generation. The older generations remember being taught that is school and the days of the gold standard. The younger generation does not even bother with paper money and pays with their cell phones. This is raising the question of whether gold will remain as a safe-haven instrument in the future if the younger generation does not even consider gold suitable for anything other than a trinket.

There are cycles to yet cycles to cycles. Just as we moved from gold to paper, we have then moved from paper to electronic. With each passing trend, there are always people who refuse to leave behind the old ideas and traditions. The real question emerging shall be: Will people even regard gold as anything but jewelry 300 years from now? Of course, there will be those who immediately will argue that gold has always been money. They are simply wrong. Money has been many things to many different societies. The real issue is not whether gold is money, silver, copper, bronze, seashells, sheepskins or cattle. The real question is will money be COMMODITY based (Tangible) with its roots in barter or will it be simply a representative of economic output that can be electronic? That is the real question. Are we headed into a future as in Star Trek where physical money is obsolete?

There are cycles to yet cycles to cycles. Just as we moved from gold to paper, we have then moved from paper to electronic. With each passing trend, there are always people who refuse to leave behind the old ideas and traditions. The real question emerging shall be: Will people even regard gold as anything but jewelry 300 years from now? Of course, there will be those who immediately will argue that gold has always been money. They are simply wrong. Money has been many things to many different societies. The real issue is not whether gold is money, silver, copper, bronze, seashells, sheepskins or cattle. The real question is will money be COMMODITY based (Tangible) with its roots in barter or will it be simply a representative of economic output that can be electronic? That is the real question. Are we headed into a future as in Star Trek where physical money is obsolete?

When we look at these transition periods in the monetary system throughout history, we see how money takes shape of a representation of what it once was. The Minoans fashioned their bronze ingots in the shape of a sheepskin because that is what use to be a symbol of value before the Bronze Age. We see the same transition in Rome with ingots of bronze with a picture of a cow because cattle was once money.

The real question is blunt. Are we also passing from a COMMODITY based monetary system to a purely electronic based system with the passing of the generations? Even the pitch that India buys gold because it is a tradition is starting to show it to moves with cycles. The younger generations do not share the same view of gold as the older generation. Things do change with the generations and the problem has always been that those of one generation judge the future ONLY by its own belief system. So, despite all the yelling and screaming that I was wrong and that gold would NEVER retest the $1,000 level, we have broken sharply falling to 1180 yesterday in the fact of a strong dollar as we approach the pending Benchmarks in September. Gold trades inversely to the dollar because it is now just a commodity-based asset class – not money. When we had a gold standard, it traded opposite against all asset classes. It will rally when the dollar backs off and decline as the dollar rallies until everything begins to enter the Great Aligment.

There has been a lot of lobbying behind the curtain going on asking Qatar to change its position and help Turkey for the IMF would not be able to come to the rescue. Sources are saying that Qatar will help Turkey to the tune of $15 billion for now. Those lobbying have included the United States. This will help ease things a little with Turkey

QUESTION: Mr. Armstrong; I really understand why the government wanted your model so bad. You have been the only one to correctly forecast the entire world. The emerging markets are cracking and the euro is falling apart. What is next in your timetable?

ANSWER: We have been warning that the first to crack would be emerging markets and Turkey was the focal point. We are also beginning to witness the debt crisis in China due to loans in dollars as well. Many of these companies simply lacked the sophistication to understand currency risk or hedging strategies. The second in line would be Europe and the Euro is really in danger of bringing the entire world economy down. The third in line will be Japan, and then finally the crisis will hit the USA. We are just living in an era where people have believed the nonsense for far too long. Adam Smith’s Invisible Hand cannot be defeated.

This is SERIOUS. People have to understand that this is NOT my personal belief, opinion, or anything else based upon some predetermined conclusion. People attack me personally because they cannot defend a system that NOBODY in their right mind would have created from scratch. Our system is a patchwork of band-aids that are applied to each crisis and then never removed. Collectively, that have combined to create a complete nightmare. This has become such a mess, there is NOT a single person I know in government capable to even correcting this mess. The truth ALWAYS is exposed.

I am only one person. I do not have the support to manage a global crisis or step in to help every country. This will take a lot more than just me. The countries who want help are generally the peripheral not the majors for this is too political

The European Central Bank is instructing banks to restrict the conversion of Euros to dollars. The Euro has fallen to 113006. Once again, the dangerous game here is when we cross that line of demarcation between CONFIDENCE in government and the REALIZATION that there is nobody in control but the free markets. Once all the talk and all the promises are no longer considered to be worth listening to, that is when the monetary crisis begins to really shake the foundations. We are moving closer to that point of no return.

The truth always comes from the mouths of babes. In the case of politicians, it is the new one who comes to power and has not yet learned the tricks of the trade. In this respect, Italy has spoken the truth. The ECB has had the Eurozone on life-support. They cannot pull the plug without the collapse of the Euro and with that, lies the jobs in Brussels. This is why they will become draconian and attempt to outlaw selling the Euro all to maintain their jobs. They will lose. The free markets ALWAYS win!.

QUESTION: Do you have any more Roman coin you will offer for Christmas? I would really like to buy a few to give to my grandchildren.

WJ

ANSWER: Yes. I have several hoards I will make available some that I bought probably back in the 1970s. There are no major quantities. Generally less than 100 of various types. I do have a very nice lot of bronze Sestertius, which is the main Roman coin used as the unit of account pictured above.

I have only perhaps 50 Judaea widow’s mites which were the coin that was presented in the Synoptic Gospels (Mark 12:41-44, Luke 21:1-4), in which Jesus is teaching at the Temple in Jerusalem. The Gospel of Mark specifies that two mites (Greek lepta) are together worth a quadrans, the smallest Roman coin. I know everyone will want these really bad. I just do not have a sufficient quantity for everyone.

I still have a limited number of Alexander the Great drachms and the Victoritai. I also have a small hoard of silver denari and 3rd-century bronze Antoniniani. We really cannot mail them outside the USA anymore. Those from overseas we can hold then if you are attending the WEC. We can probably ship to Asia, not Australia. Europe seems to be just a no go.

I will put everything together and let everyone have a shot online

QUESTION: Mr. Armstrong; I do not understand your statement that even when coins were silver and gold, they were still a form of fiat money. Could you explain that please?

BB

ANSWER: The evidence that supports that statement is abundant. We find coins of the immediate financial capital be it Greece or Rome, were IMITATED by the surrounding peripheral regions. Here are four Celtic imitations of a silver Tetradrachm of Thasos, an island in Thrace. Because of its proximity to the Celtic world, they were engaged in trade. However, the Celts minted imitation coinage copying the designs as best they could to satisfy their own internal commerce. You can see a genuine coin at the top with a weight of 16.91 grams and four imitations that were very close to the same metal content. Obviously, the raw silver was worth more when it was in coin form or they would never have bothered to imitate the Greek coinage.

ANSWER: The evidence that supports that statement is abundant. We find coins of the immediate financial capital be it Greece or Rome, were IMITATED by the surrounding peripheral regions. Here are four Celtic imitations of a silver Tetradrachm of Thasos, an island in Thrace. Because of its proximity to the Celtic world, they were engaged in trade. However, the Celts minted imitation coinage copying the designs as best they could to satisfy their own internal commerce. You can see a genuine coin at the top with a weight of 16.91 grams and four imitations that were very close to the same metal content. Obviously, the raw silver was worth more when it was in coin form or they would never have bothered to imitate the Greek coinage.

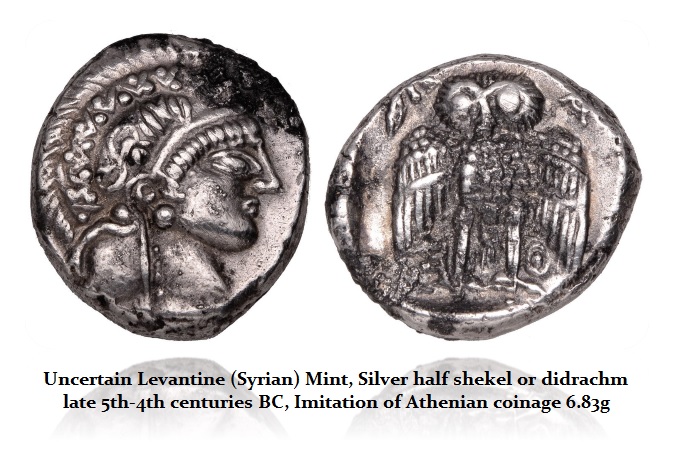

There are imitations by the Swiss of gold coins of Macedonia made by the Helvetii tribe. In this case, they appear to be half denominations. We find imitations of the famous Athen’s Owls. These type of imitations are dominant in North Africa. Here is a SILVER DIDRACHM which is style off of the main trade coin being the Dekadram. This design of the facing owl with open wings only appeared on the large Dekadrachms and not on smaller denominations.

Interestingly, the Egyptians never minted their own coins under they were conquered by Alexander the Great. Nevertheless, we have Egyptian imitations of Athenian owls as well. Here the metal is good and the designs are properly performed as well as the denominations. Obviously, we have raw metal being shaped into coins that imitate the Greek world when they were the Financial Capital of the World.

Interestingly, the Egyptians never minted their own coins under they were conquered by Alexander the Great. Nevertheless, we have Egyptian imitations of Athenian owls as well. Here the metal is good and the designs are properly performed as well as the denominations. Obviously, we have raw metal being shaped into coins that imitate the Greek world when they were the Financial Capital of the World.

The numismatic record is abundantly clear. The peripheral economies routinely imitated the coinage of the dominant economy which I refer to as the Financial Capital of the World at that moment in time. So here we have even Egypt which imitates the coinage of Athens so that they can make use of silver in trade. The produced no coinage for domestic circulation and instead used a receipt monetary system based upon grain.

Here we have India imitating the gold coinage of Rome. They appear to have imitated the coinage even changing the design with the current emperor from the time of Tiberius onward. Once again, we do not see that these were counterfeits, but imitations. They were struck generally with the same quality of gold and at the proper weight. There is an over-weight gold aureus of Septimus Severus (193-211AD). These Indian imitations extend into the 3rd century at least until the monetary crisis begins with the capture of the Roman Emperor Valerian I in 260AD.

Here we have a Double Aureus (Bino) of a rare Emperor Pupienus who reigned only between April 22nd and July 29th, 238AD. We have an Indian imitation of a coin that has not survived in its genuine form. All we have is a single Indian imitation to suggest it existed.

The mere existence of “imitations” establishes that statement as contrasted with counterfeits. Throughout the Roman coinage, there exist Fourrée Denarius. These appear to be struck generally with official dies but on bronze based coinage silver plated. One theory is that people from the mint produced these forgeries and pocketed the profit.

Here is a genuine silver denarius of Octavian (circa 30-29BC). Note that on the cheek of Octavian there is a crescent-shaped punch mark. This is an ancient banker’s mark that is rather common demonstrating that the coin was tested to see if it was a forgery.

You can easily see that there are counterfeits and then there are imitations. The raw metal was worth LESS in trade than a coin. This is why I take issue with those who think that merely minting a coin from gold or silver means it is NOT fiat. That is simply not true. The coinage was worth MORE than the raw metal involved

Italy has called on the ECB to guarantee the bond yields warning that if they END quantitative easing the Eurozone will break apart. On this score, they are not wrong. The economic spokesman for the Italian governing party Lega has warned of a collapse of the Eurozone. The ECB should ensure that the yield spreads of government bonds of the euro countries are contained and not allowed to soar. This is what Claudio Borghi told Reuters. “Either the ECB offers a guarantee or the euro will break apart.” Interest on Italian, Spanish and Portuguese bonds rose in response to the currency crisis in Turkey. Borghi warned that this situation cannot be solved and will explode in everyone’s face. This is the Sovereign Debt Crisis coming into play. We are no looking at the risk premium for ten-year Italian government bonds has risen to 2.7% above Germany. The promise that a single currency would produce a single interest rate has been a complete failure

Italy has called on the ECB to guarantee the bond yields warning that if they END quantitative easing the Eurozone will break apart. On this score, they are not wrong. The economic spokesman for the Italian governing party Lega has warned of a collapse of the Eurozone. The ECB should ensure that the yield spreads of government bonds of the euro countries are contained and not allowed to soar. This is what Claudio Borghi told Reuters. “Either the ECB offers a guarantee or the euro will break apart.” Interest on Italian, Spanish and Portuguese bonds rose in response to the currency crisis in Turkey. Borghi warned that this situation cannot be solved and will explode in everyone’s face. This is the Sovereign Debt Crisis coming into play. We are no looking at the risk premium for ten-year Italian government bonds has risen to 2.7% above Germany. The promise that a single currency would produce a single interest rate has been a complete failure

Erdogan is shifting to Russia already. He will abandon the West all to retain power. Turkey was the critical lynch-pin for emerging markets. Many foolish banks ran to buy Turkey’s debt because they could earn 20% interest. The currency has fallen 25% in two days. We are looking at European banks taking major losses on Turkish debt. Trump has to stop his trade war. This is now about undermining the fabric of the global economy. Welcome to the beginning of the crisis that will end only with a monetary reset in the years ahead. Erdogan claims he has a plan to stabilize the lira but he offers no details. He fails to grasp the root problem – he has lost all confidence domestically and internationally to remain head of state.

Meanwhile, Erdogan is still focused on Syria. He is planning a summit with Russia on the 7th of September in the Turkish capital Ankara. This is to be a four-person summit, which Erdogan has proposed as a distraction for the collapse in the lira. He will limit the summit to Germany, France, Turkey, and Russia.

I have created this site to help people have fun in the kitchen. I write about enjoying life both in and out of my kitchen. Life is short! Make the most of it and enjoy!

De Oppresso Liber

A group of Americans united by our commitment to Freedom, Constitutional Governance, and Civic Duty.

Share the truth at whatever cost.

De Oppresso Liber

Uncensored updates on world events, economics, the environment and medicine

De Oppresso Liber

This is a library of News Events not reported by the Main Stream Media documenting & connecting the dots on How the Obama Marxist Liberal agenda is destroying America

Australia's Front Line | Since 2011

See what War is like and how it affects our Warriors

Nwo News, End Time, Deep State, World News, No Fake News

De Oppresso Liber

Politics | Talk | Opinion - Contact Info: stellasplace@wowway.com

Exposition and Encouragement

The Physician Wellness Movement and Illegitimate Authority: The Need for Revolt and Reconstruction

Real Estate Lending