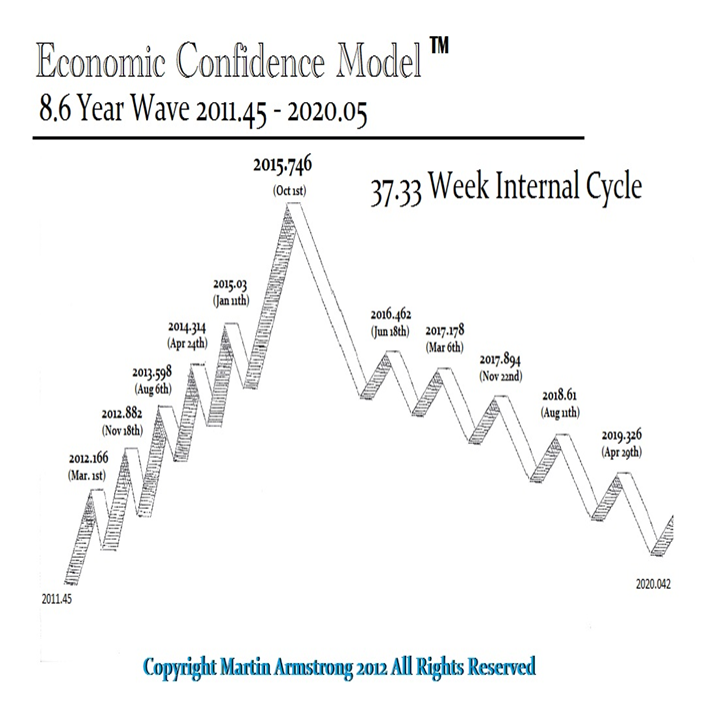

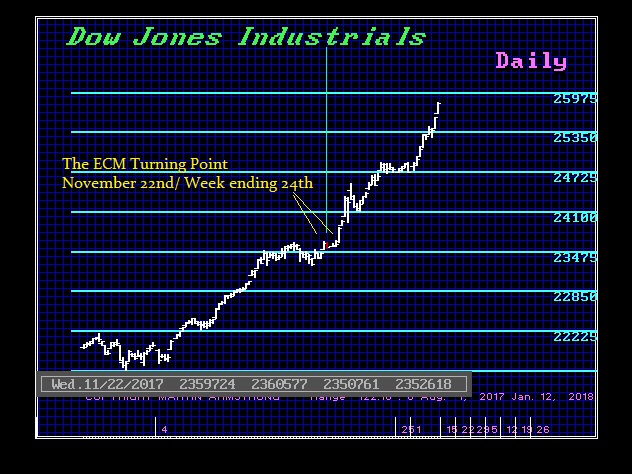

QUESTION: Reviewing the private blog, at the end of 2016 on December 31 you wrote “When it comes to the Euro, the Major Yearly Bearish Reversal lies at 10365 and the intraday low for 2016 was 10352 closing the year at 10513. This too warns that we may not be ready to meltdown just yet.” You called for the Euro rally into the German elections but it did not reach the 125 and stopped at 120. Then for the close of 2017 you wrote on the private blog: “On our Yearly Models, we have had THREE Directional Change targets all back-to-back from 2017 to 2019. From a technical perspective, we achieved an outside reversals to the upside in the Euro making 2017 the low but closing above the 2016 high. We never quite reached our target in the 125 level, so it appears we still have time to do this here in the coming New Year.” You also wrote: The year-end signals we achieve in the Euro for the closing of 2017 will be significant for the overall tone of what is to come reflecting how fast things will develop. Our models are reflecting a sharp rise in volatility in 2018 as well.”

My question is this. With three yearly directional changes from 17 to 19, I assume this means choppiness. Your volatility models show a sharp rise in 2018 as well. Do you think we can really reach the 128 or 135-140 level by March?

HS

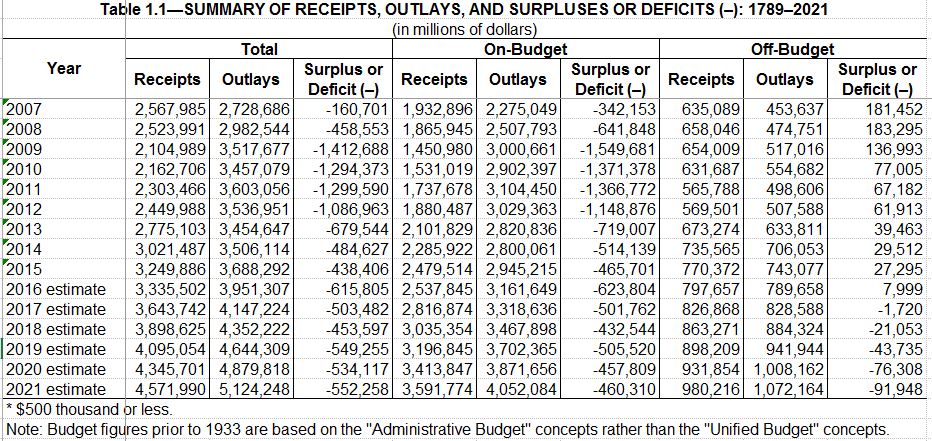

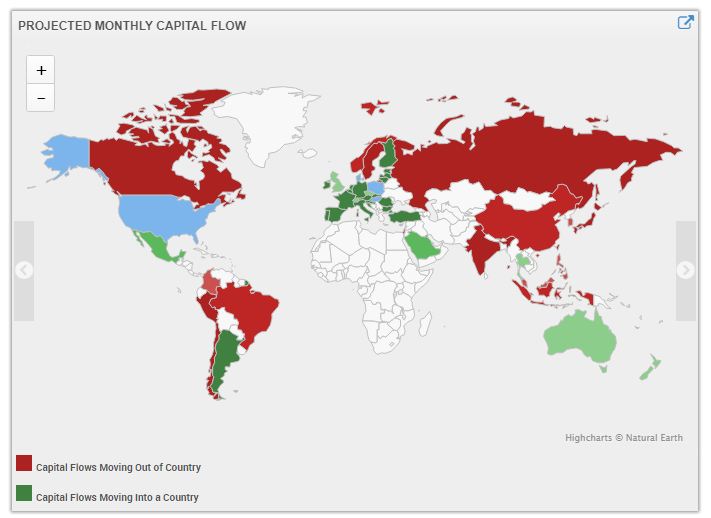

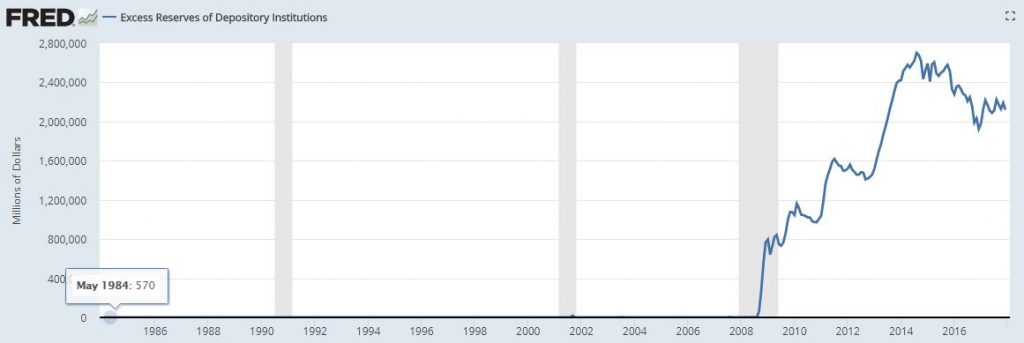

ANSWER: In order to create the greatest amount of chaos, you always have to swing to extremes. If we are going to really create total havoc that will bring down the monetary system as we head into 2021 and force some sort of a new Bretton Woods, the only way to do that is a dollar rally. A dollar decline means sovereign debts issued by other nations in dollars will be devalued encouraging them to issue more. The way to break the system is only a dollar rally which forced Roosevelt to devalue the dollar back in 1934 and it forced the Plaza Accord in 1985 that gave birth to the G5. The US always wants a lower dollar to reduce the trade deficit. This is Trump’s policy as well. The market will NOT be that forgiving.

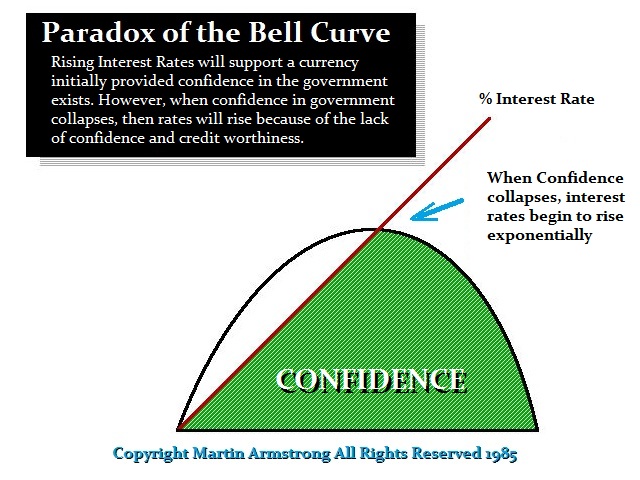

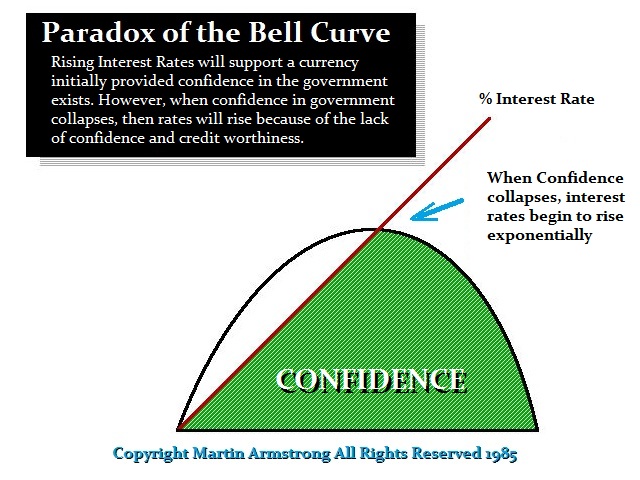

A rising Euro will increase the debt burden in Europe and deflation reducing exports. Ending QE by the ECB will result in rising interest rates. But that is always a bell curve. What people constantly get wrong is the classic one-dimensional analysis. They assume whatever trend is in motion will remain in motion. Rising interest rates will always at first support a currency as should be expected with the Euro short-term. However, that will be the trend provided the confidence in government remains. If confidence collapses, then suddenly the interest rates will continue to rise exponentially and the currency will collapse along with asset values.

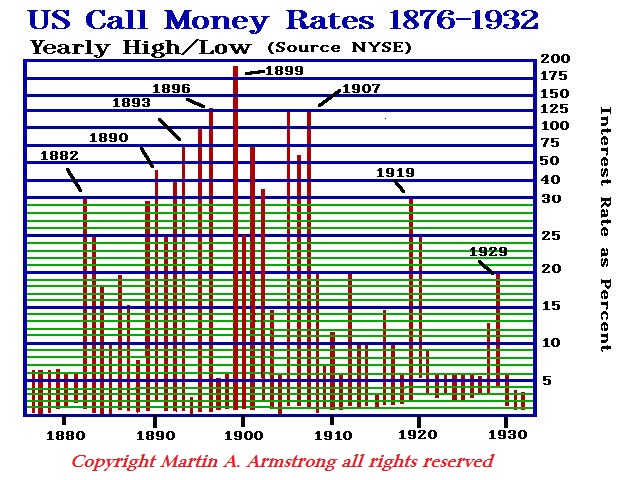

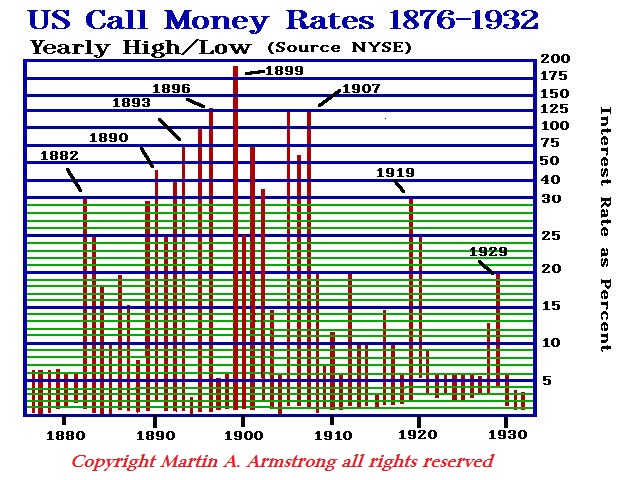

The high in US interest rates took place in 1899, It was 1896 when J.P. Morgan had to bail out the US Treasury because they were broke. Following America gaining control of the Philippines as part of the ending of the Spanish-American War, in 1899 the Philippines declared war against the United States requiring independence from America. The war continued until 1902 when the Philippine President Emilio Aguinaldo surrendered. In 1916, the United States granted the Philippines autonomy and promised eventual self-government, which came in 1934. In 1946, following World War II, the Philippines was granted full independence. The fact that the USA was at war with Spain led to questions of its ability to cover its finances. The USA nearly doubled the output of $20 gold coins during 1898 and 1899 to pay for expenses of the war. When confidence declined, this is when we see the highest levels of interest rates.

The high in US interest rates took place in 1899, It was 1896 when J.P. Morgan had to bail out the US Treasury because they were broke. Following America gaining control of the Philippines as part of the ending of the Spanish-American War, in 1899 the Philippines declared war against the United States requiring independence from America. The war continued until 1902 when the Philippine President Emilio Aguinaldo surrendered. In 1916, the United States granted the Philippines autonomy and promised eventual self-government, which came in 1934. In 1946, following World War II, the Philippines was granted full independence. The fact that the USA was at war with Spain led to questions of its ability to cover its finances. The USA nearly doubled the output of $20 gold coins during 1898 and 1899 to pay for expenses of the war. When confidence declined, this is when we see the highest levels of interest rates.

This is what will happen in Europe. It is all depending upon the fleeting whims of confidence. Only a complete fool thinks that a trend set for a few days will continue forever. Nevertheless, the first level is the technical resistance just below 124. Then we have 125 and 12890. These remain possible and will help to create the impression the euro will rally and the dollar will collapse. That will suck everyone in and then you have the stage set for the slingshot in the opposite direction.

This is what will happen in Europe. It is all depending upon the fleeting whims of confidence. Only a complete fool thinks that a trend set for a few days will continue forever. Nevertheless, the first level is the technical resistance just below 124. Then we have 125 and 12890. These remain possible and will help to create the impression the euro will rally and the dollar will collapse. That will suck everyone in and then you have the stage set for the slingshot in the opposite direction.

We should see the flurry build once the Downtrend Line is exceeded. Then you will hear the big sucking sound bringing in all the dollar haters and we then set the stage for crazier choppy trends.

This is NOT going to be an easy people between 2018 and 2021. So hang on to your socks. This will be a very interesting time. The key is to survive it.