Tag Archives: Basel II

Stunning Day of Economic Gaslighting – Despite All Positive Data, Corporate Media Cheering For Recession…

August 14, 2019

A “negative yield curve“; a pending “economic recession“. These are the obtuse and ridiculous proclamations of the Mainstream Corporate Media today. So let’s take a moment to discuss how stunningly -intentionally- disconnected they are.

Always remember, there are trillions of dollars at stake; and these media entities have a vested interest in maintaining the Wall Street position, adverse to Main Street USA.

First the “negative yield curve” aspect; where long-term bond rates (returns on investment) are lower than short-term rates (returns). As Reuters proclaims:

“A key bond market metric turned negative for the first time since 2007 on Wednesday, sending stocks tumbling”…

I must admit, I actually started laughing out loud when I first read that proclamation. Allow me to introduce a radical concept in economics: “supply and demand” !

The long-term borrowing rate for return on investment dropped momentarily lower than the short-term borrowing rate of return on investment because massive numbers of foreign investors were rushing to buy long-term U.S. bonds. Wait… what? Yes, a ‘negative yield curve’ is what happens when everyone wants to buy bonds in your long-term economy.

There weren’t enough long-term bonds to fill the demand of those who wanted to purchase them. Ergo, the return rate of interest dropped because there was no need to have an incentive to sell them…. everyone wants them.

So the yield drops, because the U.S. doesn’t need to incentivize the sale… because everyone is lined up to buy them. See how that works?

Do lines of people wrapping all around the world trying to get to the U.S.A Bank and buy U.S. treasury bonds sound like the USA economy (underlying the bond) is weak or in trouble?

It’s OK to laugh out loud.

No, really, it’s ok.

Yes, Alice, it’s true. The financial media would have you believe that customers lined-up around the building to purchase your products means your business is about to close because of a lack of customers. THAT my friends is the stupidity of it.

The U.S.A economy is so strong, so healthy, and forecast to remain so with such intensity, that everyone wants to purchase dollars because it is the world’s highest predicted rate of return for investment….. And somehow the media can spin that into a bad thing.

No, really. That’s the narrative of today.

Now let’s look at the second stupid “A looming recession“:

First, a “recession” is two consecutive quarters of negative GDP growth. That’s how you define a recession. So to start a recession you need need one quarter of negative GDP growth right? Well, duh, it hasn’t happened, and there is not a single economist who is predicting a negative Third Quarter growth rate (July, Aug, Sept., ’19).

First Quarter GDP growth was 3.1%. [Beating all expectations] Second Quarter GDP growth was 2.1%. [Again, beating all expectations]… and somehow the Third Quarter is suddenly going to be negative growth? It’s OK to laugh again.

So how does CNN et al “warn of a looming recession” when there’s not a single economist forecasting a negative GDP for the third quarter? Well, they make shit up that’s how.

Think about it…. if the economy was contracting, people would not be getting hired right? Employers would be laying people off right? Businesses would be selling off assets right? Wages would be dropping right?

Do you see any of these things happening?

No? Why not?

Because it ain’t happening, that’s what !!!

The U.S. economy is not shrinking. Main Street is strong, and getting stronger.

Go back to point #1, would the world be rushing to buy dollars if the U.S. economy was on the precipice of collapse? Think about it.

Now, that said, there are some economies that are shrinking; and they all have something in common. The manufacturing export dependent nations are in trouble because President Trump is starting to limit their access to their most desired customers, the USA. And President Trump is telling companies that operate in those export nations that it would be in their best interests to come to the United States to make their goods.

Germany, the economic engine for the EU, is a manufacturing export dependent nation, and it is contracting. China is a manufacturing export dependent nation and their manufacturing is contracting. But the U.S. is strong, because we are not dependent on exports. In fact the U.S. consumes more than 80 percent of what we produce; we are a self-sustaining economy.

Our U.S. economic strength is why Asian and European investors are rushing to buy dollars (US Bonds); and why the U.S. treasury doesn’t need to provide high yield rates as incentives to buy them (hence the negative yield curve).

Stop me when any of the U.S. economic data has even the slightest implication of a slowdown, or “looming recession”.

Our last jobs report showed 164,000 new jobs created in July (yeah, like two weeks ago). In addition 363,000 people moved from part-time to full-time employment… does that sound like a weak economic outcome? Current blue-collar wage growth is in excess of 3.4%, and current overall U.S. worker income is growing at a rate exceeding 5.4%.

Does any of that sound like what you see just before a “looming recession”?

Every actual data result exceeds expectations.

Every measurable KPI in the U.S. economy beats every forecast.

Show me data that supports this “looming recession” claim. Guess what; you can’t because it is a manufactured bucket of nonsense. Abject stupidity created in the basement of media narrative engineers and pushed into the U.S. mainstream talking points in an effort to create something that doesn’t exist. You know the word for that? “Gaslighting” !

Why?

Why are the financial pundits doing this?

Because the engine for the U.S. economy is the U.S. consumer. The Wall St./Media pundit goal is to erode consumer confidence, instill fear, and hopefully get people to sit on those high wages…. thereby creating a self-fulfilling prophecy.

This my friends is the battle behind Wall Street -vs- Main Street.

There are trillions of dollars at stake.

[You Can Read More Here]

Wealth, Poverty, and Politics

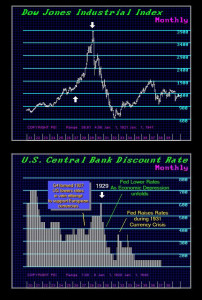

Has the “Smart Money” Entered the US Share Market Yet?

Armstrong Economics Blog/Dow Jones

Re-Posted Aug 14, 2019 by Martin Armstrong

QUESTION: Dear Armstrong,

According to Dow, a bull market has 3 phases, the final being the distribution by the smart money to the public.

You stated that retail is still not participating. Could this be why the market appears to be unable to stop going up? Because the smart money continually fail to entice the dumb to jump in?

Cheers

GF

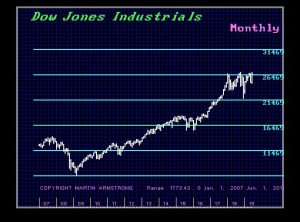

ANSWER: So far, the “smart money” has been more foreign than domestic. We have not even remotely reached that level where the domestic “smart money” is sticking more than their toe in the water. Just look at the Dow in euros compared to US dollars. The Europeans have been making a fortune buying the dips in the US market on a currency play in addition to the market itself.

Can the US Government Really Force the Dollar Lower?

Armstrong Economics Blog/Capital Flow

Re-Posted Aug 12, 2019 by Martin Armstrong

QUESTION: Hi Martin, What tools do the US have to TRY and manipulate their dollar lower (other than cutting interest rates) and in your opinion would they be successful? How much do they have in the Exchange Stabilization Fund? Do they have a defense plan to limit and control capital flows coming in?

Thanks,

RM

ANSWER: They lack any power to prevent a dollar rally. The Exchange Stabilization Fund (ESF) is a U.S. Department of Treasury emergency reserve fund that includes holdings of U.S. dollars (USD), other foreign currencies, and special drawing rights (SDR) funds. The financial statement of the ESF can be accessed at “Reports” or “Finances and Operations.” However, all previous attempts at manipulating currencies have ended in disaster. Yes, the U.S. could put capital controls to block capital coming in, but they would destroy the world economy if they even attempted such a hair-brain idea.

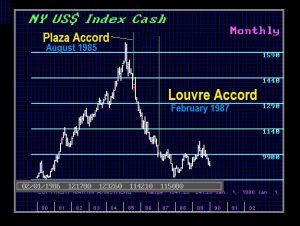

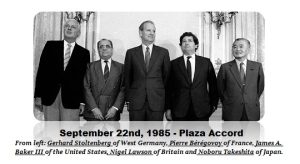

Lowering interest rates will not help for if capital fears survival elsewhere, the level of interest rates will mean nothing. Just look at the creation of the G5 at the Plaza Accord. The market had already turned so their manipulation was already in the direction of the decline. When the dollar fell too far and the other members complained, they then held the Louvre Accord. The markets saw them as incompetent and the dollar continued its cyclical decline on schedule.

Therefore, I have yet to find any period in history where there has been a coordinated effort that has ever succeeded.

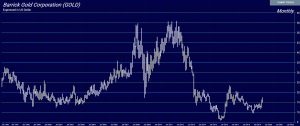

Why Gold Stocks Rallied During the Great Depression

Armstrong Economics Blog/Gold

Re-Posted Aug 12, 2019 by Martin Armstrong

QUESTION: Hi Marty

Can you enlighten us on what happened back in history to gold mining shares in terms of why shares did not collapse during the crash of 1929 compared to what happened to mine shares in 2008?

What happened to the shares held by the public in 1933 when FDR confiscated gold?

So you were safe holding the shares!

GG

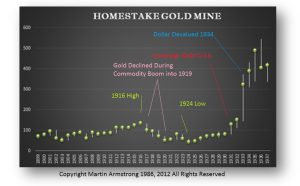

ANSWER: You must realize that gold was money under the gold standard. You can see how it declined following the commodity rally during World War I and eventually bottomed in 1924. During the Great Depression, cash was king and as such Homestake rallied into 1930, but then began to break out with the Monetary Crisis in 1931. The sharp rise came in 1934 with the devaluation of the dollar. Therefore, any comparison to modern times is irrelevant since we are not on a gold standard. Gold now responds in the opposite direction of the currency.

An Environmental Economist to Take the Head of the IMF

Armstrong Economics Blog/Politics

Re-Posted Aug 7, 2019 by Martin Armstrong

QUESTION: Mr. Armstrong; You had once written the Christine Lagarde was only a lawyer and she was really put in the role of the IMF chief by Obama. What do you have to comment on this new Bulgarian selection? DO you know her?

HU

ANSWER: Kristalina Georgieva will probably take over the International Monetary Fund (IMF). At least this Bulgarian is an economist, and she has banking experience whereas Christine LaGarde did not. Georgieva is currently chief executive of the World Bank. I do not know her personally, although we probably shook hands yet nothing more.

Georgieva was considered back in 2016 for the post of the UN Secretary General, but was passed over for the Portuguese António Guterres. For the IMF, Georgieva was the candidate of France and of some Eastern European states. Germany and others were backing the former Dutch Finance Minister Jeroen Dijsselbloem. This time the French won.

If we look at Georgieva background, she does hold a doctorate in economics and research at the London School of Economics and at the Massachusetts Institute of Technology (MIT). From 1993 to 2010 she worked at the World Bank. She headed the Environmental Department of Washington Bank and, in the meantime, her representative office in Moscow. In 2010 she moved to Brussels becoming a Commissioner as Europe’s top development aid worker.

When Jean-Claude Juncker took over the Presidency of the Commission in 2014, he made Georgieva Vice-President in charge of the budget. Georgieva had been involved in a major restructuring at the World Bank turning it greener. We should keep in mind that Georgieva wrote her doctoral thesis on “Environmental Policy and Economic Growth in the US.”

Can the Fed really Control the Economy?

Armstrong Economics Blog/Central Banks

Re-Posted Aug 7, 2019 by Martin Armstrong

QUESTION: This whirligig talk of whether the Fed cuts rates by 25 or 50 basis points is carnival-level absurdity. Does the Fed have the “pretense of knowledge,” as F.A. Hayek, said, that they can regulate the economy like turning up or down the thermostat? I know you don’t agree with this, Martin, but then, Wall St. trades on daily sentiment not ideology.

TM

ANSWER: I understand the theory, but where it is seriously flawed is the idea that people will borrow simply because you lower rates. More than 10 years of Quantitative Easing, which has failed, answers that question. The way the Fed was originally designed allowed it to stimulate the economy by purchasing corporate paper directly, which placed it in a better management position. Buying only government paper from banks who in turn hoard the money fails. As Larry Summers admitted, they have NEVER been able to predict a recession even once.

The Fed lowered rates during every recession to no avail just as the ECB has moved to negative rates without success. The central banks are trapped and they are quietly asking for help from the politicians which will never happen.

Hayek’s “The Road to Serfdom” – Lawrence H. White

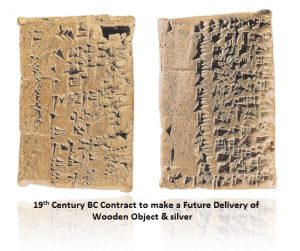

When did Trading Begin? Were Free Markets the Key to the Rise of Empires?

Armstrong Economics Blog/Economics

Re-Posted Aug 2, 2019 by Martin Armstrong

QUESTION: Mr. Armstrong; I figured there is nobody more qualified to answer the question of where and when did markets first begin to trade? Did markets have anything to do with the rise of nations you write about?

KD

ANSWER: Only those societies that developed financial markets ever rose to greatness. Those who bash markets fail to understand that without them, most people would still be digging for potatoes. The evidence supports the first markets were futures markets which traded in Babylon, at least during the 19th century, since we have futures contracts from that period which have survived. All of the research I have conducted clearly demonstrates that economic growth is linked directly to the expansion of financial markets. Once there is a marketplace, then people will invest and economic growth will expand provided they know that if they needed to raise capital, they can sell their investments. Therefore, my research reveals that it takes CONFIDENCE in order to expand an economy and that translates into liquidity. Just look at this from your own perspective. You will buy a share in some company ONLY because you think you can make a profit. But how is that profit even attainable? The potential for a profit exists ONLY if there is a liquid market.

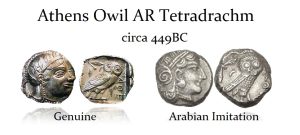

Agora, Athens

The Athenian economy had a financial marketplace in the Agora. There were bankers as well as insurance companies. Aristotle wrote about the people who made money from money. As the Athenian economy began to expand because of the introduction of financial markets, there was a transition of which Aristotle wrote about in his “Politics.” Aristotle believed that the Athenian economy was changing from what I call the Villa Model (Agricultural) of self-sufficient enclaves to an economy of market-driven incentives which encourage the production of excess for the purpose of trade giving rise to a Market Economy Model. Similarly, this was the same transition period emerging from feudalism. Once a financial marketplace emerges, then people will produce more if there is a marketplace where it can be sold.

There are academics who have tried to breakdown the Athenian economy with such detail that they could not see the forest while focusing on the bark of just one tree. They read Aristotle’s “Politics” but missed the whole point of his concern — the transformation of Athens into the financial capital of the ancient world which even predated China. Some have argued that the ancient Greek word oikonomiais the root of our modern English word “economy,” but it is not synonymous with our definition of “economy” as we perceive it today. They argue that today “economy” refers to a distinct sphere of human interactions involving the production, distribution, and consumption of goods and services; oikonomia meant “household management” because it was guide written by Xenophon — how to manage your Villa Economy. They then mix in the political system of Greek Democracy and claim family activity was subsumed into traditional social and political institutions. They then go as far as to degrade the Greek monetary system, admitting that they produced and consumed goods, engaged in various forms of exchanges including long-distance trade among nations, and developed monetary systems employing coinage. This is all discounted by many academics arguing that they did not see such activities as being part of a distinct institution which we call the “economy.” I really see these arguments as gibberish where they have had way too much time to think and produce nothing. Instead, they get lost in their own thoughts. They lack a complete knowledge of the monetary history and fail to comprehend that Athens’ coinage was so dominant in the ancient world it was imitated in the north by the Celts, Slavic people, Asians, and even down in Arabia. That would never have taken place if it was so de minimis as they have tried to portray.

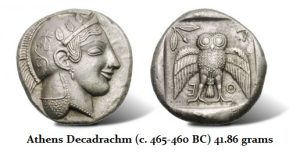

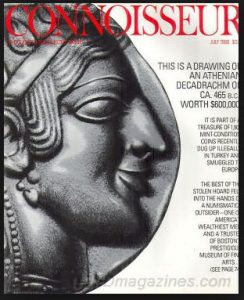

Athens produced the Decadrachm (10 drachmas) with a weight of nearly 42 grams. These coins would have been like 10,000 bills. They are very rare. Again, some academics tried to claim these were merely commemorative issues. They lack sufficient understanding of the world monetary system for these coins have rarely ever been discovered in Greece. Treasure hunters near the village of Elmali in southern Turkey unearthed a trove of ancient coins that included the rarest and most valuable Greek coins ever found. The coins, it said, were smuggled out of Turkey and sold to William I. Koch and two partners. It was the hoard of the century.

Athens produced the Decadrachm (10 drachmas) with a weight of nearly 42 grams. These coins would have been like 10,000 bills. They are very rare. Again, some academics tried to claim these were merely commemorative issues. They lack sufficient understanding of the world monetary system for these coins have rarely ever been discovered in Greece. Treasure hunters near the village of Elmali in southern Turkey unearthed a trove of ancient coins that included the rarest and most valuable Greek coins ever found. The coins, it said, were smuggled out of Turkey and sold to William I. Koch and two partners. It was the hoard of the century.

The Elmali Hoard was discovered around April 1984 containing nearly two thousand ancient Greek and Lycian silver coins. Turkish authorities contacted Interpol seeking international assistance to find and arrest the traffickers. In 1984, the consortium OKS Partners, which included Koch, purchased almost 1,700 of these coins for about $3.2 million. They began to sell the coins in 1987 and that is when the lawsuit was filed. The hoard was eventually returned to Turkey.

The Elmali Hoard was discovered around April 1984 containing nearly two thousand ancient Greek and Lycian silver coins. Turkish authorities contacted Interpol seeking international assistance to find and arrest the traffickers. In 1984, the consortium OKS Partners, which included Koch, purchased almost 1,700 of these coins for about $3.2 million. They began to sell the coins in 1987 and that is when the lawsuit was filed. The hoard was eventually returned to Turkey.

The significance of this hoard establishes that the Athenian Decadrachms were high denomination coins used in international trade. They are not found in Athens, but in ancient port cities around the Mediterranean coast. Some scholars claimed that the Athenian decadrachm is comparable to the more abundantly produced Syracusan decadrachm, which was minted around the same time. However, the Syracuse decadrachm was also minted for celebratory and practical purposes. The Syracuse minted their decadrachms in response to their defeat of the Carthaginians and they attempted to try to argue this was the same reason behind the Athenian decadrachms.

Numismatists have identified 24 separate reverse dies used for one issue of Syracusan decadrachms by created by the artist Euaenetus. This suggests that a minimum original circulation of just this issue would have been between 240,000 and 360,000 coins with a modern survival rate ranging between .08% and .25%. The Athenian decadrachm was used in international trade when they were attaining timber and metals from the Near East. The majority of Athens was composed of farmers who would never have a need for a decadrachm. The decadrachm became obsolete by the time of Pericles and Democracy for Athens was losing its supremacy and lost in war to Sparta. In fact, during the Peloponnesian War (431–404 BC), Athens lost its silver resources and began to issue its coins merely silver plated.

Numismatists have identified 24 separate reverse dies used for one issue of Syracusan decadrachms by created by the artist Euaenetus. This suggests that a minimum original circulation of just this issue would have been between 240,000 and 360,000 coins with a modern survival rate ranging between .08% and .25%. The Athenian decadrachm was used in international trade when they were attaining timber and metals from the Near East. The majority of Athens was composed of farmers who would never have a need for a decadrachm. The decadrachm became obsolete by the time of Pericles and Democracy for Athens was losing its supremacy and lost in war to Sparta. In fact, during the Peloponnesian War (431–404 BC), Athens lost its silver resources and began to issue its coins merely silver plated.

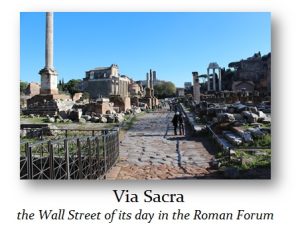

Therefore, both the Athenian and Roman economies began to expand into sophisticated agricultural-based economies only with financial markets. This is how the economies emerged from a Villa Model of self-sufficient enclaves as was also the case in feudal times into a integrated market economy which led to international trade and the birth of Mercantilism. Rome did not have a national debt nor did it possess a central bank. Consequently, there was a deep financial market which would also take place in the Roman forum along the Via Sacra — the Roman version of Wall Street.

Most people assume that the invention of corporations really began with the East India Company since it was the first share to begin trading in the 1500s. However, there were plenty of early examples of markets which were similar to stock markets. Even during the 1100s, France had a system where courretiers de change managed agricultural debts throughout the country on behalf of banks. This can be seen as the first major example of financial exchange because the men effectively traded debts — bonds. Later, the merchants of Venice were credited with trading government securities as early as the 13th century. Post-Dark Age, the first trading in any type of financial marketplace was confined to debt instruments rather than corporate shares.

What is typically overlooked is that the first public corporation concept is truly attributed to also the same man who gave us the word “economics” from the title of his book, “Oikonomikos” meaning actually how to regulate the household – Xenophon (431 – 350 BC). Xenophon was a student of Socrates. He became a mercenary and was the leader of the famous “Ten Thousand” (of recent movie epic). He was opposed to extreme democracy that sentenced Socrates to death. His last writing in 355 BC was his “Ways and Means” that advocated peace rather than war that destroyed the economy (yes, Congress’ committee is named after his work – Ways & Means Committee). Xenophon was not a philosophic intellectual, but rather a practical man of action who wrote from experience.

Xenophon proposed a public corporation for a bank that would be formed by shares subscribed to by all the Athenian people. Commerce was seen as more important than even agriculture. Xenophon proposed a public bank that would lend at interest to expand the economy. He proposed that the profits would be used to pay for public works. During the reign of Augustus (27 BC-14 AD) in Rome, there was such a public loan bank, but not subscribed to by individual members of society. This public bank provided loans to the poor without interest and it was funded by the confiscation of property from those alleged to be criminals, which would include political dissents as well. Collateral was required at twice the amount being borrowed. These types-of public banks aided the purchases of land.

The word “corporation” derives from corpus, the Latin word for body, or a “body of people.” By the time of Justinian (527–565 AD), Roman law recognized a range of corporate entities under the names universitas, corpus or collegium. These included the state itself (the Populus Romanus), municipalities, and such private associations as sponsors of a religious cult, burial clubs, political groups, and guilds of craftsmen or traders. Therefore, these bodies of people commonly had the right to own property and make contracts. They could also receive gifts and legacies, to sue and be sued. They could perform legal acts through representatives as well. Private associations were granted designated privileges and liberties by the emperor and these are the origins of corporations.

Roman knights of the republic did invest in small business and they would receive a share of the profits. These were contracts which could be resold to someone else, but they did not trade on an open exchange. Likewise, senators would also invest in land and gain a portion of the harvest as their return on investment. Trading in shares of corporations really materialized in the 1500s, but the Roman and Greek systems would be more like venture capital and private placements.