Posted originally on the conservative tree house on September 6, 2022 | Sundance

What is predicted to happen in Europe is just stunning, literally stunning.

♦Context – According to official data from the World Bank, the combined Gross Domestic Product (GDP) of the European Union was just over $17 trillion US dollars in 2021. That is the last calculated measure. The combined GDP value of European Union represents roughly 12.78 percent of the world economy.

According to analysts for Goldman Sachs, the current energy crisis in Europe has increased electricity prices at a rate that is increasing almost daily. Within the data it is now estimated that households within the EU will pay an additional $2 trillion for electricity in the next year.

Put that $2 trillion into context with their GDP, and that scale of energy cost would be wiping out 12% of the purchasing strength within the total EU economy. Forget about buying anything else, if this analysis is correct Europeans will be buying food and energy, nothing else.

If you consider what that means, it is bordering on full economic collapse of western Europe.

What is being described above is what we posited when we outlined the impact of the “Energy Economy” {Go Deep}. When you suck 12% of the purchasing power out of an economic engine simply to maintain the status of current energy use, everything else starts to collapse.

Also keep in mind we are only talking about the direct impact of $2 trillion in electricity cost. The downstream consequence is far greater because everything created, produced, or manufactured, including food, is dependent on electricity – which will drive the final cost to produce of all those products even higher.

The damage is almost unimaginable in scale.

[Fortune] – European households should brace for an expensive winter owing to the continent’s deepening energy crisis that will likely send electricity and heating bills soaring.

Energy affordability in Europe is reaching a “tipping point” that could peak next year, with total spending on bills across the continent growing by 2 trillion euros ($2 trillion), a Goldman Sachs research team, led by Alberto Gandolfi and Mafalda Pombeiro, said in a note published Sunday.

Many European households are already feeling the bite of a steadily worsening energy crisis, brought on by Russian natural gas producers intermittently pausing flows along the critical Nord Stream pipeline following Western sanctions this year.

Energy bills at some restaurants and coffee shops have already more than tripled this year, but with threats looming that natural gas supply from Russia could become even tighter as the Ukraine War rages on, analysts warn that Europe’s coming struggles are set to rival some of the worst energy crises on record.

“The market continues to underestimate the depth, the breadth, and the structural repercussions of the crisis,” the Goldman Sachs analysts wrote. “We believe these will be even deeper than the 1970s oil crisis.” (read more)

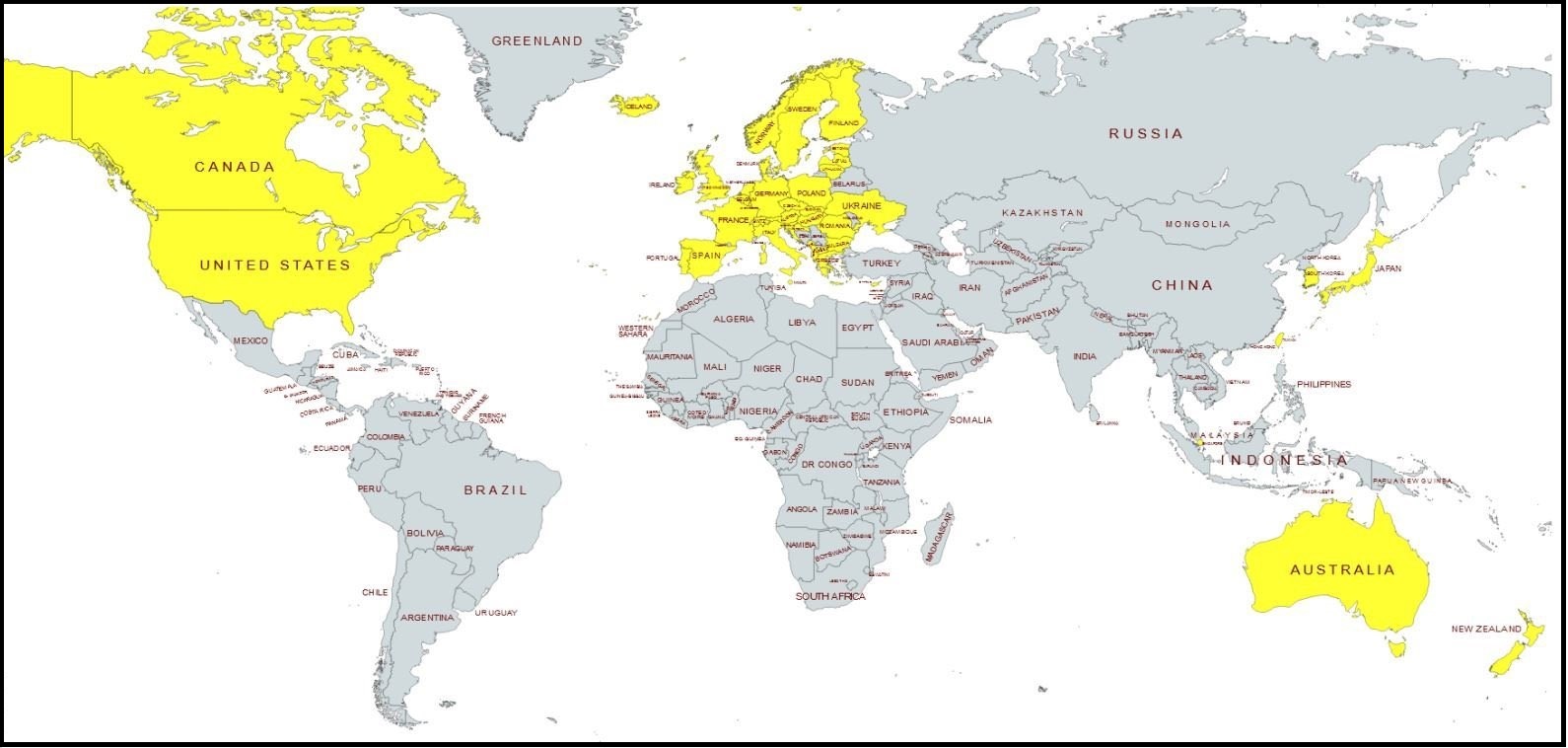

The economic contagion will not be isolated to Europe.

The impacts to the social fabric are also almost unquantifiable in scale.

Example: What happens to migration patterns when economic migrants are now considered a threat to scarce resources?

While the US is not quite in the same level of energy desperation, what we were discussing last week is an example of the problem we too may face.

Let’s say you are an average USA Main Street household with an income around $100,000/yr, and you now face an increase in electricity rates from $300 to $500 due to Joe Biden’s new national energy policy known as the Green New Deal. That’s $200 more per month for this initial economic/energy “transition” moment.

That extra $200/month equates to $2,400 per year.

That $2,400 per year is static economic activity. Meaning nothing additional was created, and nothing additional was generated. The captured $2,400 is simply an increase in the price of a preexisting expense.

Take that expense and expand it to your community of 100 friends and family households. The $2,400 now becomes $240,000 in cost that doesn’t generate anything. $240,000 is removed from the community economy. $240,000 is no longer available for purchasing other goods or services within this community of 100 households.

The economic purchasing power of the 100-household community is reduced by $240,000 per year.

Take that expense and expand it to your county of 10,000 households. Now you are reducing the county economic activity by $24 million. In this county of 10,000 households, $24 million in economic transactions have been wiped out. Meals at restaurants, purchases of goods and services, or any other spending of the $24 million within the county of 10,000 households (approximately 25,000 residents) has been lost.

Now expand that expense to a larger county, quantified as a mid-size county, of 50,000 households. The mid-sized county has lost $120 million in household economic activity, simply to sustain the status quo on electricity rates. Nothing extra has been generated. $120 million is lost. The activity within the county of 50,000 households shrinks by $120 million.

Expand that expense to a large county of 100,000 households, and the lost economic activity is $240 million.

Expand that expense to a small state of 1 million households (2.5 million residents), and the lost economic activity is $2.4 billion.

Expand that expense to a state with 5 million households (approximately 12 million residents) and the economic cost is $12 billion in lost economic activity unrelated to the expense of maintaining the status-quo on electricity use. This state loses $12 billion in purchases of goods and services, just to retain current energy use.

These examples only touch on household expenses. The community, county and state business expenses for offices, supermarkets, stores, etc. are in addition to the households quoted.

Meanwhile the Gross Domestic Product (GDP) of the community, county and state, remains static because the GDP is calculated on the total value of goods and services generated in dollar terms. The appearance of a static GDP is artificial. In real Main Street terms, $12 billion in economic activity is lost, but the price or increased value of electricity hides the drop created by the absence of goods and services purchased.

Fewer goods and services are purchased and consumed. However, statistically the inflated price of electricity gives the illusion of a status quo economy.

Now expand that perspective to a national level and you can see our current economic condition.

All of this is being done under the justification of “climate change.”

Previously I would have said this level of economic impact in Europe would lead to a total revolt against the government. However, with the backdrop of the recent COVID lockdowns and government control mechanisms in mind, and looking at the citizen compliance that took place in response to those government mandates, it is now more likely the citizens in Europe will simply bow to the energy control mechanisms of the governing authority.

It’s almost as if the COVID compliance effort was the test…