Armstrong Economics Blog/Europe’s Economic History

Re-Posted Sep 20, 2018 by Martin Armstrong

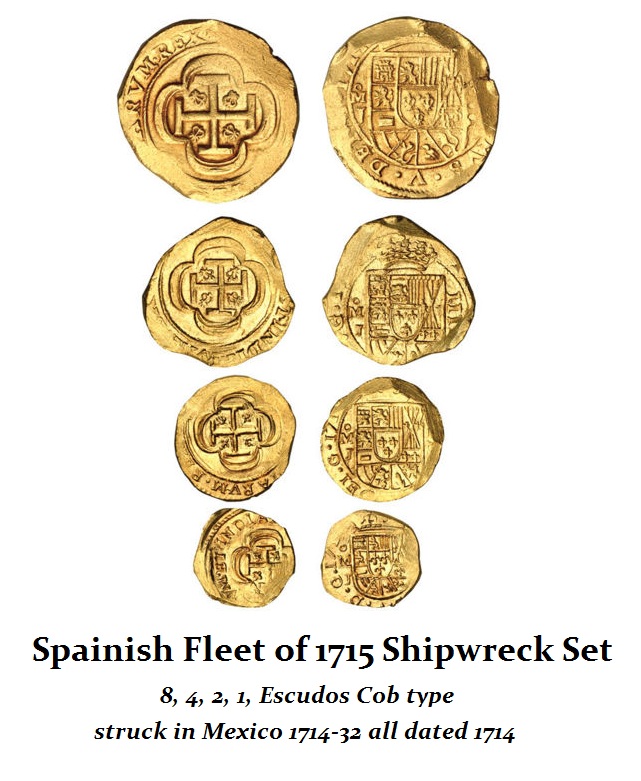

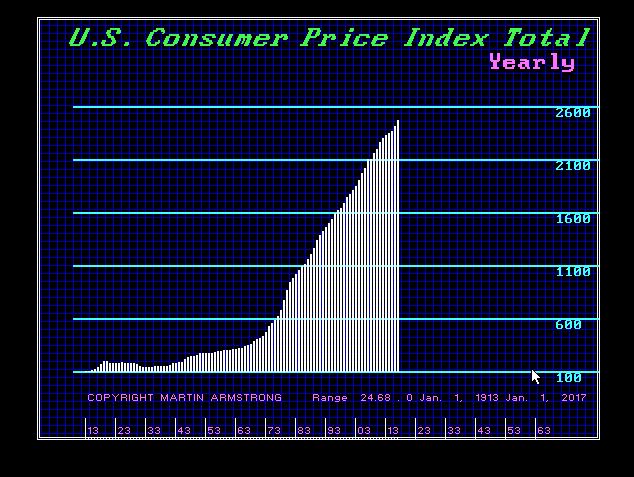

There is little doubt that Spain was once the Financial Capital of the West. Their discovery of America produced mountains of gold and silver to the point that they really impacted the European economy creating significant waves of inflation. However, there was the War of the Spanish Succession (1701–1714) which was why the famous Spanish Fleet that sank on July 31st, 1715 took place. This was a massive treasure fleet that remained in the New World until the war was over because the risk of being attacked by the British was too high. The British sought to prevent the Spanish from funding themselves for the war by preventing ships carrying gold to make it to Spain. The fleet was 11 ships and they are said to have been carrying not just gold and silver, but the dowry for the Queen called the Queen’s Jewels.

There is little doubt that Spain was once the Financial Capital of the West. Their discovery of America produced mountains of gold and silver to the point that they really impacted the European economy creating significant waves of inflation. However, there was the War of the Spanish Succession (1701–1714) which was why the famous Spanish Fleet that sank on July 31st, 1715 took place. This was a massive treasure fleet that remained in the New World until the war was over because the risk of being attacked by the British was too high. The British sought to prevent the Spanish from funding themselves for the war by preventing ships carrying gold to make it to Spain. The fleet was 11 ships and they are said to have been carrying not just gold and silver, but the dowry for the Queen called the Queen’s Jewels.

When the Spanish Colonial authorities heard of the great disaster, they responded from Havana and St. Augustine. Over 1,000 men died and the survivors were few on the beach. The authorities tried to direct their efforts at salvaging the galleons. By September 1715, some survivors were still at the camp on the beach. The Spanish authorities had turned the beach into a base of salvage operations. The Spaniards claimed that they were able to recover large portions of the treasure. This may have been a tactic of the Spanish exaggerating the amount of the recovery to deter others. Nevertheless, there were pirates were responding to the wreck perhaps even as fast as the Spanish. One English privateer named Jennings was a very successful pirate in early 1716. Given the vast number of coins that have still been recovered, obviously, the Spanish never recovered any significant portion.

When the Spanish Colonial authorities heard of the great disaster, they responded from Havana and St. Augustine. Over 1,000 men died and the survivors were few on the beach. The authorities tried to direct their efforts at salvaging the galleons. By September 1715, some survivors were still at the camp on the beach. The Spanish authorities had turned the beach into a base of salvage operations. The Spaniards claimed that they were able to recover large portions of the treasure. This may have been a tactic of the Spanish exaggerating the amount of the recovery to deter others. Nevertheless, there were pirates were responding to the wreck perhaps even as fast as the Spanish. One English privateer named Jennings was a very successful pirate in early 1716. Given the vast number of coins that have still been recovered, obviously, the Spanish never recovered any significant portion.

The War of the Spanish Succession was a European conflict of the early 18th century that was triggered by the death of the childless Charles II of Spain in November 1700. His closest heirs were members of the Austrian Habsburg and French Bourbon families. With the riches of the New World at stake, who would rule Spain was a major economic prize. This also was a critical issue in changing the European balance of power. Charles II had actually left the undivided Spanish monarchy to Louis XIV’s grandson Philip of France who was proclaimed King of Spain on November 16th, 1700. Disputes erupted over the separation of the Spanish and French crowns. In reality, in an effort to regulate the impending succession there were three principal claimants, England, the Dutch Republic, and France. During October 1698, they signed the First Treaty of Partition. They all agreed that on the death of Charles II, Prince Joseph Ferdinand, son of the elector of Bavaria, should inherit Spain, the Spanish Netherlands, and the Spanish colonies. They also allocated Spain’s Italian dependencies would be partitioned between Austria which would get the Duchy of Milan and France Naples and Sicily.

Then in February 1699, Joseph Ferdinand died. Now a second treaty was drafted and signed on June 11th, 1699, by England and France and in March 1700 by the Dutch Republic and Spain. Leopold, however, refused to sign the treaty and demanded that Charles receive all the Spanish territories intact. Therefore, we see the contest between the Bourbons of France and Spain against the Grand Alliance. Bavaria joined France in September 1702 while Savoy and Portugal joined the Grand Alliance with Austria, whose candidate was Archduke Charles, the younger son of Habsburg Emperor Leopold. This led to war breaking out in 1701.

By 1710, fighting was really at a stalemate. France was unable to conquer Italy and the Low Countries. Philip V was the secure ruler in Spain. When Archduke Charles unexpectedly succeeded as Emperor Charles VI in 1711, Britain effectively withdrew. This then forced the Allies to make peace which produced the 1713 Treaty of Utrecht, followed in 1714 with Rastatt and Baden. With the British withdrawing and peace was restored, then Philip V could be confirmed as King of Spain and, in exchange, he renounced the French throne. The European territories were divided between Austria, Britain, and Savoy. Britain emerged as the key European maritime and commercial power overshadowing the Spanish and the Dutch.

By 1710, fighting was really at a stalemate. France was unable to conquer Italy and the Low Countries. Philip V was the secure ruler in Spain. When Archduke Charles unexpectedly succeeded as Emperor Charles VI in 1711, Britain effectively withdrew. This then forced the Allies to make peace which produced the 1713 Treaty of Utrecht, followed in 1714 with Rastatt and Baden. With the British withdrawing and peace was restored, then Philip V could be confirmed as King of Spain and, in exchange, he renounced the French throne. The European territories were divided between Austria, Britain, and Savoy. Britain emerged as the key European maritime and commercial power overshadowing the Spanish and the Dutch.

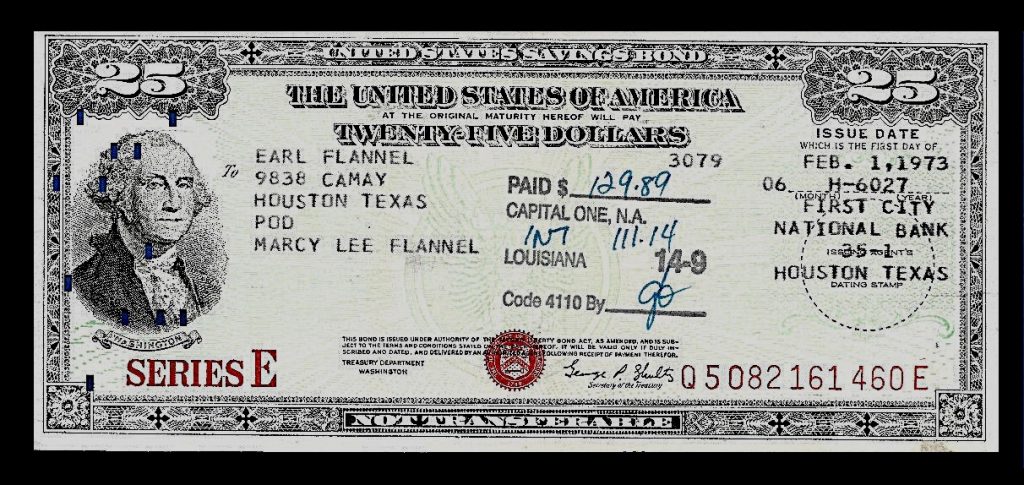

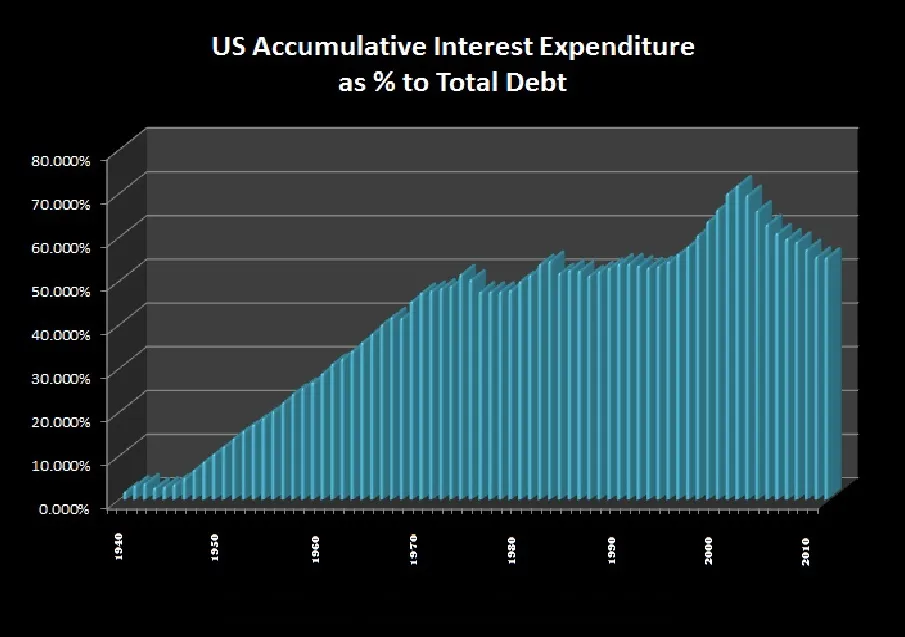

Spain had borrowed heavily for this War of Succession because it could not risk bringing in its treasure fleets. Spain had become a serial defaulter beginning in 1557 followed by 1570, 1575, 1596, 1607, and 1647 ending in a 3rd world status. The loss of the treasure fleet of 11 ships in 1715 was a crushing blow to Spain. The lost of the 1715 Treasure fleet reduced Philip V to the status of a beleaguered monarch. Philip V had badly needed all the gold and silver to pay loans. The New World wealth that had made Spain a world power in the 16th and 17th Century had now become a fraction of what it once was. Spain’s role in world affairs declined in proportion with the loss of the 1715 Treasure Fleet.

Nobody has yet found the gold, silver, and jewels that were designated as part of the dowry for his new 22-year-old wife. He had married Elisabeth Farnese of Parma by proxy in 1714 and was still trying to make a good impression on the reluctant lady. Her dowry was to be the greatest of any queen in Europe. More than 1200 pieces of rare jewelry were said to have gone down with the fleet. She was demanding that her dowry be the greatest in Europe. She requested a heart made of 130 pearls, 14-carat pearl earrings, a pure coral rosary with large sized beads and an emerald ring weighing 74 carats. The Queen’s dowry was reported to have been stored in the personal cabin of the Fleet’s senior officer. She gives a new meaning to the term “gold digger” and no doubt was a woman worthy of the title – high maintenance. Of course, they were never marriages for love or even physical attraction.

The loss of the 1715 fleet immediately resulted in the debasement of silver coins which began in 1716. The Spanish mints flooded Spain with debased silver based on the real sencillo of 3·067 g, containing 2·556 g silver. These silver coins were called plata provincial. The silver minted in America was now officially called plata nacional, but was also called plata vieja (old silver) or plata gruesa (heavy silver), and occasionally plata doble (double silver).

There were more than 100 gold Roman coins discovered in a buried hoard in the

There were more than 100 gold Roman coins discovered in a buried hoard in the