According to CNBC, Bob Woodward reported that Trump told Gary Cohn, the former Goldman Sachs/director of the National Economic Council to just print more money to reduce the national debt. Woodward reports this discussion:

Trump: “Just run the presses—print money.”

Cohn: “You don’t get to do it that way. We have huge deficits and they matter. The government doesn’t keep a balance sheet like that.”

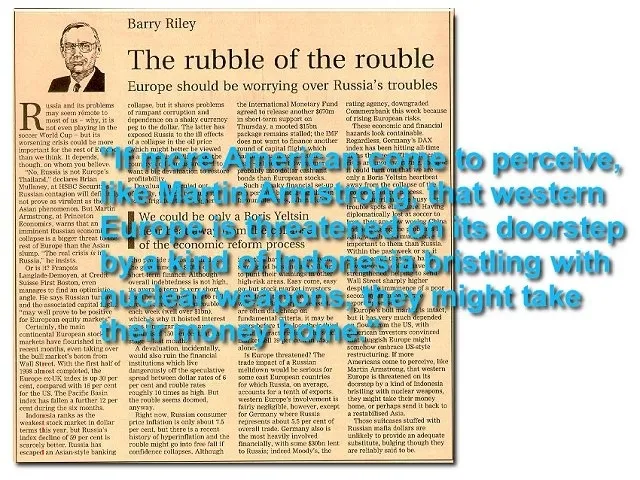

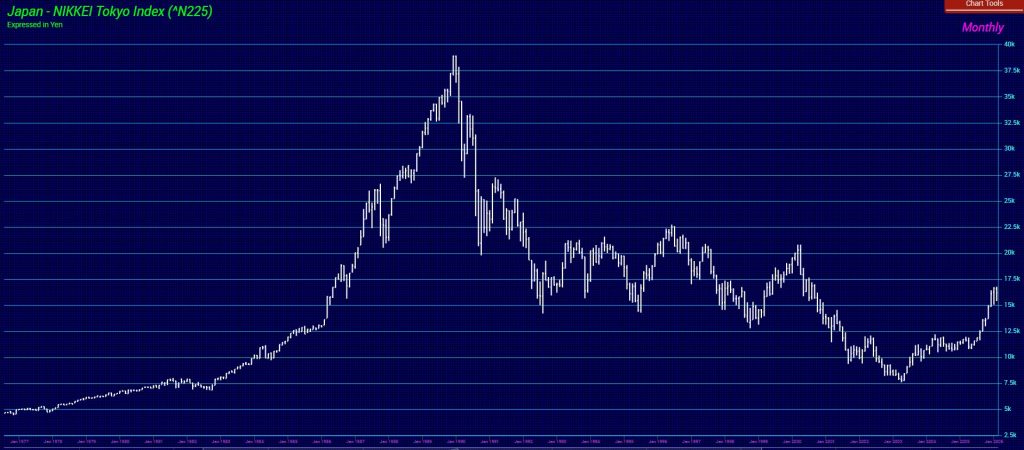

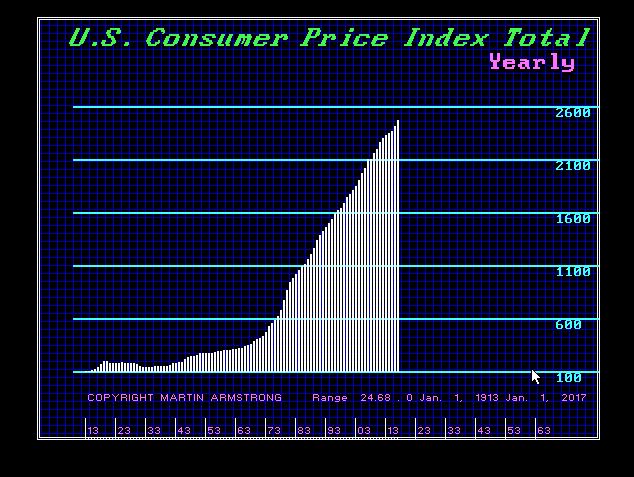

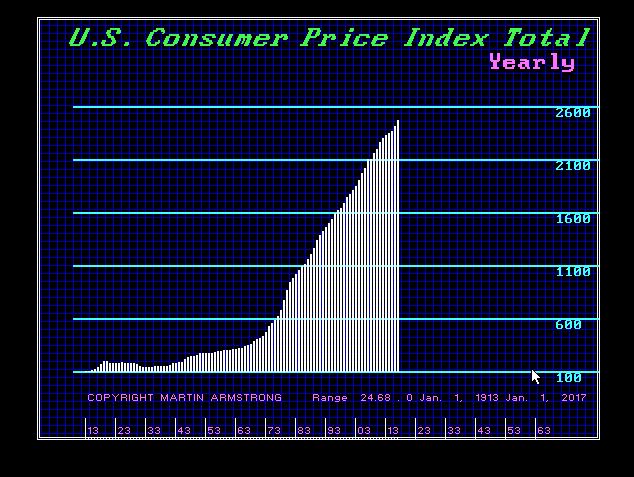

Here is a chart of the US CPI not seasonally adjusted. It has begun its sharp advance since the Floating Rate System was adopted in 1971 with the fall of Bretton Woods. In spite of borrowing, inflation over time has actually advanced more aggressively than if we had just printed instead of borrowed. Cohn has said the book “does not accurately portray” his experience of the White House. This claimed quote demonstrates that someone is seriously out of touch with economics. Actually, Trump is correct. Now we have Quartz joining the media calling Trump an idiot confirming they too are clueless about debt and printing. In fact, if you did just print the money and retired the debt, it would be DEFLATIONARY and not INFLATIONARY from the budget perspective because these people are clueless themselves about how the national debt works.

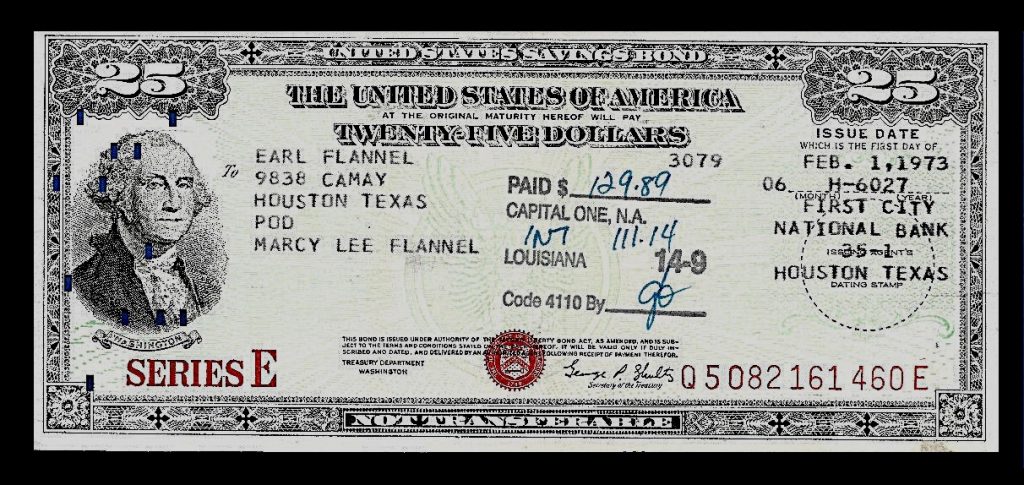

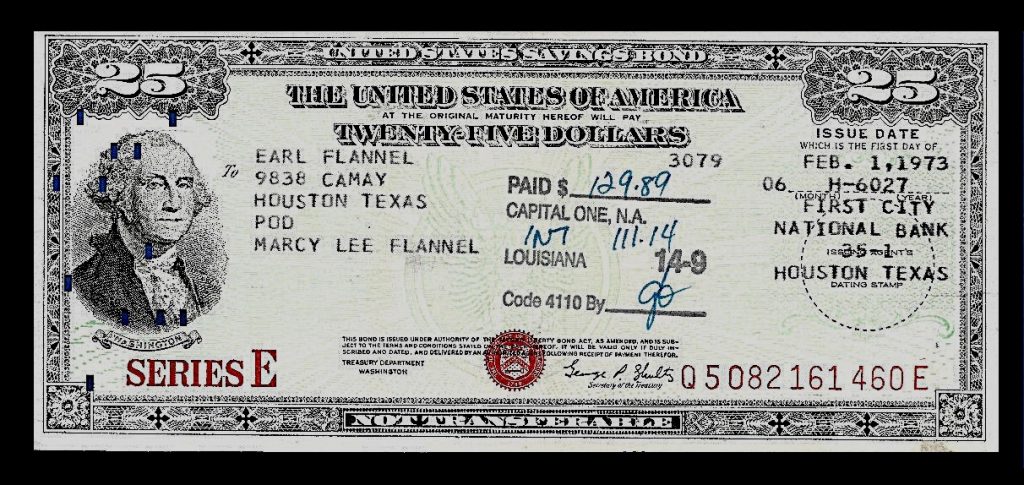

Before 1971, the debt could not be used as collateral for loans such as Savings Bonds. If you needed the money, you were forced to cash them in. Under this system, it was logically less inflationary to borrow than to print. However, post-1971, you buy T-Bills and post them as collateral to trade futures. The distinction between borrowing and printing has been turned upside down. A national debt is now worse than printing because itis money that now pays interest forever. Then there is no intention of ever paying off the national debt.

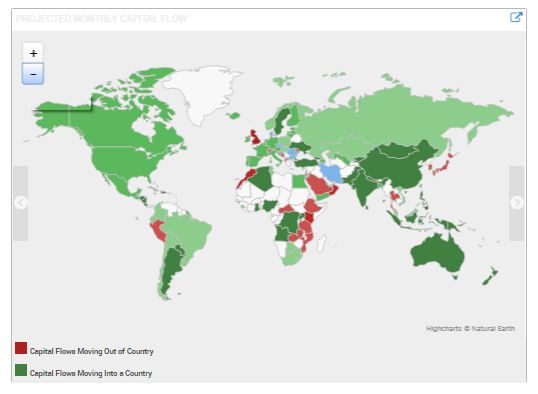

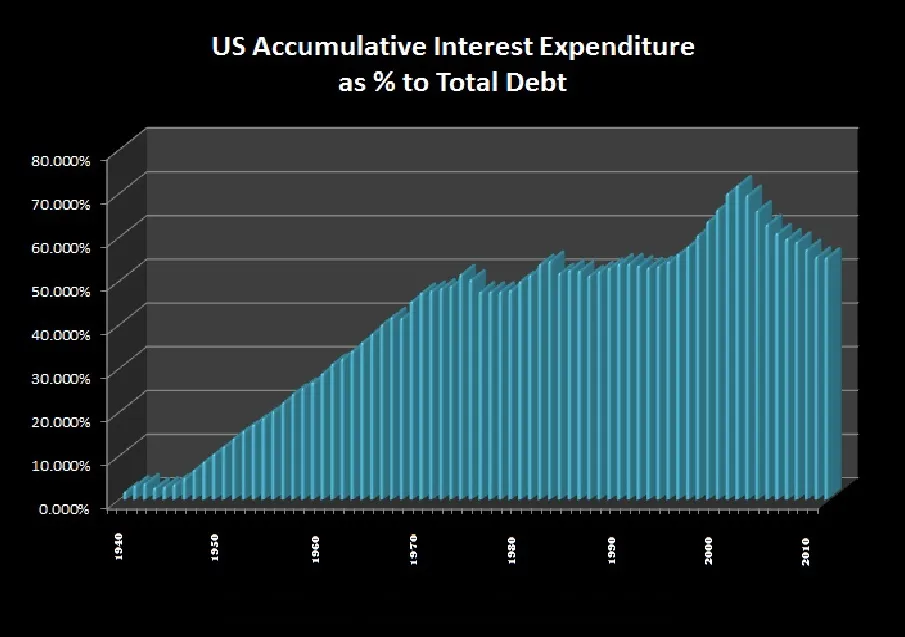

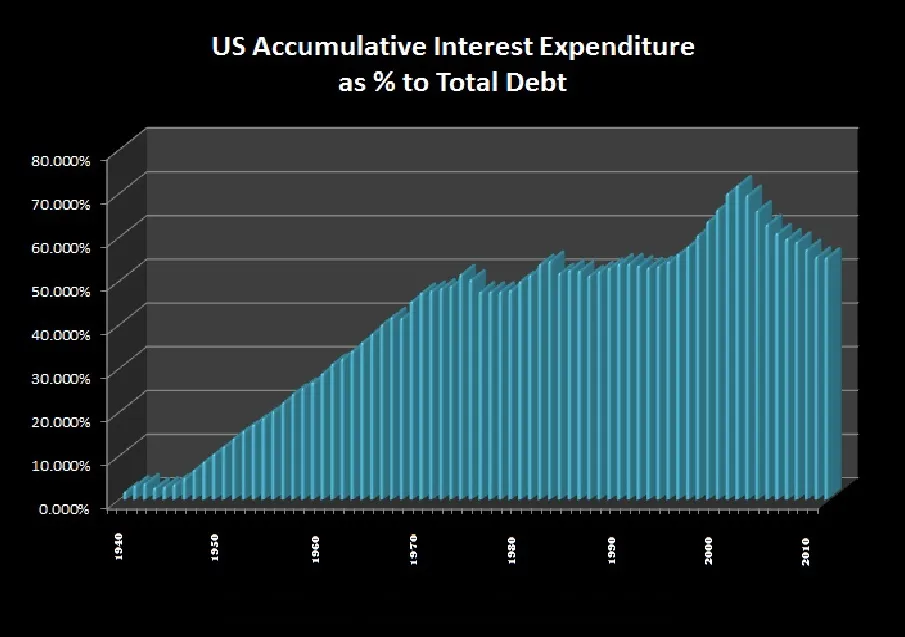

The truth is had we printed since 1971 instead of borrowing, there would be far less of an economic crisis compared to what we face today. If we simply printed to pay off the national debt, Social Security would suddenly become a Wealth Fund that actually made money instead of a Slush Fund for politicians. Now, Social Security can only invest 100% in US government debt and then the Fed lowers the interest rate to “stimulate” the economy and Social Security goes broke forcing higher taxes. Up to 70% of the national debt at times has been purely accumulated interest which never benefited anyone. It competes with the private sector in what we call the “flight to quality” and it forms the bank reserves. What is never discussed is the fact that US debt is also the reserve currency of nations – not paper dollars. That means that the interest we pay is exported and it stimulates foreign economies – not domestic.

So who is crazy here? Trump or Woodward? To keep borrowing year after year is insane. To monetize the debt will be DEFLATIONARY from the perspective of government expenditure. In 2019, interest expenditures even at this low level of interest rates will EXCEED military expenditure.

Woodward is by no means qualified to criticize Trump on such an issue he clearly does not even understand. Trump should really address the nation and explain this problem very simply. I will be glad to supply the charts.

Just when you thought President Recep Tayyip Erdogan was really off the reservation, he suddenly appears off the planet. Erdogan has appointed HIMSELF as chairman of Turkey’s Sovereign Wealth Fund and got rid of the entire management staff. It looks like Erdogan now thinks he can force the free market to do as he commands if he is also the trader for the Sovereign Wealth Fund.

Just when you thought President Recep Tayyip Erdogan was really off the reservation, he suddenly appears off the planet. Erdogan has appointed HIMSELF as chairman of Turkey’s Sovereign Wealth Fund and got rid of the entire management staff. It looks like Erdogan now thinks he can force the free market to do as he commands if he is also the trader for the Sovereign Wealth Fund.

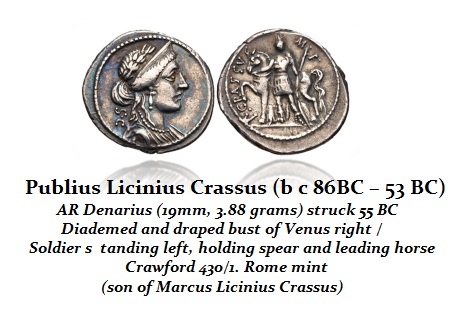

There were more than 100 gold Roman coins discovered in a buried hoard in the

There were more than 100 gold Roman coins discovered in a buried hoard in the