Armstrong Rconomics Blog/Ancient Economies

Re-Posted Feb 10, 2020 by Martin Armstrong

QUESTION: Marty, do you happen to know what type/kind of shekel coins Jesus was most likely betrayed for?

Thanks,

A

ANSWER: The Biblical account makes no mention of shekels for they were not the coin of currency. Thirty pieces of silver was the payment for Judas Iscariot’s betrayal of Jesus, according to an account in the Gospel of Matthew 26:15 in the New Testament. The Roman Emperor at the time was Tiberius (14-37 AD). The exact date of his crucifixion is not known. Most scholars have provided estimates for the crucifixion to be within the range 30–33 AD, with perhaps April 7, 30 AD to be the majority of consensus. The pieces of silver would have been of the silver denarius. The amount of coinage under Augustus (27 BC-14 AD) was massive. The coinage of Tiberius was very frugal.

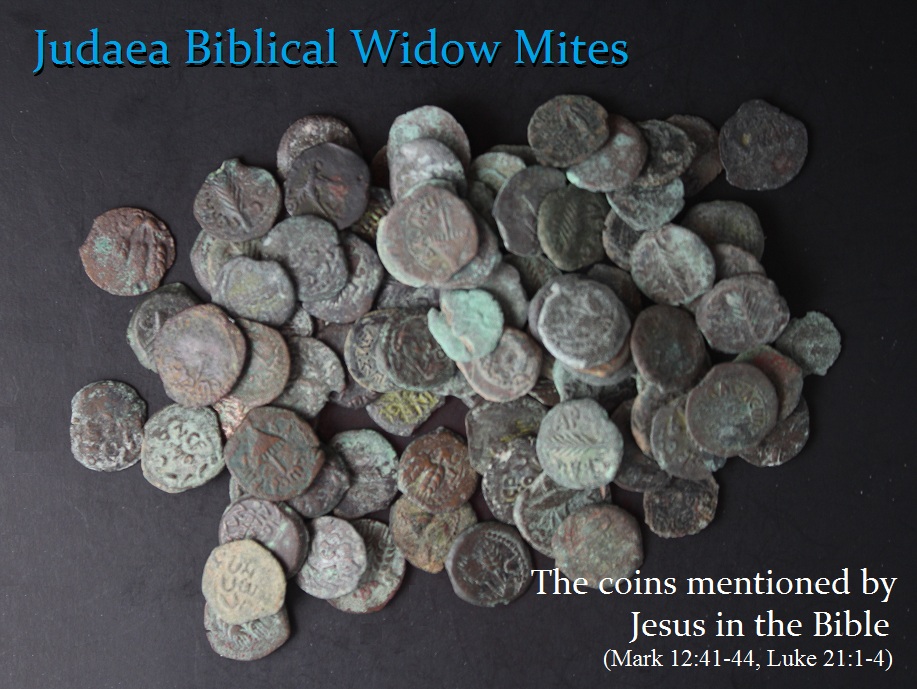

The only local coinage was that of tiny bronze coins for small change. To put this in perspective, the wages of a Roman foot soldier in 30 AD was 900 sestertii annually. A silver denarius was worth 4 sestertii. Therefore, 30 pieces of silver was about one and a half month’s pay for a Roman soldier. It was not a huge amount of money, but it was respectable for an average Jew.

The Roman denarius weighed about 3.7 grams in reality when its theoretical weight was supposed to be 4 grams. When the Jews revolted against Rome, that is when they over-struct or melted down other coins and issued their Shekel which was a Sumerian unit of weight. This was the dominant system from Babylon to Carthage throughout Northern Africa. The Shekel was by no means simply a Jewish standard of weight or coin.