QUESTION: Hi Marty,

I have read that Lincoln’s treasury issued “Greenbacks” to help fund the North during the civil war.

1. Was this a direct printing, issuing of paper currency, aka like your “The Solution” ? (Bill Still, creator of the money masters documentary claims such…)

2. Others claim that it was meant all along to be backed by gold, and they point to the Specie Payment Resumption Act of January 14, 1875 as evidence..

So many different conflicting opinions / explanations out there, and was hoping you would tell us all what you believe about the Greenbacks. Thanks once again for all you do!

DC

ANSWER: Paper currency was issued to fund the Civil War beginning in 1861. Demand notes were issued between August 1861 and April 1862 to fund the American Civil War in denominations of 5, 10, and 20 USD. Demand notes were the first issue of paper money by the United States that achieved wide circulation. They were used to pay expenses incurred during the Civil War including the salaries of its workers and military personnel.

ANSWER: Paper currency was issued to fund the Civil War beginning in 1861. Demand notes were issued between August 1861 and April 1862 to fund the American Civil War in denominations of 5, 10, and 20 USD. Demand notes were the first issue of paper money by the United States that achieved wide circulation. They were used to pay expenses incurred during the Civil War including the salaries of its workers and military personnel.

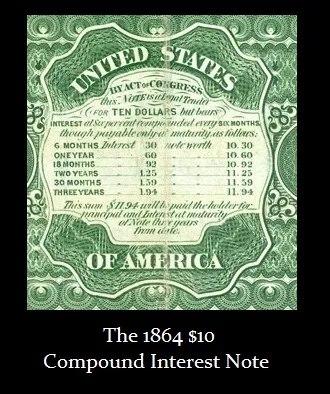

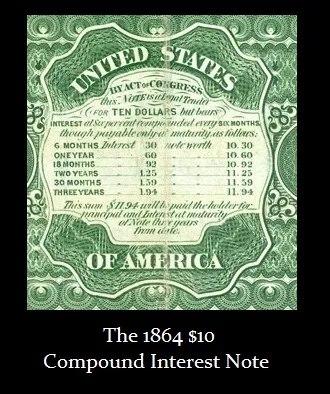

There was a reluctance to accept the demand notes, for there was no intent on redeeming them in gold. Instead, the government issued currency that was really a form of circulating bearer bonds. They were interest-bearing notes that had the table on the reverse, expressing the value of the note in terms of interest.

Demand notes became known as “greenbacks,” which distinguished them from the interest-bearing notes that displayed the interest table on the reverse. The demand note only had green ink.

The demand notes were discontinued, and their successors were the legal tender notes. The legal tenders could not be used to pay import duties, which were the taxes imposed at that time (indirect taxation). Demand notes took precedence and were acceptable. As a result, most demand notes were redeemed.

Therefore, the issue of paper money to pay the expenses worked. There was no such promise to repay these notes in gold when they were issued.

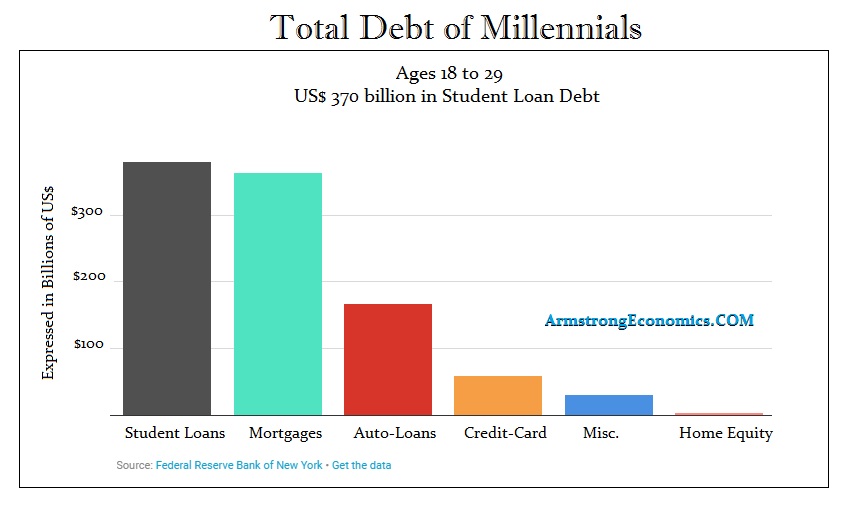

Ironically, millennials are much more conservative than the debt balances may indicate, but this could also be because of the student debt. In fact, in comparison to previous generations, this group is significantly more fiscally conservative with credit cards. Many into their 30’s are still living at home. With high student debt, many cannot afford a home, but another level cannot even afford an apartment. There is a new trend emerging whereby old motels are becoming housing. They lack the credit to rent an apartment with a security deposit. The new alternative is to rent per day in these old motels with rates of $50 to $80 per day.

Ironically, millennials are much more conservative than the debt balances may indicate, but this could also be because of the student debt. In fact, in comparison to previous generations, this group is significantly more fiscally conservative with credit cards. Many into their 30’s are still living at home. With high student debt, many cannot afford a home, but another level cannot even afford an apartment. There is a new trend emerging whereby old motels are becoming housing. They lack the credit to rent an apartment with a security deposit. The new alternative is to rent per day in these old motels with rates of $50 to $80 per day.