Tag Archives: Rule #1 Never Marry The Trade

Clinging to Old Theories of Inflation

Armstrong Economics Blog/Economics

Re-Posted Sep 14, 2018 by Martin Armstrong

QUESTION: Mr. Armstrong, I think I am starting to understand your view of inflation. It is very complex. I think some people cannot think beyond a simple one dimension concept as you often say. So I am trying to be more dynamic in my thinking process. Here you point out that when debt is collateral it is the same as printing money but worse because it pays interest. Then you point out that hyperinflation takes place not because of printing money but because a collapse in confidence and people then hoard their wealth which reduces the economic output and that compels a government to print more to cover expenses. So there is a line that is crossed and kicks in that collapse in confidence as in Venezuela. This is very interesting but complex. Is this a fair statement?

QUESTION: Mr. Armstrong, I think I am starting to understand your view of inflation. It is very complex. I think some people cannot think beyond a simple one dimension concept as you often say. So I am trying to be more dynamic in my thinking process. Here you point out that when debt is collateral it is the same as printing money but worse because it pays interest. Then you point out that hyperinflation takes place not because of printing money but because a collapse in confidence and people then hoard their wealth which reduces the economic output and that compels a government to print more to cover expenses. So there is a line that is crossed and kicks in that collapse in confidence as in Venezuela. This is very interesting but complex. Is this a fair statement?

ANSWER: You are doing very well. You are correct. Some people cannot get beyond an increase in money supply is automatically inflationary. If that was true, then 10 years of quantitative easing by the ECB failed completely in that theory. They too cannot get beyond this simple-minded one dimension concept. There is yet another dimension that these people who will say I am wrong while clinging to the old theories that they fail to understand. The BULK of the money is actually created by the banks in leveraged lending. If I lent you $100 and you signed a note that you would repay it, then the note becomes my asset on my balance sheet. I can take that to a bank and borrow on my account receivables. In this instance, just you are I are creating money. Now let a bank stand between us. I deposit $100 and they lend it to you. We now both have accounts that show we have $100. We just doubled the money supply and nobody printed anything. These people that yelled that Quantitative Easing would produce hyperinflation and gold would soar, refuse to admit that everything they have relied upon is an old theory that no longer applies to our modern society. Money is now debt issued by the government, debt created privately, and the physical money issued. But the actual paper money is a tiny fraction of the real money supply. The common thread between it all is CONFIDENCE.

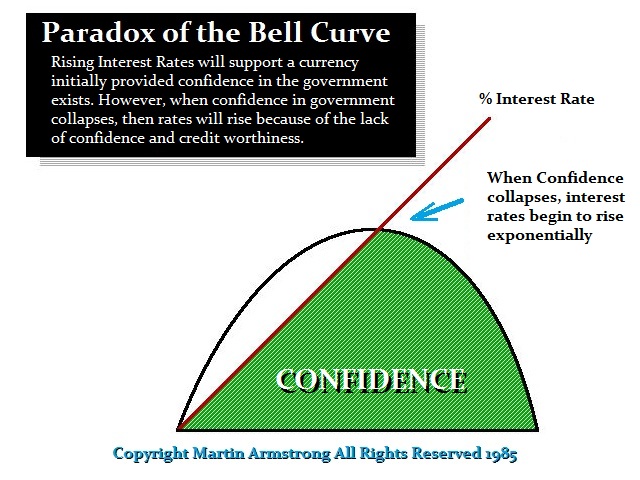

Just look at Turkey. Erdogan has now been forced to raise interest rates. Inflation and interest rates follow a Bell Curve. Everything will be normal until confidence is lost. Once that threshold is crossed, then hyperinflation begins and interest rates rise in a desperate move to try to attract capital and confidence. This simplistic perspective of an increase in the money supply produces inflation is just so childish it demonstrates these people have never just looked at the charts. This theory is what was behind the entire central bank management of the economy. I have quoted Paul Volcker, in his Rediscovery of the Business Cycle he states clearly that this view of Keynesian economics failed back in the 1970s.

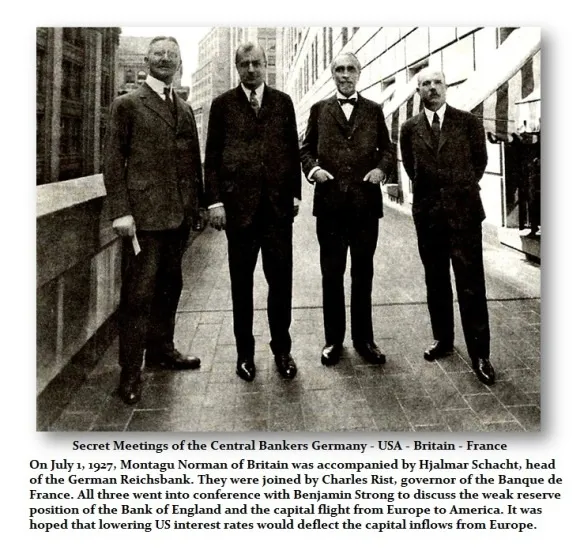

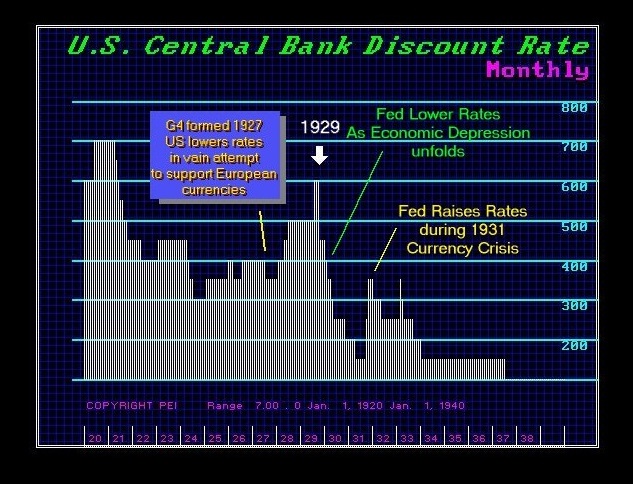

These people who cannot understand the complex relationship of money v inflation should work for the government. The central banks even back in 1927 looked at interest rate differentials and have attempted to use that to manipulate currency values. The Fed lowered interest rates hoping capital would return to the higher interest rates offered in Europe to prevent the economic collapse. The smart money realized that something was wrong and the capital flows moved into the US share market and the Dow. It was like smelling a rat in Venezuela or Turkey. Capital lost confidence in Europe and the higher interest rates failed to attract capital as we see today in Turkey or Venezuela. As the capital fled Europe, they drove the dollar higher. The invisible line of confidence was crossed.

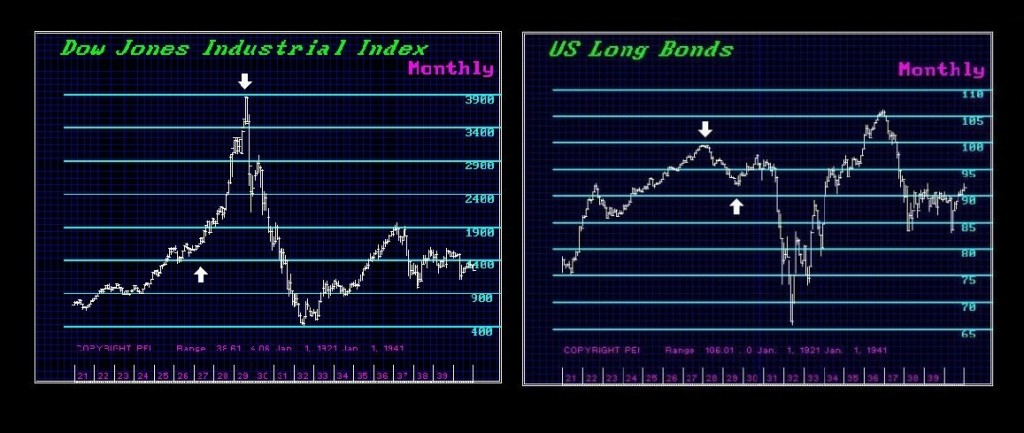

All you have to do is look at the charts. When the Fed lowered the rates in 1927, the capital smelled a rat. It began to pour into the USA. The Fed then assumed the rally was because it lowered the interest rates. They responded and began to raise rates to then try to stop the speculative bubble. The Fed then raised rates from 3.5% to 6% and the stock market rallied. All I do is look at the evidence. So much for raising rates will make the stock market decline. That is for idiots.

All you have to do is look at the charts. When the Fed lowered the rates in 1927, the capital smelled a rat. It began to pour into the USA. The Fed then assumed the rally was because it lowered the interest rates. They responded and began to raise rates to then try to stop the speculative bubble. The Fed then raised rates from 3.5% to 6% and the stock market rallied. All I do is look at the evidence. So much for raising rates will make the stock market decline. That is for idiots.

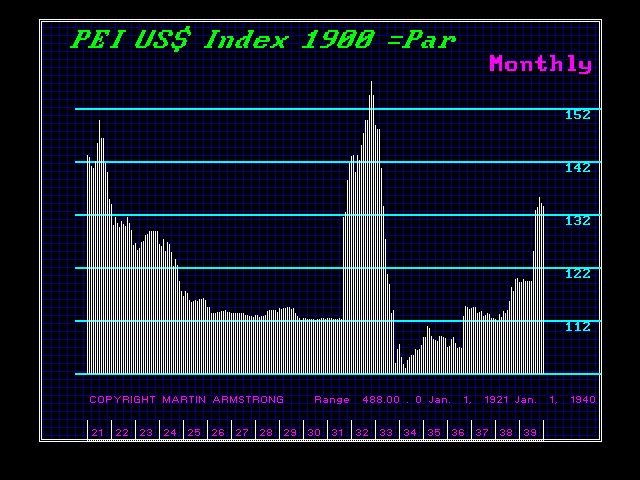

As the capital fled Europe it rushed into the dollar. The US dollar rose so high, this is what began the whole Smoot-Hawley protectionist round. That was passed in 1930 AFTER the high. Because the dollar kept rising, this produced asset deflation. Commodities collapsed which sparked Smoot-Hawley because they were concerned with agriculture Even silver, which peaked in 1919, declined and bottomed in 1932 with the stock market.

As the capital fled Europe it rushed into the dollar. The US dollar rose so high, this is what began the whole Smoot-Hawley protectionist round. That was passed in 1930 AFTER the high. Because the dollar kept rising, this produced asset deflation. Commodities collapsed which sparked Smoot-Hawley because they were concerned with agriculture Even silver, which peaked in 1919, declined and bottomed in 1932 with the stock market.

Milton Friedman criticised the Fed because all this gold came flooding into the USA and the gold reserves rose dramatically. Milton criticized the Fed for not issuing money to expand the money supply when Roosevelt’s Brain Trust worried about maintaining the confidence in the system and wanted the austerity.

The Fed had been lowering interest rates from 1929 into 1931 just as Draghi did in the ECB with the same net result – DEFLATION. The Fed then raised interest rates during the 1931 Currency Crisis deeply concerned about CONFIDENCE.

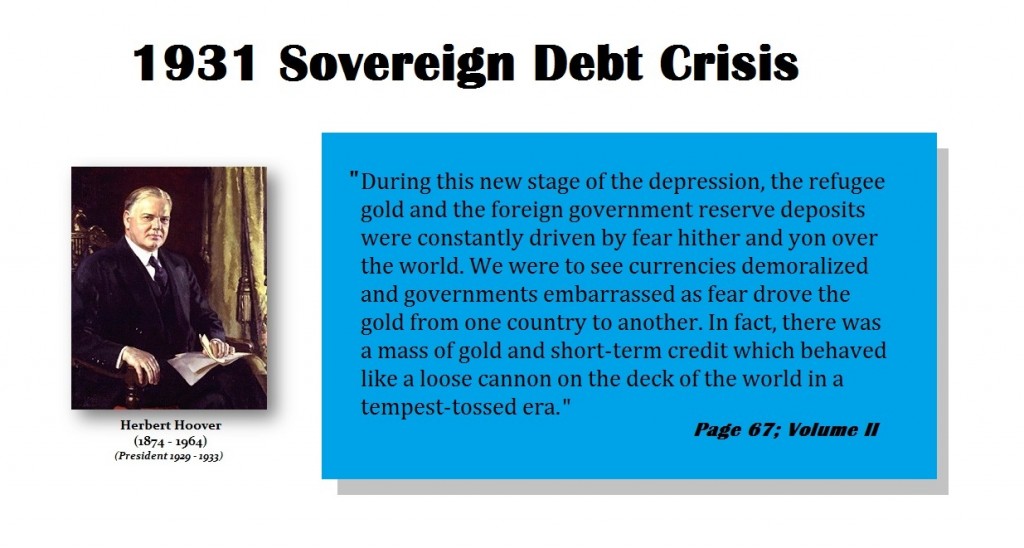

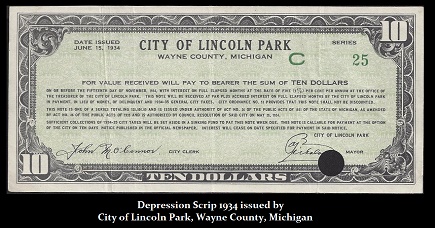

Herbert Hoover’s Memoirs recorded what took place. He said capital was rushing from one currency to the next they could not form a committee fast enough to figure out what even took place. NONE of this crazy period has ANYTHING to do with increasing the money supply. It was all about CONFIDENCE. Over two hundred cities began to issue their own money BECAUSE there was a shortage of money. This was called Depression Script. Depression scrip was used during the Great Depression era of the 1930’s as a substitute for government-issued currency because there was a SHORTAGE plain and simple. Because of some 9000 banks closed, this added to the problem of a lack of physical currency. Therefore the concept of issuing a local currency was the answer to allow commerce.

Herbert Hoover’s Memoirs recorded what took place. He said capital was rushing from one currency to the next they could not form a committee fast enough to figure out what even took place. NONE of this crazy period has ANYTHING to do with increasing the money supply. It was all about CONFIDENCE. Over two hundred cities began to issue their own money BECAUSE there was a shortage of money. This was called Depression Script. Depression scrip was used during the Great Depression era of the 1930’s as a substitute for government-issued currency because there was a SHORTAGE plain and simple. Because of some 9000 banks closed, this added to the problem of a lack of physical currency. Therefore the concept of issuing a local currency was the answer to allow commerce.

At one point, the U.S. Government considered issuing a nationwide scrip on a temporary basis because they feared that increasing the money supply itself would be inflationary. This idea was shot down by the Secretary of the Treasury William H. Woodin at the time. Meanwhile, it was also argued that the currency had been reduced in size on June 20th, 1929 and while the old notes were still valid, the argument was that the U.S. Bureau of Engraving and Printing did not issue enough currency fast enough which also contributed to the deflation.

It was actually the Agricultural economist George Warren (1874-1938) who convinced Franklin Roosevelt that the way to end the deflation was to devalue the dollar. Roosevelts Brains Trust vehemently disagreed clinging to the old theory that they needed to maintain CONFIDENCE in the government by rejecting anything that would increase the money supply.

It was actually the Agricultural economist George Warren (1874-1938) who convinced Franklin Roosevelt that the way to end the deflation was to devalue the dollar. Roosevelts Brains Trust vehemently disagreed clinging to the old theory that they needed to maintain CONFIDENCE in the government by rejecting anything that would increase the money supply.

When Roosevelt devalued the dollar and confiscated gold to prevent people from profiting from the devaluation, the economy immediately boomed and rallied into 1937. Why? Suddenly assets rise in terms of the new depreciated currency and people THINK in nominal terms. So if the stock market doubles, you assume you doubled your money. But if everything else doubles in value, in terms of net purchasing power, you gained NOTHING!

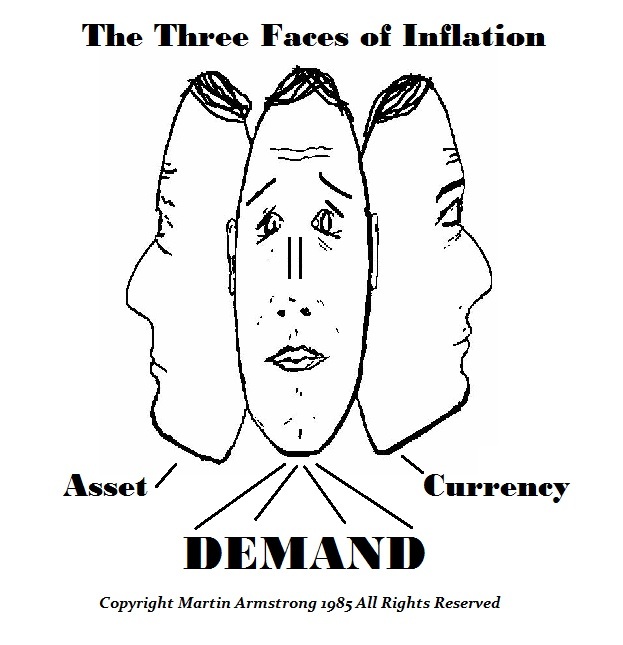

The sad part is these people who just yell and scream that I am wrong because inflation is caused by only a rise in the supply of money, to be as polite as I can, they are just incapable of understanding complex systems. Even in nominal terms, inflation can be caused by different simulations. The currency declines and we have asset inflation as I just laid in the USA from 1934 to 1937, or just look at Turkey and Venezuela in real time. We have asset inflation as in the DOT.COM bubble where capital is rushing into some new hot investment sector. Then we have demand inflation, which can be illustrated by say a serious weather condition and wheat rises because of crop failures.

The sad part is these people who just yell and scream that I am wrong because inflation is caused by only a rise in the supply of money, to be as polite as I can, they are just incapable of understanding complex systems. Even in nominal terms, inflation can be caused by different simulations. The currency declines and we have asset inflation as I just laid in the USA from 1934 to 1937, or just look at Turkey and Venezuela in real time. We have asset inflation as in the DOT.COM bubble where capital is rushing into some new hot investment sector. Then we have demand inflation, which can be illustrated by say a serious weather condition and wheat rises because of crop failures.

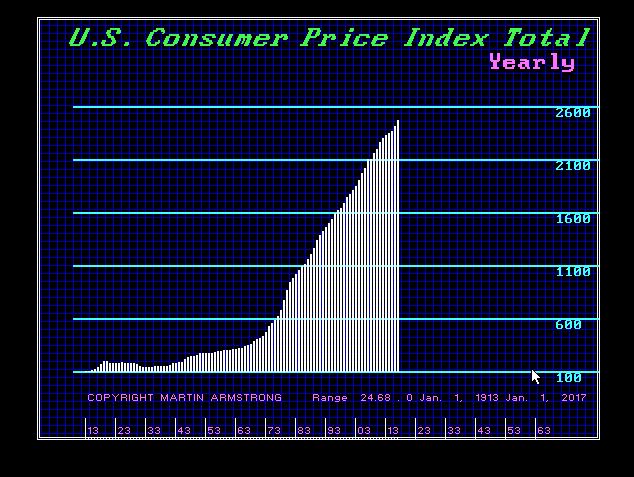

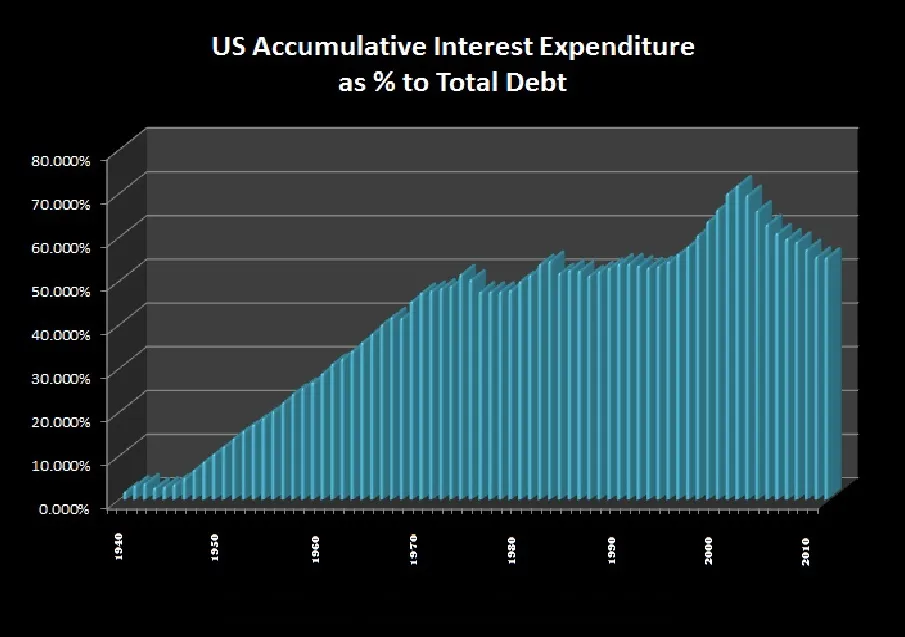

So in the end, since the national debt is growing exponentially now thanks to interest expenditures that will exceed defense spending in 2019, obviously if you did pay off the debt by printing money, there would be a far less inflationary impact from the government budget perspective. It would no longer have the interest carrying costs so you would REDUCE the actual amount of new money being created which includes DEBT.

This is just not a simple equation of increasing the supply of money = inflation. I was the one yelling on the Hill that the Fed buying in 30-year bonds would NOT stimulate the economy BECAUSE they ASSUMED the system is an isolated domestic affair. It is not!. You buy-in the 30-year bonds and you have no idea if the seller is domestic or foreign. So the money left the country and stimulate somewhere else. You have to look at the whole system. Anyone who says inflation is created by an increase in money supply is off the reservation clinging to old theories that ignore debt, banking leverage, international capital flows, and that is just the beginning.

Is it Time to Turn the Lights Out on Turkey and just Take Your Losses and Run?

Armstrong Economics Blog/Turkey

Re-Posted Sep 13, 2018 by Martin Armstrong

Just when you thought President Recep Tayyip Erdogan was really off the reservation, he suddenly appears off the planet. Erdogan has appointed HIMSELF as chairman of Turkey’s Sovereign Wealth Fund and got rid of the entire management staff. It looks like Erdogan now thinks he can force the free market to do as he commands if he is also the trader for the Sovereign Wealth Fund.

Just when you thought President Recep Tayyip Erdogan was really off the reservation, he suddenly appears off the planet. Erdogan has appointed HIMSELF as chairman of Turkey’s Sovereign Wealth Fund and got rid of the entire management staff. It looks like Erdogan now thinks he can force the free market to do as he commands if he is also the trader for the Sovereign Wealth Fund.

Of course, Treasury and Finance Minister Berat Albayrak, Erdogan’s son-in-law, will also sit on the board, according to a decree published in the Official Gazette. Anyone who actually thinks that Turkey can recover is out of their mind. The fund was formed to try and capitalize on state assets and put a lid on market turmoil in the wake of a failed coup attempt. This is a guaranteed nightmare in the making. We are witnessing a stubborn politician who has become a dictator and believes there is nothing beyond his power. It is just approaching the time to turn out the lights on Turkey as any viable place for investment. Turkey is now approaching the highest Country Risk for investment on the board

Who is the Fool? Trump or Woodward?

Armstrong Economics Blog/Economics

Re-Posted Sep 13, 2018 by Martin Armstrong

According to CNBC, Bob Woodward reported that Trump told Gary Cohn, the former Goldman Sachs/director of the National Economic Council to just print more money to reduce the national debt. Woodward reports this discussion:

Cohn: “You don’t get to do it that way. We have huge deficits and they matter. The government doesn’t keep a balance sheet like that.”

Here is a chart of the US CPI not seasonally adjusted. It has begun its sharp advance since the Floating Rate System was adopted in 1971 with the fall of Bretton Woods. In spite of borrowing, inflation over time has actually advanced more aggressively than if we had just printed instead of borrowed. Cohn has said the book “does not accurately portray” his experience of the White House. This claimed quote demonstrates that someone is seriously out of touch with economics. Actually, Trump is correct. Now we have Quartz joining the media calling Trump an idiot confirming they too are clueless about debt and printing. In fact, if you did just print the money and retired the debt, it would be DEFLATIONARY and not INFLATIONARY from the budget perspective because these people are clueless themselves about how the national debt works.

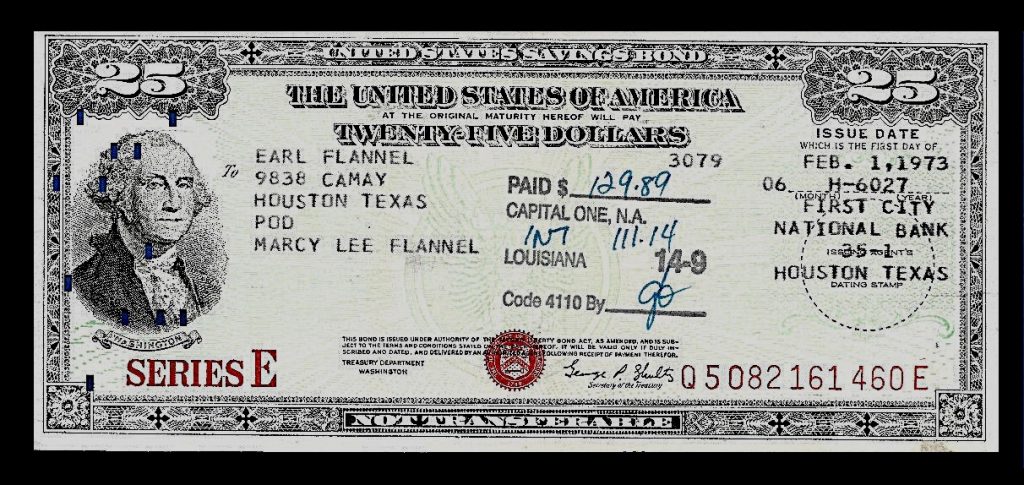

Before 1971, the debt could not be used as collateral for loans such as Savings Bonds. If you needed the money, you were forced to cash them in. Under this system, it was logically less inflationary to borrow than to print. However, post-1971, you buy T-Bills and post them as collateral to trade futures. The distinction between borrowing and printing has been turned upside down. A national debt is now worse than printing because itis money that now pays interest forever. Then there is no intention of ever paying off the national debt.

The truth is had we printed since 1971 instead of borrowing, there would be far less of an economic crisis compared to what we face today. If we simply printed to pay off the national debt, Social Security would suddenly become a Wealth Fund that actually made money instead of a Slush Fund for politicians. Now, Social Security can only invest 100% in US government debt and then the Fed lowers the interest rate to “stimulate” the economy and Social Security goes broke forcing higher taxes. Up to 70% of the national debt at times has been purely accumulated interest which never benefited anyone. It competes with the private sector in what we call the “flight to quality” and it forms the bank reserves. What is never discussed is the fact that US debt is also the reserve currency of nations – not paper dollars. That means that the interest we pay is exported and it stimulates foreign economies – not domestic.

So who is crazy here? Trump or Woodward? To keep borrowing year after year is insane. To monetize the debt will be DEFLATIONARY from the perspective of government expenditure. In 2019, interest expenditures even at this low level of interest rates will EXCEED military expenditure.

Woodward is by no means qualified to criticize Trump on such an issue he clearly does not even understand. Trump should really address the nation and explain this problem very simply. I will be glad to supply the charts.

Hoard of Roman Gold Found from the Last Days of Rome

Armstrong Economics Blog/Ancient History

Re-Posted Sep 12, 2018 by Martin Armstrong

There were more than 100 gold Roman coins discovered in a buried hoard in the Cressoni theatre in Como, north of Milan. What I have examined from the photographs supplied to me, is that this is a hoard from the virtual fall of Rome. The coins I identified were from the Puppet Emperor of Ricimer, a Germanic general who ruled Rome through puppet emperors going into the end of the Western Empire. His power emerged in 461AD until his death in 472AD. The official fall of Rome took place in 466AD. After Ricimer’s death, the Germanic King of Italy, Odoacer deposed the last Western Emperor Romulus Augustus in 476AD, which is considered to mark the fall of the Western Roman Empire.

There were more than 100 gold Roman coins discovered in a buried hoard in the Cressoni theatre in Como, north of Milan. What I have examined from the photographs supplied to me, is that this is a hoard from the virtual fall of Rome. The coins I identified were from the Puppet Emperor of Ricimer, a Germanic general who ruled Rome through puppet emperors going into the end of the Western Empire. His power emerged in 461AD until his death in 472AD. The official fall of Rome took place in 466AD. After Ricimer’s death, the Germanic King of Italy, Odoacer deposed the last Western Emperor Romulus Augustus in 476AD, which is considered to mark the fall of the Western Roman Empire.

The photographs of the coins I reviewed clearly show the puppet Emperor Libius Severus III (461-465AD) was rather common in the hoard. This established that the hoard is from this period forward meaning it was a stash place for someone during the fall of Rome. Obviously, the person did not live to come back to retrieve his coins. These coins are worth probably $1 million+ depending upon the emperors in this entire batch which might be discovered. It could possibly rise to at least the $2 million valuations.

Who was the Richest Man in Ancient History

Armstrong Economics Blog/America’s Economic History

Re-Posted Sep 11, 2018 by Martin Armstrong

QUESTION: Mr. Armstrong; You are a history buff. Who was the richest person in ancient times? Has there ever been a trillionaire?

PD

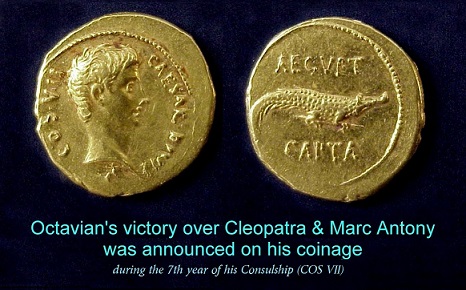

ANSWER: The Roman Emperor August. He is believed to have been worth in current dollar terms nearly $5 trillion. The only other person to have reached the trillion dollars net worth status was King Solomon of Judaea. After Octavian/Augustus defeated Marc Antony and Cleopatra, he then possessed the entire wealth of Egypt. In this respect, the wealth really did belong to him. Some have attributed the entire wealth of nations conquered and argued that Genghis Khan was worth probably 100 trillion dollars. However, the Roman system was rather different. Even taxation for a governor of a province would be owed by the governor to the state so whatever he would collect fell to him personally.

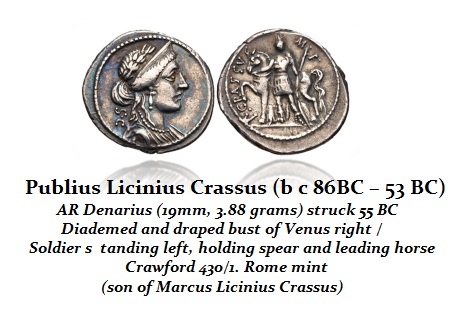

Marcus Licinius Crassus was perhaps one of the richest private men in Roman history. He amassed an enormous fortune through real estate speculation buying confiscated property seized by Marius from the supporters of Sulla. Crassus’s wealth is estimated by Pliny at approximately 200 million sestertii. Plutarch says the wealth of Crassus increased from less than 300 talents at first to 7,100 talents. An Attic (Greek, Athens) talent was the equivalent of 60 minae or 6,000 drachmae. A silver Drachm was generally 15mm in diameter with a weight of 4.20 grams. In Roman terms, this was about 26 kilograms (57 lb). If we take Plutarch’s measurement of wealth, that would be 42.6 million denarii.

Marcus Licinius Crassus was perhaps one of the richest private men in Roman history. He amassed an enormous fortune through real estate speculation buying confiscated property seized by Marius from the supporters of Sulla. Crassus’s wealth is estimated by Pliny at approximately 200 million sestertii. Plutarch says the wealth of Crassus increased from less than 300 talents at first to 7,100 talents. An Attic (Greek, Athens) talent was the equivalent of 60 minae or 6,000 drachmae. A silver Drachm was generally 15mm in diameter with a weight of 4.20 grams. In Roman terms, this was about 26 kilograms (57 lb). If we take Plutarch’s measurement of wealth, that would be 42.6 million denarii.

A Roman soldier earned 225 denarii a year. Today, the average soldier in the US army earns $48,538 per year. That would approximately be $9.189 billion. If we take Jeff Bezos who is reported to be worth $164 billion based upon his stock in Amazon, that works out to the annual salary of 3.4 million soldiers compared to Crassus’ worth being 189,333 soldiers. However, the real difference is that Crassus’ wealth is cash whereas Bezos’ wealth is the current value of a stock. If he tried to sell it for cash, the value would be significantly less.

Crassus’ son, Publius Licinius Crassus (c 86BC – 53 BC), served under Julius Caesar. He did issue coins during the Republic as a “moneyer” who was a person authorized to issue the coins during the Roman Republic. The Senate actually controlled the quantity of money to be produced. There would be a “State of the Union” type of address to the Senate where they would be given the account of money on hand and what they expected the annual expenses would be. The Senate would then authorize the number of coins to be issued that fiscal year. The Quaestors handed the raw bullion and they would turn that over to the official who was the “moneyer” for that year. The moneyers would decide on the design to be issued which often celebrated his ancestors. The coinage would be struck and then handed back to the Quaestors for the expenditure of the government. The office of a moneyer continued into the Imperial period.

Influence & Ranks

Armstrong Economics Blog/Economics

Re-Posted Sep 9, 2018 by Martin Armstrong

COMMENT: Marty; Did you know that your site is listed in the top 20 economic sites in the world? You are in the top 20 with Wall Street Journal, Bloomberg, London FT, and even Brookings Ben Bernanke’s Blog. The rest of the list includes the Economic Policy Institute, Economics & Statistics Administration, and The Berkeley Blog Business & Economics. You may be a lot more influential than you portray.

JS

REPLY: Perhaps. But keep in mind that your enemies always read you because they need to know what you are saying now to feed their hatred. Aside from that, every intelligence service reads our work. They understand there is a cycle to everything and ever since the London FT reported I warned Russia would collapse just before the 1998 Long-Term Capital Management collapse on Russian bonds, they all pay close attention.

Trump Threatens to Cancel NAFTA If Congress Interferes

Armstrong Economics Blog/World Trade

Re-Posted Sep 8, 2018 by Martin Armstrong

QUESTION: Mr. Armstrong; Do you agree with Trump that if he canceled NAFTA, the United States would be better off?

SN

ANSWER: Ironically – YES from a jobs perspective, not the consumer. What you have to understand is that these trade deals are all nonsense. They are NOT Free Trade in the least. They are compromises so politicians can pretend they have accomplished something.

Take the deal with Europe. France’s position was that nothing can be called “Champagne” unless it comes from that region in France. Every trade negotiation is a compromise that maintains protectionism. In that regard, if Trump actually canceled NAFTA, his boast that the US would be better off is meant that all products would then be subjected to tariffs and all of the American industry would be protected.

Now, that said, this view is that of the worker – not the consumer. All of these trade negotiations are one-sided. They are always focused only on jobs and not producing the best price for the consumer which in turn raises our standard of living. I have never encountered even one politician who has EVER defended the consumer in trade deals. This violates the principle of Comparative Advantage put forth by David Ricardo. It’s true that Saudi Arabia could grow lettuce but the cost of irrigation in the desert would make the cost 10 times more than simply buying it from Europe or North America. It would cost the consumer far more to simply grow that product in the desert than importing so it is best to buy it elsewhere and focus on your productive capacity in which you have some comparative advantage over others.

Don’t Cry for Me Argentina – It’s a Global Debt Crisis

Armstrong Economics Blog/Emerging Markets

Re-Posted Sep 5, 2018 by Martin Armstrong

QUESTION: Mr. Armstrong; Our government here in Argentina has told us we should expect more poverty and there is no hope for the future. Socrates has been amazing on its forecasts on our currency. There are enough of us down here who would sincerely ask would you consider advising Argentina to straighten out our economy and nation? You have forecast this emerging market crisis long before anyone else and your solution video on YouTube is very thought-provoking. If we can demand the government meets with you, would you do it?

KRD

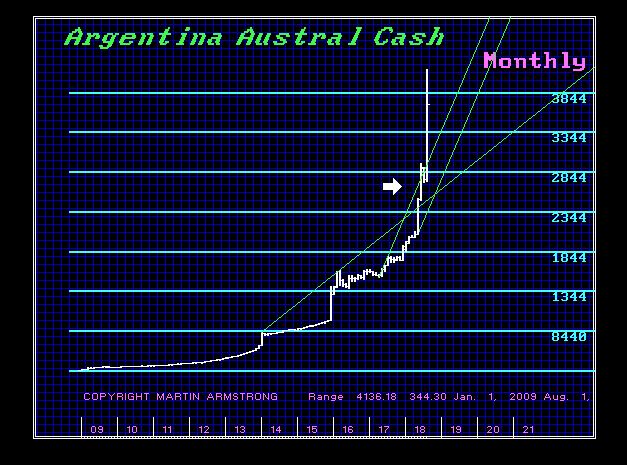

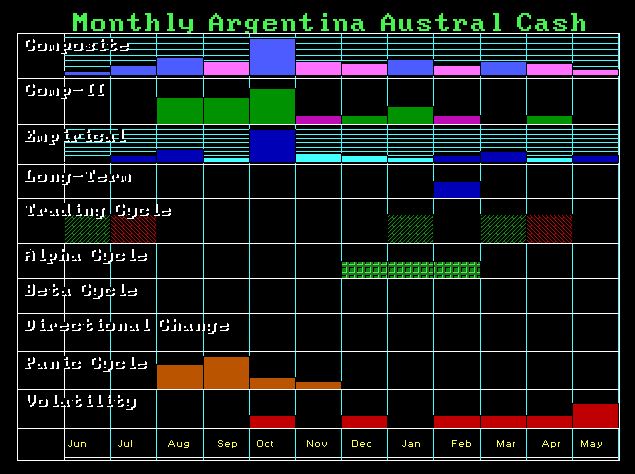

ANSWER: The song maybe Don’t Cry for Me Argentina, but it applies to the entire world for what happens in Argentina is merely the beginning of the global debt crisis. We can see from the chart that the dollar has been soaring. However, the Array picked August as the Panic Cycle and that has been spot on. Unfortunately, it does not look like this is going to calm down. We may be headed into a real Emerging Market crisis by October.

ANSWER: The song maybe Don’t Cry for Me Argentina, but it applies to the entire world for what happens in Argentina is merely the beginning of the global debt crisis. We can see from the chart that the dollar has been soaring. However, the Array picked August as the Panic Cycle and that has been spot on. Unfortunately, it does not look like this is going to calm down. We may be headed into a real Emerging Market crisis by October.

The reason why we are able to forecast such events well in advance is rather common sense. As I have said before, every solution to a crisis sets the stage for the next crisis. The Emerging Market debt crisis is unfolding because central banks in the USA and Europe lowered interest rates to “stimulate” the economy and they have no idea about how an economy truly functions. This is all based upon Keynesianism which is in turn based upon an isolated theory of the economy. They never consider that you lower interest rates and there are pensions who simply need higher rates to break-even. Then emerging markets issued debt in dollars with higher yields for the pension funds bought it assuming there was no currency risk. Now we have Portuguese and Spanish banks who would not lend to their domestic economies for there were way too many nonperforming loans so they ran and bought Turkish debt.

What began in Argentina and Turkey has snowballed into broader collapse complete confidence in Emerging Market debt and the pension funds stopped buying and simply are now trying to get out as fast as they can. This now has officials in Indonesia, India, South Africa, and Brazil scrambling to protect their economies. The debt party is over! The ECB has created a global nightmare for so many European institutions ran into emerging markets because the ECB maintained NEGATIVE rates. Draghi has created a global debt crisis and now he himself is trapped. This is why Italy now wants to change the structure of the ECB so they can buy member debt directly rather than in the secondary market which they have destroyed. Draghi cannot stop Quantitative Easing for the 28 member states will be unable to sell their new-issue debt at rates that are similar to the current levels. Rates will soar in Europe if Draghi actually stopped buying and then we will see a global debt crisis you cannot imagine.

What began in Argentina and Turkey has snowballed into broader collapse complete confidence in Emerging Market debt and the pension funds stopped buying and simply are now trying to get out as fast as they can. This now has officials in Indonesia, India, South Africa, and Brazil scrambling to protect their economies. The debt party is over! The ECB has created a global nightmare for so many European institutions ran into emerging markets because the ECB maintained NEGATIVE rates. Draghi has created a global debt crisis and now he himself is trapped. This is why Italy now wants to change the structure of the ECB so they can buy member debt directly rather than in the secondary market which they have destroyed. Draghi cannot stop Quantitative Easing for the 28 member states will be unable to sell their new-issue debt at rates that are similar to the current levels. Rates will soar in Europe if Draghi actually stopped buying and then we will see a global debt crisis you cannot imagine.

Left unchecked, more nations are going to be swept up in this debt crisis as their bond values collapse. This is threatening the entire world’s economic growth and confidence. As institutions begin to wise up for once, we will see the confidence in public debt collapse. This will become a game of musical chairs and the one left standing with government debt will lose everything!

The Turkish lira, which has been relentlessly setting new all-time lows and this is creating the contagion. Rumors are that Erdogan is such a tyrant, he will sooner turn to Russia and default on all Turkish debt just to retain personal power. Institutional Traders are the first to worry about countries with large current account deficits and a large stock of dollar-denominated debt in a world with rising interest rates and a stronger dollar. But their management often lags and do not listen to their trading desks because they tend to be more politically correct. The phones were actually ringing at the top and it was the ECB telling the banks to stop buying dollars because they were making the dollar rally. You can play those games only for so long before the whole house of cards comes crashing down.

The Turkish lira, which has been relentlessly setting new all-time lows and this is creating the contagion. Rumors are that Erdogan is such a tyrant, he will sooner turn to Russia and default on all Turkish debt just to retain personal power. Institutional Traders are the first to worry about countries with large current account deficits and a large stock of dollar-denominated debt in a world with rising interest rates and a stronger dollar. But their management often lags and do not listen to their trading desks because they tend to be more politically correct. The phones were actually ringing at the top and it was the ECB telling the banks to stop buying dollars because they were making the dollar rally. You can play those games only for so long before the whole house of cards comes crashing down.

I would be glad to fly to Argentina to help if the pain reaches their eyeballs so they will do as directed to save the country. Half-ass maybe’s are a waste of time. It is only worth it when they realize they have no choice

Foreigners Selling UK Debt as Hard BEXIT appears

Armstrong Economics Blog/Pound

Re-Posted Sep 4, 2018 by Martin Armstrong

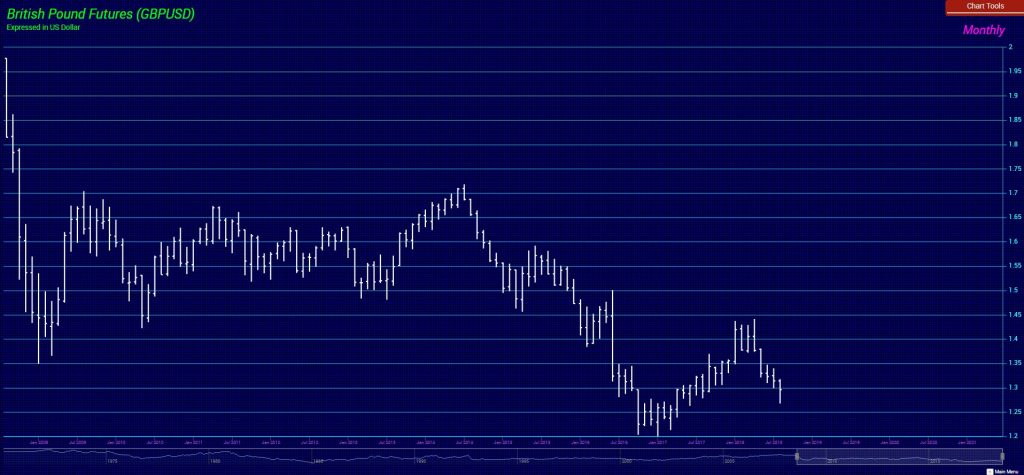

Foreign investors have been withdrawing on a large scale from British government bonds since July when the Conservatives seems to be splitting. Bank of England data released revealed a net outflow of £17.153 billion from foreigners in July, the largest since records began in 1982, Reuters reports. Even in June, there was still net capital investment from foreigners of 1.362 billion pounds. The decline in foreigners’ holdings is due to sales as well as to non-reinvested, expiring, bonds. According to International Monetary Fund data, the UK has the largest current account deficit of the major industrial nations and is heavily dependent on foreign capital inflows. Theresa May’s refusal to stand firm and defend the people’s vote has seriously undermined the confidence in Britain.

Foreign investors have been withdrawing on a large scale from British government bonds since July when the Conservatives seems to be splitting. Bank of England data released revealed a net outflow of £17.153 billion from foreigners in July, the largest since records began in 1982, Reuters reports. Even in June, there was still net capital investment from foreigners of 1.362 billion pounds. The decline in foreigners’ holdings is due to sales as well as to non-reinvested, expiring, bonds. According to International Monetary Fund data, the UK has the largest current account deficit of the major industrial nations and is heavily dependent on foreign capital inflows. Theresa May’s refusal to stand firm and defend the people’s vote has seriously undermined the confidence in Britain.

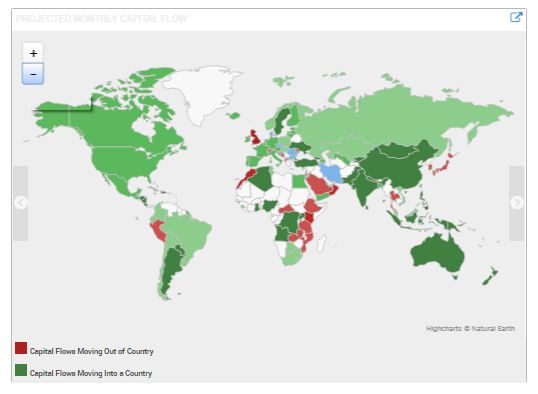

We can see on our Capital Flow Map where we trace the net movement of capital that Britain has turned RED. We have been monitoring the significant net capital flight from Britain thanks to Theresa May. This is also one primary reason it appears that the British pound is still is a distinctive bear market trend with respect to the broader term.

While we did not elect any Monthly or Weekly Bearish Reversals, the pound is still is a broader bearish position at this time.