Posted originally on the conservative tree house on July 30, 2022 | Sundance

In fact, there are several western nations who see the ‘climate change” energy transformation as an economic kamikaze mission… and that reality is upsetting those who control the larger western alliance agenda.

When we outlined the ‘biggest problem‘ we noted: Brazil, Mexico, and more recently Japan, have started pushing back against the climate change ideologues. We must do the same.

So, let’s get everyone up to speed.

Factually, Brazilian President Jair Bolsonaro is not only a nationalist leader for his country, Brazil itself is in an emerging economic relationship within the BRICS group (Brazil, Russia, India, China, South Africa). The BRICS group are not in ideological or geopolitical alignment with the World Economic Forum (WEF) climate change instructions known as Build Back Better. This lack of ideological synergy is one of the reasons we see a joint effort between the U.S. State Dept and U.S. intelligence group to target Jair Bolsonaro for removal. [Watch Bolsonaro w/ Tucker Carlson]

Recently, Mexican President Andres Manuel Lopez-Obrador (AMLO) visited the White House. AMLO is basically soft-socialist, a nationalist who does not like the influence of multinational corporations on the economic politics within Mexico. When he visited with Joe Biden, AMLO’s public comments in the oval office (he actually had them written down so he would not be deterred from his delivery) about the U.S. chasing a short-sighted and dangerous energy policy, were just ignored by media. However, watching AMLO deconstruct the Biden energy policy was very telling. [Review Outline Here].

In addition to so-called geopolitical adversaries like Russia, China and Iran, there are also geopolitical allies who clearly see that fracturing the global economy based on energy development, the center of the Build Back Better agenda, is going to create major issues for the citizens within the countries determined by ideological quest to change their energy system. As noted with Brazil and Mexico, not everyone in the “west” is on board with the program.

Even in Germany and the U.K. we see evidence indicating pragmatic discussion is starting to surface.

There will eventually be an inflection point within the EU as the desires of the ideological leaders run into the reality of the situation. [ex. Dutch farm protests]

The Build Back Better climate agenda is essentially a process to deindustrialize economies, then rebuild them. Will Germany really accept a lower standard of living, just to be equitable in economic malaise? If you know any German people, you know the answer to that is an emphatic NO.

Additionally, southeast Asia (ASEAN group) represents an almost impossible region to shift away from traditional oil, coal, gasoline and food derivatives that need fertilizer and natural gas etc. And everyone knows China is not going to go along with the ‘climate’ nonsense.

Even if Beijing puts a smiley-faced panda mask on the Beijing dragon, they are going to use the climate change suicide mission of the west as a geopolitical advantage toward their own expanded economic influence. Hell, who wouldn’t.

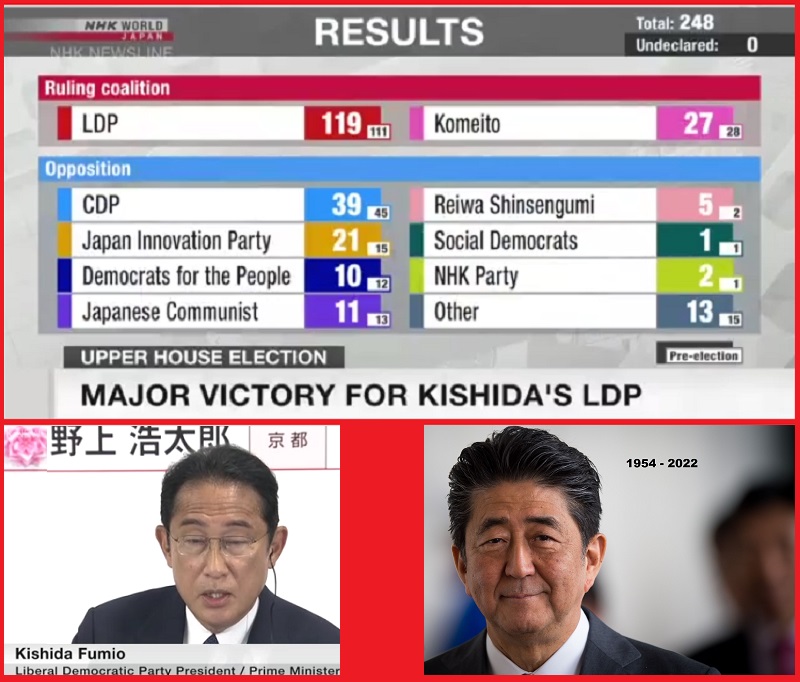

♦ Which brings me to the recent appearance of Japanese pushback, which comes with a typically Japanese subtlety.

Keep in mind that Japanese industry is still the largest investor in U.S. manufacturing and jobs.

Despite Japan signing-on with the western alliance sanctions against Russia, almost assuredly a decision intended to stay in alignment with the G7 politics, recently Japan has refused to join the collective western approach to raise central bank interest rates to facilitate the BBB ‘transition’ (link).

This has caused the Japanese yen to fall rapidly against western currency, specifically against the U.S. dollar. The dollar has gained 25.5% against the Japanese yen (link).

Now, inflation in Japan is still an issue, but it is less an issue than in the EU and North America (Canada/USA with Mexico excluded). Part of that lower inflation dynamic is caused by Japan not driving supply-side inflation as a result of the energy transition.

The decision by the Bank of Japan (BoJ) has created some anxiety within the western alliance group of central bankers. Additionally, Japan is remaining in good standing with Russia for energy resources and continues to purchase all oil and LNG at the lowest rates possible, regardless of origination. Japan is also the top investor and buyer of LNG from Russia’s Sakhalin-2 plant, so they are the most exposed to Moscow’s new demand to pay for energy through a Russian bank.

(Reuters) – SINGAPORE — Russia’s Sakhalin Energy Investment Co has requested its liquefied natural gas (LNG) customers to make payments via a Moscow unit of a European bank and is in talks to change the payment currencies away from U.S. dollars, two sources familiar with the matter said on Friday. (link)

Again, another geopolitical dynamic that breaks Japan away from the collective western suicide mission.

From the perspective of Japan, all of these moves -while not aligning with the demands of the BBB agenda- make perfect sense.

While their currency is suffering from not following the western agenda, they have several upsides. First, exports from Japan to the United States and the EU now become even cheaper. With a higher dollar value, Japanese imports into the United States come at a discount. This will help Japan export goods and retain a strong export economy.

Second, with Japan already a massive investor inside the United States, the dollars that are generated in profit from their operations are delivered back to Japan at a higher value. A higher dollar value, the outcome of their breaking from the western central bank decision to raise rates, does not hurt Japan. They bring back high valued dollars from their decades in investment into North America, and they continue exporting to the U.S. at a discount.

So, the nationalist outlooks of Japan, Brazil and even our Mexican neighbors are reflecting a pragmatic self-interest that so far has withstood the pressures from the western alliance to fall into line. This is how those three countries are positioned to push back against the insufferable BBB agenda.

We can use the example of those western industrialized nations to show that not everyone is in alignment with this globalist multinational finance and corporate takeover.

If we can get more people to see how short-sighted and dangerous the agenda of the World Economic Forum is, we can further expose the real nature of the BBB agenda, to accumulate wealth and control amid a very small conglomerate of WEF corporate and banking interests.

The ‘climate change agenda‘ has always been about a small group of multinational interests having more assembled power, influence and affluence. As they now take their Davos effort onto the world stage, they will encounter resistance and push-back. Not everyone in the western alliance is on board with the objective.

Stay smart, avoid the shiny things, stay focused, and look for ways to throw sand into the machinery.

There are more of us than them.