Armstrong Economics Blog/Armstrong in the Media

Re-Posted Dec 2, 2017 by Martin Armstrong

COMMENT: Mr. Armstrong; You are the only person who has ever even explain a vertical market. After reading your report, I have come to understand so much more about markets. Thank you for explaining the difference between a Phase Transition blip and a Plateau Move.

However, what has also jumped out at me is the fact that you stand alone in the analysis because you have actually been a hedge fund manager. That begs the question, why has the mainstream media not acknowledged your analysis? The only answer is because they are not interested in reporting news but are simply too corrupt to even expose the truth when it goes against the government.

That is my take on this entire mess. They ignore you because they want to report the fake news.

Cheer

LB

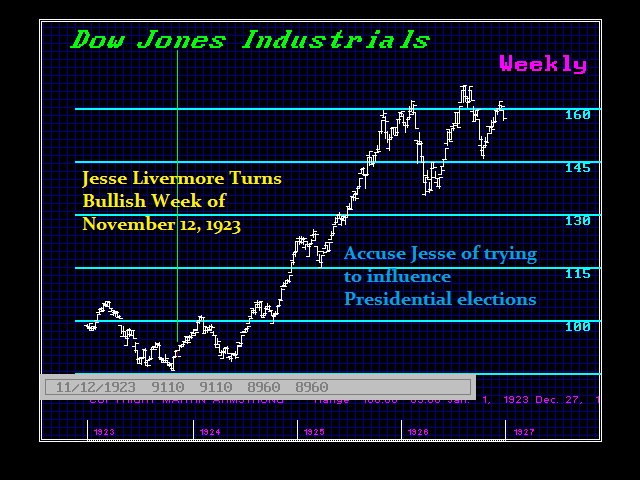

REPLY: That is an interesting perspective. The Wall Street Journal falsely accused Jesse Livermore of turning bullish on the market, as I did following the 2007-2009 correction, accusing him of trying to influence the presidential election. When the market broke out and rallied, all the other publications took swipes at the WSJ saying everyone reported Jesse’s comments except the WSJ.

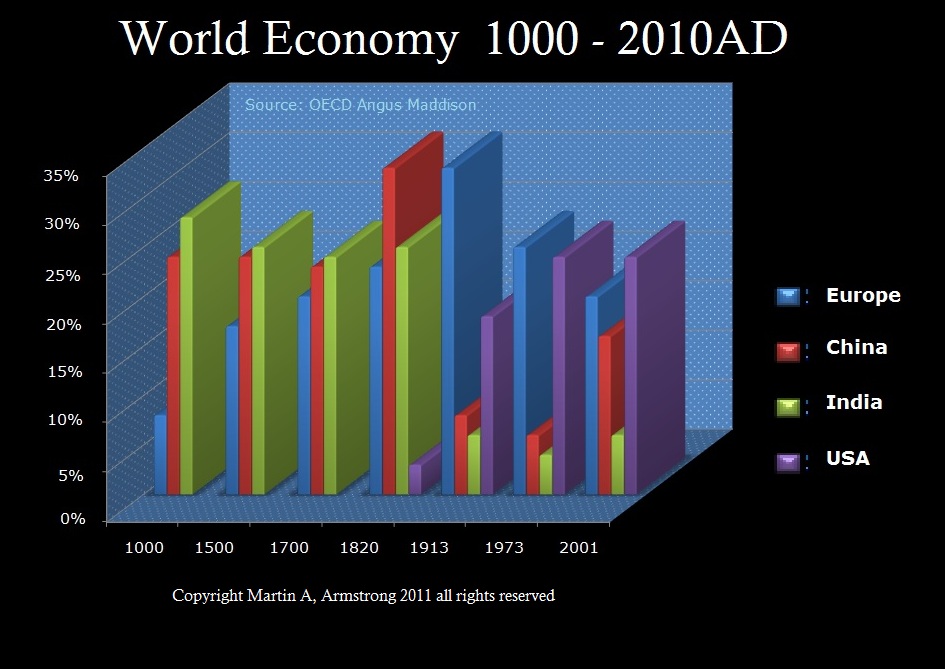

What we must also consider is that we forecast the entire world, which nobody else does. Consequently, if they dared to report that our forecasts ALONE were correct, then they just might have to acknowledge WHY they were correct and open up Pandora’s Box.

What we must also consider is that we forecast the entire world, which nobody else does. Consequently, if they dared to report that our forecasts ALONE were correct, then they just might have to acknowledge WHY they were correct and open up Pandora’s Box.

The implications behind that forecast are very deep. On the Private Blog, we showed how the Dow is making new highs and the German Dax has fallen. The real world ramifications of tracking global capital flows undermine domestic analysis, changes politics, and upsets academia. That is a very tall order so it is best to pretend we do not exist.

REPLY: Interesting. Soros became famous with the bet against the pound. But let’s make this very clear. That was a “riskless” trade betting against the break of a peg. If you are wrong, the peg holds and you get your money back. If you are right, you make a fortune. Everyone was betting against the pound. That was the coup against Margaret Thatcher who really wanted to take Britain into the euro. They forced the pound into the

REPLY: Interesting. Soros became famous with the bet against the pound. But let’s make this very clear. That was a “riskless” trade betting against the break of a peg. If you are wrong, the peg holds and you get your money back. If you are right, you make a fortune. Everyone was betting against the pound. That was the coup against Margaret Thatcher who really wanted to take Britain into the euro. They forced the pound into the