Armstrong Economics Blog/Interest Rates

Re-Posted Feb 17, 2020 by Martin Armstrong

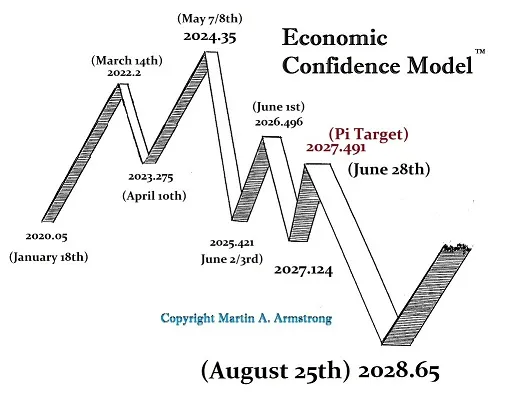

QUESTION: Mr. Armstrong; I can see your warning about Big Bang and the bonds markets would crash after 2015.75 going into the bottom of your business cycle on January 18, 2020. However, it seems that the negative interest rates have created your bond crash not in price but in participation. There is no viable bond market outside the United States with small exceptions of Britain, Canada, Australia, and New Zealand. Is there any way to come back from this destruction? Do you see the bond markets ever reviving or is this destruction permanent?

HC

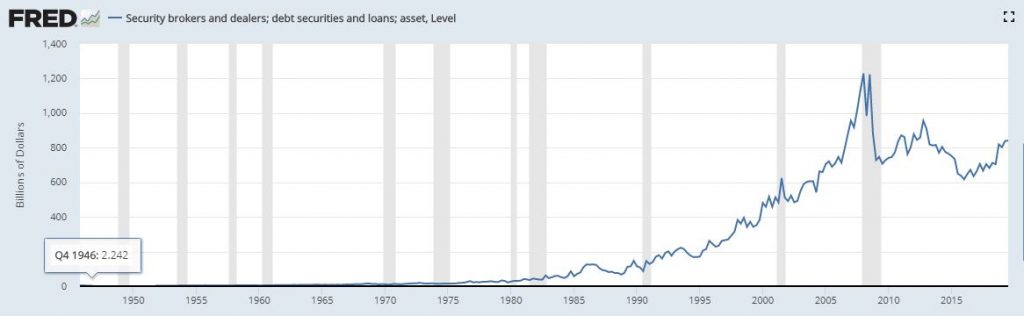

ANSWER: If there was a free market, then you would have witnessed the bonds crash price and interest rates rise as people perceived risk. The introduction of negative interest rates which began in late 2014 going into 2015.75 and Quantitative Easing, shifted the risk from the free market to the central banks. This is what I mean that they are now TRAPPED! If interest rates rise, their portfolios crash in value (price). Such an outcome would raise the question of will the private sector return to the government bond markets when they see there is a rising risk factor? Our model shows that this will not be the case. In other words, the Sovereign Debt Crisis has taken place and to prevent the PRICE crash, the central banks became the buyer to hold interest rates down and bond prices up.

Some would think that the forecast was wrong simply because the prices have not crashed. We have had the Bank of Japan saying they will buy government bonds on an unlimited basis. This is NOT a free market. It has “crashed” from the perspective of participation.

It is like the creation of the Euro. Yes, it effectively eliminated the volatility in the currency markets between the Eurozone members. However, it really only transferred the volatility from the currency market to the spreads between the bond markets of member states. Obviously, Greece and Germany both use the Euro. The volatility which would have been reflected in the currency simply moved to the bond markets.

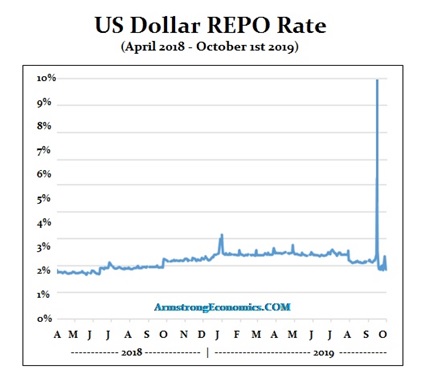

Now we have a serious crisis that has shifted from the bond markets exclusively to the central banks. This is now part of the crisis unfolding in the REPO Market. There does not appear to be any recovery on the horizon. Politicians are undermining the confidence in government, to begin with, and that will influence bond buyers.