November 20, 2018

CTH has pointed, repeatedly, toward a very specific economic and financial dynamic because President Trump is uniquely focused on Main Street’s “real economy“.

Everything happening in/around the financial markets is very predictable when you focus on understanding the principles of Main Street MAGAnomics and how those basic principles diverge from Wall Street’s “paper economy” (currently weighted by tech stocks).

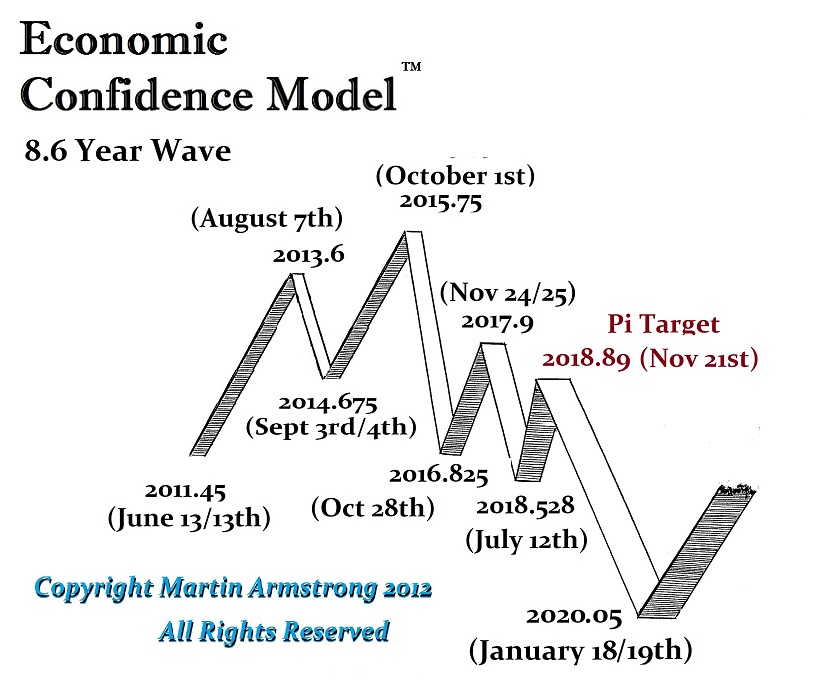

Everything is happening in a very predictable sequence. Few understand the MAGAnomic reset and what was predicted to happen in the space between disconnecting a Wall Street economic engine (globalism and multinationals) and restarting a Main Street economic engine (nationalism/America-First). In 2016 CTH explained where we would be today. With current Wall Street events, perhaps it is worthwhile remembering the CTH forecast.

Originally outlined far more than a year ago. Reposted by request on Oct 11th.

President Trump’s MAGAnomic trade and foreign policy agenda is jaw-dropping in scale, scope and consequence. There are multiple simultaneous aspects to each policy objective; however, many have been visible for a long time – some even before the election victory in November ’16. What is happening within the financial markets should not be a surprise.

If we get too far in the weeds the larger picture is lost. Our CTH objective is to continue pointing focus toward the larger horizon, and then at specific inflection points to dive into the topic and explain how each moment is connected to the larger strategy.

Today, as a specific result of a very predictable stock market contraction, we repost an earlier dive into how MAGAnomic policy interacts with multinational Wall Street, the stock market, the U.S. financial system and perhaps your personal financial value. Again, reference and source material is included at the end of the outline.

If you understand the basic elements behind the new dimension in American economics, you already understand how three decades of DC legislative and regulatory policy was structured to benefit Wall Street, Multinational corporate interests, and not Main Street USA.

If you understand the basic elements behind the new dimension in American economics, you already understand how three decades of DC legislative and regulatory policy was structured to benefit Wall Street, Multinational corporate interests, and not Main Street USA.

The intentional shift in economic policy is what created distance between two entirely divergent economic engines to the detriment of the American middle-class.

REMEMBER […] there had to be a point where the value of the second economy (Wall Street) surpassed the value of the first economy (Main Street).

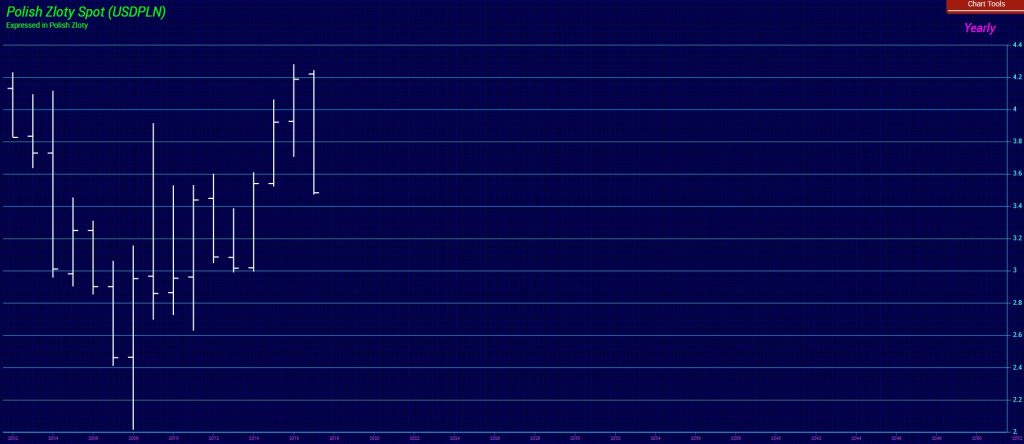

Investments, and the bets therein, needed to expand outside of the USA. hence, globalist investing.

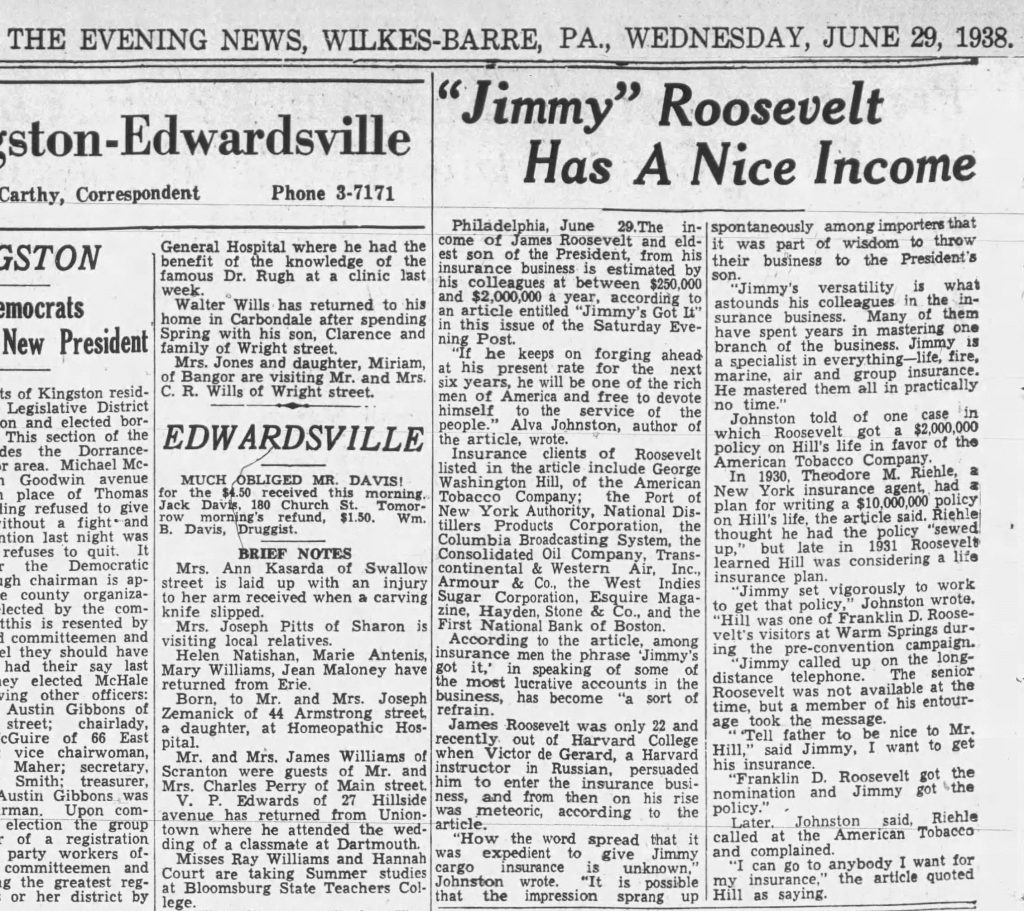

However, a second more consequential aspect happened simultaneously. The politicians became more valuable to the Wall Street team than the Main Street team; and Wall Street had deeper pockets because their economy was now larger.

As a consequence Wall Street started funding political candidates and asking for legislation that benefited their multinational interests.

When Main Street was purchasing the legislative influence the outcomes were -generally speaking- beneficial to Main Street, and by direct attachment those outcomes also benefited the average American inside the real economy.

When Wall Street began purchasing the legislative influence, the outcomes therein became beneficial to Wall Street. Those benefits are detached from improving the livelihoods of main street Americans because the benefits are “global”. Global financial interests, multinational investment interests -and corporations therein- became the primary filter through which the DC legislative outcomes were considered.

There is a natural disconnect. (more)

As an outcome of national financial policy blending commercial banking with institutional investment banking something happened on Wall Street that few understand. If we take the time to understand what happened we can understand why the Stock Market grew and what risks exist today as the financial policy is reversed to benefit Main Street.

President Trump and Treasury Secretary Mnuchin have already begun assembling and delivering a new banking system.

President Trump and Treasury Secretary Mnuchin have already begun assembling and delivering a new banking system.

Instead of attempting to put Glass-Stegal regulations back into massive banking systems, the Trump administration is creating a parallel financial system of less-regulated small commercial banks, credit unions and traditional lenders who can operate to the benefit of Main Street without the burdensome regulation of the mega-banks and multinationals. This really is one of the more brilliant solutions to work around a uniquely American economic problem.

♦ When U.S. banks were allowed to merge their investment divisions with their commercial banking operations (the removal of Glass Stegal) something changed on Wall Street.

Companies who are evaluated based on their financial results, profits and losses, remained in their traditional role as traded stocks on the U.S. Stock Market and were evaluated accordingly. However, over time investment instruments -which are secondary to actual company results- created a sub-set within Wall Street that detached from actual bottom line company results.

The resulting secondary financial market system was essentially ‘investment markets’. Both ordinary company stocks and the investment market stocks operate on the same stock exchanges. But the underlying valuation is tied to entirely different metrics.

Financial products were developed (as investment instruments) that are essentially wagers or bets on the outcomes of actual companies traded on Wall Street. Those bets/wagers form the hedge markets and are [essentially] people trading on expectations of performance. The “derivatives market” is the ‘betting system’.

♦Ford Motor Company (only chosen as a commonly known entity) has a stock valuation based on their actual company performance in the market of manufacturing and consumer purchasing of their product. However, there can be thousands of financial instruments wagering on the actual outcome of their performance.

There are two initial bets on these outcomes that form the basis for Hedge-fund activity. Bet ‘A’ that Ford hits a profit number, or bet ‘B’ that they don’t. There are financial instruments created to place each wager. [The wagers form the derivatives] But it doesn’t stop there.

Additionally, more financial products are created that bet on the outcomes of the A/B bets. A secondary financial product might find two sides betting on both A outcome and B outcome.

Party C bets the “A” bet is accurate, and party D bets against the A bet. Party E bets the “B” bet is accurate, and party F bets against the B. If it stopped there we would only have six total participants. But it doesn’t stop there, it goes on and on and on…

The outcome of the bets forms the basis for the tenuous investment markets. The important part to understand is that the investment funds are not necessarily attached to the original company stock, they are now attached to the outcome of bet(s). Hence an inherent disconnect is created.

Subsequently, if the actual stock doesn’t meet it’s expected P-n-L outcome (if the company actually doesn’t do well), and if the financial investment was betting against the outcome, the value of the investment actually goes up. The company performance and the investment bets on the outcome of that performance are two entirely different aspects of the stock market. [Hence two metrics.]

♦Understanding the disconnect between an actual company on the stock market, and the bets for and against that company stock, helps to understand what can happen when fiscal policy is geared toward the underlying company (Main Street MAGAnomics), and not toward the bets therein (Investment Class).

The U.S. stock markets’ overall value can increase with Main Street policy, and yet the investment class can simultaneously decrease in value even though the company(ies) in the stock market is/are doing better. This detachment is critical to understand because the ‘real economy’ is based on the company, the ‘paper economy’ is based on the financial investment instruments betting on the company.

Trillions can be lost in investment instruments, and yet the overall stock market -as valued by company operations/profits- can increase.

Here’s the critical part – Conversely, there are now classes of companies on the U.S. stock exchange that never make a dime in profit, yet the value of the company increases.

This dynamic is possible because the financial investment bets are not connected to the bottom line profit. (Examples include Tesla Motors, Amazon and a host of internet stocks like Facebook and Twitter.) It is this investment group of companies, primarily driven by technology stocks in the “tech sector” that stands to lose the most if/when the underlying system of betting on them stops or slows.

Specifically due to most recent U.S. fiscal policy, modern multinational banks, including all of the investment products therein, are more closely attached to this investment system on Wall Street. It stands to reason they are at greater risk of financial losses overall with a shift in economic policy.

That financial and economic risk is the basic reason behind Trump and Mnuchin putting a protective, secondary and parallel, banking system in place for Main Street.

Big multinational banks can suffer big losses from their investments, and yet the Main Street economy can continue growing, and have access to capital, uninterrupted.

Bottom Line: U.S. companies who have actual connection to a growing U.S. economy can succeed; based on the advantages of the new economic environment and MAGA policy, specifically in the areas of manufacturing, trade and the ancillary benefactors.

Meanwhile U.S. investment assets (multinational investment portfolios) that are disconnected from the actual results of those benefiting U.S. companies, highly weighted within the tech sector, and as a consequence also disconnected from the U.S. economic expansion, can simultaneously drop in value even though the U.S. economy is thriving. THIS IS EXACTLY what is happening!

.