Charles Dickens wrote about how corrupt the courts were out of control in Bleak House published back in 1859. He began in his first chapter on Chancery:

“This is the Court of Chancery, which has its decaying houses and its blighted lands in every shire, which has its worn-out lunatic in every madhouse and its dead in every churchyard, which has its ruined suitor with his slipshod heels and threadbare dress borrowing and begging through the round of every man’s acquaintance, which gives to monied might the means abundantly of wearying out the right, which so exhausts finances, patience, courage, hope, so overthrows the brain and breaks the heart, that there is not an honourable man among its practitioners who would not give—who does not often give—the warning, ‘Suffer any wrong that can be done you rather than come here!’”

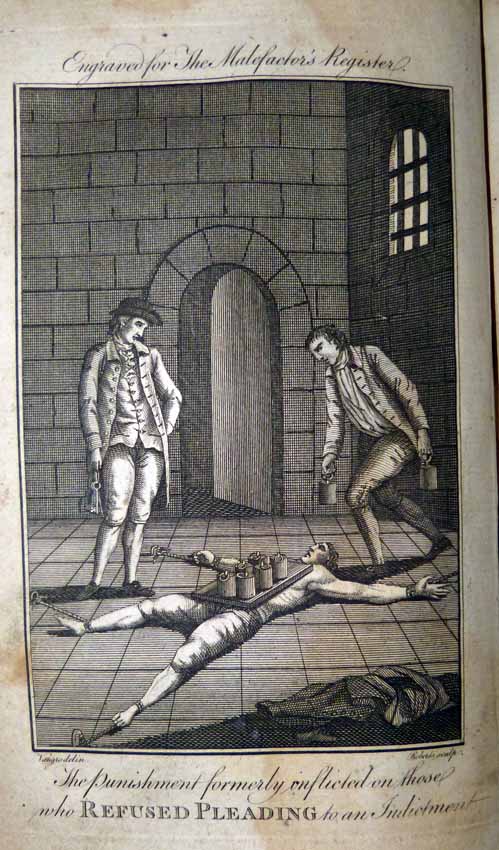

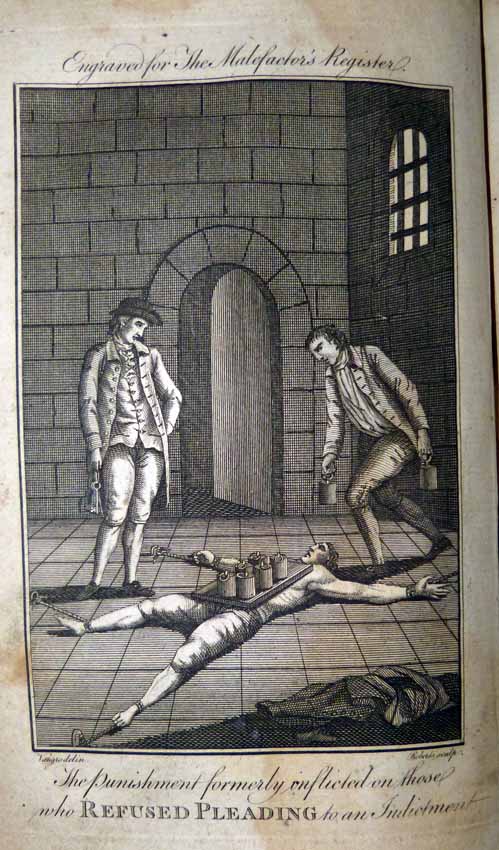

The rule of law is so dangerous when it lies in the hands of government for inevitably it has historically ALWAYS been abused for political purposes with perhaps one of the most famous cases being that of the trial of Socrates for effectively knowing too much. I paid my respect at the cell where Socrates died in Athens. Torture was legal in England as in the American Colonies. If a charged person refused to plead to the crime the government demanded, he was subjected to peine forte et dure, which meant that he would be subjected to having heavier and heavier stones placed upon his or her chest until a plea was entered, or he/she died.

The rule of law is so dangerous when it lies in the hands of government for inevitably it has historically ALWAYS been abused for political purposes with perhaps one of the most famous cases being that of the trial of Socrates for effectively knowing too much. I paid my respect at the cell where Socrates died in Athens. Torture was legal in England as in the American Colonies. If a charged person refused to plead to the crime the government demanded, he was subjected to peine forte et dure, which meant that he would be subjected to having heavier and heavier stones placed upon his or her chest until a plea was entered, or he/she died.

Many defendants who were charged with a felony, which was a capital offense, refused to plead in order to avoid forfeiture of property for their family. If the defendant pleaded either guilty or not guilty and was executed, their heirs would inherit nothing and the state took all assets. If they refused to plead guilty or not guilty, then their heirs would inherit their estate, even if they died in the process. This is how the law was enforced and to this day, they threaten you with life imprisonment if you refuse to plead. Before 1406, if they refused to plead, the government simply just starved you to death. It was always about the money (see The Roots of Evil, p35, Christopher Hibbert, first edition 1963). To increase the opportunity for the state to charge crimes, it became an offense to use profane swearing as well as to gamble with cards.

Many defendants who were charged with a felony, which was a capital offense, refused to plead in order to avoid forfeiture of property for their family. If the defendant pleaded either guilty or not guilty and was executed, their heirs would inherit nothing and the state took all assets. If they refused to plead guilty or not guilty, then their heirs would inherit their estate, even if they died in the process. This is how the law was enforced and to this day, they threaten you with life imprisonment if you refuse to plead. Before 1406, if they refused to plead, the government simply just starved you to death. It was always about the money (see The Roots of Evil, p35, Christopher Hibbert, first edition 1963). To increase the opportunity for the state to charge crimes, it became an offense to use profane swearing as well as to gamble with cards.

Winston Churchill knew the dangers of enforcing the claimed rule of law. He said in 1910: “The mood and temper of the public with regard to the treatment of crime and criminals is one of the most unfailing tests of the civilisation os any country.” It was during the early 15th century when the paying of a fine was allowed to be the substitute for imprisonment. Today, the United States fines and imprisons everyone for any type of crime. There was even the payment for “easement of irons” whereby you paid the jailor to avoid being chained to the floor on your back with spiked collars around your neck and heavy iron bars placed over your legs. If you paid, then these tortures were avoided. It wasn’t until 1729 when a Parliamentary Committee was moved to finally investigate and the report found that 350 prisoners died of starvation in just three months. Major Bernardi was a English political prisoner who died at the age of 82 while waiting to go to trial for 40 years. Lord George Gordon, another political prisoner, died of “gaol fever” (jail fever) which was a plague that began in prison from the unclean conditions in the autumn of 1793.

It took some time to realize that plagues were beginning in prisons. These “gaol fever” epidemics would spread to the city populations. Prisoners had to be brought to the court pending trial for years. Some 500 people died in Oxford during the Black Assize of 1577. Another plague kill about 500 people in Exeter in 1586 which also began in the jail. Many hundreds died during the Lent Assizes in Tauton in 1730 and again in 1750 even the Lord Mayor of London and two Judges died of plague coming from the prison (see The Roots of Evil, p135). If it were NOT for these plagues coming from prisons because of the refusal to take care of people, there would never have been healthcare introduced. Guards go home at night and whatever plague began in prison they quickly took to the population.

This is part of the backdrop behind the US Constitution where the 8th Amendment forbids cruel and unusual punishment. The federal courts have held for years that inmates cannot be denied medical care just because they are incarcerated. This is NOT something that is “liberal” for it historically impacts society. Many immediately cannot see why a prisoner should get healthcare. What they fail to understand is the United States thrives on imprisoning people for “conspiracy” meaning they never had to even attempt to do the alleged crime. The real criminal testifies against others so they go to prison and they get credit for bringing in other people. The conviction rate before the conspiracy law changed was about 72%. Today, it is almost 99%. To everyone’s shock, the number of prisoners in jail for violence is only 3.3%. The vast majority are there for drug offenses, which include marijuana that accounts for 46.1% of prisoners. I have written about this before for it is the real face of evil.

The cost of imprisoning people for decades for non-violent crimes is tremendous. The prison population is growing old as well and the demands for taking care of people continue to grow. Yet prisons hardly provide adequate care to this day. A parasite had entered my left eye and I was denied medical care. I petitioned two judges, Renee Marie Bumb and John F. Keenan. Both judges REFUSED to take me to a real doctor. I had to wait until I was released and saw Dr. Michael J Barnish, a specialist in infectious diseases. What I had was a parasite from South America. A simple blood test confirmed what I complained about and was treated to kill the organism which left the vision in my left eye less than that of my right. This is the problem. The government wants to imprison everyone and they do not look at the diseases they may be imported into the country because they want to prosecute people from other countries. I am a living example. For when I petitioned both judges, I was denied medical care because such parasites do not exist in North America. They do when you bring in people from South America.