Posted originally on May 24, 2024 By Martin Armstrong

I discussed how the rising costs of childcare surpass the cost of rent by 25% to 50% across the United States. The cost of raising a child is directly reflected in the birth rate crisis we are seeing across the world. Another new phenomenon is permanently altering the family structure as a result of economics – the absence of the role of grandparents.

Unlike countless animal species, humans were designed to survive well past child-rearing years. Only a few animal species, such as elephants and whales, undergo menopause, and not so coincidentally, these species rely on shared wisdom passed down through the generations for survival. Men begin to decline in testosterone around the same time that women go through menopause, and while they can continue having children throughout their life cycle, men are wired to be less likely to compete for mates later in life. Grandparents served an essential role in the family structure.

The nuclear family has always been supported by the extended family. Older generations helped to care for the younger generations, passing down priceless knowledge. Younger generations had the ability to then care for the elderly. Tens of thousands of years of evolutionary biology is no longer the norm due to economics.

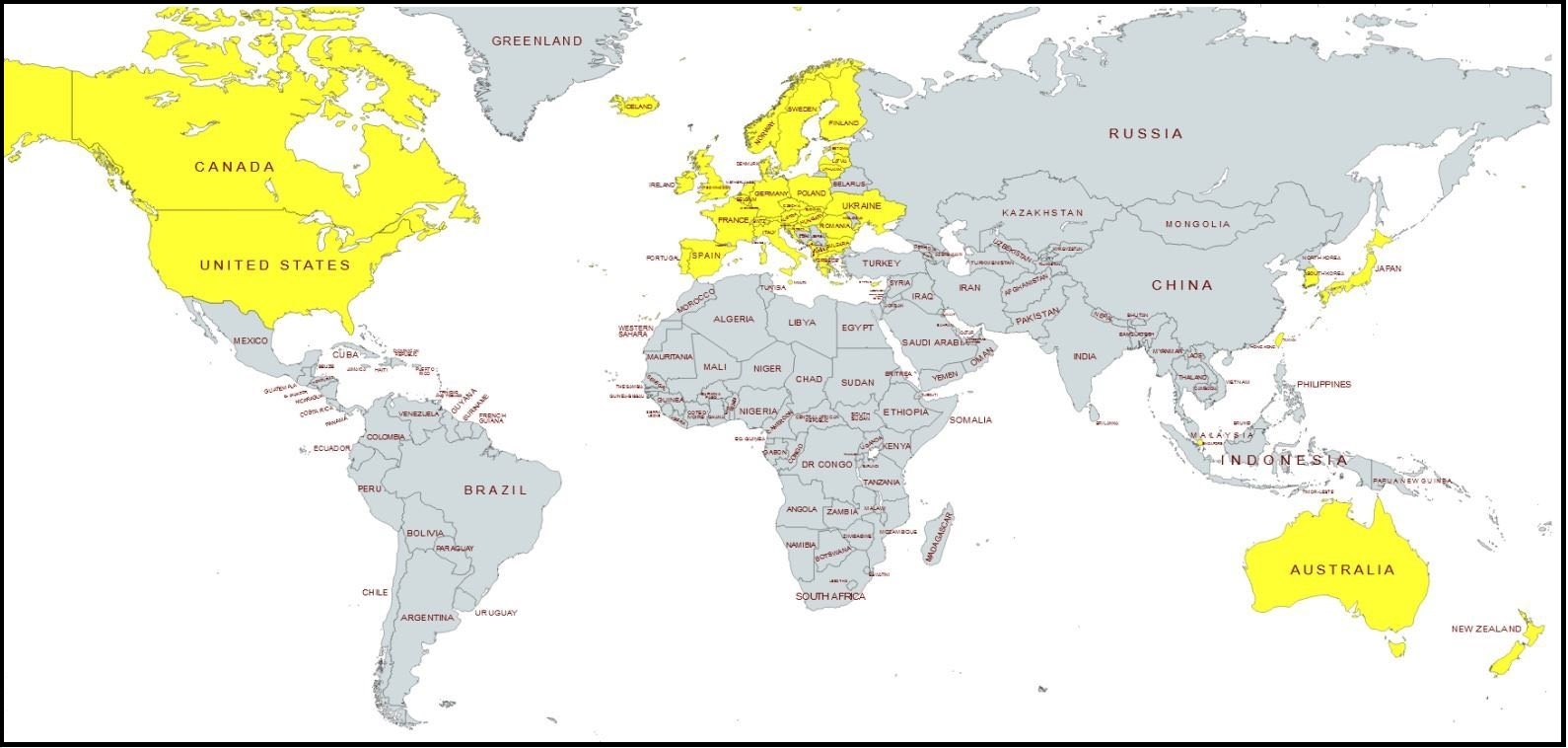

Simply put, most grandparents are still working to survive. I will speak from the US perspective, but this phenomenon is happening throughout the world. Over half of families (53.3%) were dual-income earners in the United States as of 2019. A recent survey found the average age of retirement is between 61 to 64, up from 57 in 1990. The current cost of living will require most to work far beyond this age for survival. Social Security will go bust, and hardly anyone outside of government employees will receive a pension. A comfortable retirement is hard to obtain for the average person.

Additionally, children are less likely to support their parents as they age for cultural and financial reasons. We saw nations like China fining young people for not caring for aging parents. Individualism is favored in our societies, and the youth throughout the world is geared toward starting a new life in the cities away from their immediate families. Younger generations notoriously have less saved for retirement compared to earlier generations due to the high cost of living, and many are unable to financially care for sick and elderly parents because they lack the resources. Life expectancy is slightly declining, but we are living far longer than past generations.

Since grandparents are preoccupied working, the parents are placing their children in daycares rather than with grandparents. That once essential role of the grandparent is less prominent in modern societies. The public education system rather than the family is passing down knowledge, or the knowledge they deem appropriate.

Could the extreme increase in the cost of living revive the multigenerational family structure? Pew Research has found that multigenerational homes, “defined as including two or more adult generations (with adults mainly ages 25 or older) or a “skipped generation,” which consists of grandparents and their grandchildren younger than 25,” are now rising in America. Around 59.7 million Americans lived in multigenerational homes in March 2021, compared to 58.4 million in 2019 before the pandemic. Yet a large cause of this shift is an increase in Asian and Latino immigrants, who account for a higher proportion of multigenerational households.

Around 10,000 Baby Boomers will turn 65 every day from now until the pivotal year of 2030. Estimates believe that there will be a 50% increase in the number of seniors living in nursing homes full-time by 2030. The Washington Post found that 10% of seniors 85 years of age or older now live in retirement homes unless they are working in US Congress.

The role of the grandparent was essential throughout all of evolutionary biology. Women had the opportunity to enter the workforce, and now, it is mostly a mandatory obligation due to living costs. Both parents are working, as are the grandparents, and the children are being partially raised by daycares and the school system. The role of the grandparent is vanishing from our society as a direct result of shifting economic and societal norms.