Posted originally o TrilSite New by Dr-Ron-Brown on January 21, 20227 Comments

Note that views expressed in this opinion article are the writer’s personal views and not necessarily those of TrialSite.

Dr. Ron Brown – Opinion Editorial

January 21, 2022

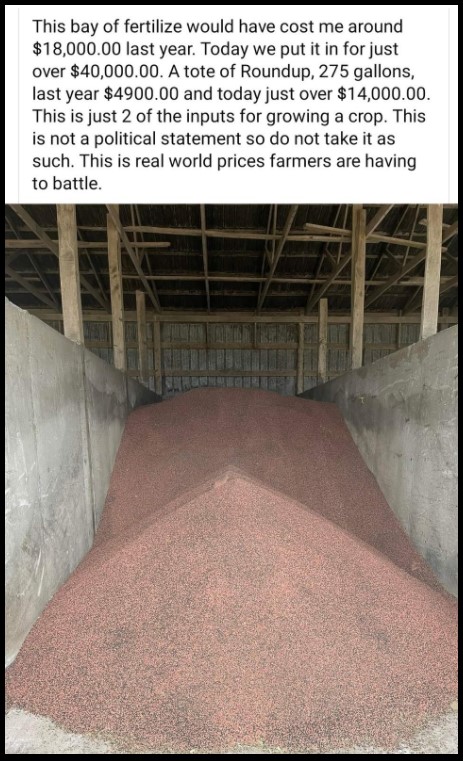

A study of ivermectin use in a Brazilian population, published on January 15, 2022, reports that the repurposed drug reduced COVID-19 infections by 44%, hospitalizations by 56%, and deaths by 68%: Ivermectin Prophylaxis Used for COVID-19: A Citywide, Prospective, Observational Study of 223,128 Subjects Using Propensity Score Matching. Here is a figure from the report summarizing the findings: “Ivermectin-prophylaxis.-Summary-of-the-findings”

The reported findings from ivermectin use are relative risk reductions (RRRs), calculated as follows below from the data in the figure (note an error in the figure: the 8.2% infection rate in non-ivermectin use should be 6.6%).

Events are infections, hospitalizations, and deaths. Relative risks (RRs), called the rate risk ratio in the figure, are calculated by dividing an event rate of ivermectin use by the event rate of non-ivermectin use (the control). The RR decimal is then subtracted from 1 to give the RRR as a percentage.

Infection RRR

RR: ivermectin 3.7% / control 6.6% = 56%

1 – 0.56 = 44%

Hospitalization RRR

RR: ivermectin 1.45% / control 3.26% = 44%

1 – 0.44 = 56%

Mortality RRR

RR: ivermectin 0.82% / control 2.6% = 32%

1 – 0.32 = 68%

Calculations for the Unreported Absolute Risk Reductions (ARR)

The study’s unreported absolute risk reductions for COVID-19 infections, hospitalizations, and deaths with ivermectin use are calculated by subtracting the event rate of ivermectin use from the event rate of non-ivermectin use (the control).

Infection ARR

control 6.6% – ivermectin 3.7% = 2.9%

Hospitalization ARR

control 3.26% – ivermectin 1.45% = 1.8%

Mortality ARR

control 2.6% – ivermectin 0.82% = 1.8%

Conclusions

Unsurprisingly, the unreported ARRs of COVID-19 infections, hospitalizations, and deaths from ivermectin use—2.9%, 1.8%, and 1.8%, respectively—are much lower than the respective reported results of 44%, 56%, and 68%.

Furthermore, the study’s appendices include a STROBE Checklist (Strengthening the Reporting of Observational Studies in Epidemiology) which lists the following item:

“Main Results (c) If relevant, consider translating estimates of relative risk into absolute risk for a meaningful time period.”

For some unexplained reason, the study authors overruled this checklist item with the response: “NOT APPLICABLE.” Perhaps the authors can write to TrialSite and offer readers a helpful explanation of why relative risks weren’t translated to absolute risks to “strengthen” the report?

Until then, I guess it’s totally the public’s responsibility to determine whether a repurposed drug with an unreported 2.9% absolute risk reduction of COVID-19 infection is effective enough to warrant clinical use.