Armstrong Economics Blog/Economics

Re-Posted Sep 8, 2019 by Martin Armstrong

Margaret Thatcher on the ERM Crisis & why even the euro will f

Margaret Thatcher on the ERM Crisis & why even the euro will f

Back during the Great Depression, there were people who theorized that gold hoarding was preventing economic recovery. There is always this same theory that people who save hoarding their money and are not spending it results in the lack of a recovery suppressing demand. This theory has been around for a very long time. It assumes a recovery is always blocked by people hoarding their money and saving for a rainy day.

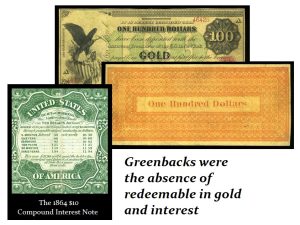

Back during the American Civil War, the federal government issued paper currency for the first time after the Revolution. Much of this currency paid interest. Some were in the form of virtually circulating bonds with coupons for the interest payments. Some were backed by gold. Others offered a table on the reverse providing a schedule. The interest baring notes remained valid currency, but the interest expired within a specific time period. Hence, one would redeem the note since it would no longer pay interest beyond a specific date.

Back during the American Civil War, the federal government issued paper currency for the first time after the Revolution. Much of this currency paid interest. Some were in the form of virtually circulating bonds with coupons for the interest payments. Some were backed by gold. Others offered a table on the reverse providing a schedule. The interest baring notes remained valid currency, but the interest expired within a specific time period. Hence, one would redeem the note since it would no longer pay interest beyond a specific date.

The rumbling behind the curtain I am hearing is a growing idea of making the currency in Europe simply expire. I have explained before that in Europe currency routinely expires – even in Britain. The United States has never canceled its currency so a note from the Civil War is still legal tender. But that is not the case in Europe.

Europeans are accustomed to having their money simply expire. This is not limited to paper currency. They also cancel the coins. The proposal being whispered in the dark halls of Europe is that perhaps the way to impose negative rates to force people to spend is to just cancel all the currency and authorize only small notes for pocket change. They want everyone to be forced to use bank cards and this is the new theory to revitalize the economy.

The chart patterns for the Euro are about as long-term bearish as one can imagine. The problem facing the world economy is this idea that they can even FORCE people to spend their savings recklessly as the government does. Canceling the euro may be a drastic and desperate step, but it is being proposed as an alternative to deep negative interest rates which have failed to work for more than 10 years. The middle ground proposes a paper currency with expiration dates.

Either way, the risk of a profound dollar rally remains in the wings. The powers behind the curtain desperately want to defeat Trump for they know he would NEVER cancel the American currency. To pull that off, they need a career politician. Joe Biden would be perfect. He might just sign whatever bill is put before him and then take a nap. It is ironic, but there would be a lot of Americans who would wake up and want Trump bank after that one. Joe would be too tired to tweet.

Either way, the risk of a profound dollar rally remains in the wings. The powers behind the curtain desperately want to defeat Trump for they know he would NEVER cancel the American currency. To pull that off, they need a career politician. Joe Biden would be perfect. He might just sign whatever bill is put before him and then take a nap. It is ironic, but there would be a lot of Americans who would wake up and want Trump bank after that one. Joe would be too tired to tweet.

QUESTION: Mr. Armstrong; I did my own research on the 1998 Russian collapse. All the big names lost billions. Even the New York Times reported that George Soros lost $2 billion. You were the only one who made money so it made sense that you were named hedge fund manager of the year in 1998. My question is this. Since all the big names were involved in the Russia trade which took down Long-Term Capital Management, is this why you call them the “club” for they all do seem to be involved in the same trade?

DU

ANSWER: Correct. This is also why they try to prevent people from listening to me. They are convinced that the reason they lost was that I was too influential and had too many institutions listening to me. That absurdity is what they ran to the government with, so I was then accused of “manipulating” the world economy. They all lost after I warned them and refused to join in their takeover of Russia I believe I was given the nod by the Clintons. They told me they had the IMF in their back pocket and they would continue to fund Russia. I warned them that the IMF got their funding from governments and they were not going to back it.

The Russian financial crisis hit Russia on the 17th of August 1998. Our World Economic Conference was held in London that June. Our forecast was then published by the London Financial Times on the front page of the second section.

They did not give up. After they got the Federal Reserve to bail them out, they then focused on setting up Yeltsin and got him to divert $7 billion in IMF loans. Even CNN reported the money was stolen from the IMF.

CNN Theft of IMF Money – Sep. 1, 1999

Edmond Safra’s Republic National Bank ran to the Department of Justice and then reported that a $7 billion money laundering scheme just went through Bank of New York. They attempted to blackmail Yeltsin to step down and appoint their guy; Yeltsin then turned to Putin. It was the US bankers, with the support of the Clintons, who first tried to interfere into Russian elections. This is why Putin was not friendly to Clinton and said Mueller could come to question anyone in Russia he liked, provided Russia could question Americans including Bill Browder who was Safra’s partner in Hermitage Capital.

While “The Forecaster” was shown even on TV throughout Europe, Canada, and Asia, the question is WHY was it banned in the United States? If it was just a conspiracy theory, they could care less. When something strikes closer to home, they ban it.

COMMENT: Sir,

I appreciate that I may not always agree with what you write but I listen and examine and respect your viewpoint. You, in turn, have answered my many questions and discussed my comments with respect in return.

This makes me worry that the ability to discuss problems in a straightforward and thoughtful way may not be possible in the future.

Keep up the good work

F

REPLY: In order to be an international adviser, the very first lessons I learned was (1) listen to everyone, and (2) view the world through their eyes.

I was giving a lecture in Geneva to a small group of institutions back in 1982 but some had flown in from other countries. One was from Canada and the exchange was quite interesting. I had provided the forecasts on the individual currencies and then I moved to the commodities. The Canadian asked so he should be a buyer of gold and I said yes. The on Swiss institution said yes but your forecast on the Swiss franc would mean I would lose money.

When I looked at it in terms of each perspective it was clear. The rally in gold would be impressive only in US$ and CD$ so it was a buy for the Canadian and a sell for the Swiss. Indeed, the rally into 1983 was a strong rally for gold in US$ and CD$, but not in Swiss.

We all have a view and money to each of us is still a mental calculation based upon our home currency. To even do my job, I have to be able to see the world from all perspectives. We are all human and we will all act in our own self-interest.

My clients have trained me. Having to deal with many crises around the world forced me to see the world through global eyes. This is why MY DEFINITION of what constitutes a bull market is something which rises in ALL CURRENCIES!!!!!

We will all never agree for we will always see things through our own pair of glasses. Never forget, others will respond in the same way.

My philosophy is very simple. There should be no law which compels others to act in a way I believe if correct provided their actions do not harm anyone else. I leave you alone and you leave me alone and we can all get along. I object to politics that seeks to exploit class warfare for historically that has ALWAYS, and without exception, led to civil wa

My philosophy is very simple. There should be no law which compels others to act in a way I believe if correct provided their actions do not harm anyone else. I leave you alone and you leave me alone and we can all get along. I object to politics that seeks to exploit class warfare for historically that has ALWAYS, and without exception, led to civil wa

QUESTION: It seems that as we get closer to a change-over of economic systems that as a society we are more willing to give up our rights to the State. Is that part of a pattern during these types of events? Was it seen as Britain, Rome, and other countries lost power after their peaks?

DS

ANSWER: Unfortunately, the trend first materializes when people need the government to protect them usually from an external force. The British used this tactic against both the French and the American colonists. That prompted Ben Franklin to comment on this trend.

After the 3rd Century Monetary Crisis bottomed in the Roman Empire in 268 AD, there was a surge to build a wall around Rome by Emperor Aurelian following the same pattern. Aurelian saw the corruption that led to the debasement of the currency because those minting the coins were robbing the treasury. Aurelian moved to DRAIN THE SWAMP in Rome. When Aurelian returned to Rome in 271 AD after fighting off barbarians, he had to pacify a terrified city. He immediately halted the rioting and restored order to the capital. The controller of the mint in Rome began a rebellion over the monetary reforms laid out by Aurelian. He ordered that all the debased currency be purchased back and replaced with a new currency of higher content in silver. The rebellion was led by Felicissimus.

It appears that those who had been running the mint were embezzling the intended silver and issuing the debased coinage at least in part on their own authority. Obviously, any reform to the monetary system that called for an increase in silver content would have been unprofitable for those running the mint for personal gain. In the rebellion, as many as 7,000 soldiers died when Aurelian was forced to trap and execute them and their allies, some of the senatorial rank, in a terrible battle on the Caelian Hills.

Aurelian then constructed a wall around Rome — the first of its kind. Clearly, there was both a DRAINING OF THE SWAMP and a sense of security that people surrendered in the name of safety. The final phase comes when the suppression of liberty continues to become oppressive and therefore the people eventually wake up and see that the government is using this as a tactic to sustain or grab more power usually in self-defense.

QUESTION: Hi Marty, I come from a golfing family and remember very well the shock when a Japanese investment group bought the Pebble Beach Golf Links, in 1990, for $850 million. The previous October Japanese investors bought the Rockefeller Center, triggering a flurry of Japanese purchases of signature U.S. properties such as Pebble Beach.

Was all this investment caused by The Plaza Accord in 1985, which devalued the USD by 40 percent? Which, as you’ve pointed out, also devalued American assets held by Japanese, igniting a sell-off of American investments and the 1987 crash. With cash repatriated back to Japan, the capital inflows into Japan ran the Nikkei up to its peak, in 1989. Within this late-80s early-90s timeframe, this is when the Japanese made their global malinvestments such as Pebble Beach, which they sold just two years later, in 1992, for $500 million, taking a 42 percent loss. Do I have the correlations and causations correct?

Thanks,

TGM

ANSWER: Yes. The Japanese bought US assets at the peak of their markets in 1989. As you can see, the dollar against the yen kept falling into April 1995. Not only did the Japanese lose money on US assets, but they also lost, even more, when they sold them and converted it back to yen on the decline in the dollar.

Currency is EVERYTHING. It dramatically alters the capital flows and can destroy economies because people remain clueless about how foreign exchange markets even function. That should be no surprise since they still teach all the economic theories of the Bretton Woods fixed exchange rate era including Keynesianism.

That is why everyone in the field is self-taught. You cannot get a degree in hedge fund management. Christine Lagarde of the IMF and soon to be head of the European Central Bank is a lawyer with no experience in funds management. People run for president spouting economic promises without the slightest background even in economics. What they teach in school has become ever more irrelevant in the real world. Other than a doctor or lawyer, it is hard to find someone who is working in the field in which they obtained a degree

QUESTION: Hello Marty,

I have a question about Gold & Silver in other currencies – namely GBP.

Accepting your rational, with evidence I must say, that precious metals are a reflection of the confidence people have in their countries currency, you can see from the price of gold & silver in GBP and EURO that leading up to the Brexit referendum until now confirms this. When you look at the ECM for this period – 2015.75 up to 2020.05 – you can see that there are three main waves to it. One wave down from 2015.75 to 2016.825, then three shorter wave from 2016.825 to 2018.89 – single consolidation wave?, then a third wave down from 2018.89 to 2020.05. Gold & Silver rallied, consolidated, then rallied again within this ECM period. Does Gold & Silver have their own internal cycle? Will your upcoming report include content on Gold & Silver in other currencies? The trade in Gold:GBP since the ECM turning point of 2015.75 has been very lucrative

– thanks for your service and opening up Socrates for us.

Regards,

AJ

England.

ANSWER: When you plot gold in dollars and pounds, you can see the steepness in the pound. This has been the strength in gold in dollars. It has been the hedge, not against fears of inflation in the USA, but it has risen in the face of the fear of a recession OPPOSITE of its previous relationships. This is all because we are approaching a Monetary Crisis Cycle.

Forecasting gold in dollars is pointless for that will be irrelevant to those in different countries. So yes, our report will be in terms of all the major currencies so people can make the appropriate decision in their own currency.

Published on Aug 26, 2019

I have created this site to help people have fun in the kitchen. I write about enjoying life both in and out of my kitchen. Life is short! Make the most of it and enjoy!

De Oppresso Liber

A group of Americans united by our commitment to Freedom, Constitutional Governance, and Civic Duty.

Share the truth at whatever cost.

De Oppresso Liber

Uncensored updates on world events, economics, the environment and medicine

De Oppresso Liber

This is a library of News Events not reported by the Main Stream Media documenting & connecting the dots on How the Obama Marxist Liberal agenda is destroying America

Australia's Front Line | Since 2011

See what War is like and how it affects our Warriors

Nwo News, End Time, Deep State, World News, No Fake News

De Oppresso Liber

Politics | Talk | Opinion - Contact Info: stellasplace@wowway.com

Exposition and Encouragement

The Physician Wellness Movement and Illegitimate Authority: The Need for Revolt and Reconstruction

Real Estate Lending