On economic matters, no one really knows what is about to happen, with one possible exception. It is demonstrably certain inflation into 2022 will continue increasing. Beyond that, after pumping $9+ trillion into the U.S. economic system under the guise of COVID relief, we are entering some very uncharted waters.

On a macro level, CTH has an idea what is likely to take place in the next three years; however, before getting to that, allow me to present evidence for the underlying supposition. As you can see from this Biden message, shaped entirely by politics, on an economic basis the people around him have no idea what the downstream consequences of 2020 and 2021 will present in 2022:

The team behind Joe Biden brag about the U.S. economy being the only economy to continue growing during the COVID-19 pandemic period. Their top line reference point is the Gross Domestic Product, or GDP. Their brag is the U.S. GDP did not shrink during 2021 and the COVID pandemic.

However, what they omit (for political reasons) is that massive U.S. spending and bailouts covered the GDP hole. More than $9 trillion was injected for stimulus payments, blue state bailouts, payroll protection programs, rent moratoriums, school subsidies, medical payments to hospitals, student loan payment pauses, vaccination purchases, covid sick pay and years of continually extended and enhanced unemployment benefits.

They also omit that none of this domestic spending would be possible if the global trade currency did not take place in dollars. Our value is propped up by the fact that almost all trade takes place in U.S. currency. If that system was not in place, congress could not spend this much money without collapsing the U.S. into a devaluation position resembling what happened previously in Greece.

The only way for Biden to avoid the direct economic consequence of this massive injection of $9+ trillion, which has created the illusion of a strong GDP by subsidizing consumer spending, is to keep injecting more money to keep the artificial GDP inflated.

Biden really needs congress to keep spending. However, it now looks like congress does not have an appetite to do this….. so, the consequences are coming.

The prior spending covered a hole created by a drop in total economic activity. Outputs dropped, payrolls dropped, consumer spending would have dropped, etc. In essence, the void in economic activity was subsidized on a massive scale by government.

The U.S. economy was essentially a $20 trillion GDP going into the pandemic period. Think of the GDP as total value. We do not know what the total contraction on the economy was due to the first subsidy; but we do know the aggregate response over the past two years has been to subsidize -or cover- the contraction with a $9 trillion blanket.

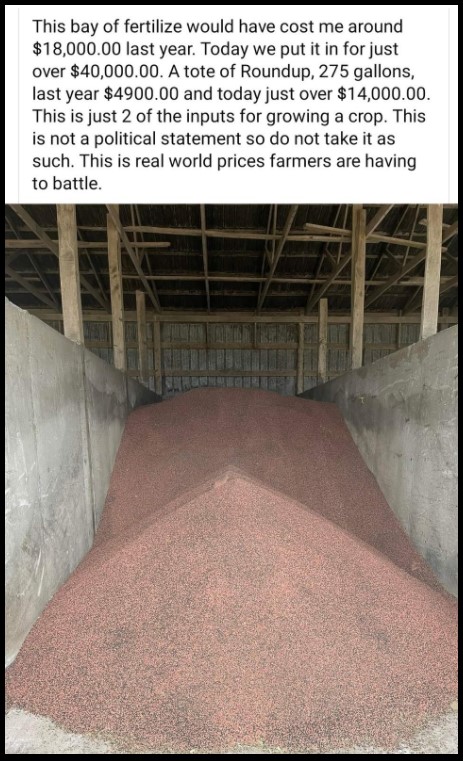

That $9 trillion in artificial GDP value is the most direct cause of inflation. There are other aspects related to energy policy making products more expensive (energy, gas, fuel, transportation, heating, cooling, etc), but the $9 trillion artificial spend is the largest factor of current inflation.

These two figures will become important moving forward. A $20 trillion natural economy, and $9 trillion in unnatural spending to maintain it.

In our economic studies, CTH has assembled a reference library from which we can draw guidance. The 2008 and 2009 bailout phase [TARP, auto-bailouts, American Recovery and Reinvestment Act (ARRA), QE1 and QE2 as well as the porkulous bill] provide some reference points for long term outlooks.

There is a general investing guideline consisting of a factor of seven. Seven years to double money, seven years to recover investment, seven years of depreciation etc. The number seven shows up in multiple macro-economic reference points. Seven is also represented by an approximate of 13%.

Spending at the level of 25% of our GDP (over two years) creates an inflationary pressure point of a similar size. Two years at 13% is 26% inflation. In real terms, that’s roughly where we are right now – we are somewhere in the 25% range in higher prices on goods overall. That aligns with the spending subsidy inside the U.S. economy.

If my review of the ’08/’09 spending impact is accurate as an overlay, it means our natural economic cycle will take roughly four years to make parity between real wage incomes and the inflation rate. It will take us four years to grow wages enough to cover for all this spending. Meaning, in four years the level of overall wages will be enough to finally catch the inflation currently recorded in the price of goods.

However, the problem arises in the near future. Without that $9 trillion spent, our GDP would have contracted. We now need to work through the value of that contraction in the economy. We need wages to rise to compensate for inflation; but unfortunately, we are about to enter a phase where employment is likely to contract.

Two-thirds of the U.S. GDP is created by consumer spending. Inflation, created by prior spending, is chewing up current wages and incomes. As a consequence, disposable income is wiped out. Consumer spending on non-essential products and services (luxury stuff) is essentially gone. That reality is going to lead to a natural drop in employment as non-essential goods and services are no longer in demand.

We covered the prior point where the drop in demand for less essential products would have happened with government spending. That subsidy is now drying up, and the hole we avoided is now in front of us. All of the people who work in the economic process of providing ‘less-essential‘ goods and services will now likely see lay-offs.

This could potentially set us on a collision course. If the employment condition worsens, there will be no need for upward pressure on wages. At the same time, wage pressure decreases the inflation pressure remains high. This dynamic means it takes even longer than four years to cover the hole of the previous spending.

We have talked about the predictable consequences of this dynamic for approximately eight months. Some of the data is now beginning to surface to support exactly what we were discussing last year. All of the artificial spending is drying up, and now the inflationary bills (chickens) are coming home to roost.

Each spike on the WolfStreet graphic below is government COVID spending. Massive influxes of artificial payments into the economy. The first spike is the Paycheck Protection Plan and initial economic bailout. The second spike was the second covid relief bill, and the third spike (the tallest) was the soon followed even larger covid relief bill.

The WolfStreet analysis shows how inflation is much higher than wage growth {DATA HERE}. Those spikes represent approximately $4.5 trillion in spending – subsidy infusions into the U.S. employer and employee workforce.

Inflation will continue chewing up wages through next year. However, it can readily be expected that total employment will start getting a lot more tenuous as consumers/workers hunker down and prioritize spending on higher priced housing, food, energy and fuel.