Posted originally on Dec 14, 2023 By Martin Armstrong

Whenever those in Congress mess with real estate, they have ALWAYS, and without exception, caused a major crash. The Entire Savings & Loan (S&L) Crisis was a catastrophic disaster that wiped out nearly one-third of all the 3,234 savings and loan associations in the United States between 1986 and 1995. I previously mentioned that hedge funds were created by a regulation conflict between the Commodity Futures Trading Commission (CFTC) and the Securities & Exchange Commission (SEC). If you obeyed one, you went to jail with the other.

Back in the 1980s, we began the S&P500 Report when futures started to trade. We had to refund everyone’s money and shut down the report because these two agencies were fighting over who had the regulatory power of stock index futures. We could not provide analysis as long as the two agencies fought for power. It came down to a Supreme Court decision that finally said forecasting was free speech – SEC v Lowe. Nevertheless, in funds management, you could not hedge for a client domestically because if you had a stock portfolio and you thought there was a crash unfolding, you were only allowed to hedge 17% for anything more than that made you a futures fund – rather than a stock fund. The only way to trade everything was to move offshore, and these were called Hedge Funds, which you were not allowed to do domestically. To this day, you have separate funds domestically, each claiming they are the best, forcing the decision onto the average person.

The S&L crisis was also created by Congress’s persistent quest to regulate things they do not understand. Once more, there was a conflict and mismatch of regulations regarding S&Ls v banks. Congress had imposed restrictions on S&Ls with the creation of the Federal Home Loan Bank Act of 1932, which included such caps on interest rates on deposits and loans. They also directed that S&Ls should be lending into the real estate market and banks should be focused effectively on businesses. The banks still could do mortgages.

The market conditions moved into deflation between 1981 and 1985 because Volcker raised rates at the Fed to 14% to stop inflation, which caused capital inflows to buy bonds, sending the dollar to rise dramatically on international markets. The British pound crashed from $2.40 to $1.03 by 1985. However, the regulations on how much interest an S&L could pay meant they could not compete with the rates that the Fed adopted, and nobody in Congress noticed until 1982. The S&Ls experienced a massive capital outflow, and they were left with low-interest long-term mortgages.

In 1982, President Ronald Reagan signed Garn-St. Germain Depository Institutions Act, which was intended to correct the conflict between high interest rates and caps on the S&Ls. The reform eliminated loan-to-value ratios and interest rate caps for S&Ls. In addition, it also allowed them to hold 30% of their assets in consumer loans and 40% in commercial loans for the first time. The S&Ls began paying higher rates to attract funds. S&Ls also began investing in commercial real estate, which had tax advantages with regard to amortization.

As always, the Democrat’s constant hunt to punish the rich with every breath they take caused the entire S&L crisis of the 1980s. The Democrats only see the money dangling in front of them and nothing else. They pushed through a landmark 1986 Tax Reform Act that reduced the top personal income tax rate from 50% to 28%. However, in a bitterly divided Congress, as usual, demanded a compromise and that the income tax cuts were to be paid for by raising the rate on capital gains from 20% to 28% and limiting the deductibility of real estate losses for passive investors. The braindead unintended consequences undermined the entire real estate market and took down the S&L Industry in the process.

The S&L crisis demonstrated that those in government NEVER understand the private sector. They created the business model of the S&Ls whereby they made 30-year fixed-rate mortgages, which Roosevelt invented to solve the real estate collapse back in the Great Depression. To provide those loans, S&Ls depended on a deposit based on DEMAND that could be withdrawn within 30 days. When the Fed raised rates to 14% in 1981, the S&Ls were in trouble and lost deposits when they were prevented from paying higher rates. That was not lifted until the Reagan 1982 reform. This is the basic banking model using on-demand money to lend out long-term. To this day, the Fed directs the “Model Risk,” which you can review at SR 11-7: Guidance on Model Risk Management.

At first, the measures seemed to have worked, and by 1985, S&L assets had risen by almost 50%. Commercial real estate became the “hot” market. This is what attracted the Democrats. They saw all this money pouring into mortgages, so they could not resist changing the laws to get at that money in 1986. The Economic Recovery Tax Act of 1981 accelerated the depreciation of commercial and noncommercial real estate, making those investments quite attractive. Then, the Democrats saw the money and pushed the Tax Reform Act of 1986 to extend depreciation schedules for both real estate forms, reducing the attractiveness of those investments.

These people NEVER understand market behavior. By extending the depreciation tables, they created a one-way market. Real Estate collapsed, everyone tried to sell, and there was NO BID! One of the few Congressmen with real estate experience at the time called me and asked what my model projected. I told him this would be a major crash that would cost a fortune because there were also government guarantees behind a portion of the mortgages left over from the Great Depression days. Nobody would listen to his warnings.

In the meantime, pressure was mounting on the Federal Savings and Loan Insurance Corporation’s coffers (FSLIC). By 1987, the FSLIC had become insolvent. Rather than allowing it and S&Ls to fail as they were destined to do, the federal government recapitalized the FSLIC, exposing taxpayers to even greater risk. The S&Ls were allowed to continue to pile on risk. I had a client who wanted to buy an S&L, and I advised him not to get involved and that the crisis would worsen. He did not listen, bought a failed S&L, and recapitalized it; as the crisis worsened, they kept changing the capitalization requirement, ended up seizing his S&L, and lost most of his investment.

A bill is now being introduced to Congress that will prohibit hedge funds and other institutional investors from buying single-family homes. What these people in Congress FAIL to ever understand, is that they will now eliminate that segment of buyers and create a one-way market. Prices will have to collapse as these investors will ONLY be able to sell to a mom-and-pop, and as we head into a recession from 2024 to 2028, this does not bode well for the blue states especially.

The intent of the bill is to address the housing supply, which continues to dry up as prices have been climbing 20% since 2021. They believe that the low housing supply is driving up prices, and they are pointing their finger at hedge funds to blame, like Blackrock. The bill’s sponsors are U.S. Senator Jeff Merkley (D-OR) and Representative Adam Smith (D-WA). Of course, they ignore their spending, and pouring countless billions into Ukraine has nothing to do with inflation, and certainly, their COVID scam had nothing to do with anything regarding prices or unemployment. It is NEVER them on Capital Hill – it is always we, the Great Unwashed.

This bill is entitled the End Hedge Fund Control of American Homes Act of 2023, targeting both hedge funds and private equity firms that have been buying single-family houses as investment properties. While the bill addresses a serious issue, what we MUST understand is that people “feel” rich when their homes rise in value, for they see that as their savings. Both the Great Depression and the Great Recession of 2007-2009 impacted real estate, and this is the MOST sensitive area of the economy. You can take the stock market down 90% and the bond market. They will impact only a portion of the economy, typically the upper classes. However, when you take down the real estate market, now you are messing with the bulk of the middle class.

Senator Jeff Merkley said in his statement, “The housing in our neighborhoods should be homes for people, not profit centers for Wall Street.” While I do not support Blackrock and its agenda, this is closing the barn door after the horse ran away. He has made a big splash, saying: “It’s time for Congress to put in place commonsense guardrails that ensure all families have a fair chance to buy or rent a decent home in their community at a price they can afford.”

Larry Fink, BlackRock CEO, is a board member of Klaus Schwab’s World Economic Forum who preaches you will own nothing and be happy. Fink is also behind Zelensky, promising to invest in a war zone. Meanwhile, Fink sent his 2022 letter to CEOs of companies he has invested in on January 17th, 2022, while intimidating them to follow Schwab’s WEF. His letter reflected Klaus Schwab’s Agenda 2030. He stated:

“I write these letters as a fiduciary for our clients who entrust us to manage their assets – to highlight the themes that I believe are vital to driving durable long-term returns and to helping them reach their goals.”

BlackRock insists that it does not invest in single-family homes. It claims that it invests in multifamily properties, apartment complexes, and other residential real estate. They insist that they are not one of the large asset managers and private equity firms who have been buying single-family homes.

On August 2, 2021, CNN reported that during the first three months of 2021, “nearly a quarter of all homes sold in the United States were going to investors.” They reported that BlackRock (BLK), JPMorgan Chase (JPM), and Goldman Sachs (GS) were among the big-name buyers. They further reported, “Institutional investors still own only about 2% of all single-family rentals in the United States, or roughly 300,000 homes, according to John Burns research director Rick Palacios.”

The headline from 2021 made it sound that Blackstone was BUYING 17,000 single-family houses, outbidding regular mom-and-pop buyers with its $6 billion war chest. Blackstone bought Home Partners of America, which had already owned 17,000 single-family houses, and rents them out to tenants with an option to buy at a preset price at any time with 30 days’ notice. They insist that they are facilitating private home ownership by providing an option to buy.

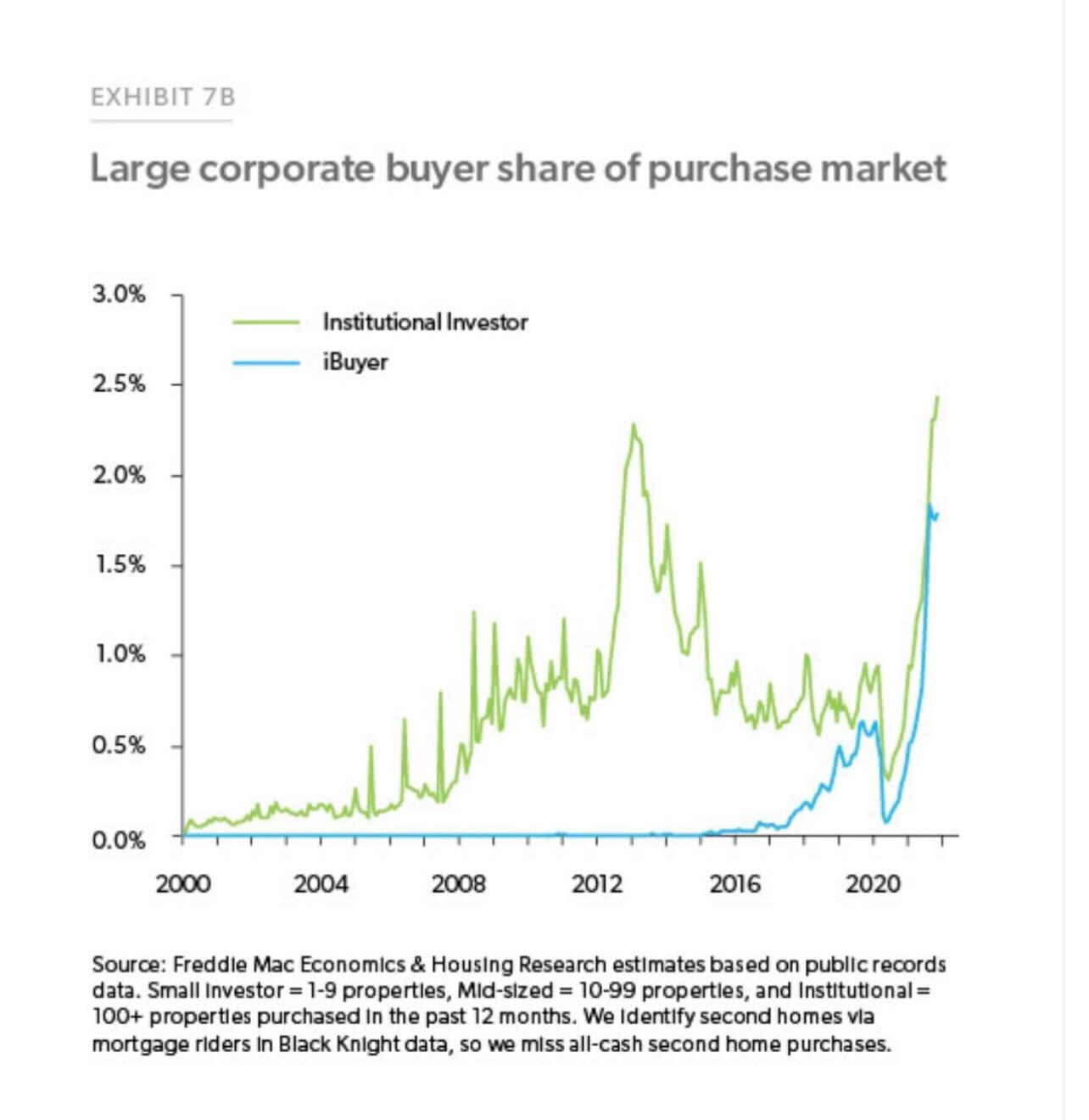

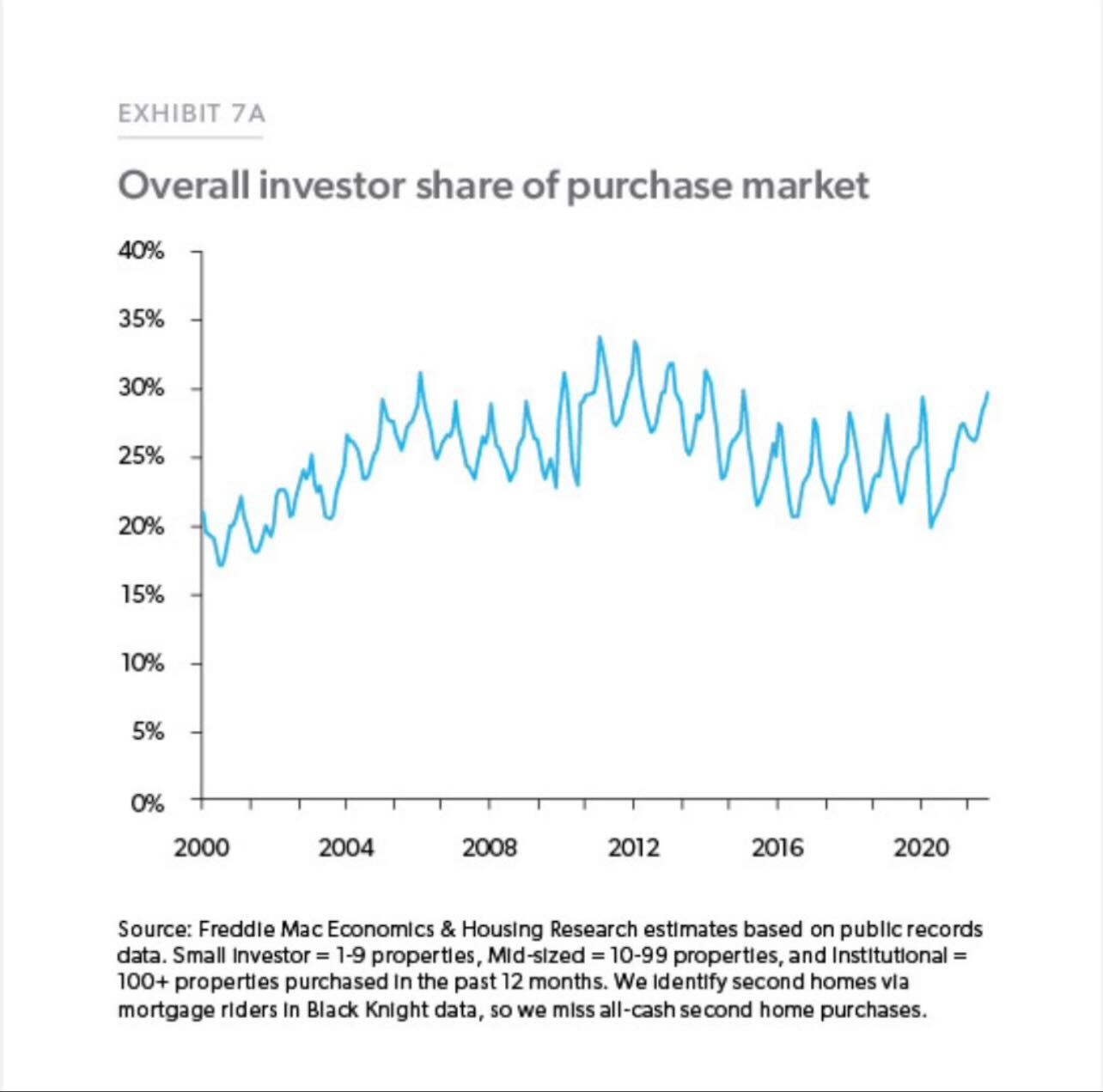

Here is a chart provided by Freddie Mac, which shows the contest between large institutional buyers vs mom-and-pop as a percentage of the marketplace. The overall market share of investors has grown to around 30%. Like the changing of the depreciation table on real estate in 1986 by the Democrats caused a one-way market of sellers with no bid, outlawing investors now when they already have 30% of the market can lead to a MAJOR recession following the ECM between 2024 into 2028.