Posted originally on the CTH on September 4, 2023 | Sundance

The issues around the Twitter platform (X Corp) are important for several reasons, including the anticipated tech moves around the 2024 election.

Many people are holding up Elon Musk as a tech figurehead who might just be able to push back against the tide of totalitarianism. However, a more realistic look at Musk shows he is participating in the control space just as much as any other platform. Additionally, Musk has threat and influence vectors just like any other person or social media company. The most obvious influence vector is the cost of operating his X platform.

Earlier today Musk outlined the current status of Twitter revenue generation. The baseline here is the prior peak of revenue for the company, which was around $3.8 billion, prior to Musk acquisition. Musk shares today that revenue is down 60% from that point.

That would put current revenue around $1.52 billion/yr.

Service on debt is around $1.25 billion/yr. Amazon and Goggle services around $1 billion/yr. That’s an operational loss of around $1.6 billion/yr when you factor in subscription revenue. In essence, Twitter loses around $130 million every month.

With the latest revelations we shared about the financial position of Twitter {Go Deep on FINANCIALS}, all of the moves now underway make sense. Musk was on track to hit a date in/around October of this year where Twitter would be insolvent. If you had read those previous “Go Deep” links, you will easily see the problem. Musk needs another infusion of cash, and he is limited on his Tesla stock as an option.

The use of Enhanced Artificial Intelligence to control information and communication is a subject that too few people understand. This is why I have spent time trying to share information so that people can see into the future of their internet reality. Everything will change.

As you should know by now, the X platform (Twitter) is designed to produce a different user experience based on “definitions” of the user. The definitions are applied by the platform, to create unique identifying characteristics of the user. The result is that each user gets a completely different platform experience, based on their definitions.

“Twitter is a different platform for each user.” Repeat that phrase as often as needed to understand the evolution of what is coming to the American internet.

You might ask, how is applying all of these granular definitions even possible? The answer is through the use of AI. Humans will no longer be assigning the definitions of you; an autonomous system will take on the job of assigning the definitions. Now, keep referencing the word “definitions,” because that is your identity and gateway pass into the platform content. If you carry a particular definition, you will be blocked, throttled, shadow-banned or experience friction applied to your user id.

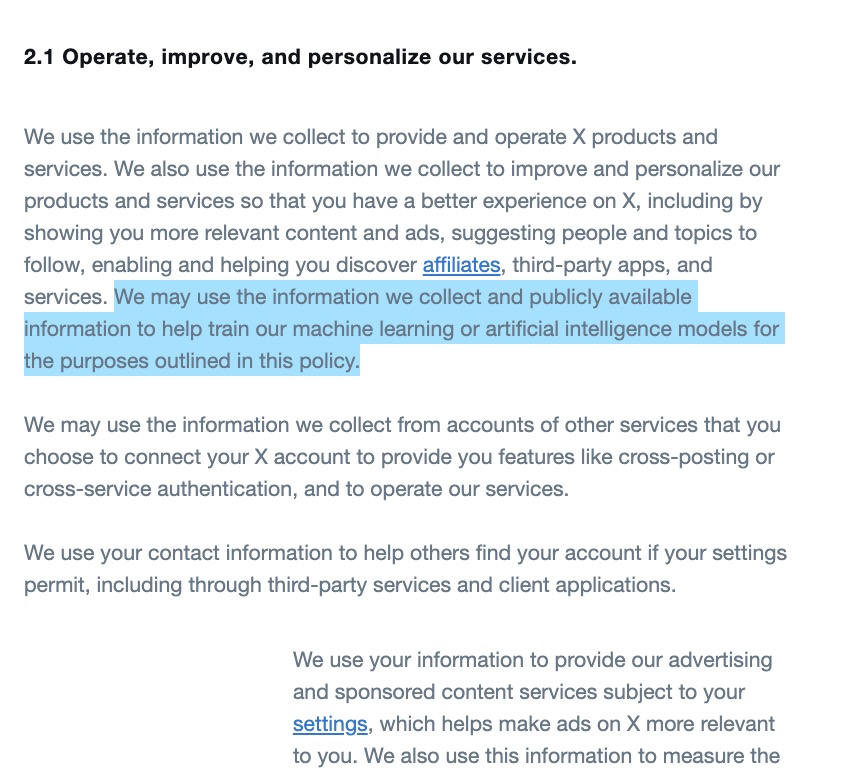

Remember when Elon Musk restricted users and claimed it was because the platform content was being “scraped” by organizations who were using the content to train their Enhanced AI systems? Remember, Musk saying that, and expressing his concern? Well, now the platform is telling users in a new X Corp privacy policy, that X corp itself is going to do exactly the thing Musk said he abhorred.

Twitter (X Corp) is going to use the content you provide to train the AI how to apply the definitions. All of your interactions with the X Corp product are then going to be tailored based on the definitions that are applied to your identity, your account. Some content will not be available to you; some content will only be available to you; the key and essential point is that YOU are defined.

Once you understand how your experience with the X platform is an outcome of definitions applied by X platform to you, then you can elevate your thinking and start to understand what the new American internet is all about. Your definitions will determine what paths and/or roadways are available to you.

Enhanced AI will act like an invisible gatekeeping system on the American internet, showing or hiding internet outcomes according to your definitions. It’s not that the offramp (a specific pathway on the internet) doesn’t exist, it’s an issue of you not being able to see any off ramp. Your experience online is modified according to the definitions, that are applied to you. This is why Enhanced AI is needed to (a) monitor and define; then (b) control the pathways of your travel.

Currently, your experience with Twitter is contingent upon your definitions. Very soon, that same process will apply to the larger internet.

There really is no other phrase that seems to adequately describe the future for online life in the United States than to describe it through the prism of the previously discussed shadow banning that takes place on the X-platform for specifically wrong-thinking users.

It is important to begin with the end in mind. Perhaps some people are unaware that internet services, meaning the actual experience of using the internet for communication and commerce, are not the same in every nation. In fact, it is quite a different experience depending on where on the globe you are located. The differences are driven by internal controls, the intranet of the regional internet per se.

The internet in China is not the same as the internet in Europe, which is not the same as the internet in Australia, which is not the same as the internet in North America, which is not the same -at all- as the internet that now exists within Russia. Even in some continents, the internet traffic flows are controlled at different levels within each nation. The “world wide web” is a format, but when you get down to the national level, things change.

This baseline helps to understand that internet freedom is defined by access to information and commerce.

To the extent the information or commerce is defined as against the interests of the authority structure, or potentially a threat to the national security interest of the government therein, the internet content is filtered, modified, censored, removed or just simply blocked from view. This is one layer in the information control system.

Another layer is the flow of commerce that floats atop the flow of information. This is where advertising, product sales, purchasing and general e-commerce takes place. This layer represents another option for control; therefore, this e-commerce layer should be considered running in parallel to the information, albeit perhaps indirectly attached.

When western government applied economic sanctions against Russia via financial restrictions writ large, the layer of internet commerce control merged with the information and national security control systems of the internet.

Russian citizens were blocked from e-commerce access, specifically from western nations in alignment with the sanctions, and the mechanisms of online purchasing were restricted. However, the entire world did not participate in the sanctions, and there is a massive amount of e-commerce that takes place, even with the systems of western control financial blocks in place.

Additionally, there is a large black-market system for commerce and financial transactions that started organically in the aftermath of the Russian sanctions. Crypto currency, as a financial transaction mechanism, was predictable; however, over time people became even more strategic and alternate transfer systems were created. You can purchase advertising in Russia, but are you really purchasing advertising – or are the purchasers really just transferring funds? Think about it.

I share that Russia example, because I do not want people to get too disheartened in what is going to happen here in the United States. There will always be a market for information, regardless of the control systems that are created to stop it. Additionally, there will always be smart rebellious people who think of ways to subvert the intents of the control mechanisms. Freedom may be diminished from a raging fire to a small burning flame, but it will never be fully extinguished. WE just need to learn to adapt.

It took me over two years to assemble The Benghazi Brief, because the background story was so large and complex that it took time, research and retrospection to appropriately contextualize the truth of the issue. {GO DEEP} The Benghazi attack was a small, albeit deadly outcome, of a much larger story. The brief walks through everything in context.

In a similar construct, the Shadowbanning of The United States internet is a big and complex story, and I am only about halfway through the assembly of all the data to put context to it. However, as time becomes critical, it is important for me to push the information forward – because many of the timelines in the construct are likely to surface before I am complete with the fully assembled story.

I am going to drop some links that will help serve as a flashlight into the rabbit hole. Each story may seem initially disparate or disconnected. However, I would encourage you to think big picture with each of the puzzle pieces that are presented. This is likely to become a series, and I will create a new “Internet” category on the side bar where I will tag any future elements.

Please keep in mind, the issues of e-commerce: ie. information monetization, advertising, deplatforming and debanking, are not disconnected from the issues of information control. The same larger national security system that has mandated (and will mandate), information blocks, content censorship, content restrictions, content removal and various platform control elements, is all part of one interconnected compliance system. Electronic Commerce and Electronic Information are all subject to the online control process. This is a public-private partnership on the internet.

The origin of the public-private partnership goes all the way back to the origin of the tech system in relationship to the DARPA programs and government sponsored research labs. The outcome of the modern partnership is evident in the Dept of Homeland Security (DHS) collaboration with the various communication platforms or pipes of information. Systems like the Global Internet Forum to Counter Terrorism’s (GIFCT) database, are simply outcomes of the partnership. There are hundreds more.

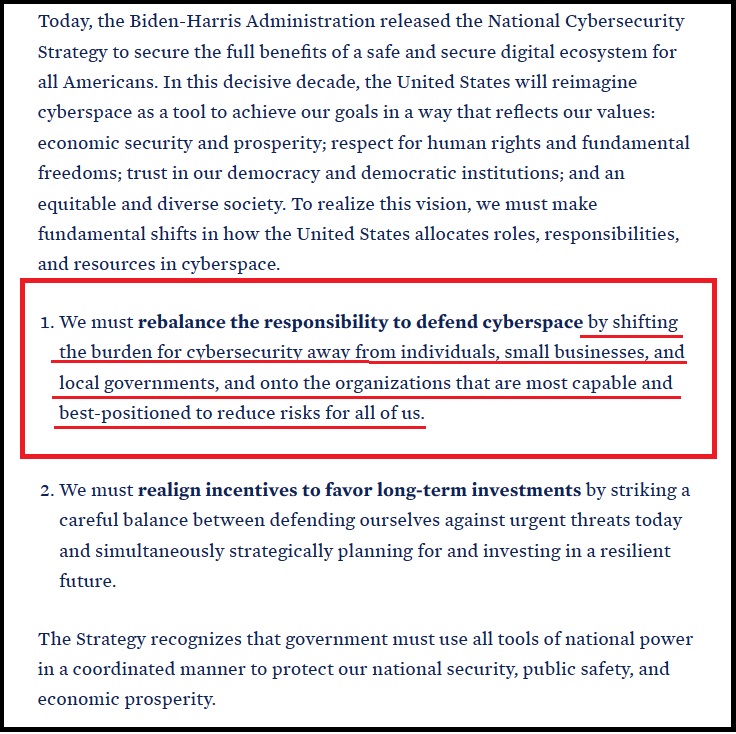

There is a rush now to provide context because Artificial Intelligence (AI), or smart data systems, are launching into the United States internet control mechanisms almost daily. We are close to the time when AI will be triggered to help control the content of the internet under the guise of national security.

The timeline for full deployment of the modern United States internet control system, is likely around late fall and early winter this year, in advance of the 2024 U.S. election cycle.

Everything will change. Every route of online traffic including Internet Service Providers (ISP’s) to filters and rerouting on Domain Name Systems (DNS), to the Internet Protocol (IP) itself will be subject to change in the form of background shadow banning. If the DHS partnership is successful, you will not initially notice – much like a shadow banned platform user doesn’t notice their new defined status. The shift will become more obvious over time.

One odd outcome will be a regional targeting system. Depending on where you are in the USA, your online experience will be different. There will also be enhancements to your internet travel based on your profile. Good thinking users will have benefits that enhance the experience of the user and supports the interests of the national security guardians.

♦ Deployment of a Virtual Private Network (VPN) is irrelevant in this construct. A VPN is like you renting a car without a license plate. You travel past all the Automatic License Plate Readers, arrive at your destination, leave the keys in the ignition and just abandon the car. Your personal travel was essentially invisible to the APLR system. However, when the internet roads are controlled by the national security state, and there is no longer an offramp to the destination, your VPN use is irrelevant – you cannot reach your destination. That’s part of the shift.

You will notice I use the term “definition” quite often. That is because the root of every control mechanism is grounded upon defining things. When you accept the terms ‘disinformation’, ‘misinformation’, and/or ‘malinformation’, you are buying into the process that permits definitions to determine your travel. Those who define both you and your destination, ultimately control your online experience.

Now, before getting to a recent example of this construct as it is being built, it is important to return to the e-commerce aspect and overlay the Diversity, Equity and Inclusion (DEI) index into the world of online commerce.

♦ Right now, you can physically boycott Bud Light by choosing another brand. However, for total goods and services the amount of online purchasing is now exceeding the amount of purchasing in real life (brick and mortar shopping). Overlay the economic control system (think Russian sanctions approach) with the national security requirements for DEI, amid all online commerce, and apply that layer of analysis. In the e-commerce world, choosing not to buy Bud Light will become a little more difficult; and those who do support the boycott become subject to the previously mentioned “definitions”.

I’m jumping ahead, because there was a big development a few weeks ago. As you read this, do not think small as presented – think bigger. Think beyond the use of AI moderation on a platform and think of AI moderation on the U.S. Internet System. Online moderation conducted by AI:

OPEN AI – […] GPT-4 is also able to interpret rules and nuances in long content policy documentation and adapt instantly to policy updates, resulting in more consistent labeling. We believe this offers a more positive vision of the future of digital platforms, where AI can help moderate online traffic.

[…] Content moderation demands meticulous effort, sensitivity, a profound understanding of context, as well as quick adaptation to new use cases, making it both time consuming and challenging. Traditionally, the burden of this task has fallen on human moderators sifting through large amounts of content to filter out toxic and harmful material, supported by smaller vertical-specific machine learning models. The process is inherently slow and can lead to mental stress on human moderators.

We’re exploring the use of LLMs to address these challenges. Our large language models like GPT-4 can understand and generate natural language, making them applicable to content moderation. The models can make moderation judgments based on policy guidelines provided to them. (read more)

Do you remember me telling you about what I noticed in the most recent Google spider crawls?

“The Alpha/Google spiders are not crawling around with their enhanced AI looking for words, phrases or content issues. Enhanced Artificial Intelligence (AI) has given the spiders the ability to look for context. The new Alpha/Goog AI spiders are crawling the internet looking for information provided with a detrimental and accurate context. Those who are applying truthful context are the subversive voices that must be targeted. Keep this in mind.”

As we have shared, the crawl is not headlines, the crawl is in content. Yes, even content in the comment section is now flagging to the control systems. Why? Because we operate a proprietary constructed private commenting system that doesn’t have a backdoor and protects you, the user.

The Google Spiders are newly enhanced with AI instructions, dispatched looking for content and ‘context’ that is against the interests of the Vanguard, Blackrock, Larry Page (Alpha/Goog owners), and the public-private partnership. This content is considered “dangerous or derogatory”. Think about that for a moment.

Do not get alarmed, get informed.

I share this information with you so that you understand what is being constructed and what is about to be deployed on a large scale throughout the U.S. internet operating system. The U.S. internet will be different. The social media restrictions became more prevalent and noticeable in the past several years; now it is time for DHS to expand that process to the entire U.S. internet.

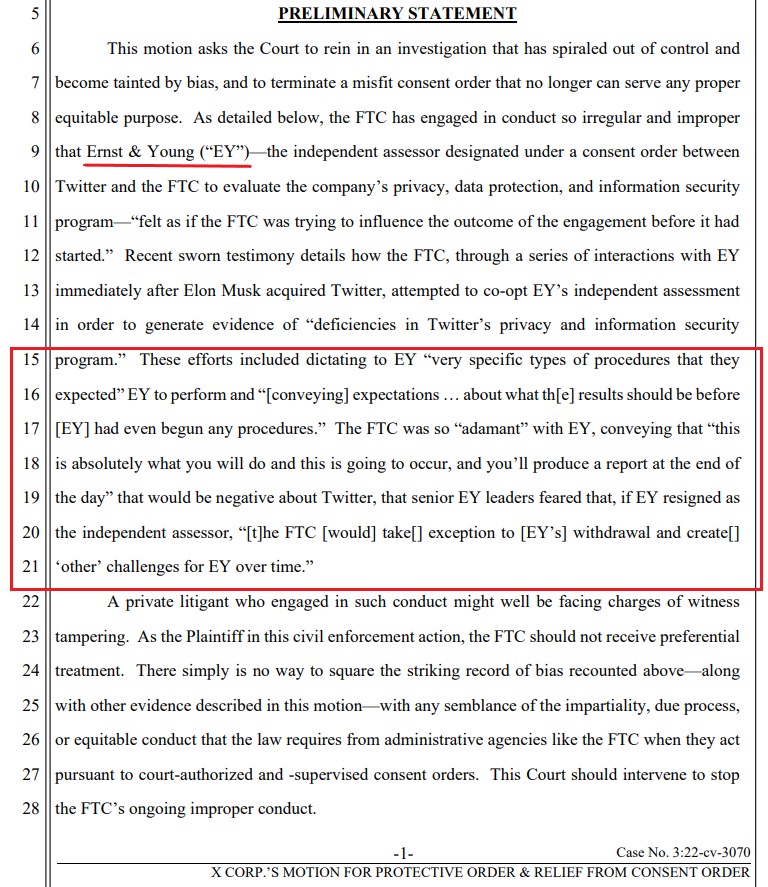

When I wrote about Jack’s Magic Coffee shop, people initially thought I was crazy – but the guys inside the coffee shop didn’t. Eventually DHS control over Twitter was revealed in the Twitter files. The same background is true here. The entire American online apparatus is going to change, quite soon.

More will follow….

RESOURCES:

Using AI for Content Moderation

Facebook / META / Tech joining with DHS

Zoom with allow Content Scraping by AI

AI going into The Cloud

U.S. Govt Going into The Cloud With AI

Pentagon activates 175 Million IP’s

Big Names to Attend Political AI Forum