Posted originally on the conservative tree house on December 15, 2021 | Sundance | 573 Comments

At first blush, this story seemed too bizarre to be true; alas it is not. [h/t Gateway Pundit] As noted by Jim Hoft at Gateway Pundit, a few weeks ago the Salvation Army stepped into the social justice arena and began promoting the premise of white guilt.

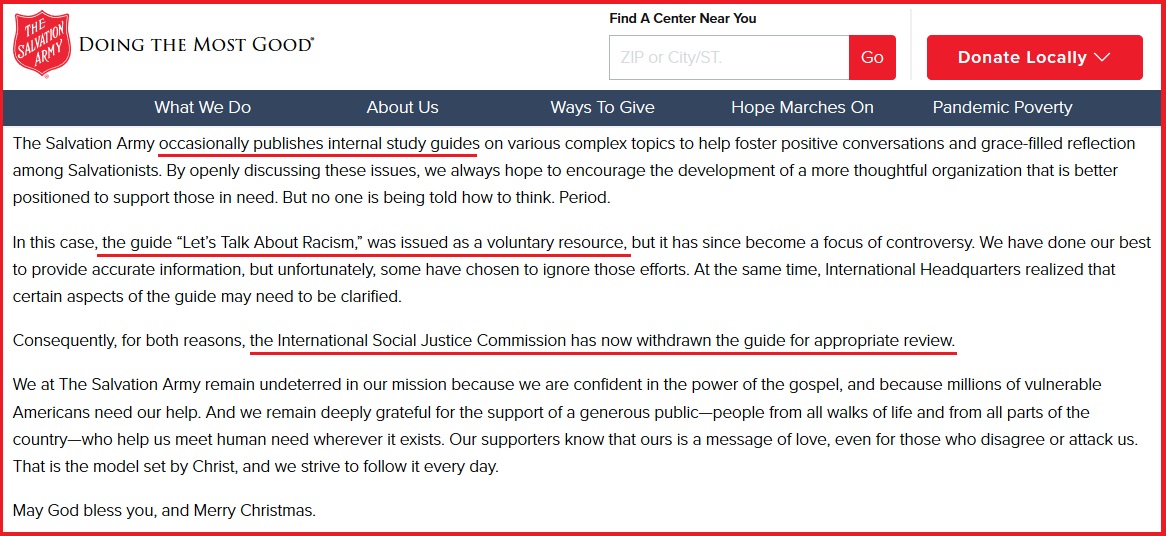

According to an “internal study guide” from the charitable organization intended to “foster positive conversations and grace-filled reflection among Salvationists“, the white members and donors to the Salvation Army were requested to reflect on their inherent racism. According to the Salvation Army’s “International Social Justice Commission“, this was presumably of some charitable value.

Obviously, this request stirred up some controversy. In an era where the toxic issues around Critical Race Theory being taught in schools has been in the headlines, there is likely not a worse time for a charitable group to join the social justice cause and push CRT toward the aggregate public.

Many people were surprised by the decision of the Salvation Army to push the divisive issue of racism in what appeared to be an effort by the organization to enter the orbit of wokeism.

Quite frankly, I cannot reference a more ridiculous organizational decision than this example in recent memory. However, that said, while the original decision was nuts, the effort to clean up the mess they created for themselves is exponentially more nuts. Amid the backlash, the Salvation Army released the following statement:

[LINK]

The first thought of ‘what were they thinking‘, becomes compounded by realizing the Salvation Army is a partner with something called the “International Social Justice Commission.” I mean, seriously, what the heck is this all about?

Mistake one might be taking the intent of a historic organization away from charitable giving and into the toxic and divisive world of racial politics. Mistake number two is doubling down on the decision to engage with race in some ill-fated effort to establish politically correct bona fides.

If you wanted to completely destroy the guiding mission of a charity, the Salvation Army is showing everyone exactly how to do it.

I’m not sure what qualifications or prisms others use, but myself, as a donor, I want to see my money used by a charity in such a way as to care for people who are in the most need – and that has absolutely nothing to do with race or any other qualification. I am literally stunned by the intent of the Salvation Army in this mess, and their cleanup effort is even worse.

This is one of the biggest disappointments of the year, and yet, again shows that organizations can lose their entire purpose by following leadership making stupid decisions.

Jim Hoft follows up the issue with a highlight showing the Salvation Army is in a crisis now, because people are not giving to the charity at the time of year when the Christmas Season Salvation Army kettles usually raise a lot of money.

(Fox-13) […] Not only is the nonprofit organization short on donations, they also are in desperate need of bell ringers to staff the red kettles seen at businesses around the country. (read more)

Well, DUH! What exactly did The Salvation Army expect to happen?