Posted originally on the conservative tree house on January 8, 2022 | Sundance | 524 Comments

Things that seem disconnected, but ain’t.

(1) A shortage of processed potatoes (frozen specifically).

And/Or a shortage of the ancillary products that are derivates of, or normally include, potatoes.

(2) A larger than usual footprint of turkey in the supermarket (last line of protein).

(3) A noticeable increase in the price of citrus products.

(4) A sparse distribution of foodstuffs that rely on flavorings.

(5) The absence of non-seasonal products.

(6) Small to little price difference on the organic comparable (diff supply chain)

(7) Unusual country of origin for fresh product type.

(8) Absence of large container products

(9) Shortage of any ordinary but specific grain derivative item (ex. wheat crackers)

(10) Big brand shortage.

(11) Shortage of wet pet foods

(12) Shortage of complex blended products with multiple ingredients (soups etc)

(13) A consistent shortage of milk products and/or ancillaries.

These notes above are all precursors that show significant stress in the supply chain.

At first, each retail operation will show varying degrees of the supply chain stress according to their size, purchasing power, and/or private manufacturing, transportation and distribution capacity.

Remember, the dairy farmers in 2020 dumping their milk because the commercial side of milk demand (schools, restaurants, bag milk purchasers) was forcibly locked down? Plastic jugs were in short supply, and the processing side of the equation has a limited amount of operational capacity.

Potato farmers and fresh food suppliers were also told to dump, blade or plough-over their crops due to lack of commercial side demand. These issues have longer term consequences than many would understand. These are fresh crops, replenishment crops, which require time before harvest and production.

The retail consumer supply chain for manufactured and processed food products includes bulk storage to compensate for seasonality. As Agriculture Secretary Sonny Perdue noted in 2020, “There are over 800 commercial and public warehouses in the continental 48 states that store frozen products.”

Here is a snapshot of the food we had in storage at the end of February 2020: over 302 million pounds of frozen butter; 1.36 billion pounds of frozen cheese; 925 million pounds of frozen chicken; over 1 billion pounds of frozen fruit; nearly 2.04 billion pounds of frozen vegetables; 491 million pounds of frozen beef; and nearly 662 million pounds of frozen pork.

This bulk food storage is how the total U.S. consumer food supply ensures consistent availability even with weather impacts. As a nation, we essentially stay one harvest ahead of demand by storing it and smoothing out any peak/valley shortfalls. There are a total of 175,642 commercial facilities involved in this supply chain across the country

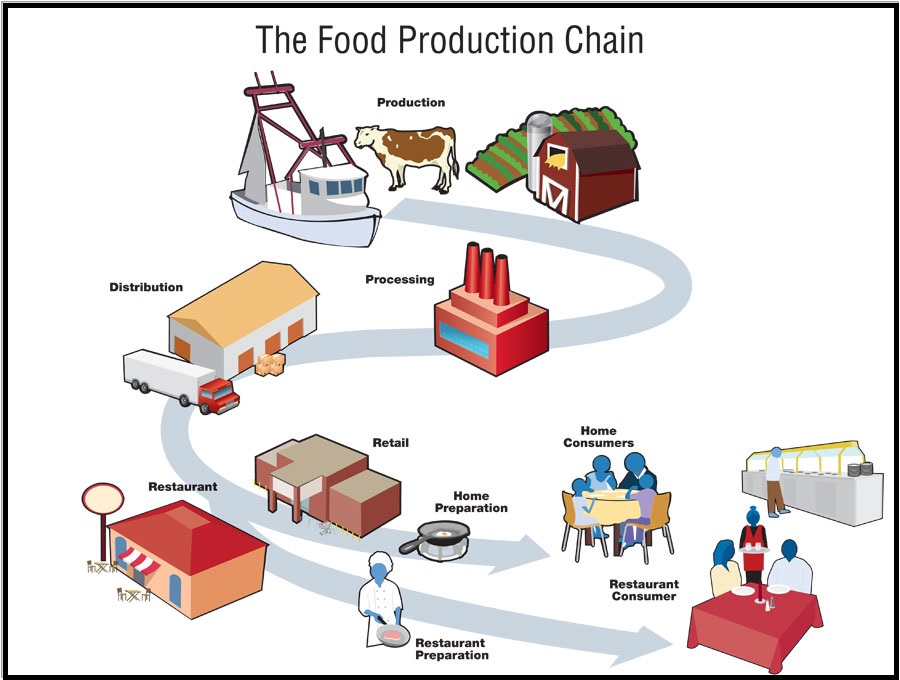

The stored food supply is the originating resource for food manufacturers who process the ingredients into a variety of branded food products and distribute to your local supermarket. That bulk stored food, and the subsequent supply chain, is entirely separate from the fresh food supply chain used by restaurants, hotels, cafeterias etc.

Look carefully at the graphic. See the fork in the supply chain that separates “food at home (40%)” from “food away from home (60%)”?

Food ‘outside the home’ includes restaurants, fast food locales, schools, corporate cafeterias, university lunchrooms, manufacturing cafeterias, hotels, food trucks, park and amusement food sellers and many more. Many of those venues are not thought about when people evaluate the overall U.S. food delivery system; however, this network was approximately 60 percent of all food consumption on a daily basis.

The ‘food away from home‘ sector has its own supply chain. Very few restaurants and venues (cited above) purchase food products from retail grocery outlets. As a result of the coronavirus mitigation effort, the ‘food away from home’ sector was reduced by 75% of daily food delivery operations. However, people still needed to eat. That meant retail food outlets, grocers, saw sales increases of 25 to 50 percent, depending on the area.

Covid regulations destroyed this complex supply chain in 2020. It takes time to recover because the replenishment is based on harvest cycles. This stuff must be grown.

When the food at home sector was forced to take on the majority of food delivery, they immediately hit processing constraints. The processing side of the supply chain to funnel food into suppliers for the grocery store has “x” amount of capacity. That system cannot (not feasible) and did not expand to meet the 20 to 50% increase in demand.

Think about potatoes. A potato farmer sells into one of the two paths “food at home” (retail stores, or a processing supplier) or “food away from home” (commercial food or commercial food processors). Other than bulk raw potatoes, the harvest goes into: (1) processing or (2) storage.

(1a) processing for retail sales (40%), ex. Ore Ida frozen potatoes, canning, or any of the other thousand retail products that use potatoes, whole or mashed.

(1b) processing for commercial sales (60%), ex. McDonalds french fries, or any of the thousand restaurant, lunchroom and cafeteria needs that use potatoes, whole or mashed.

♦ Processing – When 1b was shut down in 2020, 1a quickly reached maximum retail processing capacity. Massive multi-million machines and food processing systems have a capacity. The supplies they use also have a capacity: plastic bags, cardboard, trays, bowls, etc. The 1a processing system can only generate “X” amount of retail product at maximum capacity.

The remaining 1b commercial product was shut down. A massive percentage of 1b (commercial) potatoes have nowhere to go, except waste.

♦ Storage – Each processor in 1a stores product (deep cold or frozen storage) for 365-day processing and distribution. Those storage facilities have a limited amount of capacity. The 1b customers need fresh product for the majority of their outlets. Ergo storing for 1b customers who might eventually be allowed to open later only works for a short period of time. The fresh potato sales missed by 1b outlets = the 1b discard by potato farmers.

When you restart 1b suddenly the 1b short-term (fresh) storage product is quickly depleted. Refilling that 2020 storage is dependent on a new 2021 harvest, which simultaneously has a greater immediate demand because the supply chain on the processing side was boxcar’d (over capacity) and then reset to a higher capacity playing catchup.

The amount missing from 2021 storage, because it was used instead of saved, is essentially equal to the amount that was wasted in 2020.

Now you end 2021 will less reserves because storage is depleted, because a greater percentage of the current harvest was immediately used. You enter into the beginning of 2022 (winter) in a race to try and spread out the stored potatoes as you cross your fingers and race against the clock for the next harvest before running out.

You probably noticed, but there’s another motive to keep people (employees) away from large industrial cafeterias and even students from school lunchrooms. The total food supply chain needs time, and harvests, to catch up.

In the example above you can replace *potato* with just about any row crop or retail/commercial food commodity like milk.

The reason I list potato as the #1 precursor is because every food outlet sells a potato in some form. Every supermarket and every single restaurant (fancy or fast food) sells some form of potato. Potatoes are demanded by every single food outlet; therefore, a shortage of potatoes is the first noticeable issue.

The 2020 demand disruption problem now becomes a 2021/2022 supply chain problem on both the fresh and processing side (depleted inventories), with each vector now competing for the same raw material: wheat, soybeans, grains, beans and stored row crops.

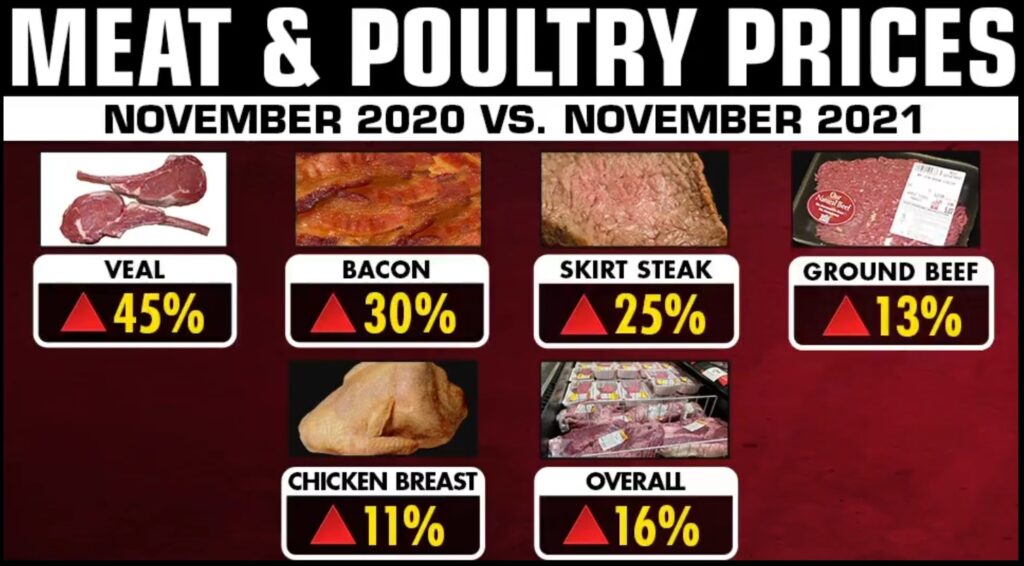

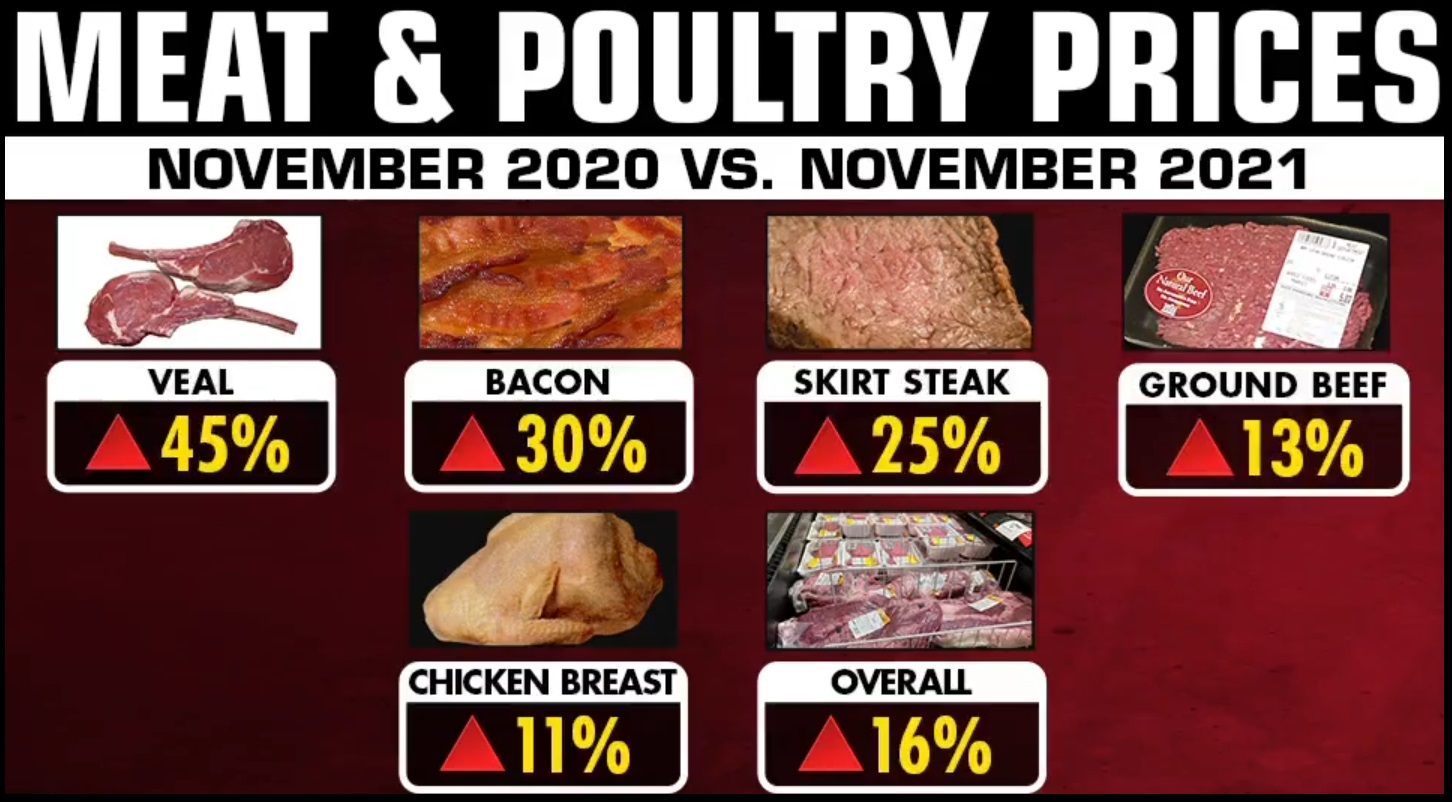

Making matters worse, the protein suppliers also need grain as feed for cattle, pigs, cows, chickens, etc.

[Note: who gets the short straw? The pet food manufacturers]

That’s the nub of the background supply chain issue in the food sector. Additionally, recovery is not a single-issue problem.

The recovery price and shortages relate to everything from current oil and gas prices to diesel engine oil prices, to fertilizer and weed killer costs, to plastic costs and petroleum packing shortages (Styrofoam especially), to cardboard and sustainable packaging costs, to energy costs and transportation/delivery costs. All along this complex supply chain there’s also workers and higher payroll costs.

Thus, we get the double-edged sword of higher prices (inflation) and simultaneous shortages.

Here’s what you can do to offset shortages (while possible):

(1) Buy the generic or store brand equivalent (sub-set inside retail supply chain)

(2) Purchase the organic version (another sub-set inside retail supply chain)

(3) Purchase the powered/dehydrated version (potatoes, milk, etc) and experiment (jazz it up).

Each retail operation, or chain of stores, will show varying degrees of the supply chain stress according to their size, purchasing power, and/or private manufacturing, transportation and distribution capacity.

This is where field to fork supplier relationships can make a big difference. However, every outlet regardless of their operational excellence, is going to have significant shortages in their inventory. It’s an unavoidable outcome of the previous chaos.

On average the retail shortages will last for about the same time as one full harvest schedule (4 to 6 months) depending on the commodity. By September of 2022 the sector should be relatively recovered, depending on how government responds when people get seriously stressed in a few weeks.

The short-term prices will likely go up again, another 10, 20 up to 50% depending on item. Those prices will eventually level off, but it’s doubtful they will be able to come back down until supply and demand find some equilibrium again, if ever. Right now, that’s too far off to even fathom.