Posted originally on the conservative tree house on January 24, 2022 | Sundance | 244 Comments

The support for the Canadian trucker protest is already getting results. As we shared previously, ‘the absence of food will change things‘, and the reason is simple, it focuses priorities.

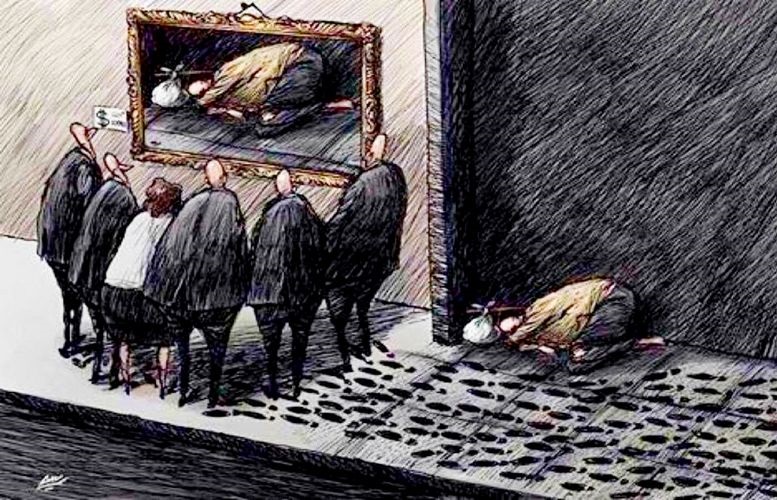

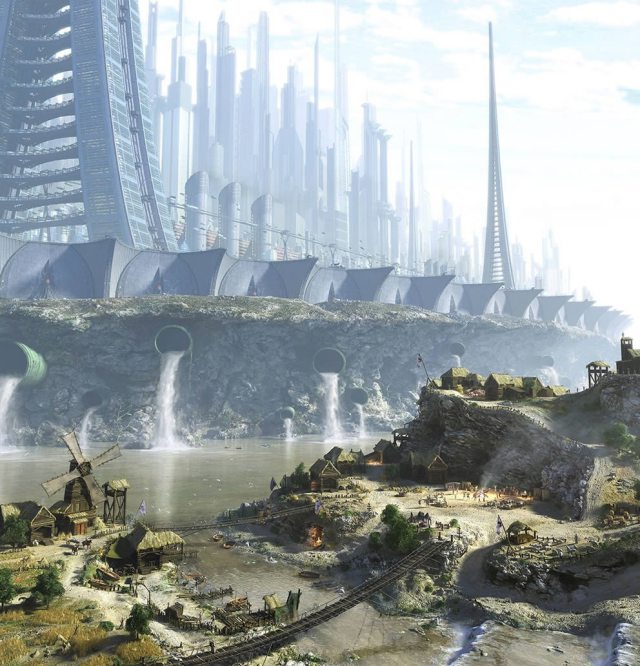

In the bigger picture, a grassroots protest from Main Street (truckers) forces the multinationals to a position of vulnerability. The multinationals control the politicians, so any pressure applied directly to the multinationals ends up being transmitted to their beneficiaries, the government officials.

In the modern era, the professional left has used this dynamic to pressure corporations via organized activism and leftist demands. However, the middle class actually has more power in this type of engagement, they just don’t use it.

The Canadian trucker protest is an example of the working class using the power of their influence. The results are immediately surfacing.

The multinational business advocacy groups in Canada are now telling the Canadian government officials to back down from their vaccination mandate against the truckers.

CANADA – Business leaders are urging Ottawa to ease vaccine mandates for cross-border truckers to relieve the congested supply chain with the United States.

Prime Minister Justin Trudeau defended Monday the mandate as a necessary step to keep supply chains open, arguing that COVID-19 itself is the biggest risk to Canada’s economy. But in separate statements the Canadian Chamber of Commerce and the Canadian Manufacturing Coalition both urged him to back down.

Perrin Beatty, the president of the Chamber, told The Canadian Press that while “we strongly favour getting as many people vaccinated as possible,” the government should allow more time before imposing the mandate on truckers.

[…] The Canadian Manufacturing Coalition, which represents over 30 manufacturing trade associations, called for a full reversal of the vaccine mandate after meeting Friday with Industry Minister Francois-Philippe Champagne.

Dennis Darby, the president of Canadian Manufacturers & Exporters which chairs the coalition, told Champagne that “Canadians are seeing empty shelves” because vaccine mandates are making supply chain bottlenecks worse.

In a statement, Darby said the meeting with Champagne was “a good first step but now we need to see concrete action by the government to start addressing these challenges, starting with reversing the trucker vaccine mandate.” (read more)

The middle class and working class can win this battle if they keep the pressure applied. This is the fundamental truth within the “yellow vest” movement writ large, and it is the essential truth inside all Main Street economies.

The Canadian people can win this fight. These signals from the multinationals are the first recognition of a changed dynamic. Any scenario that unites the middle class against the corporatist system becomes a risk to the politicians and the corporations who pay for them.