Armstrong Economics Blog/Economics

Re-Posted Aug 20, 2018 by Martin Armstrong

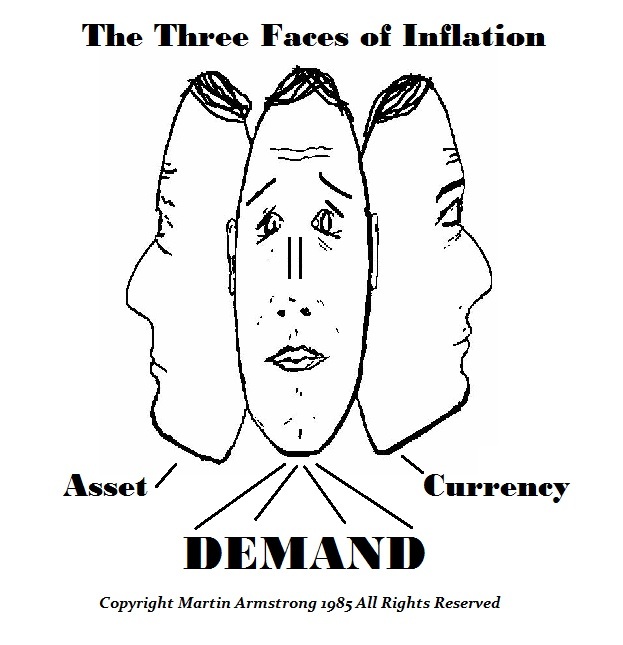

Many people worry about over-indebtedness and point to a default of borrowers. It is interesting how the view of debt is always the low-life borrower. In reality, the real stupidity rests with the lender. Many are pointing to US corporate debt and stating that it has grown to an estimated US $ 7 trillion and they paint this as high-risk bonds and corporate loans which have been issued over the past decade. Of course, there were some who were foolish to issue variable interest rate bonds. Those companies are likely to find themselves in trouble. But there are others who issued long-term fixed bonds at low rates. Our advise to corporate clients was to borrow as much as possible at fixed rates for 50 to 100 years while the fools were willing to buy. Other major corps issued 100-year bonds including Walt Disney Company (DIS) and Coca-Cola (KO). The loser will be the BUYER, not the ISSUER. It was a fool’s market to buy such fixed rate bonds for 100 years.

When Greece got in trouble, what is the first solution economists ALWAYS recommend? A debt haircut!. , which in most cases is based on the Libor benchmark interest rate, which has increased significantly in recent months. The first thing they did was extend the Greek debt by 10 years to avoid a default and the ECB agreed that any profits made by central banks in the Eurozone on Greek bonds would be returned to Athens in two equal tranches every year, between 2018 and 2022. You always extend maturity to avoid a default and you take a haircut in the value of the bonds you bought.

We are also witnessing this at the municipal level in Germany where about 50% of municipal governments are effectively bankrupt. The President of the German Institute for Economic Research (DIW), Marcel Fratzscher, came out and called for fundamental reforms where the holders of their debt would take a haircut. He has made it clear that a reduction in more than half of the state investments was made by the municipalities. The German grand coalition was supposed to organize a haircut to reduce the value of outstanding debt from the federal states on down to the municipalities. In reality, they are hopelessly over-indebted not unlike Illinois and California in the USA.

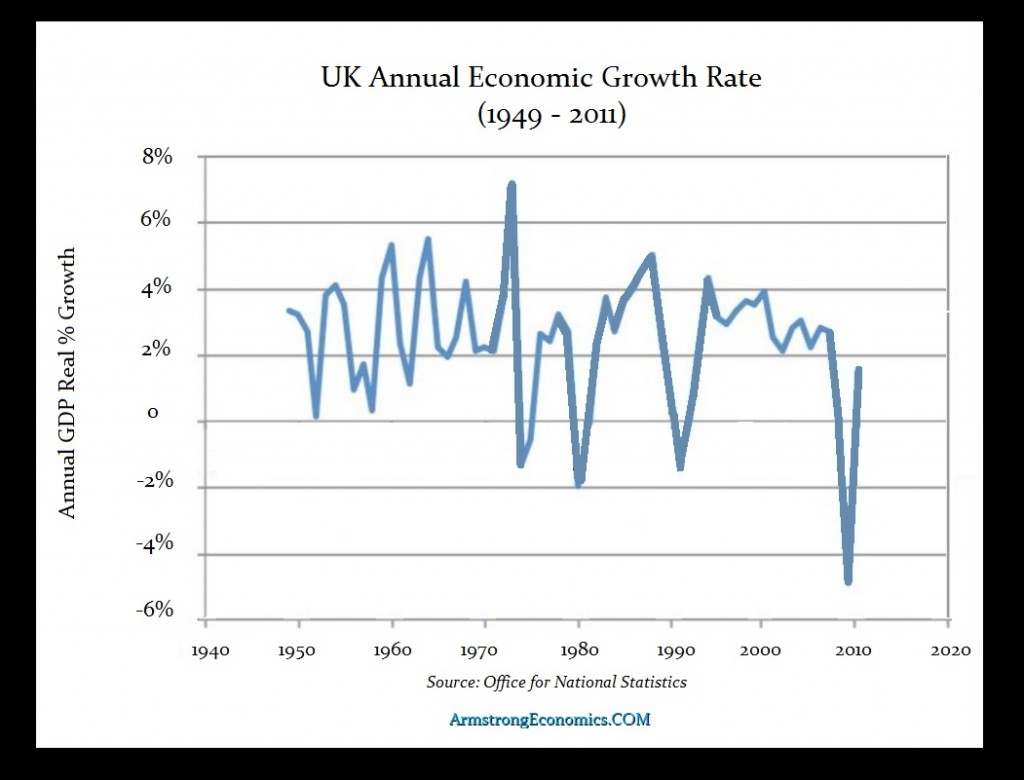

Even when we look at the war loans from the USA to Europe, it was not until 2015 that Britain finally repaid it war loans. There were still 38,000 holders of UK war bonds with amounts less than £100 as well. They actually cut the 5% coupon in 1932 reducing it by agreement to 3.5%. So you see, taking 100 years to repay a debt meant that the value of the pound when the money was lent was $4.86 and when it was paid off less than $2. Actually, the French never even paid interest on the $4 billion they owed the USA after World War I and the only country to pay the United States back during the 1930s was Finland.

So when we look at the indebtedness of even Emerging Markets, keep in mind that the loser will be the lender – not the borrower. It seems that no matter how many times a government defaults like Spain, seven times, the fools rush right back in and buy again. The famous bank of the Medici had a rule “to deal as little as possible with the court of the Duke of Burgundy and of other princes and lords, especially in granting credit and accommodating them with money, because it involves more risk than profit” (Raymond de Roover Professor of History at Brooklyn College: The Rise and Decline of the Medici Bank was first published in 1966. id/ p 343). The Medici failed because later generations did not follow that rule