Posted originally on the CTH on January 6, 2023 | Sundance

The Bureau of Labor and Statistics (BLS) released the December jobs report today [DATA HERE] showing 223,000 jobs gained in December ’22.

Most of the job growth was in the “leisure and hospitality” sector (+67,000), healthcare (+55,000), construction (+28,000) and social assistance (+20,000). Additionally, average hourly earnings rose by 0.3%, with a year-over-year measure of wage growth at 4.6%.

At this point in the history of our economic pretending game, we are well aware the employment numbers are heavily manipulated in order to support the government policymaking that is destroying the same workforce they claim to represent. It’s all a ruse, just look around your community and you will see what I am talking about.

The financial pundits, Wall Street, government policy makers and various individuals and economic gaslighters are concerned that worker wage growth could drive inflation. This is one of the most aggravating aspects to reviewing the majority of economic punditry. [Example:]

This knuckleheaded narrative engineer from the New York Times/Atlantic even has the audacity to say, “let prices continue to fall to target,” as if there is a single item at any price that is dropping. His spin is a good example of gaslighting just from the use of the statement “price inflation is falling back towards where we want it.”

Price inflation is not price. ‘Price inflation’ is the rate of increase. There’s a BIG DIFFERENCE between “inflation falling back” and prices dropping. Inflation falling back is merely a lessening of the rate of price increase. The price does not drop, and never will.

This reality is why it is infuriating to see government policymakers and pundits decry wage growth as a bad thing that might cause inflation.

Government monetary, fiscal and energy policy created inflation. Devalued currency from spending, simultaneous to massive government policy changes driving up supply side energy costs, exploded inflation.

Prices for energy, oil, gas, home heating, fuel and food all skyrocketed as a result. Workers need pay raises to afford these essential costs of life. However, the same people who created the inflation are now worried that wage rate increases may drive inflation. The mindset at work here is infuriating.

Consider these empirical data points. In August of 2021 the Biden administration permanently increased food stamp benefits by 25% for everyone who needed the subsidy {LINK}. This permanent benefit increase was delivered at the same time as the administration was claiming “inflation was transitory.” They knew it wasn’t transitory. They were lying.

The Social Security Benefits were also raised in 2022 by 8.7% for the largest ever cost of living adjustment in 2023 {LINK}. Both the 25% food stamp increase and the 8.7% SSI COLA were needed to offset the inflation created by government policy…. However, the same government doesn’t want wages to rise. Can you see the hypocrisy.

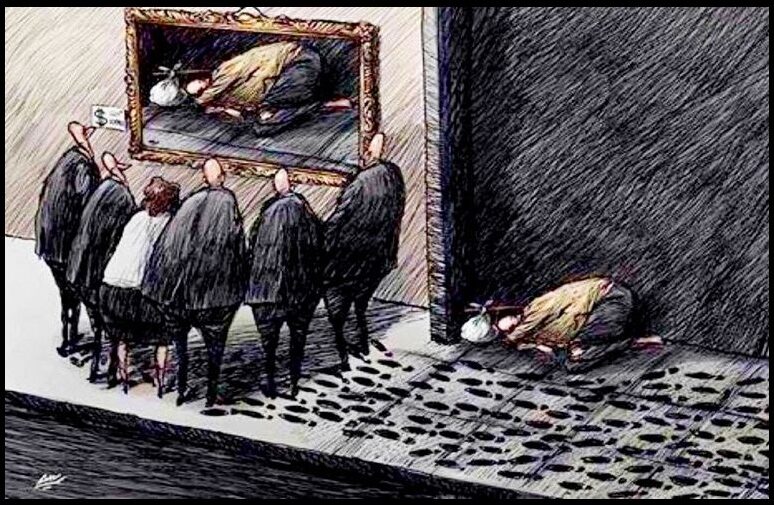

Workers are being crushed by the outcomes of policy, and those who created the policy making the outcomes do not want worker wages to offset the policy.

We need to see wage growth in the 20% range just to keep pace with the increased cost of living created by policy. Food costs 40% more, energy 30% more, housing 20% more and the list keeps going.

The prices for many goods have already doubled, worker wages need to compensate for those increases. However, government, Wall Street, corporations and policy makers do not want to see wage growth that will offset the price of goods because they fear those wage gains will drive inflation.

The financial media, Wall Street, govt policy makers (republican & democrats) and corporations are lying to us and simultaneously killing the working-class. We, the workforce, are in an abusive relationship with govt…. and they have the nerve to blame us for inflation.

Our food costs +40%, energy +30%, housing +20%, all of it.. with interest rates now climbing, making it worse. Yet, they now clutch pearls and worry about our need for higher wages to afford these costs (from their policy) driving inflation higher?

Yet we are supposed to be concerned about giving an entitled republican control of the speaker position in congress because.. why?

Probably the same reason they want us looking at Ukraine, or transgender issues, or queer/gay rights, or climate change, or (fill_in_the_blank with something Ron DeSantis is promoting) all to keep us from realizing our economic life is being destroyed all around us while this constant and insufferable game of pretending continues.

A pox on all their houses!

I hate them all right now.