Armstrong Economics Blog/Opinion

Re-Posted Jan 13, 2019 by Martin Armstrong

QUESTION: I read that the Heritage auction of the penny they said would bring $1.7 million was a flop. Any indication as to why? Or is it just the firm trying to pawn something for big bucks?

HK

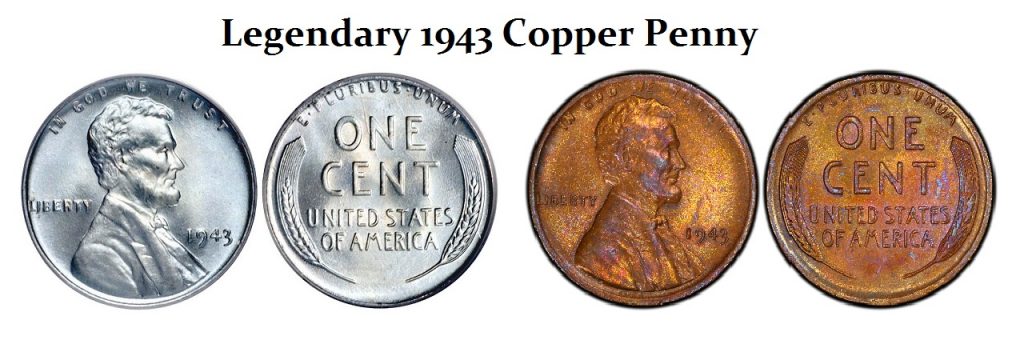

ANSWER: I have no idea why Heritage would have claimed the coin would bring $1.7 million. It is not that rare. There are about 40 to 45 known 1943 copper cents from the Philadelphia Mint. The general assumption is that they were struck by accident when there were some copper blank planchets still remaining in the press hopper when production began on the new steel pennies.

Now as far as sales go, there was a 1943 copper cent which was first offered for sale back in 1958, which sold for more than $40,000, or so it was claimed. Subsequently, there was one sold for only $10,000 at an ANA convention in 1981. The highest amount ever paid for this error previously was $82,500 back in 1996.

There was only one copper 1943 penny known from the Denver Mint which did sell they claim for $1.7 million by Legend Numismatics of Lincroft, New Jersey. I would not guarantee that price personally. US coins tend to get really hyped. This unique coin, not publicly known to exist until 1979, was certified PCGS MS64BN. If Heritage was claiming their penny should bring $1.7 million which was from the far more common hoard of Philadelphia, I really question such expertise. The Heritage example sold for only $204,000, which is a modest advance over the last sale of $82,500 back in 1996.

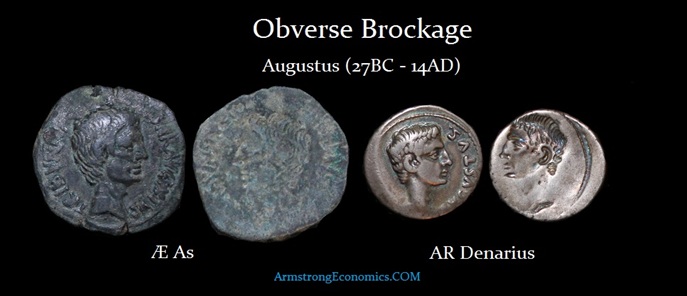

The culture in American coins is strikingly different. American collectors seem to prize errors. A brockage is an error coin where one side is normal, but the other side instead of the reverse displays the obverse again, but incuse or in a negative mirror-like form. Brockage errors are caused when an already minted coin sticks to the coin die and impresses onto another blank pressing a mirror image of the other coin into the blank.

The culture in American coins is strikingly different. American collectors seem to prize errors. A brockage is an error coin where one side is normal, but the other side instead of the reverse displays the obverse again, but incuse or in a negative mirror-like form. Brockage errors are caused when an already minted coin sticks to the coin die and impresses onto another blank pressing a mirror image of the other coin into the blank.

Brockage errors coins are rare. However, they do not bring significant premiums. A nice Augustus(27BC-14AD) denarius may bring $1,000+ whereas the Brokage will bring about $500 as illustrated above. Here is an extremely rare official Roman die of Emperor Tiberius (14-37AD) with precisely this problem of a silver denarius stuck to the reverse die.

This die of Tiberius is UNIQUE and was discarded because of the brokage error coins it would have produced which would have appeared like the Augustus denarius illustrated above. There are only about 12 official Roman dies that have survived.

This die of Tiberius is UNIQUE and was discarded because of the brokage error coins it would have produced which would have appeared like the Augustus denarius illustrated above. There are only about 12 official Roman dies that have survived.

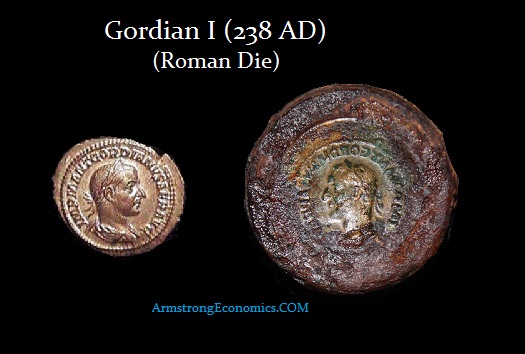

Here is Another genuine Roman die of an extremely rare Emperor Gordian I (238AD) who reigned for only 21 days. Obviously, this die was discarded because he did not last in office very long.

There is a completely different culture outside of American coins. Such an error would never bring such premiums. In ancient coins, the premiums attained are for high quality.