Armstrong Economics Blog/Understanding Cycles

Re-Posted Sep 1, 2018 by Martin Armstrong

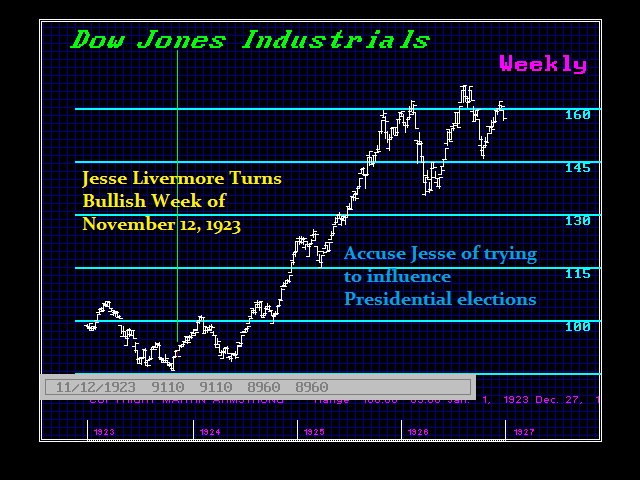

The US share markets are being driven up by two main factors. First, institutions have sold the market assuming there would be a major crash. In February at the lows, Goldman Sachs was forecasting that the market could plunge another 25%. In May, Goldman Sachs again was warning that the next crash will be worse because of computerized trading. Investopedia published an article last January: Why The 1929 Stock Market Crash Could Happen In 2018. Fox Business reported on October 18, 2017: Stock market crash inevitable, financial historian says. The number of forecasts that keep calling for a major crash has been truly amazing. This has been one reason why I have said that this is the Most Hated Bull Market in History! For at least the final 18 months going into the high on September 3rd, 1929, the general consensus turned bullish. People were also bearish and in fact, the Wall Street Journal even accused Jesse Livermore of turning bullish to try to influence the presidential election. Strangely reminiscent of Russian hackers in 2016. As long as the major remain bearish calling for every top to be the last one, you know we are nowhere near the high yet.

The US share markets are being driven up by two main factors. First, institutions have sold the market assuming there would be a major crash. In February at the lows, Goldman Sachs was forecasting that the market could plunge another 25%. In May, Goldman Sachs again was warning that the next crash will be worse because of computerized trading. Investopedia published an article last January: Why The 1929 Stock Market Crash Could Happen In 2018. Fox Business reported on October 18, 2017: Stock market crash inevitable, financial historian says. The number of forecasts that keep calling for a major crash has been truly amazing. This has been one reason why I have said that this is the Most Hated Bull Market in History! For at least the final 18 months going into the high on September 3rd, 1929, the general consensus turned bullish. People were also bearish and in fact, the Wall Street Journal even accused Jesse Livermore of turning bullish to try to influence the presidential election. Strangely reminiscent of Russian hackers in 2016. As long as the major remain bearish calling for every top to be the last one, you know we are nowhere near the high yet.

Besides the constant selling that has led to repeated short-covering, we also have the excuse that the rally is primarily being caused by massive buybacks by corporations of their own shares. They point out that corporate-buy-backs will also reach an all-time high in 2018. They present this as evidence that somehow these purchases are not legitimate. In truth, the excess cash has led companies to buy back shares which will have two interesting impacts. First, it actually creates a shortage of shares. This was one factor in creating the 1929 bubble. Indeed, some of the last stocks to be floating going into the high of 1929 were Mausoleum companies.

Additionally, the US share market has benefited from the political-economic turmoil outside the USA – especially in Europe. Even IMF acknowledged that the European Central Bank’s pledge to buy government bonds set in motion a capital flight and the financial fragmentation of the eurozone back on October 9th, 2012. the return of global dollar capital to the US as a result of the central bank’s interest rate hikes also contributed to the positive trend. When we look at the Dow Jones Industrials, we can easily see that it continues to make new highs in Euro. This foreign buying has absorbed domestic selling.

QUESTION: Greetings Marty,

I have followed you since the old Money Radio days!

Can you help me understand the disparity between the declining velocity of money, the growth of the economy and what the natural consequence may be?

Thank you for your willingness to share your knowledge!

Regards,

MRM

ANSWER: Oh yes. Buzz Schwartz was a fantastic guy. I enjoyed doing his show there in California. The economic growth has been declining for decades as has the velocity of money, As the velocity declines, it shows that people are either saving more or they do not have disposable income after taxes to spend. Normally, the velocity will decline and that is a sign of a recession. This is the normal reaction when people save and do not spend. However, if you are not in an economic recession/depression there is no FEAR FACTOR of what the future will bring, then the velocity declines because people really do not have the money after taxes to spend. This is one reason I keep harping on – it’s the taxes stupid!

In the USA, the velocity bottomed during the 2nd quarter of 2017 and has started to turn up with Trump lowering taxes. This is the first uptick since the decline began from the 3rd quarter of 1997 when the capital flows began to shift creating the 1997 Asian Currency Crisis. When Obama raised the tax rate from 35% to 39.6% in 2013, that began the real sharp decline.

The decline in the velocity of money and the rising burden of taxation is very alarming. That has been the worst combination which has suppressed the Euro zone economy. We see this with central banks setting targets for 3% inflation and they cannot reach that level.

QUESTION: Do you think that robots will eliminate a lot of jobs in the future?

EH

ANSWER: Yes. But you have to understand WHY are we even turning to robots. The answer to that question is TAXES & SOCIALISM! The bottom line is rather blunt. Any routine job that can be replaced by allowing the consumer to choose their own order to be it at a fast-food store or the internet will be at risk along with jobs that are easily be defined by a mathematical or logic equation will be at risk in the future. Many companies are now limiting workers to 33 hours per week or less to simply avoid having to provide benefits and pensions.

Health reform is ABSOLUTELY vital for the future. To be able to provide REASONABLE health care at a reasonable cost DEMANDS tort reform. This is what is driving the cost of medicine really high because the doctors have to pay huge insurance fees because of the lawyers. Turn on the radio and you hear ads for lawyers all the time. They are the NUMBER ONE occupation among those in Congress so you can bet they will NEVER provide tort reform against their own industry. This idea of universal health care is a real joke. They will make comparisons to Europe, but fail to explain that doctors work for the government in most cases.

Obamacare really escalated the entire problem. What Obama pulled off was the idea that forcing the youth to buy insurance would reduce the cost for those who really needed it. There were ZERO reforms and just more bureaucracy. You cannot get the benefits without reforming the system.

Then throw in the pension crisis. This is leading to growing part-time employment and makes robots VERY attractive to replace jobs because they do not require benefits and salaries. As for universal income, here we go again. This is another ploy where we keep trying to come up with schemes that support a system that is failing. Deal with the heart of the issue and just maybe we might get somewhere.

Let’s eliminate the income tax and adopt a new system which will not make labor outrageously expensive.

The rumors running around is that Turkey will default as Erdogan decides to move to align with Iran and Russia and leave the West behind. While there have been speculative attacks on the Turkish economy and US tariffs and sanctions have been detrimental, the initial causes of this growing monetary problem are really all internal. Erdogan’s management of the economy has been a disaster. He has pretended to borrow too much money from foreign investors to stimulate the economy. It is true that the total debt rose to over $450 billion, about half of GDP. Turkish exports and the current account deficit rose to $50 billion. This has led to rapid inflation that has been at least an annual rate of nearly 7% on average during the last ten years. In truth, Erdogan was really trying to build the economy to fulfill his dream of reestablishing the Ottoman Empire and emerge as at least the dominant power over the Middle East.

Unfortunately, Erdogan is stubborn and he really has no way out. He wants his cake and consumes it all at the same time. The rumors running around the trading desks is that he will pull the plug and turn his back on the West. By doing so, he can then justify defaulting on the debt of the “corrupt” West who wants to subjugate Turkey will be the justification spin of things. It looks like this will remain volatile into October.

QUESTION: Dear Mr. Armstrong,

Zimbabwe is just coming out of a very hard time. Their currency is not (at least to my knowledge) recognised internationally. What advice would you give to the Government as they try to sort out this situation? Would you consider advising them on the way forward so that they do not make any fundamental errors in the beginning. It is a lovely place, I can assure you, if you do go.

Best regards,

CH

ANSWER: I am aware of the hope which has taken hold there in Zimbabwe with the tens of thousands of people celebrating the victory of President Emmerson Mnangagwa yesterday. He really needs to restore world confidence and that is possible. He finished out Mugabe’s term but almost 20% of the white population fled and Mugabe was a Marxist. It will take some political guidance, but if he would really listen, he could actually transform your country into a powerhouse. The first and primary directive is always the rule of law. If a property can be taken, then capital will never trust such a nation. It falls into the category of Country Risk.

Overall, the economy of Zimbabwe was quite strong. From 1991 to 1996, the Zimbabwean Zanu-PF government, which was in power since independence, and its President Robert Mugabe adopted an Economic Structural Adjustment Programme (ESAP) that was really insane and we see similar policies rising in South Africa. Mugabe created an extremely serious economic change that was not unlike the drastic approach of Maximinus I of Rome. Maximinus effectively attacked the rich and paid informants who reported anyone with hidden wealth. Commerce began to collapse and it was his actions that really began the decline and fall of Rome into 268AD.

We have to be honest here that Mugabe created the hyperinflation in Zimbabwe that began in the late 1990s because of his Marxist philosophy shortly after the confiscation of private farms from white landowners towards the end of Zimbabwean involvement in the Second Congo War. During the height of inflation from 2008 to 2009, it was difficult to measure Zimbabwe’s hyperinflation because the government of Zimbabwe stopped filing official inflation statistics. However, Zimbabwe’s peak month of inflation is estimated at 79.6 billion percent in mid-November 2008.

We would provide a set of proposals, but it would have to be confidential. If President Mnangagwa agreed, then and only then could we make them public. The risk of creating false hope in markets is not wise.

The Pension Crisis is starting to be noticed in Europe. The German Finance Minister Olaf Scholz is arguing that the federal government has to guarantee the pension level until 2040. He is arguing that the government MUST come up with a plausible financing model which seems actually impossible. The increase in taxes to cover pension that far out would devastate the younger generations. So far, this Grand Coalition in Germany has agreed on stabilization plan by 2025. We may see the pension issue become a major factor in the next election. There is no solution as long as Germany continues to adhere to austerity. The only way the pension crisis can be addressed is to inflate out so you pay people with a cheaper currency.

The collapse of Socialism is underway because the people rightly expected all governments to do everything they could to live safely and satisfy their promises of bliss for retirement. They are already witnessing that saving for retirement has not worked when central banks use interest rates to manipulate the economy and in Germany, they have had negative interest rates thanks to Draghi and the ECB. Indeed, in Germany, this policy of austerity is in direct conflict with Socialism. The only way the system has held together this long is because of inflation.

The Pension Crisis is one element behind the rise of political unrest, particularly in Italy. In Germany, the Pension Crisis is starting to fuel the AfD and the nationalist populists in their movement. Scholz has warned that without resolving this issue, Germany will see its own version of Donald Trump take command. Political change is coming and the current crop of politicians have no real answers.

The German magazine, Spiegel, reported that according to estimates by the German Pension Fund, the so-called sustainability reserve will reach around €37.3 billion euros by the end of December 2018. The reserve has been increasing of late 4.4% (year/year) because of the strong employment situation in Germany under its export model. Nevertheless, the pension insurance assumes that by 2023, the contribution rate of 18.6% of gross wages must be increased yet again. This is already a hefty percentage of gross income and it is not going to be enough

Italy is the third largest economy in Europe just behind France, but it is number two insofar as industrial production is concerned. The French manufacture three main brands, Peugeot, Citroen, and Renault, in the world of automobiles which are not very popular in the USA. The Italians, however, have the more recognized brands worldwide such as Ferrari, Maserati, Lamborghini, Alfa Romeo, Fiat, and Lancia. The sports car enthusiast is always torn between a Ferrari and a Lamborghini while you are beginning to see Maserati’s everywhere in the standard high-end marketplace.

Italy is the third largest economy in Europe just behind France, but it is number two insofar as industrial production is concerned. The French manufacture three main brands, Peugeot, Citroen, and Renault, in the world of automobiles which are not very popular in the USA. The Italians, however, have the more recognized brands worldwide such as Ferrari, Maserati, Lamborghini, Alfa Romeo, Fiat, and Lancia. The sports car enthusiast is always torn between a Ferrari and a Lamborghini while you are beginning to see Maserati’s everywhere in the standard high-end marketplace.

From the manufacturing perspective, the Italians have been able to compete producing cars in Euro for their reputation in car production carries the day. The crisis for Italy with respect to the Euro has been the conversion of their past debt to Euro which altered the standard depreciation of debt whereby you are paying back with cheaper currency.

The idea that was floated as an alternative to leaving the Euro calling for a referendum on the country’s EU membership was the proposal which called for the introduction of so-called mini-bots – government guaranteed bills. The catch was that they were to be restricted only to Italy and can be used to pay taxes. This idea does not seem to be moving anywhere close to reality. However, it recognized that there was a problem with its debt.

Instead, the proposals have turned on reforming the ECB. There are people in the Italian government who want to alter the ECB as a direct result of Draghi’s policy of Quantitative Easing which has destroyed the European Bond Market. The Italian proposal call for the ECB’s statutes should be changed to allow the central bank to act as a lender of last resort and acquire Italian government bonds not only on the secondary market by QE, but also on the primary market buying them directly from the Italian government. In reality, this would be a direct assault on the German philosophy of austerity. There would be nothing against higher inflation if it would create more jobs. Italy is making it clear that they would prefer 7% inflation and an unemployment rate of 2% rather than 2% inflation and an unemployment rate of 7%. In reality, Italy is arguing for the same policies that were adopted by Roosevelt to end the Great Depression.

This is becoming a battle behind the curtain between austerity and reality. The question to emerge is what happens if Germany refuses to yield? Are we looking at the very issue that brings down the entire EU house of cards?

QUESTION: Mr. Armstrong; I find your anecdotes fascinating and very enlightening how you always bought German cars and made money on them. Is currency the primary reason people often think something is a good investment when in fact it is really just currency fluctuations?

PVB

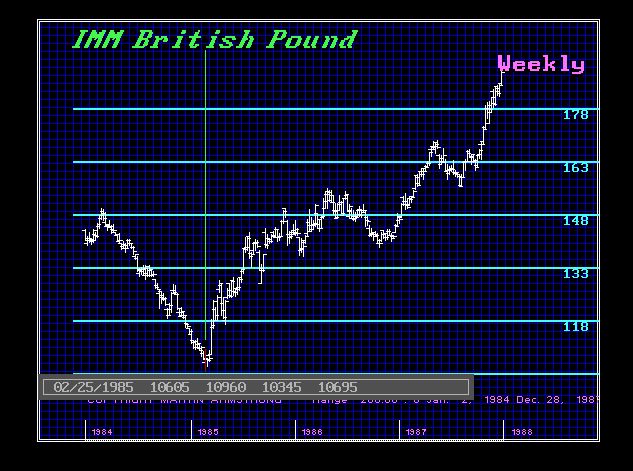

ANSWER: You are hitting the nail right on the head. The decline in the dollar throughout the 1970s made German cars appear to appreciate and this was attributed to quality. This was the entire reason why the German car industry exploded. I have often stated at WEC conferences that I made the same play with a Ferarri in London. When the British pound dropped to $1.03 in 1985, I ran out and used the currency to make some deals. I bought a 328 Ferarri for about $30,000 when in the US it was a $50,000 car. Because the pound had dropped, Ferarri could not afford to sell them in Britain at that price so they raised it £45,000.

ANSWER: You are hitting the nail right on the head. The decline in the dollar throughout the 1970s made German cars appear to appreciate and this was attributed to quality. This was the entire reason why the German car industry exploded. I have often stated at WEC conferences that I made the same play with a Ferarri in London. When the British pound dropped to $1.03 in 1985, I ran out and used the currency to make some deals. I bought a 328 Ferarri for about $30,000 when in the US it was a $50,000 car. Because the pound had dropped, Ferarri could not afford to sell them in Britain at that price so they raised it £45,000.

As you can see from the chart I provided, the pound bottomed in February 1985 at $1.0345. After Ferrari raised the price and then the pound went to nearly $2, suddenly a car that cost me $30,000 had a replacement cost of almost $100,o00. This is what led to many people buying several Ferraris and garaging them thinking that the car was the investment.

Currency Inflation is probably the most misunderstood economic force in the matrix. Probably 99% of economists and investors remain ignorant of such trends because they have never dealt in the international world of finance and focused only domestically. Those of us who have been hedge fund managers and worked internationally understand the fluctuations of currency and its impact. This is a lesson still not taught in school and politicians remain oblivious to the real implications.

People really think we have free trade and somehow Trump is reversing that fact. This, of course, is how the press has portrayed the issue, but that is just far from the truth. Trump is now looking at putting a 20%-25% tariff on cars coming from Europe. Personally, I only have German cars so I would not like to see that outcome. But personal wishes are not something I can explore for analysis. What I can say is that far too much is being fudged.

Countries are using DUTIES as the alternative to tariffs. It has gotten so impossible, we can no longer create the mugs we always give away at every conference in the USA when the conference is in Europe or Asia. Our last two conferences in Asia required us to manufacture the mugs in the country of the conference because we cannot get them into the country even when we hand them out for free. To government’s nothing is FREE and then you have to negotiate the “duty” to pay based upon what you would have paid for a cup manufactured in their country.

On that score, I have to agree with Trump. He has offered a free trade deal to the EU dropping all tariffs if they do the same. France rejected. There should be no tariffs and NO duties. Just for once let there be free trade. It has NEVER existed. Before the income tax, the US-funded itself with excise taxes. Excise taxes are taxes paid when purchases are made on a specific good, for example, gasoline. Excise taxes are often included in the price of the product. There are also excise taxes on activities, such as on wagering or on highway usage by trucks. One of the major components of the excise program is motor fuel today. Now we have consumption taxes in this manner AND income taxes. Government is now funded by just shaking us upside down and inventing countless taxes so they do not have to report the total cost of taxes.

I have created this site to help people have fun in the kitchen. I write about enjoying life both in and out of my kitchen. Life is short! Make the most of it and enjoy!

De Oppresso Liber

A group of Americans united by our commitment to Freedom, Constitutional Governance, and Civic Duty.

Share the truth at whatever cost.

De Oppresso Liber

Uncensored updates on world events, economics, the environment and medicine

De Oppresso Liber

This is a library of News Events not reported by the Main Stream Media documenting & connecting the dots on How the Obama Marxist Liberal agenda is destroying America

Australia's Front Line | Since 2011

See what War is like and how it affects our Warriors

Nwo News, End Time, Deep State, World News, No Fake News

De Oppresso Liber

Politics | Talk | Opinion - Contact Info: stellasplace@wowway.com

Exposition and Encouragement

The Physician Wellness Movement and Illegitimate Authority: The Need for Revolt and Reconstruction

Real Estate Lending