Posted originally on the conservative tree house on July 27, 2022 | Sundance

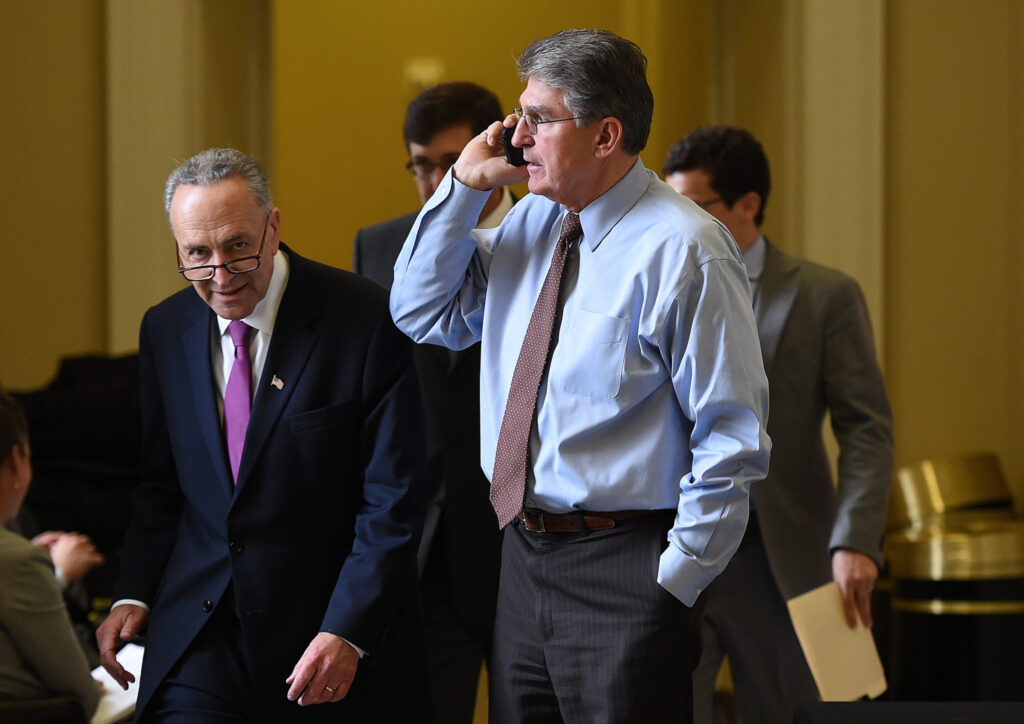

Two weeks ago, CTH warned everyone that Joe Manchin’s torpedoing of the $500 billion Green New Deal senate spending program was a head fake; he was always going to sign up to expand the control of the federal government over energy use. Today Manchin and Chuck Schumer made it official.

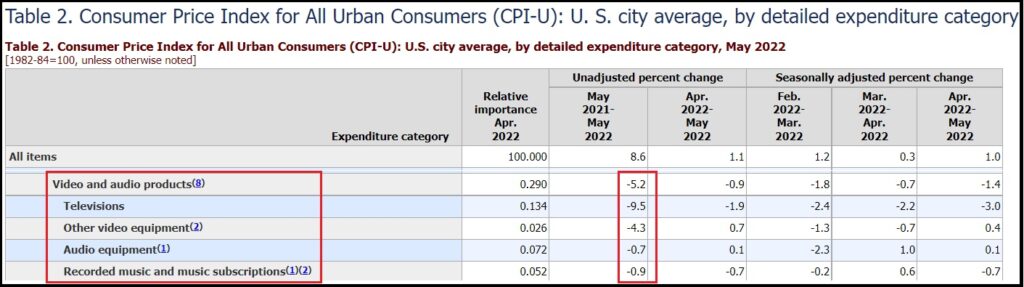

The people operating the “energy transition” levers will get $370 billion to spend on bigger windmills, more solar panels and new energy programs to eliminate coal, oil and natural gas. They will pay for it by raising taxes and hiring a new army of IRS enforcement officials. In exchange for his vote, the federal government will pay increased health insurance subsidies for West Virginians and pass out lower priced medications.

There you go. Exactly as predicted. Energy inflation will continue as the energy transition becomes a permanent feature. Ironically, Joe Manchin made them change the name to “The Inflation Reduction Act,” and pushed the effective dates for all renewals past the 2024 election (where he plans to be a candidate against Gavin Newsom).

WASHINGTON – Joe Manchin and Senate Majority Leader Chuck Schumer on Wednesday reached a deal on a bill that includes energy and tax policy, a turnaround after the two deadlocked earlier this month in talks on Democrats’ marquee party-line agenda. In a joint statement, the two Democrats said the legislation will be on the Senate floor next week. It includes roughly $370 billion in energy and climate spending.

[…] The duo said their bill, dubbed “The Inflation Reduction Act of 2022,” would “fight inflation, invest in domestic energy production and manufacturing, and reduce carbon emissions by roughly 40 percent by 2030.” Moreover, as part of the agreement announced Wednesday, Schumer and Speaker Nancy Pelosi agreed to pass legislation governing energy permits.

[…] Democrats will raise revenues for the legislation by imposing a 15 percent corporate minimum tax, increasing IRS enforcement, reducing drug prices and closing the so-called carried interest loophole. Notably, the legislation also extends the Affordable Care Act subsidies through the 2024 election and the first term of Joe Biden’s presidency, taking a big political headache off the table for Democrats. (more)

Look deeper into the people in Joe Manchin’s life that are tied to the healthcare industry. There you will find the familial beneficiaries of the deal. “Besides being Joe Manchin’s daughter, Heather Manchin Bresch, born 1969, spent several years as the CEO of Netherlands-based pharmaceutical company Mylan. She held the post from 2012, but stood down in November 2020, as a result of the company’s merging with Pfizer’s Upjohn outfit. Upon assuming the role, Heather Mamchin became the first woman to run a Fortune 500 pharmaceutical company.” LINK

The scheming strategery of Joe Manchin is as predictable as the scheming strategery of Mitch McConnell.

The two wings of the UniParty duck seem still on the surface. This type of ploy is exactly how DC is able to operate, paddling forward furiously, just below the surface; and almost no one can see what is happening.

Once you see the strings on the political marionettes, you can never return to that moment in the performance when you did not see them. However, because too few people see them, almost everyone congregates in the lobby during the mid-term intermission asking, “hey, when did Texas become dependent on windmills?”