Posted originally on the conservative tree house on March 7, 2023 | Sundance

Federal Reserve Chairman Jerome Powell delivers testimony today before the Senate Banking and Finance Committee. During his statements Powell says, “The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.” Powell continued, “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.“… “We will continue to make our decisions meeting by meeting.” … “Although inflation has been moderating in recent months, the process of getting inflation back down to 2% has a long way to go and is likely to be bumpy.”

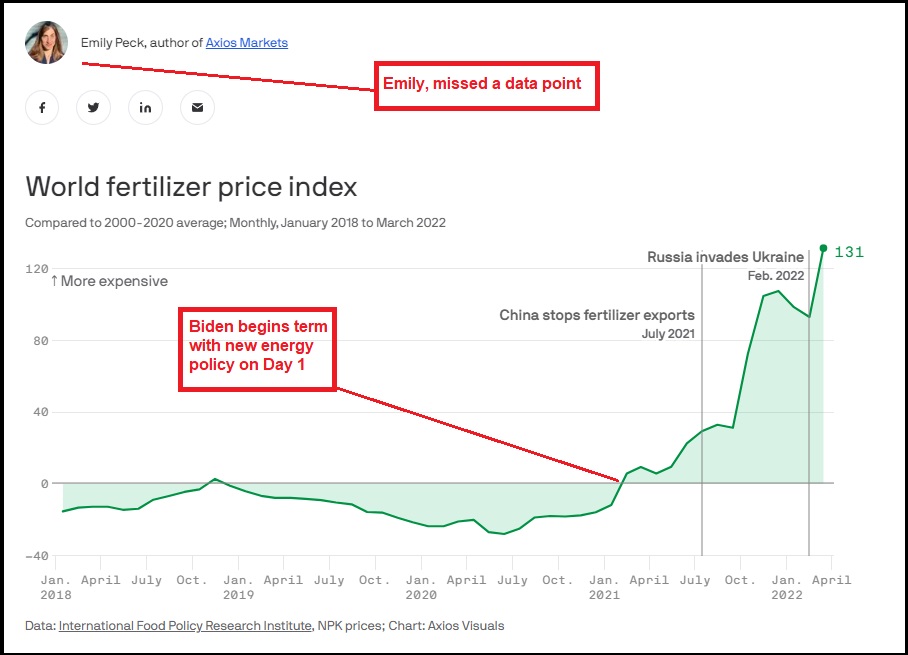

Everything about the testimony to the Senate, and almost everything within the questioning as presented, ignores the key and central component that inflation is being driven by energy policy. The scale of the pretending around this issue is jaw dropping.

Western governments, including the U.S. through Joe Biden, have limited and curtailed the production and exploitation of Oil, Coal and Natural Gas. At the core of the inflation within those same governments, this is the issue at hand. Energy prices have skyrocketed, driving the cost of everything through the roof. The central banks are raising interest rates in an attempt to shrink the economy to match the drop in energy production. This is their monetary policy (interest rates) attempting to support economic policy (Green New Deal / Build Back Better).

There are no lines for consumers in the U.S and Europe of people buying durable goods, electronics or shopping for non-essential items. Prices on the products within the durable goods economy are not being driven by excess consumer demand. There are not 25% more people buying lemons and milk than this time last year. The prices for goods in general, and for essential goods specifically, have risen as an outcome of the input costs around energy skyrocketing.

Everything is impacted by diminished energy production, and losses in infrastructure due to drops in investment, that contribute to the efficiency of energy distribution. Oil prices have jumped, gasoline prices, diesel prices, natural gas prices and electricity prices have all skyrocketed.

With those raw material production policies, farming costs, fertilizer costs, cooling and heating costs, electricity costs, home heating costs, transportation costs, packaging costs, storage and warehouse costs, refrigeration costs and everything impacted by major energy costs have increased. This is the main driver of consumer inflation.

When Jerome Powell says they are raising interest rates to “cool the economy,” the raw truth behind the statement is the central banks are trying to reduce the western economies in order to meet the diminished energy production created by policy. If they can make the economy smaller, less energy is needed….. and this should stem the rising costs from limiting the resource development.

Their problem is that baseline energy demand remains high. This is keeping energy prices high…. this is keeping inflation high. Their approach to continue raising interest rates, will only work if they achieve an economic outcome similar to the pandemic lockdown period.

Yes, excessive money does create devalued money, which in turn does create inflation. However, in the current inflationary dynamic it is not excessive money in the hands of working-class people that is driving high demand for goods. All of the consumer and sales data show that cash carrying consumers are not chasing limited goods. Consumers and workers are trying to afford essential goods and services that have increased in price as a result of energy policy.

Every economic analysis that does not take this majority factor into consideration is either: (a) making a mistake; (b) being intentionally obtuse and willfully blind; or (c) intentionally not discussing it because the motives of the analyst are to support the climate change agenda.

Once you accept that energy policy is the majority driving influence of current inflation (6.4%), then you can estimate how much economic damage will be needed in order to drop energy demand to a level that matches the diminished energy development, production and investment.