QUESTION: Mr. Armstrong; I have been reading your blog for years now. It is obvious that you are well connected behind the curtain. It did not take but perhaps a day or two after you explain the difference between wealth and income to suddenly see Elizabeth Warren adopting the position to impose a wealth tax of two percent on people with assets of 50 million or more. Will this not cause the rich to leave as they did in France?

Thank you for the enlightenment

HT

ANSWER: Warren’s proposal is not only going to be the final nail in the coffin of capitalism and the United States but indeed, investors will migrate to China. The danger is clear. The famous legal case that led to the Supreme Court’s Right to Privacy was Griswold v Connecticut. It involved a doctor who was criminally convicted for giving married persons information and medical advice on how to prevent conception with a condom. The religious extremist took the view that the Bible said go forth and propagate and thus they imposed their religious beliefs upon the majority by criminal law. The Supreme Court correctly created the Right to Privacy out of a simple logical conclusion. How would the state outlaw the use of a condom in marriage? How could it be enforced? Would a state policeman have to inspect before you had intercourse? Would you then have to apply for a license to have intercourse so the state would then know to send the policeman into your bedroom?

In order to impose a Wealth Tax, that means the absolutely EVERYONE would then by law be compelled to list everything they own right down to your wedding rings so the state could them calculate your wealth to impose a tax. This type of tax would absolutely destroy the Right to Privacy. It does not matter if it starts at $50 million. How do they know you have less than $50 million unless you still report all your assets to says you are exempt.

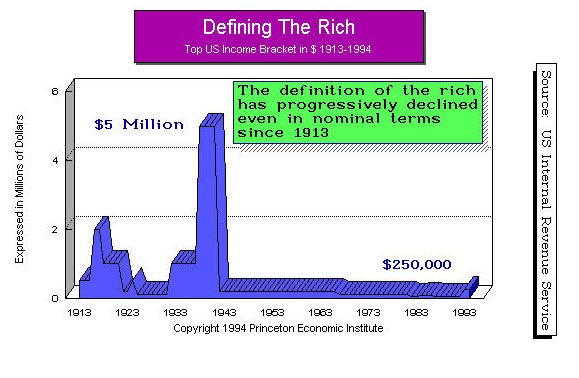

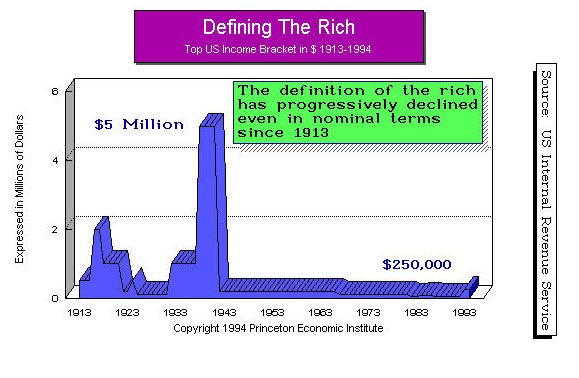

Putting the Right to Privacy aside, the government can NEVER be held to whatever it promises today. The government will always introduce a tax and claim it will only apply to the “super-rich” as she is doing – $50 million will pay 2% annually on the value government claims your assets are worth and $1 billion+ will pay 3% annually. At 8%, you will confiscate all of a person’s assets in less than 10 years. They have constantly altered even the definition of who are these “rich” people they hate so much. It inspires a feeling that you are just an economic slave and we are to be exploited and threatened with prison if we do not comply with their demands.

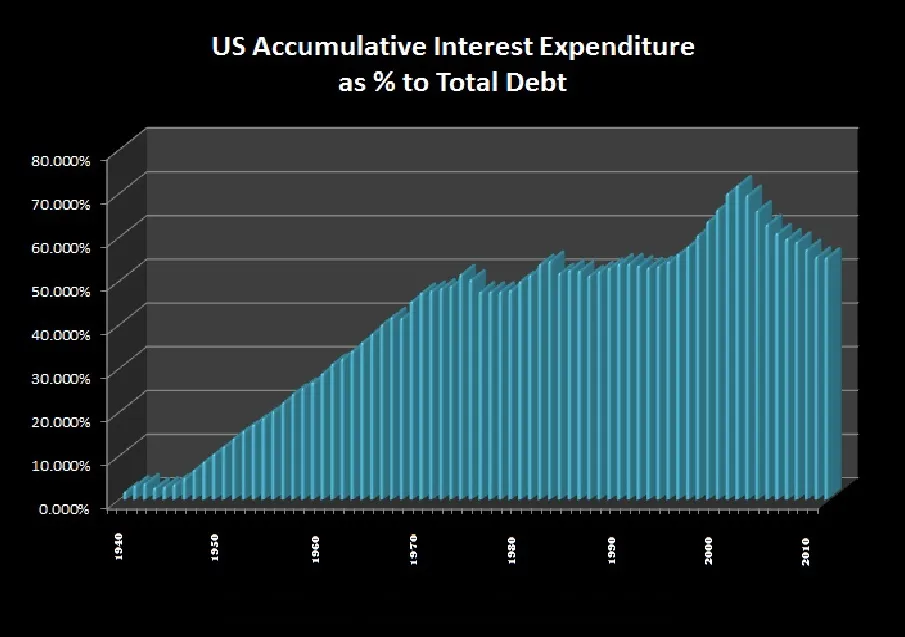

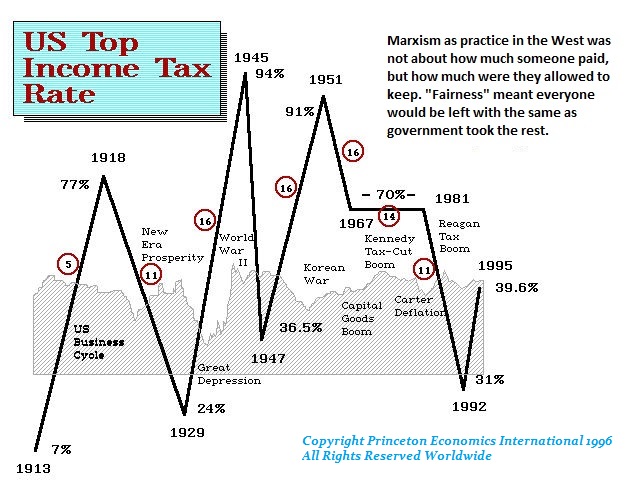

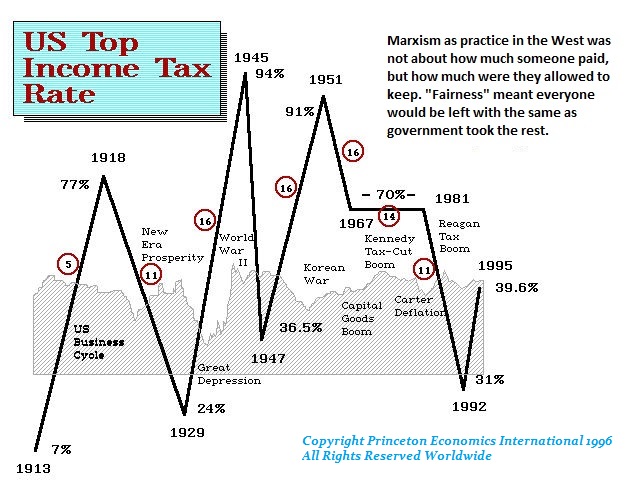

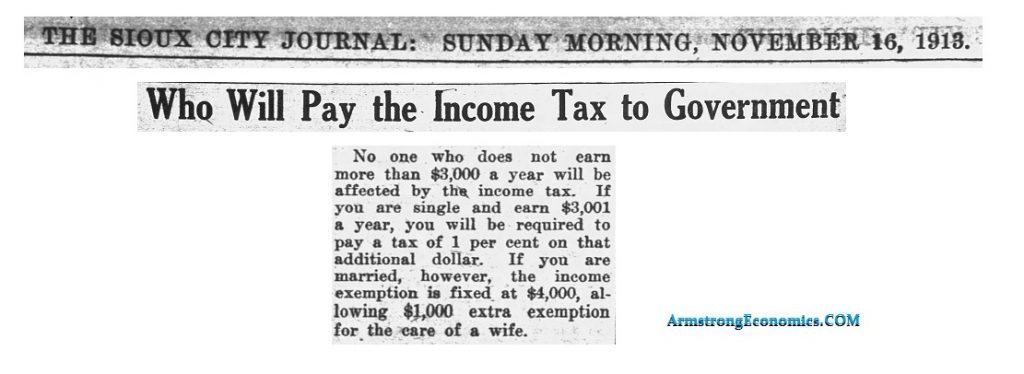

Elizabeth Warren is the new Karl Marx advocating communism in slow motion. To sell the income tax in 1913, it was to be just 1% and ONLY on the rich just as she is claiming today with her Wealth Tax. Ever since, the income tax has risen to 94%, dropped to 35%, rallied back to 91% and then eventually fell to 31% to rise again to 39.6%. This is why companies left the USA. Not to pay a worker $5 instead of $10, but to seek some consistent level of taxation. Now the Democrats once again want to raise the income tax to 70%. No matter what rate they say today, they will always change it. The USA is economically a disaster because the tax rate fluctuates depending on who wins the election. This is what is wrong with Democracy insofar as it allows the majority to exploit the minority be it in taxes or even religion crafting criminal laws to enforce religious beliefs.

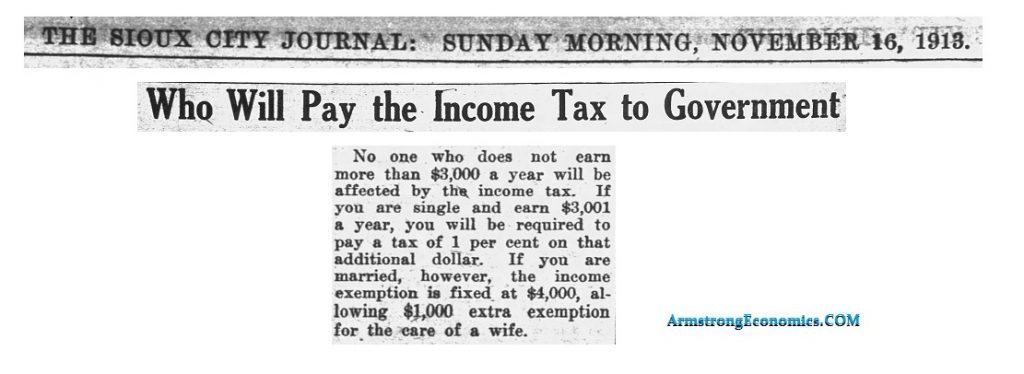

Those below that $50 million thresholds will cheer – go get em. They did precisely that in 1913. To sell the introduction of the income tax, they drew the line at $3,000 when a good job paid $0.30 per hour or $18 a week which was just under $1,000 a year. So to get a new tax in, they will ALWAYSplace it above the majority of people and pretend they will never be impacted. This is the luxury tax I saw in Australia pitching they would tax their Ferraris, Fur Coats & French Wines. They cheered. When the tax was imposed, it included all electrical products.

Once they create a new tax under false promises, they ALWAYS change the specifics. Just as ONLYthe rich would pay income tax, then comes Roosevelt’s New Deal and morally the same claims were made but suddenly they introduce the Payroll Tax and not everyone pays income tax. They will do the very same thing with a Wealth Tax. You cannot hold the government to whatever it promises. They will constantly change the rates and to whom it applies based upon they need money. They have constantly changed the DEFINITION of the “rich” and now it begins at $500,000. As the pension crisis explodes, they will need money for their own pensions like California, Illinois, and New Jersey, just to name a few. They will drop the Wealth Tax to the same level of income tax. Regardless, EVERYONE will have to report their total wealth in order to make sure you are paying your Wealth Tax.

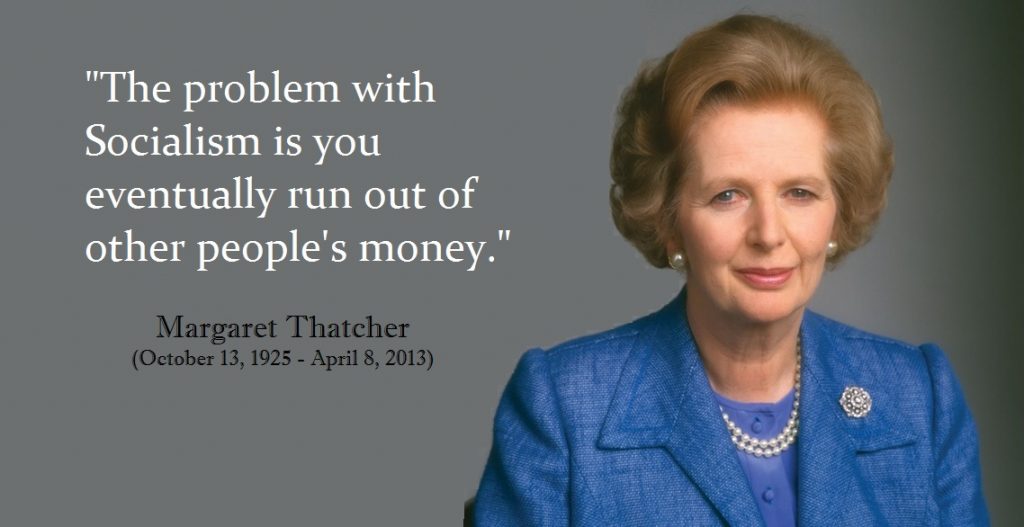

The Democrats rely upon Marxism and always preach class warfare which denies the very foundation of the Constitution’s Equal Protection Clause and violates the Ten Commandments by coveting what others have materially. They always run on a platform of a vote for me and I will go get the rich bastards. Once any new form of taxation is introduced, then politicians will ALWAYS raise the rates and lower thresholds as they continually need a never-ending source of other people’s money. The $50 million thresholds will crash to normal levels and the criteria will change for everyone. Every person will have to report their entire wealth right down to inheritance or else the government will be unable to confirm you are under the $50 million entry level. There are a lot of “super-rich” kids who inherited companies rather than cash. If your father’s company was worth $1 billion, how do you get $30 million in cash to pay taxes without liquidating at least part of the company? Then you have to pay that EVERY year!

Warren’s tax will cause a collapse in investment which means that unemployment will only rise. When people appear to make a fortune because their company goes public, they have restrictions that prevent them from selling for a period. A wealth tax will be applied simply based upon values of shares they cannot sell. This would certainly lead to a mass exit of the upper-class the very same as what took place in France – they just left!

Like the income tax, Warren’s Wealth Tax will move to 100% application to everyone because of some new event or war. Since we are already in a collapsing state of socialism, they will argue to raise this new Wealth Tax to save government pensions. Effectively, we will have a NATIONAL property tax that will include your home and then you will have to pay income tax on top of that. The pension funds will become a national emergency and the shift to increasing taxes will take place exactly as we are witnessing in California – if it moves, tax it; it fails to move tax it; and if it has any use whatsoever (like water) tax it.

Back in the ’90s, I was working to trying to Privatize Social Security to invest in equities rather than 100% government bonds and reform taxes by moving to a national retail sales tax (indirect) and eliminating the income tax. I was shuttling back and forth between the Speaker of the House Dick Armey and Bill Archer who was Chairman of the House Ways & Means Committee. Dick served in Congress between January 3, 1995 – January 3, 2003. I was sitting in Dick’s office one day when he explained the futility of it all. He had his feet up on the desk with his cowboy boots while smoking a cigar. He said to me that he could not support a retail sales tax because he did not believe he would be able to terminate the income tax.

Back in the ’90s, I was working to trying to Privatize Social Security to invest in equities rather than 100% government bonds and reform taxes by moving to a national retail sales tax (indirect) and eliminating the income tax. I was shuttling back and forth between the Speaker of the House Dick Armey and Bill Archer who was Chairman of the House Ways & Means Committee. Dick served in Congress between January 3, 1995 – January 3, 2003. I was sitting in Dick’s office one day when he explained the futility of it all. He had his feet up on the desk with his cowboy boots while smoking a cigar. He said to me that he could not support a retail sales tax because he did not believe he would be able to terminate the income tax.

He then said to me that when the political cycle would change, as I told him our computer was projecting, then the Democrats would have both taxes. It was at that moment I saw the light and I agreed. I told Dick he was absolutely correct. Without restoring the Constitution to prohibit direct taxation, it was hopeless to save the future no less Social Security. I made my decision to stop the nonsense of thinking I could prevent the future economic disaster. All I could do was advise my clients to help them survive not the nation. I gave up that day on trying to ever help the country and I knew all the top power people as the press would portray them.

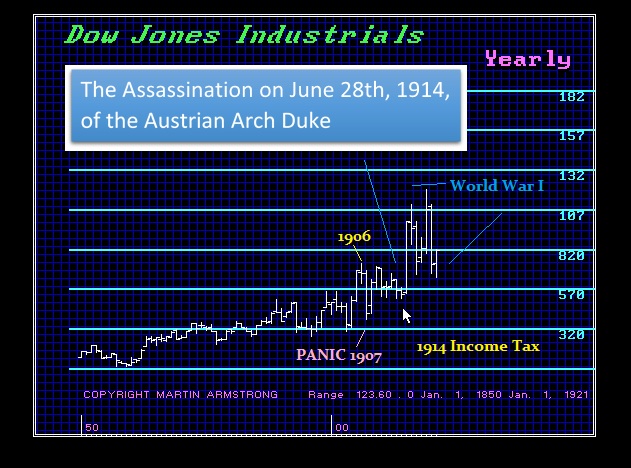

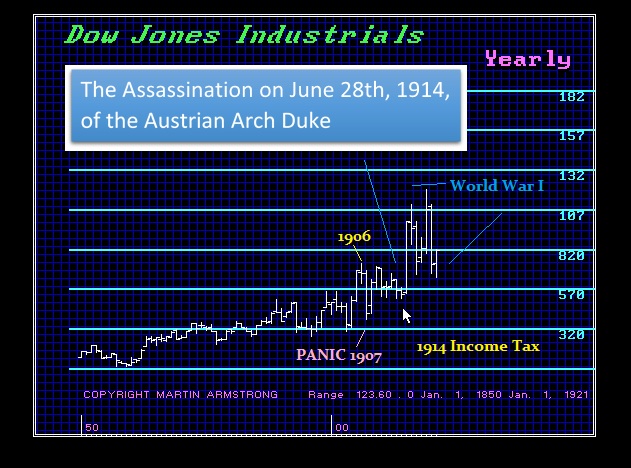

War is a great excuse, which is why politicians like war for it justifies raising taxes and introducing new powers like the Patriot Act. Make no mistake about it, when they introduced the income tax, the economy plunged into a steep recession in the face of the income tax. INVESTMENT dried up and the stock market shifted buyers. Americans were sellers and Europeans were the buyers as SMARTmoney began to move out of Europe. It had been the assassination on June 28th, 1914, in Sarajevo, Bosnia and Herzegovina of the Austrian Arch Duke which began to increase the tensions.

War is a great excuse, which is why politicians like war for it justifies raising taxes and introducing new powers like the Patriot Act. Make no mistake about it, when they introduced the income tax, the economy plunged into a steep recession in the face of the income tax. INVESTMENT dried up and the stock market shifted buyers. Americans were sellers and Europeans were the buyers as SMARTmoney began to move out of Europe. It had been the assassination on June 28th, 1914, in Sarajevo, Bosnia and Herzegovina of the Austrian Arch Duke which began to increase the tensions.

But a 43-month economic boom ensued from February 1915 to 1918, first as Europeans began purchasing U.S. goods for the war and later as the United States itself joined the battle. It was February 1915 is when the Ottoman forces attacked the Suez Canal and Germany defeated a Russian army in Poland. Eventually, the long period of U.S. neutrality made the ultimate conversion of the economy to a wartime base. The economic boom led to real plant and equipment expansion in response to the increased demand from both Europe and the United States.

Those who are in the “rich” category earn their money from INVESTMENT not wages. This is what Elizabeth Warren is addressing for she wants a tax on wealth – not income. So if you owned $100 million of a stock that was valued at that level because of a bull market, you will then have to pay 2% – $2 million. The stock crashes by 50%. You now pay 2% again every year of the current value of $1 million even though you lost $50 million. This type of Wealth Tax will unquestionably destroy INVESTMENT. You can lose and get no credit for a loss.

What this will do is far worse than the proposed 70% income tax for the new “Green New Deal” of Alexandria Ocasio-Cortez. This dynamic-duo of Warren and Ocasio-Cortez will absolutely complete what our model is forecasting – the end of the United States. Both are completely ignorant of how the economy even functions. They lick their lips at other people’s wealth and just want to get their hands on it to fund their wild ideas of some Green New Deal.

What this will do is far worse than the proposed 70% income tax for the new “Green New Deal” of Alexandria Ocasio-Cortez. This dynamic-duo of Warren and Ocasio-Cortez will absolutely complete what our model is forecasting – the end of the United States. Both are completely ignorant of how the economy even functions. They lick their lips at other people’s wealth and just want to get their hands on it to fund their wild ideas of some Green New Deal.

“The Green New Deal we are proposing will be similar in scale to the mobilization efforts seen in World War II or the Marshall Plan… Half measures will not work… The time for slow and incremental efforts has long past [sic].” – Alexandria Ocasio-Cortez, then-candidate for the U.S. House of Representatives, Huffington Post, June 26, 2018

This manifesto is very serious for they reject gradual change but are demanding immediate change to the economy. What has taken place among the Democrats is a band of newly elected members of Congress is accepting the leadership of Alexandria Ocasio-Cortez to push forward for this Green New Deal by sheer force. She is calling her proposal the most significant blueprint for system change in 100 years.

The core idea demands the mass conversion to renewable energy and zero emissions of greenhouse gases in the U.S. by 2030. Yes – Global Warming is a great excuse to raise taxes. They argue that a transition is not acceptable for it must be immediate action by the elimination of greenhouse gas emissions from our multi-trillion-dollar food and farming system they claim is long overdue because farming and cows represent a degenerative food system generates that accounts for 44-57% of all global greenhouse gases.

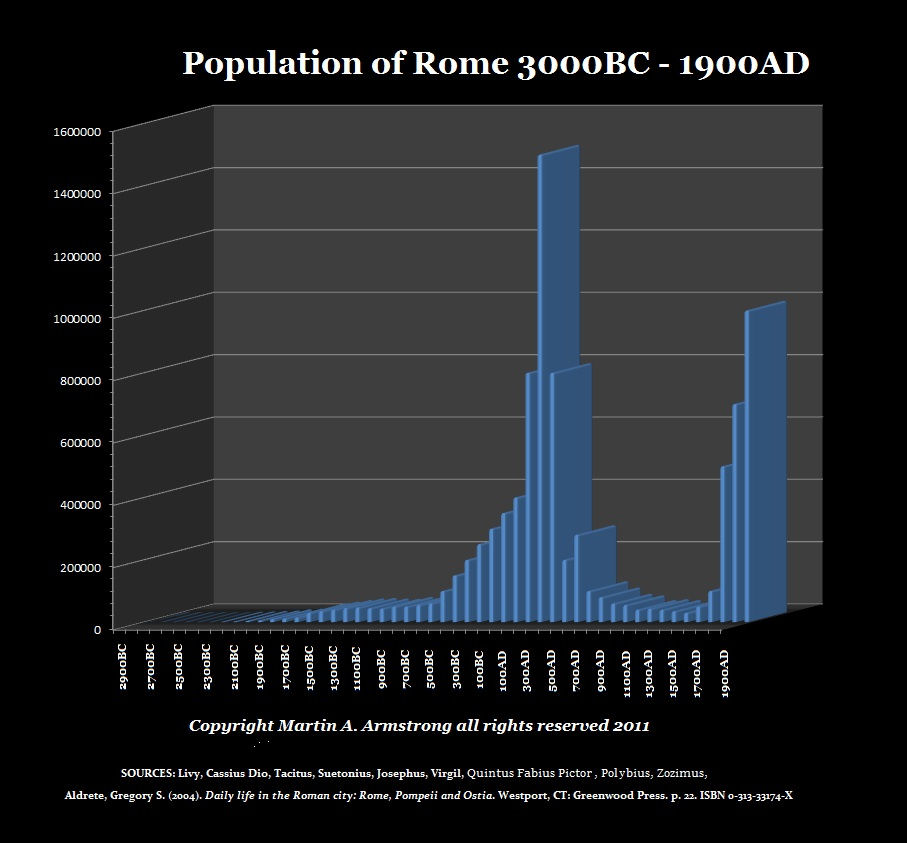

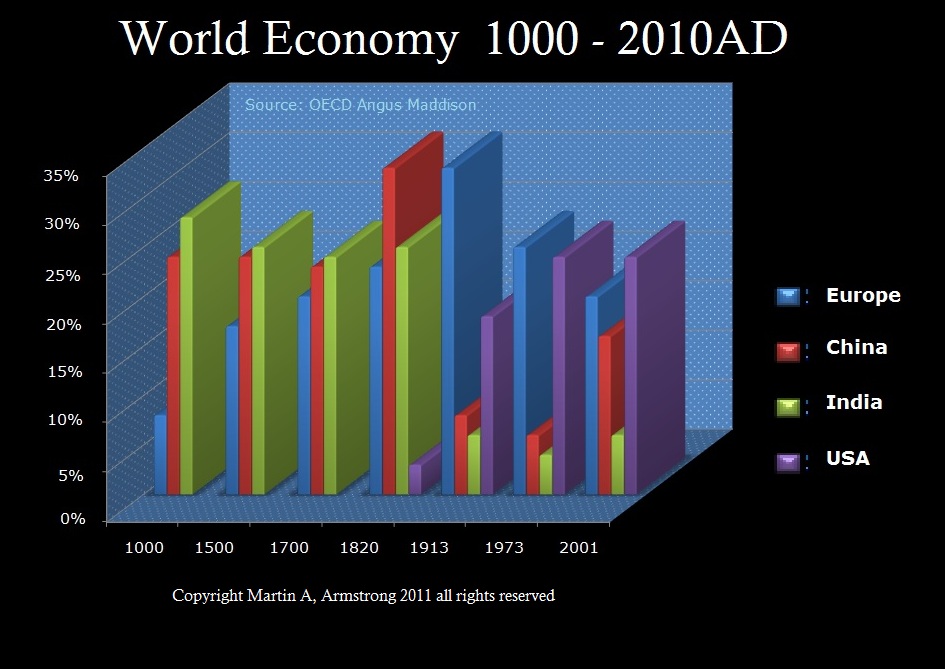

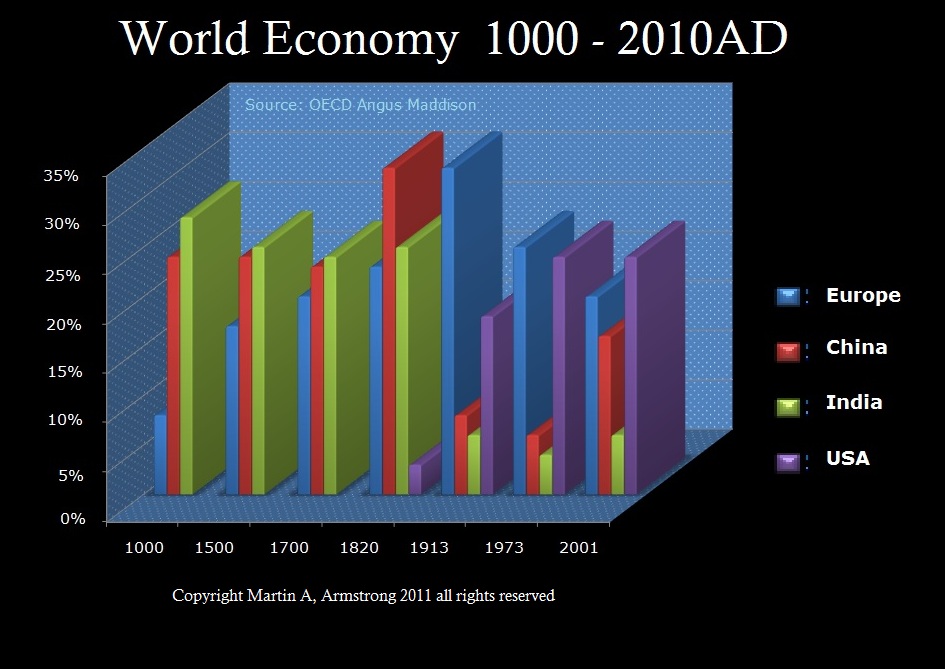

Warren’s proposal will destroy the economy and lower economic growth providing the strongest incentive for capital to migrate to China. As Europe and the United States spiral downward economically, this is how our model will be correct in the shift from the United States to China of the title – Financial Capital of the World. India and China were where all the wealth was which peaked during the early 19th century. After the fall of Rome and them Byzantium, the Financial Capital of the World began to migrate to India. That peaked by about the 14th century as India gradually declined and it moved to China.

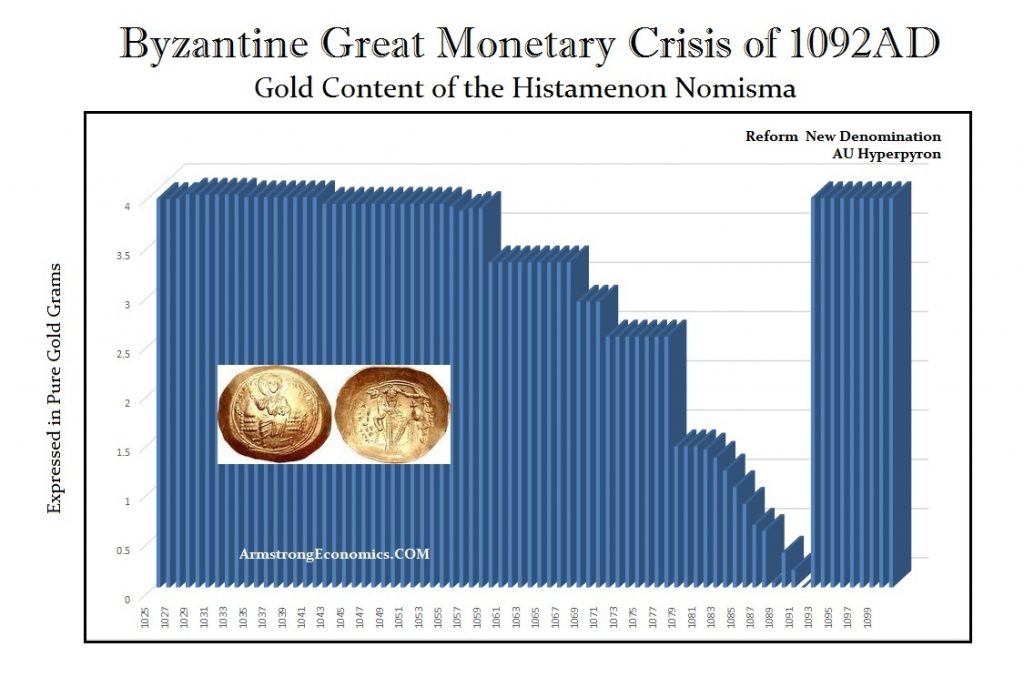

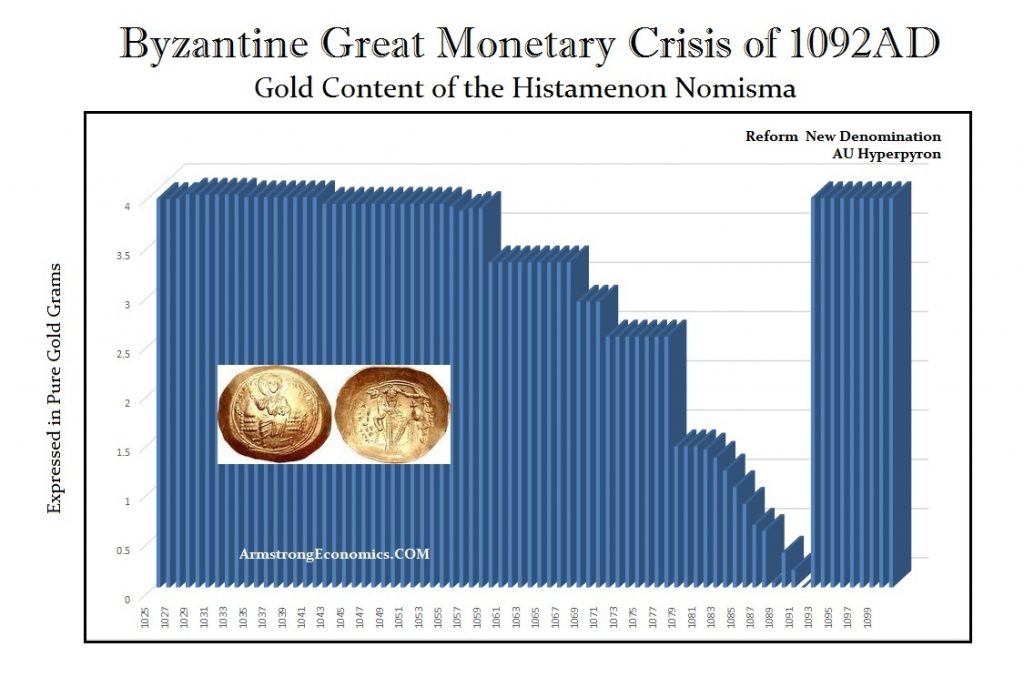

Following the Great Monetary Crisis of 1092, the Financial Capital of the World migrated to India – the land of the Spice Trade. Southern India has long imitated Roman gold coins to facilitate the local economy. We begin to see actual India coins but only under the Kushan Empire. Southern India continued to mint Roman imitations until the mid 3rd century AD. After that period, we begin to see actual India gold coins being struck showing that governments began to win the confidence of the people.

Following the Great Monetary Crisis of 1092, the Financial Capital of the World migrated to India – the land of the Spice Trade. Southern India has long imitated Roman gold coins to facilitate the local economy. We begin to see actual India coins but only under the Kushan Empire. Southern India continued to mint Roman imitations until the mid 3rd century AD. After that period, we begin to see actual India gold coins being struck showing that governments began to win the confidence of the people.

India’s economic boom period lasted about two Pi Cycles of approximately 630 years. The time period that it had captured the title of the Financial Capital of the World appears to be only about 224 years. China’s rise also lasted about 224 years. The rise of the United States has come into play for also about 224 years.

It’s just time. So thank you Warren and Ocasio-Cortez for ensuring our model will be correct once again. What these people refuse to ever look at is that the government is incapable of ever managing anything. Economic growth declines with rising taxation and regulation. No matter how many examples there are of how socialism destroys economies right down to present day Venezuela, they just cannot help themselves trying to change the very nature of human behavior. Any one who believes this tax will stay at $50 million+ is an absolute fool. History would beg to differ.

It’s just time. So thank you Warren and Ocasio-Cortez for ensuring our model will be correct once again. What these people refuse to ever look at is that the government is incapable of ever managing anything. Economic growth declines with rising taxation and regulation. No matter how many examples there are of how socialism destroys economies right down to present day Venezuela, they just cannot help themselves trying to change the very nature of human behavior. Any one who believes this tax will stay at $50 million+ is an absolute fool. History would beg to differ.

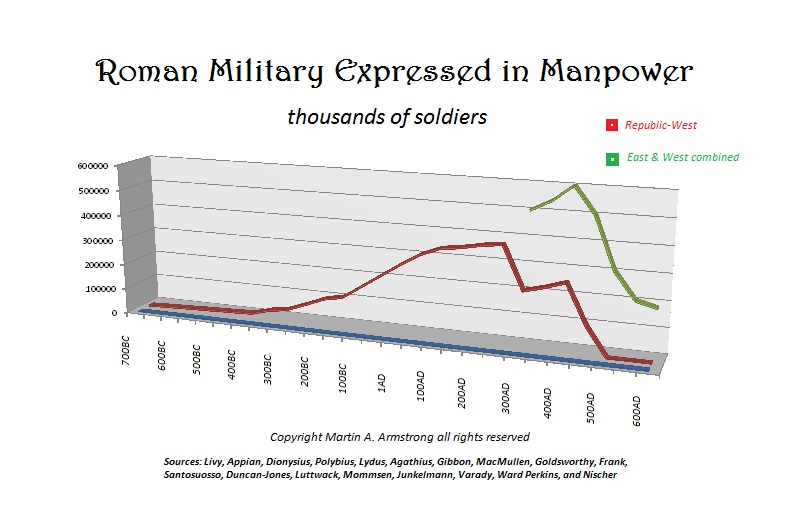

Will this end up causing a mass exodus of Americans? Yes! It will simply be time to turn out the lights and leave. This is how the United States will be destroyed like every other empire. Far too often there ends up more people in government living off the tax collections disprotionately to the living standards of the people paying taxes.

I have warned that the entire Student Loan Crisis has significantly altered the economy thanks to the Clintons courting the New York bankers making Student Loans the exception to bankruptcy. In Florida, like many other states, if you are in default on your student loans, the medical license to obtained is suspended. The Florida State Board of health has stated that some 900 healthcare workers were in danger of losing their license over the past two years because they were in default of their student loans. The board clarified it worked out repayment plans with most of those workers. It estimates the actual number of health care license suspensions is between 90 and 120 since November 2016. We may yet see the Yellow Vest Movement erupt in the United States over Student Loans.

I have warned that the entire Student Loan Crisis has significantly altered the economy thanks to the Clintons courting the New York bankers making Student Loans the exception to bankruptcy. In Florida, like many other states, if you are in default on your student loans, the medical license to obtained is suspended. The Florida State Board of health has stated that some 900 healthcare workers were in danger of losing their license over the past two years because they were in default of their student loans. The board clarified it worked out repayment plans with most of those workers. It estimates the actual number of health care license suspensions is between 90 and 120 since November 2016. We may yet see the Yellow Vest Movement erupt in the United States over Student Loans. FOX News reported that the U.S. Marshals Service in Houston was arresting people for failing to pay their outstanding federal student loans. Actually, Paul Aker, the subject of the Fox News report, failed to appear in court so the court sent U.S. Marshals to his home where he was arrested for a $1500 federal student loan he received in 1987. Of course, when they arrest anyone, the reason is irrelevant. Everyone is treated the same. If he ran, they would have shot him in the back and killed him on the spot and they would NEVER be prosecuted.

FOX News reported that the U.S. Marshals Service in Houston was arresting people for failing to pay their outstanding federal student loans. Actually, Paul Aker, the subject of the Fox News report, failed to appear in court so the court sent U.S. Marshals to his home where he was arrested for a $1500 federal student loan he received in 1987. Of course, when they arrest anyone, the reason is irrelevant. Everyone is treated the same. If he ran, they would have shot him in the back and killed him on the spot and they would NEVER be prosecuted.