Posted originally on the CTH on May 1, 2023 | Sundance

Everything about the process of cutting down energy exploitation, then driving supply side inflation, then raising interest rates to shrink demand (stem inflation) created by a desire to lower economic activity to the scale of diminished energy production, is a game of pretending.

The collateral damage from the rate hikes has been the banking destabilization, which shows the priority of the government officials and central banks to support the climate change agenda. Into the game of pretending comes the second unavoidable consequence with inflation continuing as a result of the energy policy.

They simply cannot cut energy demand enough to meet the diminished scale of production. There is no alternative ‘green’ energy system in place to make up the difference. That is the reality. Now, the fed is scheduled to raise rates again, then begin to debate the collateral damage as they continue the pretending game.

(Via Wall Street Journal) – […] Another quarter-percentage point increase would lift the benchmark federal-funds rate to a 16-year high. The Fed began raising rates from near zero in March 2022.

Fed officials increased rates by a quarter point on March 22 to a range between 4.75% and 5%. That increase occurred with officials just beginning to grapple with the potential fallout of two midsize bank failures in March.

The sale of First Republic Bank to JPMorgan Chase & Co. by the Federal Deposit Insurance Corp. announced early Monday is the latest reminder of how banking stress is clouding the economic outlook.

Fed officials are likely to keep an eye on how investors react to that deal ahead of Wednesday’s decision, just as they did before their rate increase six weeks ago when Swiss authorities merged investment banks UBS Group AG and Credit Suisse Group AG. (read more)

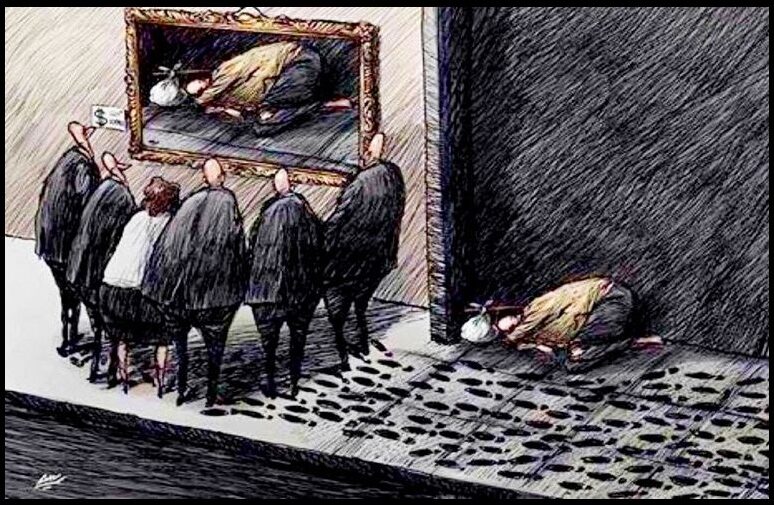

There is no other way to look at the combined policy without seeing a Central Bank Digital Currency (CBDC) in the future. All of these combined policies are creating a self-fulfilling prophecy.

Stop energy production. [Jan 2021]

Supply side inflation begins.

♦Raise interest rates. [April 2022]

Economic activity slows (but not enough).

♦Continue raising interest rates.

Banks destabilize. [Q1 2023]

Inflation continues.

♦Continue raising interest rates.

Economic activity slows (but not enough).

Banks continue destabilizing. [Q2 2023]

♦Continue raising interest rates.

Evaluate banking pressure. [We are Here]

Banks cannot withstand pressure.

Create CBDC