Posted originally on the CTH on March 11, 2023 | Sundance

In his weekly monologue, U.K pundit Neil Oliver takes the occasion of the 2023 Hollywood Oscar film awards to overlay the current state of theatrical horsepucky from the professionally political.

As the COVID-19 narrative collapses around them, the rulers who justified their fiats under false pretenses are naked to the sunlight of truth. The people are awake; the lies are easy to see; the gig is up; the bloom is off the ruse… We are watching, and the elites are not comfortable now. WATCH:

[Transcript] – Brace yourselves for the latest from La-La-Land. It’s the Oscars this weekend, another ceremony I used to care about in the world of before.

But for those who feel like we’ve been trapped for the past three years watching a bad movie with an unbelievable script, full of gaping plot holes and bad actors, I can tell you we’ve at least reached a good bit. Not the end, by any means, but perhaps a foretaste of comeuppance yet to be.

After the opening sequence the introduction of the characters establishing who were to be the goodies and baddies, after the setup and then the jeopardy and the darkness when all seems lost we’ve got to one of those bits where the audience leans forward in their seats in expectation of some payback, however slight and however brief. Anything to lift the mood.

I knew we had reached a good bit when I started hearing people talk about “limited hangout”. Have you noticed that term, yet? Limited hangout is more jargon, of course, spy talk this time, from the CIA and the rest of the secret squirrels, for what baddies try and do when they know, as we say in Scotland, that the game’s a bogey means the game is up and those fraudsters and tricksters and over-acting villains inside their hollowed-out volcanoes realise they might well have been rumbled and so start reaching for the back-up plan.

Limited hangout is a short-term fix when the baddies realise their trousers are starting to fall down. They’re not quite around their ankles but some stuff is definitely exposed and so those chancers are forced into buying some time while they try to pull themselves back together and keep going without falling over completely.

What we’ve been handed this past week or so all the high-excitement newspaper revelations are obviously what the baddies regard as the least damaging truth about what they’ve been up to, mere tidbits really, embarrassing but still the least of it. What’s been made visible to us now on account of the baddies’ zips being down, is therefore a limited hangout.

I will come back to the movie analogy in a minute but let me digress.

Billionaire financier Warren Buffet is credited with saying that it’s when the tide goes out that you get to see who’s been swimming naked. Ain’t that the truth?

Well, the tide is quite far out now not all the way but already we can see plenty of bare bottoms. We see you, Rishi Sunak and Boris Johnson and Keir Starmer we see you MSM loudmouths and the rest of the ringleaders, in politics and elsewhere making a run for the sand dunes with your bits out. We see you. You can bleat and whine all you want about how hard you found the last three years and how much pressure you were under trying to keep up with an evolving situation, but you said what you said, and you did what you did and so much of it was wrong and lies and caused incalculable harm to millions.

What we are glimpsing now – even in the midst of the so-called limited hangout – is what we’ve known all along and that is the way the truth does, in the end, what the truth always does. Which is to say, the truth comes out.

There’s been a line out there on social media from the beginning, a meme, which has it that the truth is like a lion, the truth, like the lion, needs no protecting all that is required is for the lion of truth to be set free from its cage and then that lion takes care of itself.

The truth has a partner along for the ride, and that partner is trust. You can’t have the one without the other. What our so-called leaders and their henchmen in the media did over the past three years was abuse our trust to the point where it’s gone now.

As I’ve said before, trust is like a fragile vase. If you break it, you might manage to glue it back together, but you’d never again dream of putting water and flowers in it.

I started by talking about the movies, and movies are all about stories. An old story is The Boy Who Cried Wolf and we’ve all heard it … and we all remember it … because it’s true. It reminds us of what happens when foolish people sound the alarm without good reason. Out of a desire to attract attention and so further their own ends, foolish dangerous people cry wolf when there is no wolf. Everyone around them is briefly alarmed, fearing for their lives. But sooner or later they realise they’ve been had.

One day, of course, a wolf comes a real wolf and when that same fool cries wolf again no one comes to help. The fool is eaten by the wolf and why? Because they lied, and lied again, until the people who might have helped them had no reason to believe them, far less trust them.

Boris Johnson pushed nonsense about the danger of Covid. So did Rishi Sunak. So did Michael Gove. So did Jeremy Hunt. So did Keir Starmer and scores of others. They pushed nonsense about how to handle it as well, nonsense about Scotch eggs and stickers in the aisles of supermarkets, hand washing, face masks, social distancing and the rule of six. They pushed nonsense when they knew it was nonsense while they partied together, drank together and danced together and laughed up their sleeves together about what a bunch of mugs we were.

They cried wolf. Now there’s talk about pushing more mRNA jabs … next time for TB and smallpox and diphtheria and the rest. But what happens when billions of people have no trust whatever in that science, in those products from Big Pharma? What happens when the trust is gone?

More and more people around the world have stopped listening to scientists and stopped trusting scientists. They have also stopped listening to the cries of wolf. If a real wolf comes in the future – and there are more wolves out there than just invisible viruses – millions of people will refuse to listen to the alarm.

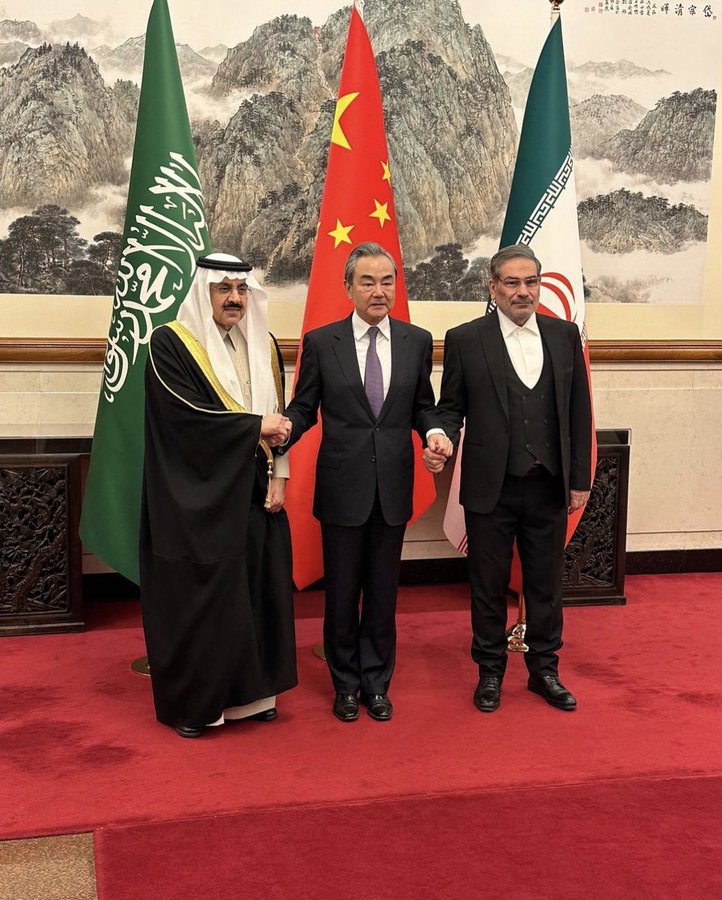

And now that the trust is gone, for so many people, more and more are questioning everything else they’ve been told by the same characters about what’s going on in the world. More and more people look at the lies and manipulative propaganda they were fed for the past three years about ONE THING, and rightly wonder if they are actually being told the truth about anything else about the war in Ukraine about the climate about immigration about the EU about food shortages about what’s being done to farmers all over the world about the real motivation behind the push for electric vehicles about the imposition of 15-minute cities.

Our so-called leaders knowingly talked nonsense that destroyed lives and turned society upside down and inside out. We know that … the people responsible are wildly exposed and cannot convincingly deny any of it. Why I ask, would anyone trust them about anything else? Liars lie, it’s what they do.

For now though, let’s, by all means, notice that it’s a good bit in the movie and we might allow ourselves to enjoy it.

It’s like when the money-grubbing lawyer in the first Jurassic Park movie tries to hide in the bamboo toilet stall only to have the T-Rex bite him in half. He’s strictly a minor character but he has put his own needs ahead of the helpless children in the movie, so it’s satisfying to watch him get caught, exposed by his cowardly nature, and gobbled up.

This is the bit when Alan Rickman’s baddie in Die Hard realises Bruce Willis is running loose with a machine gun.

This is the bit when Indiana Jones realises the big guy only has a sword, while he’s got a revolver full of bullets.

It’s important to remember the movie has a way to go yet. More clumsy twists for sure … more bad acting in the world of politics which, as we are regularly informed, is only showbiz for ugly people.

Here’s the thing: I sincerely believe that now the truth is partially revealed, if we can only find the strength to keep pushing … then the really, really good bits of this movie lie ahead. Like the bit in A Few Good Men – when Jack Nicolson plays the colonel in the dock and Tom Cruise is the underdog attorney.

Jack’s colonel does not like one bit being challenged by upstart Tom’s character about how Jack chooses to do what Jack does. Jack is angry enough to kick a puppy through a fan

When Tom finally demands to hear the truth about how a young soldier died under Jack’s watch. Jack finally loses it completely.

“You can’t handle the truth!” he roars and he evidently believes what he has just bellowed. He actually believes that Tom and the rest of the general population lack the mental circuitry to contemplate, far less to deal with, what he does down there in the darkness out of sight.

But it’s the best bit in the movie and Jack is caught out and his ass is grass and we know it.

When you get right down to it, his undoing has been no more complicated than that he has been caught lying.

Of course, the other thing we learn from watching movies is that it’s never, never safe to take your eyes off the adversary the first time they go down … the first time they seem to be finished.

We have to stay sharp and be ready for the bit when Glenn Close’s character is lying quietly in the bath in Fatal Attraction, eyes wide open and no bubbles coming out of her mouth.

Right when we think we’re safe, she’ll sit back up again with her yelling and her knife. We must pay attention.

More and more I think about the disaster movies – and if this isn’t a manmade disaster, we’re living through right now then I don’t know what it is.

I think about when the survivors step blinking out of the smoke and darkness to confront a ruined White House and a toppled Statue of Liberty … or a burning Big Ben and a flattened GCHQ. They realise, those survivors, that what they thought mattered was, in the end, just a house, just a lifeless lump of copper and steel, just a bell tower, just an office block.

Those survivors look around at the devastation, the receding flood waters of the tsunami, and realise they were caring about stuff that didn’t amount to a hill of beans. They get ready to start again with all that really matters, which is people they can trust, which is each other. If we have that, then we have all that we will need. Pass the popcorn.