Posted originally on the CTH on January 1, 2024 | Sundance

In this outline I am going to expand on the details previously discussed {HERE}. You won’t find this in any financial media discussion, and there’s only a handful of people I know in the west who really understand the ramifications. Fortunately, one of them is running for President.

First some non-pretending context. If you are a Friedman-ite, finance major from any traditional academic institute – including Wharton, and/or a person who uses data models to frame analysis about economics and finance, without the capacity to put all of your traditional reference points in the trash heap of irrelevance, then just move along. We ain’t got time for that.

Consider Austan Goolsbee and Bill Ayers having dinner talking about what would happen if they successfully de-dollarized the globe. Austan comes at it from one perspective, Bill from another. Bernardine Dohrn smiles, because neither of the Chicago dinner guests has any idea what would really happen in this ideological landscape; no one really does.

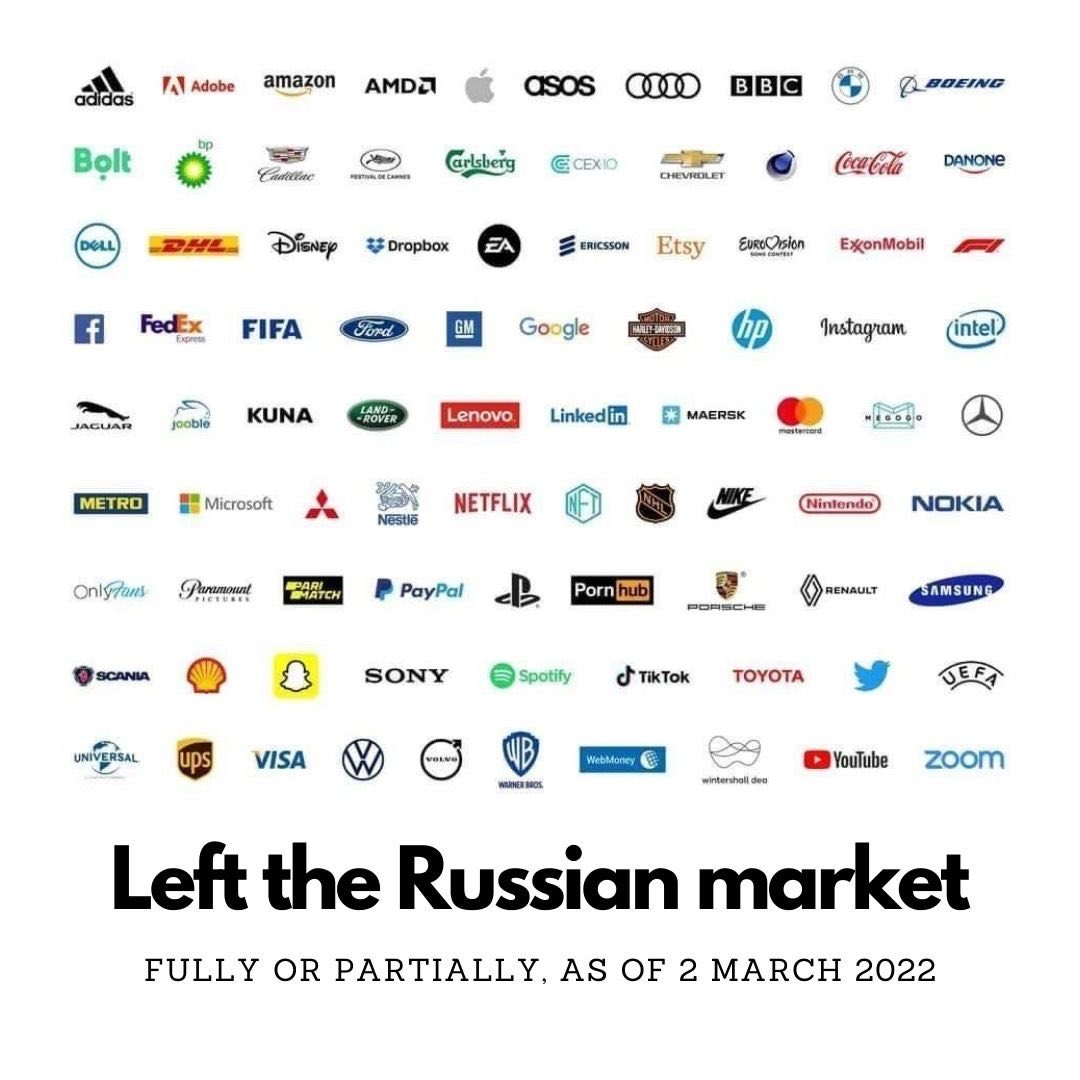

I first sounded the alarm on this on March 2, 2022, almost two years ago {SEE HERE}.

In the ideological DoS/CIA/WEF/Western banking frenzy to punish the horrible Russia, I took a different approach. I overlaid the human factor with the geopolitical reality of financial control mechanisms. I predicted a cleaving outcome, because I carry no assumptions. That’s the context.

Additionally, I’m not coming at this situational analysis having relied on charts, graphs, trade analysis, Western finance systems or actuarial constructs of monetary manipulation by central bankers. Nope. I sat quietly inside small to medium-sized regional banks in Western Europe and listened to the reality of what businesspeople are doing, actually doing, in their operation of their enterprise as it relates to finance and Russia. {Go Deep}

This is where the razor’s edge outcome of the cleaving, the “yellow zone” -vs- “grey zone” construct, meets reality.

What we will witness this year will be one of the biggest stories of 2024 that will impact every American. However, few people will understand the information that will slowly trickle toward us, because too few people analyze information without historic assumptions.

When the “West” (yellow zone) triggered the sanction regime against Russia, almost no one took a big picture overlay and asked, “What about those nations who do not align with the Western intent; what will they do?”

Russia is not an enemy of the world; in fact, they have good relationships with China, Iran, India, multiple Middle East nations including Syria, Egypt and Saudi Arabia, and several Eastern European as well as African countries.

When the USA was walking away from the Arab Spring crisis Obama created, it was Russia who stepped in to help stop radicalization; just ask President Abdel Fattah al-Sisi.

Even NATO ally Turkey has an ongoing diplomatic and strategic friendship with Russia; that’s why Turkish Airlines operates as the best transportation company for travel into and out of Russia.

In fact, when the proverbial West triggered the sanctions against Russia, approximately one-third of the global GDP was not in alignment. A trade system that represents roughly 40% of all global production and trade (grey) can sustain a targeted enemy, while the 60% (yellow) allows complacency, hubris and delusions of grandeur to create an echo-chamber.

In essence, the “West” targeted Russia, but Russia had friends.

Those friendships expanded when the international fence-sitters saw how extreme and hateful the USA was going to be. How long before they, country xxxx might upset a USA administration? Who wants to be blackmailed by a similar targeted financial control system that the USA/EU and West triggered.

You might not think this Western sanction ‘shock value’ was a factor of importance, but two years later evidence suggests it was a much bigger deal than anyone was willing to admit.

De-dollarization is underway; failing to admit or accept this reality is akin to retaining a great pretense. The outcomes are only just now beginning to surface, and when we are trapped inside the Western zone, we cannot see, quantify or fully appreciate it.

India is trading with Russia in national currencies, not dollars. Iran and Russia are trading in national currencies, not dollars. China is trading with Russia in national currencies, not dollars. This process is expanding not shrinking, and it has huge outcomes.

If trades between nations are not contingent upon dollars, then less dollars need to be purchased. Less U.S. treasuries are purchased to back up the trade. Less dollar demand means lower dollar value. This process is only just beginning, and we cannot see it. The only way to see it is to step out of the yellow zone and look at the costs of goods and services in the grey zone.

Dollars are still in demand for anyone who wants access to the USA or EU market, so this de-dollarization process is limited in scale right now. But again, it’s expanding – meaning the demand for dollars is less.

Inside the Yellow Zone we cannot see the shift, but we can see the signs of a less demanded dollar in the prices of goods and services in the yellow zone. Inflation runs high in the Western zone as this devalued dollar begins to become more of an issue.

When we talk about “inflation” it is critical to keep in mind we are not ONLY talking about the price of goods. Yes, goods are one component to increased costs of living; however, financial service products like insurance costs (health, life, auto, homeowners etc.) are part of the equation where we see the inflationary impact of de-dollarization running amok. The financial services are closely related to the overall finance sector (think banking), so those skyrocketing costs hit first and become the precursor.

Next in the inflationary scale of impact comes the energy costs, which – as a direct and consequential outcome – transfer into the increased costs of goods, via packaging, processing, manufacturing, transportation, warehousing, etc. The overall business costs for insurance and financial services then aggregate with the energy cost impact and amplify the issue.

You can argue whether the current cost drivers or inflationary reality was a feature (intent) or a flaw (short-sighted outcome) of the western sanction regime, in combination with the intentional Build Back Better energy shift.

Austan Goolsbee might say it’s an accidental outcome, while a more radical communist like Bill Ayers says it was intended.

Personally, I think it was absolutely an intended feature, created to pave the way for a digital Western currency; that’s what it looked like in March 2022, and that’s what it still looks like today.

Regardless of intent, the reality is here…. barely visible right now, but here, and the de-dollarization is growing.

That opaque visibility is what I am talking about becoming much clearer in 2024. Eventually, people will start to ask questions about why the cost of products inside the yellow zone is so far out of sync with identical products and services inside the grey zone. {GO DEEP} The only way to see it, is to travel to both.

Now bring back the traditional Goolsbee economist thinking. If domestic prices continue rising (de-dollarization outcome), then domestic wage rates will need to rise in order for people inside the yellow zone to cope. Unfortunately, as Austan would lament, this dynamic becomes a self-fulfilling prophecy for even higher prices….

True… But why is Bernardine smiling?

“Maybe,” she says from the kitchen, as Austan squints and tilts his head with curiosity.

Bill smiles and replies, “I think she says ‘maybe’, because the surest way to avoid that dynamic is to import mass volumes of cheap low-skilled migrants as an offset.”

Austan looks even more curious as Bernardine says, “Yup, if ‘Western govt’ wants to align favorably with WEF corporate needs, then let the government give the corporations the means to avoid higher wages by allowing mass migration.”

Austan sits with jaw agape as Bill finishes the discussion and drops the mic. “If, for the sake of argument, that was indeed the plan, then specifically due to the nature of the USA dollar being the most severely impacted, it would be the borders of the USA that would need the highest rise in migrant crossings.”

Huh.

Go figure!

A.R ROBERTS …”I come here to the treehouse to get my morning dose of doom and gloom, lol. Everything I hear from SD and other alt-media people paints a very bleak picture. It’s like watching an 18-wheeler going down a steep grade with no brakes and no way to stop it. What you’re talking about SD is our imminent death at the hands of these insane inbred billionaire genocidal whackos. There seems to be no political solution to our situation. They will either terrorize us if we resist their death by a thousand cuts or drag us off to a Gulag or an extermination camp.

Tell me, please, what options do we have left? They have us boxed in and control an absolute police state. How about giving us some hope, some solutions?

I feel alone. Almost every “conservative” around me has their heads in the sand with bread and circuses. They think the stock market is doing great. They think everything is going back to normal. The libs in my family think anything is better than Trump in office. They are oblivious. They think I’m being a Chicken Little. It’s pretty damn depressing. Why should I stick my neck out to fight for any of these morons? It would almost be satisfying to watch them suffer from their ignorance if it wasn’t so tragic for the rest of us.”…

Instead of writing another article, I will show you the solution. At least what the solution should look like, albeit in a USA version. Let’s call it America First.

Economic nationalism. Make America Great Again, economically.

Stop the de-dollarization by Making Dollars Great Again!

Make dollars valuable.

Make the USA more valuable.

Tell me if you see value in this video.

Tell me if you understand.