Posted originally on the conservative tree house on August 17, 2022 | Sundance

Not wanting to put too much credibility behind any Newsweek report; however, the claims within the article mirror what we have suspected all along. [Article Here]

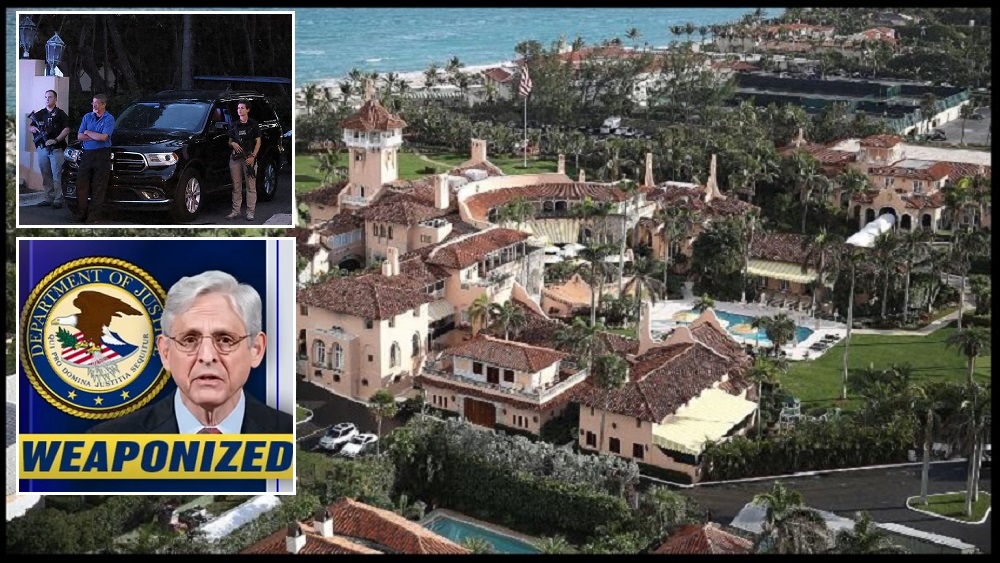

Essentially, the nub of the article states the DOJ claim to “retrieve federal documents” was a cover story so the FBI could retrieve evidence Trump took from DC showing his Russiagate targeting. This is called “throwing a bag over it.”

Newsweek – The FBI raid on Mar-a-Lago last Monday was specifically intended to recover Donald Trump’s personal “stash” of hidden documents, two high-level U.S. intelligence officials tell Newsweek.

To justify the unprecedented raid on a former president’s residence and protect the source who revealed the existence of Trump’s private hoard, agents went into Trump’s residence on the pretext that they were seeking all government documents, says one official who has been involved in the investigation. But the true target was this private stash, which Justice Department officials feared Donald Trump might weaponize.

“They collected everything that rightfully belonged to the U.S. government but the true target was these documents that Trump had been collecting since early in his administration,” says the source, who was granted anonymity to discuss sensitive issues.

The sought-after documents deal with a variety of intelligence matters of interest to the former president, the officials suggest—including material that Trump apparently thought would exonerate him of any claims of Russian collusion in 2016 or any other election-related charges. (read more)

In a lengthy four-part series, what is described in the Newsweek article essentially tracks with our own review.

In Part One we outlined the background of the modern Deep State {Go Deep}. In Part Two we outlined the specifics of how President Trump was targeted by political operatives using tools created by the DC system {Go Deep}. In Part Three we outlined how and why President Trump was blocked from releasing documents {Go Deep}. In Part Four we outlined the specifics of what documents likely existed in Mar-a-Lago {Go Deep}.

Take out the leftist slant intended to make President Trump look like he did something wrong, and the Newsweek article sounds mostly accurate.

[ READ CTH PERSPECTIVE HERE ]