QUESTION: Hi Mr. Armstrong…Thanks for trying to settle our confusion re: Griffin’s “Creature” You make a distinction between Gov’t mandated debt & Fed helicopter money. But isn’t debt still just debt?

Also, you seem to be saying the Federal Reserve is a necessary evil (maybe not even evil), & that central banks & fractional reserve banking are a fair & honest system. All very confusing.

I believe you could more easily enlighten our Neanderthal economic brains by simply describing your version of a near perfect monetary system, that’s also immune from political interference. Maybe call it “The Armstrong Guide to Perpetual Prosperity”

We’re NOT mocking you. Would love to see this as would 99% of your readers.

Wishing you a long & healthy life. We need you.

HS

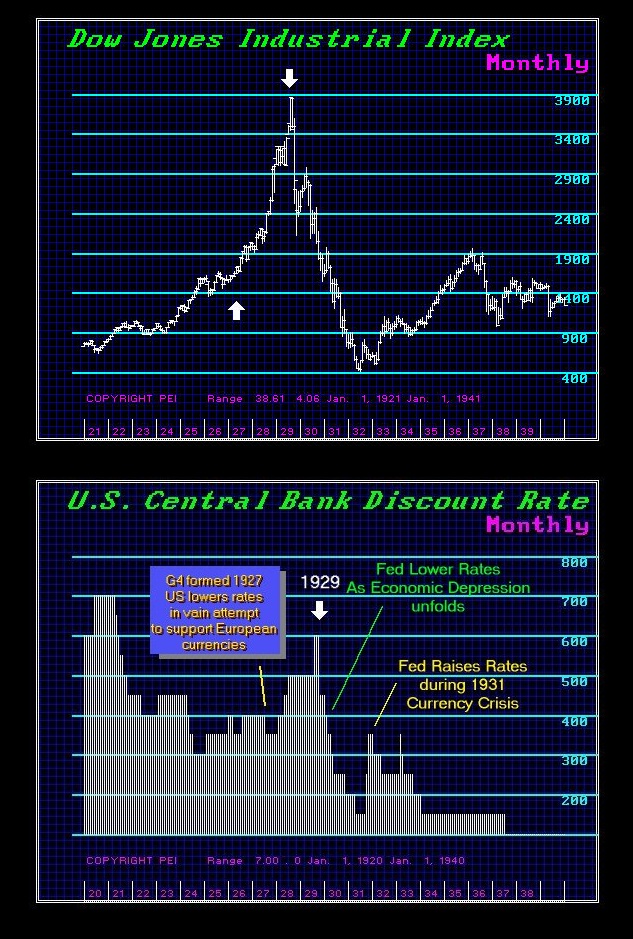

ANSWER: I understand this gets confusing because people have taken one tiny stone and assume the entire mountain is the same. The Fed was created to be funded by the banks themselves to effectively be their bailout institution. As I have written before, the Fed “stimulated” for it was authorized to buy ONLY corporate paper when banks could not lend. Because of WWI, the politicians directed the Fed to only buy government debt and never returned it to its purpose. It is nothing like what it was designed to do.

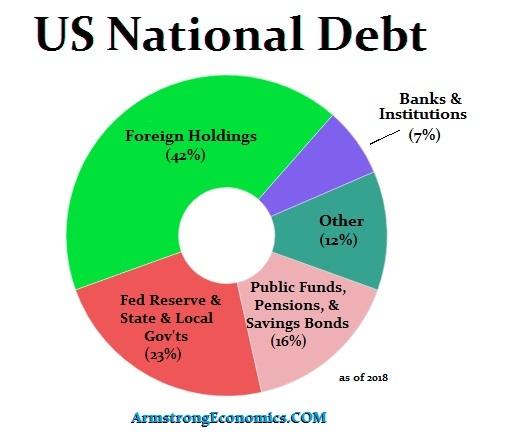

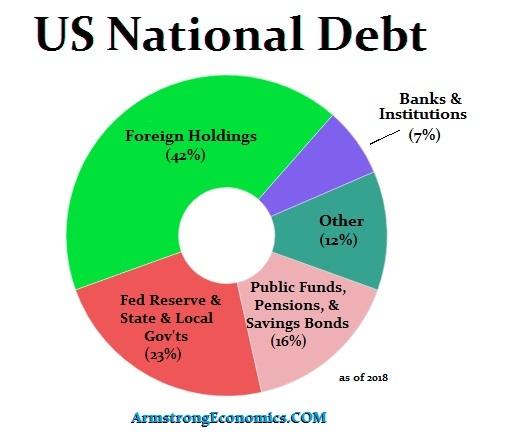

There is no such thing as Fed Helicopter Money. That is another absolute absurd proposition. The Fed can create elastic money, but it is effectively backed by the debt they purchase. The entire Quantitative Easing was by NO MEANS the creation of money out of thin air. They were buying in government debt which is in itself simply money that pays interest. The Helicopter Money these people argue was supposed to create hyperinflation only revealed that the people who call it that actually have no idea what they are talking about. They pretend that the money was just created with no backing. But it was buying in government debt. The REAL MONEY supply is not simply cash, it includes the entire national debt BECAUSE debt is now collateral and can be used in the economy. The economic reality was simply moving money from your left pocket to your right. The supply remained the same. That is why Quantitative Easing failed to work. The real creation of money is the debt and the difference is significant for it is money that pays interest requiring the creation of ever more debt.

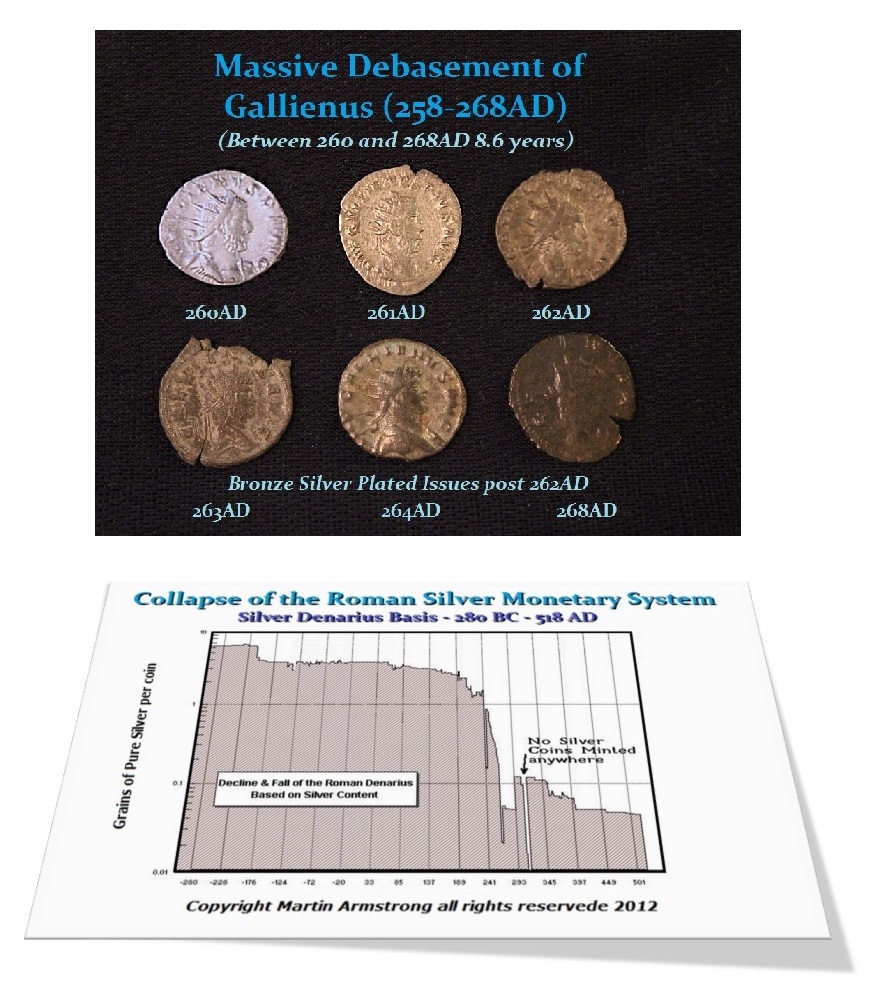

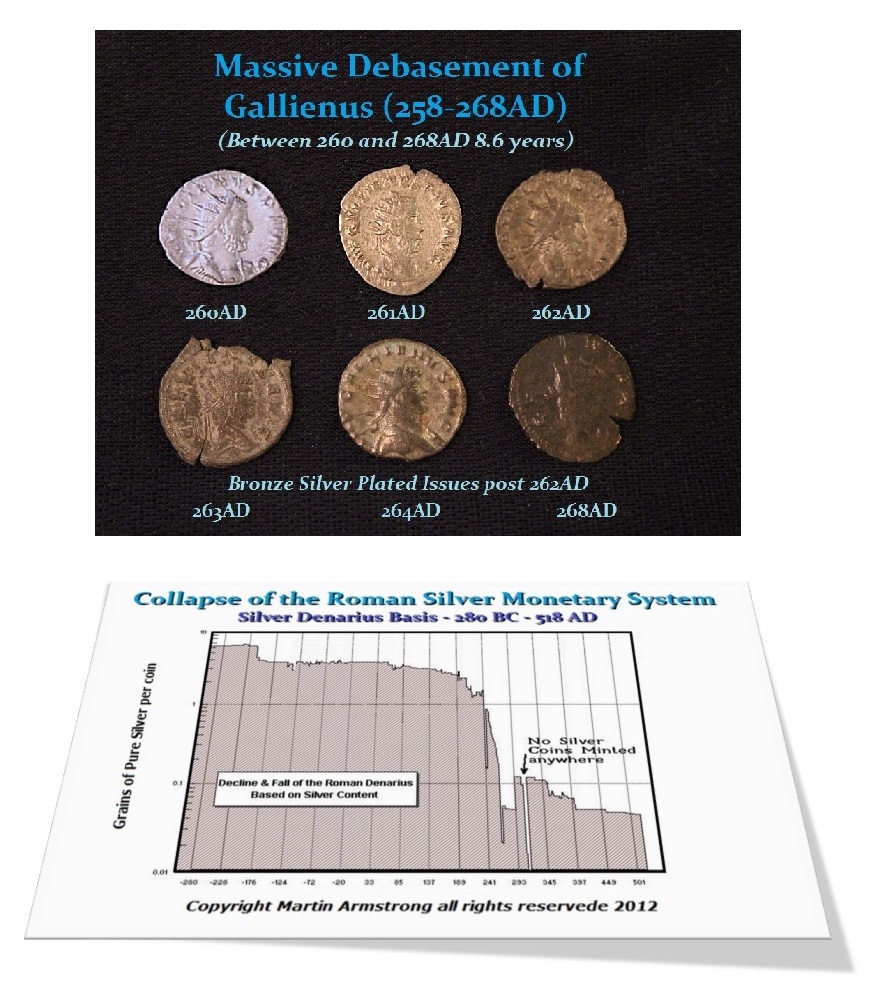

The PERFECT monetary system is one in which there is no debt. Rome lasted for 1,000 years BECAUSE it had no debt. It did use MMT insofar as it created money each year to fund itself. The great debasement took place during the 3rd century when Emperor Valerian I was captured by the Persians in 260 AD and forced to be a slave to the Persian King. That broke confidence in the government; people freaked out and began to hoard everything.

The first criteria are TERM LIMITS and the elimination of any power to borrow. No spending bill may be merged with another. Every bill must stand on its own and the people must vote by a computer on each bill. They cannot be passed without more than 50% of the people voting. Therefore, we restore a DIRECT form of Democratic government. There may be no law that is based upon any religious belief or seeks to impose any restriction upon any race, gender, or sexual orientation. Some people will object. But we must understand that we have to protect even people we disagree with in order to protect ourselves. There can be no exception to basic rights. Arnaud Amalric, prior to the massacre at Béziers, was reported to have said: “Novit enim Dominus qui sunt eius,” which is a direct translation of the Latin phrase “Kill them. For the Lord knows those that are His own.” It is not our station to sit in judgment over others pretending to know what God wants. That is his role, not ours. Laws should never be allowed to be written for the purpose of forcing the belief of one group upon another as we have today with the left v right.

Next, we must eliminate all forms of Direct Taxation (income tax), which requires people to report to the government even to confirm you are not rich. All taxation MUST be indirect as the Founding Fathers intended. The people will pay taxes based upon their consumption. Naturally, raw food and rent should be exempt. Then you cap the government expenditure at a max of 5% of GDP, not to exceed the population growth rate.

Money is simply the medium of exchange. It is NEVER a reservoir or store of wealth. It is merely the unit of account that is no different from a language. If someone says something to you in German, you immediately try to translate it to your native tongue to understand what they said. Money serves the same function. We call Trump a billionaire, not because he has cash in the bank, but because people look at his assets and translate them into money to judge his worth. That is the role of money. We must understand and embrace it. Only then can we comprehend a monetary system.

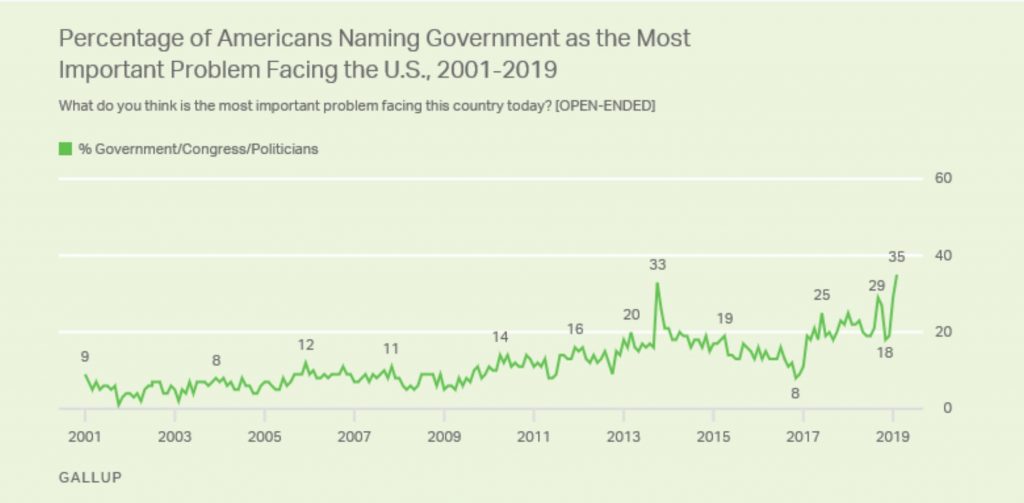

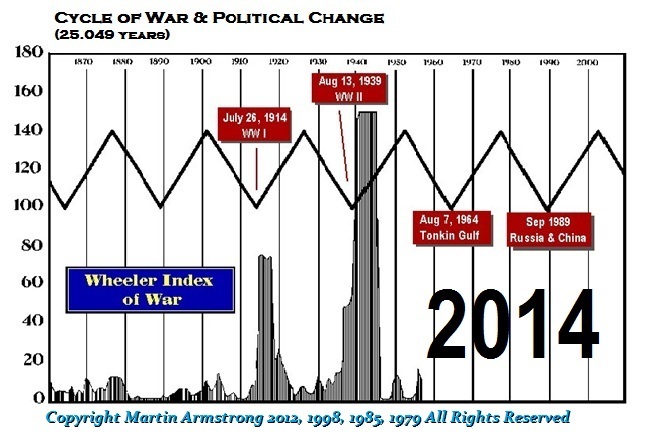

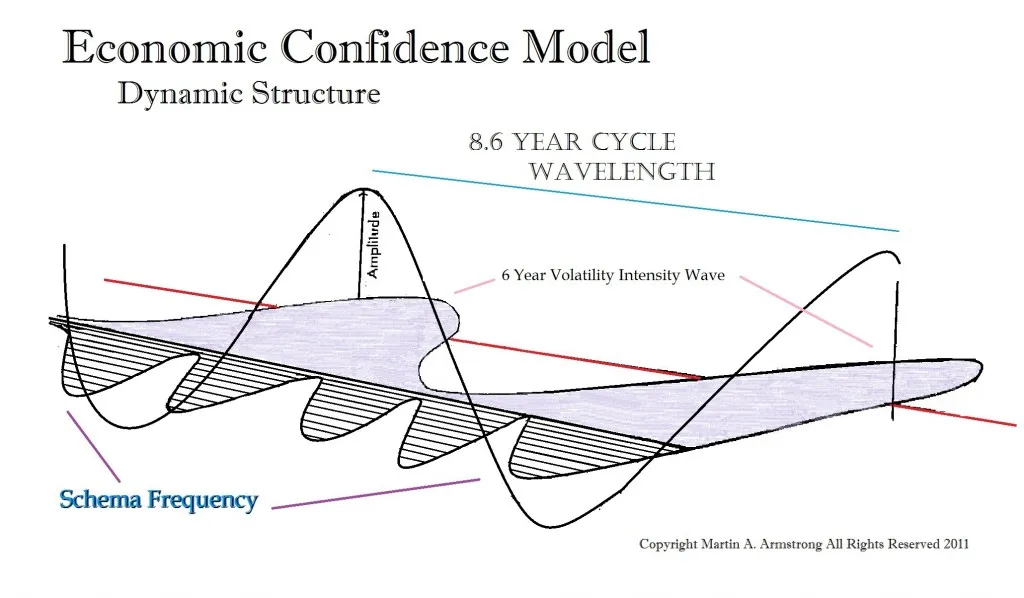

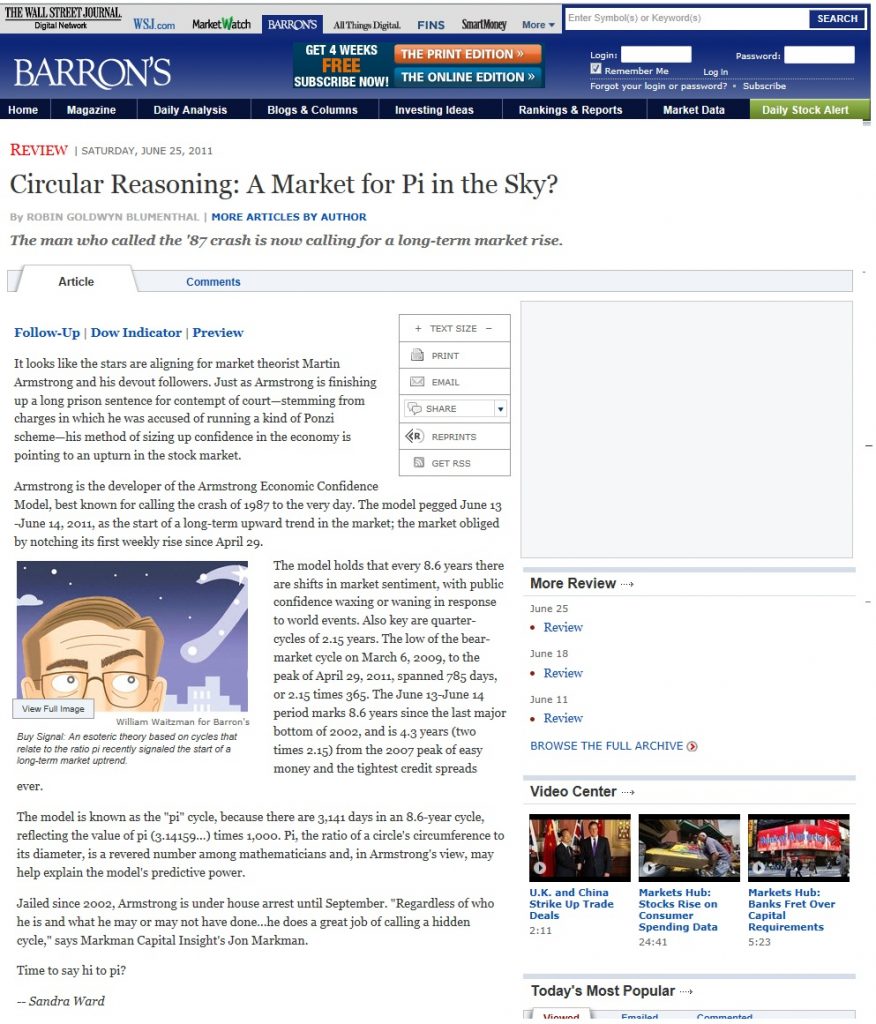

These are just a few of the necessary elements. The crisis is NEVER the quantity of money. It is those who seek to rule us from above. Direct reform at the powers that be and the monetary system will quickly fall into line. There is no possible “perpetual prosperity” because everything is connected and nature also plays a role in the business cycle. Marx to Keynes have all tried to create the perfect system that will produce endless prosperity. That is an impossible fictional dream.

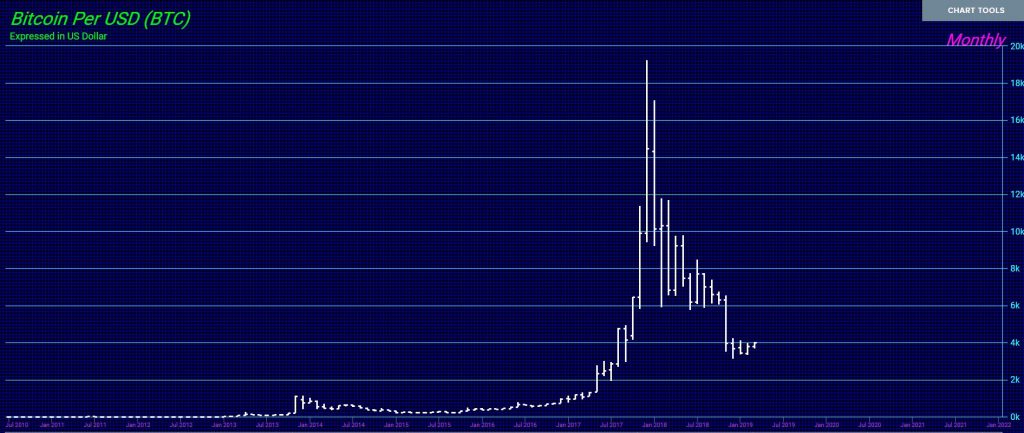

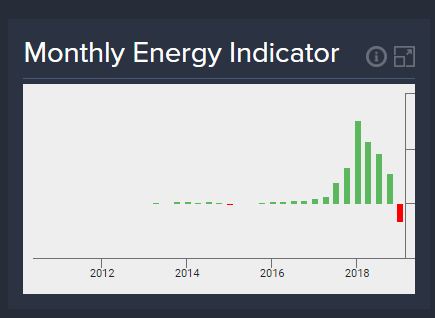

Money itself is NEVER a store of wealth. It rises and falls against tangible assets. I have stated plenty of times that Bitcoin is a trading vehicle — nothing more. Just look at the chart. This fluctuates like everything else. That alone proves it will never be some mythical store of value or reserve assets. Our Energy Models have turned negative so it has squeezed out most of the excess which would allow it to make a rally if it exceeds the Weekly Bullish Reversals (see Socrates report for further details — available to subscribers only).

Money itself is NEVER a store of wealth. It rises and falls against tangible assets. I have stated plenty of times that Bitcoin is a trading vehicle — nothing more. Just look at the chart. This fluctuates like everything else. That alone proves it will never be some mythical store of value or reserve assets. Our Energy Models have turned negative so it has squeezed out most of the excess which would allow it to make a rally if it exceeds the Weekly Bullish Reversals (see Socrates report for further details — available to subscribers only).