Armstrong Economics Blog/Politics

Posted Feb 22, 2020 by Martin Armstrong

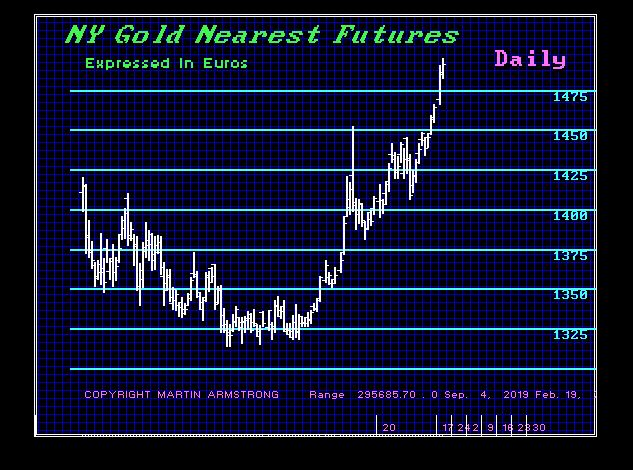

Just to let everyone know, since more than 50% of our clients are outside the USA, we have a very international reach with sources around the globe. Get prepared for volatility next week. Despite the Democrat’s personal hatred of Trump, the international view is that Trump is the ONLY sane leader in the world right now. The world is leaning so far to the left everywhere, capital is deeply concerned about where to hide. The #1 question we are getting from overseas:

What if Bernie beats Trump?

Capital can flee and seek shelter offshore. Labor cannot hoard itself nor move offshore. The average person is stuck for they cannot protect their labor so the working guy suffers the arrows that come from politicians who never understand that capital will just abandon their crazy agendas leaving only the wage earner to pay the bills which ends in revolution.

Bloomberg is the authoritarian dictator whose staff has just been “yes sir” and that was self-evident in his debate skills. He could not respond to negative attacks because he was not use to that. Bloomberg is really is no match for Trump no less Bernie. Despite all his money, he did not even make a respectable showing. He cannot buy the White House. Hillary tried that and spent 10x what Trump did and still failed.

The Democratic elites are beside themselves. They are not going to take this lightly. In United States politics, a brokered convention (sometimes referred to as an open convention and closely related to a contested convention) can occur during a presidential election when a political party fails to choose a nominee on the first round of delegate voting at the party’s nominating convention.

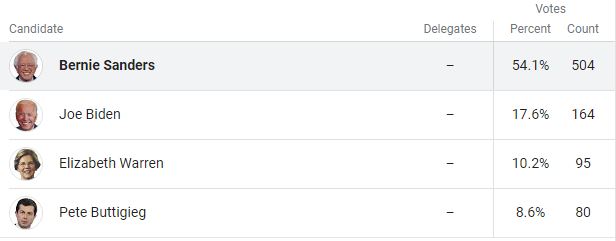

This time, the unpledged delegates, better known as superdelegates, will make up about 16% of Democratic Party delegates in 2020. These are the real party insiders who are not committed to voting based on the outcome of the state’s primary or caucus which flies in the face of the very purpose of primary voting. As Stalin said about elections, it is not the votes that matter, but who counts them.

The 2016 election was stolen from Bernie when many superdelegates announced early support for Hillary Clinton. The Democrats have claimed that they made a significant change for 2020. Superdelegates will no longer vote on the first ballot at the convention unless there is no doubt about the outcome. To win on the first ballot, the frontrunner must secure the majority of pledged delegates leading up to the Democratic Convention. There are 3,979 total pledged delegates, so they are supposed to use the total required being 1,991. There is a loophole. If they can prevent Bernie from a majority on the first ballot, Hillary takes 16% again and they will then flip to her camp. That assumes they abide by this latest rule and do not change them again.

We are looking at the split of the Democrats for the elites are not about to accept Bernie and they will lose the financial support of both the corporates and the 1%. The rumblings are to draft Hillary. That will most likely be the straw that breaks the back of the Democratic Party.

Meanwhile, brace yourself for while markets next week. We may begin to see European and Asian liquidation of equities in fear of the 2020 election ahead.