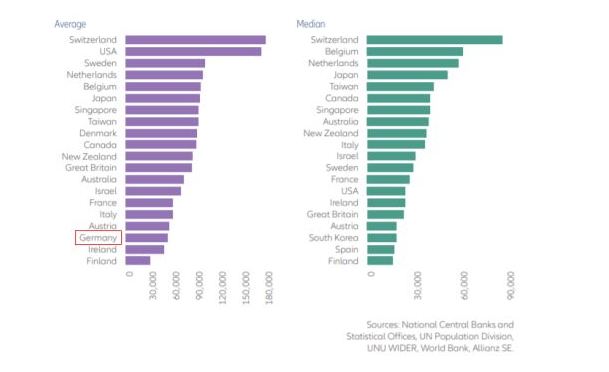

At the current federal minimum wage of $7.25 per hour, working 40 hours per week, 52 weeks per year, yields an annual income of only $15,080. This is below the annual poverty line. It also reflects something that most people are unaware of — in Illinois, there are more than 19,000 retired teachers who get OVER $100,000 per year in their pension. According to the latest data, nearly 1.5 in ten federal employees are eligible to retire RIGHT NOW, and in five years the number will hit three in 10 or about 30%. The Housing and Urban Development Department in the federal government has the highest rate of employees eligible to retire right now of any major agency in government, which stands at a shocking 24%.

Under U.S. law, there are two broad types of retirement plans: defined-benefit (DB) and defined-contribution (DC) plans. The Defined-benefit plan has been mostly abandoned in the private sector because they were rapidly revealing how they failed to work. The DB plan use to come with a gold watch and ensured you some level of benefit for the rest of your life. This was all part of how to prevent another Great Depression. Typically, your employer would invest part of your compensation in the plan based on some formula. In some cases, you, the worker, might have added more money to the pot. The employer was required to send your defined benefit each month or quarter to a fund. Typically, this was in the form of a fixed-dollar amount, sometimes with periodic cost-of-living adjustments. That scheme ran into trouble that set standards for private-sector pension plans and defined their tax benefits under federal law because government wanted a piece of the action due to income taxes.

Most state and local government employees, actually 87% of those working full time, participate in a defined benefit (DB) pension plan. They contribute nothing but are simply guaranteed a pension on top of what they earned. These plans typically provide pensions based on members’ years of service and average salary over a specified period before retirement. On top of that, most members also receive cost-of-living adjustments that help maintain the purchasing power of their benefits during retirement. In the private sector, where defined contribution (DC) or 401(k)-style plans dominate, only 19% of full-time workers belong to DB plans. This is the real PENSION CRISIS. Government workers generally contribute nothing and demand tax increases to fund their pensions.

The DC plans emerged when the DB plans were showing signs of economic stress. The handwriting was on the wall. As taxes rose, the standard of living declined and governments wanted to regulate pensions to prevent too much money going into tax-free vehicles. The 401K is a kind of defined-contribution plan (as are various types of IRAs/Keogh/SEP plans, etc.) which emerged under the DC plan structure. Government regulations govern who puts money into the plan and how much. Typically, it’s you and your employer. Your employer also has to give you some reasonable investment options, but it’s up to you to use them wisely. Good luck. Most people have discovered nothing but losses. The advice for the general public has been biased, subject to conflicts of interest, and fragmented. This is because we have fragmented agencies (i.e. SEC & CFTC). The CFTC is regarded as the unqualified regulator. The lawyers there are the people who generally are turned down by the SEC. But the real crisis is that the regulations under the SEC and CFTC are exactly opposite. If you managed money under one agency’s rules, you went to jail under the other. This resulted in the development of offshore hedge funds where you paid a manager to make all the decisions, whereas domestically, a manger in stocks could not also advise on commodities. This resulted in conflicts of interest and has seriously harmed average people in understanding how to manage their own 401K.

Therefore, regulations have prejudiced the private sector while the public sector is predominantly under DB plans where government workers have no decisions they confront. This stark difference is coming to a head. Before 2032, there will be more people on retirement from government than actual workers. Taxes have NOWHERE to go but up dramatically because nobody is willing to look at reform. The new Modern Economic Theory is their answer — just print.