Armstrong Economics Blog/Banking Crisis

Re-Posted Mar 3, 2019 by Martin Armstrong

I am writing from Frankfurt here for meetings ahead of the chaos awaiting the May elections. In Frankfurt, while the economy is clearly slowing, the financial capital is booming. New skyscrapers are rising to join those of Commerzbank, Deutsche Bank, DZ Bank, Helaba and others on Frankfurt’s skyline. This is another sign that there is a disparity between the financial world and the main street.

Nevertheless, behind the facade is a weakening banking sector that the ECB seems to be inspiring. Forcing negative interest rates where the banks must pay the ECB 0.4%, their rate of return on equity has fallen into a crash mode. The German banks’ average earnings have dwindled from once 4% back in 2010 to barely 1% into last year. Deutsche Bank, the biggest, tried to compete with Wall Street and paid the price. After four years of losses, finally, in 2018, Deutsche Bank made its first annual profit which was just a 0.4% return on equity.

As always, politics enters the game rather than logic. The German government wanted to see a Commerzbank and Deutsche Bank merge and offered some undisclosed assistance. That assistance would most likely be writing off a portion of the 15% the German government still owns of Commerzbank, which is the legacy of a bail-out and a merger with the stricken Dresdner Bank back in 2008-2009. The government does not own shares in Deutsche Bank.

The books of Commerzbank show the same problems as in Deutsche Bank so a merger between the two does not appear to solve any crisis. There are in addition rumors that Commerzbank is being considered by both French and Italian banks for a takeover. The prospects of a merger with Deutsche Bank from a non-German bank may be too ambitious politically speaking.

The German government is coming under great stress for the two biggest banks are not really very healthy at this moment and suitors are foreign – not German. Deutsche Bank could be merged with the French BNP, but that would be a loss of pride. Meanwhile, the management at Deutsche Bank would prefer a deal with Switzerland’s UBS. A previous German bank, HVB of Munich, was taken over by Italy’s UniCredit. That was one embarrassment politicians seem reluctant to repeat. The bail-in policy was devised because politicians did not want to have to contribute to bank failures they saw as inevitable in Southern Europe. To have foreign banks eying up German banks, the pillar of the EU, somehow strike a deep blow into the political heart of the EU.

The ECB’s negative interest rate policy is seriously harming European banks yet they cannot figure out an alternative without having to admit there is a major flaw in the entire structural system in Europe. Forcing banks to pay the ECB to deposit reserves is really absurd.

What is most interesting is that the emotions are running high over issues such as BREXIT and the Euro Crisis. It appears that analysts from major institutions are not allowed to discuss anything to do with debt consolidation. This appears to be off the table for discussion. The proposals to create a Euro Bond are separate and distinct leaving the current national debts to be held by each member state. That hardly removes the threat of one member failure impacting the whole of the EU.

Meanwhile, there is a silent move to reduce exposure to Italian debt held by non-Italian institutions. There remains a concern that Italy could possibly follow Britain. There is growing respect that even the hint of such a possibility that Italy would withdraw from the Eurozone can result in a sharp decline in the value of Italian debt even if they never move to actually exit the Eurozone. Italy was one of the original founders of the Euro.

Overall, there appears to be a general consensus that everyone should just keep the Euro at all costs. However, without major structural reforms, it is hard to see how the problems will not take on a life of itself. The refusal to consider a debt consolidation leaves the Euro vulnerable to the politics of each member with rising popular trends in politics.

The Eurozone’s third-largest economy, Italy, already has debts of about €2.3 trillion euros, which is the equivalent to 132% of its GDP. However, it takes more than 4% of Italy’s GDP is now being used to service its debt load and this is with historically low interest rates. There are concerns behind the curtail that Italy can play a game of chicken. If they decide to leave the Eurozone, what about all the Italian debt held by the ECB? Who will lose? The Italians, Brussels or the financial markets as a whole?

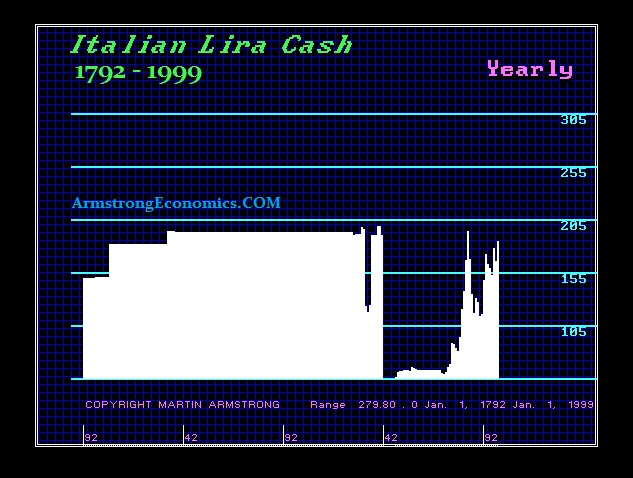

The lira was the official unit of currency in Italy until January 1, 1999, when it was replaced by the euro (euro coins and notes were not introduced until 2002). Old lira-denominated currency ceased to be legal tender on February 28, 2002. Beginning on January 1, 1999, all bonds and other forms of government debt by Eurozone nations were denominated in Euros. The value of the Euro, which started at USD 1.1686 on December 31st, 1998, rose during its first day of trading, Monday, January 4th, 1999, closing at approximately US$1.18. The Euro replaced the former European Currency Unit (ECU) at a ratio of 1:1 (US$1.1743).

Converting its national debt at 1.18, only resulted in economic chaos that devasted Italy. Whatever it owed previously in lira was suddenly now Euro. They experience their national debt doubling in real value the same as if you borrowed in Swiss franc for a mortgage that saw the Swiss franc double in value. With the Euro trading in the 1.13 level, it is finally below the original conversion rate but even that ignores all the costs of services at high price levels.

By no means did Italy benefit from joining the Eurozone. To participate in the new currency, member states had to meet strict criteria such as a budget deficit of less than 3% of their GDP, a debt ratio of less than 60% of GDP, low inflation, and interest rates close to the EU average. Both France and Germany have been over that 60% level. France’s debt is currently at 97% of GDP while Germany is at 64% of GDP. Italy is 138% of GDP and Greece is at 178%. The Netherlands is at 56.7% of GDP, Austria is at 78.4%, Belgium is at 103% while Spain is at 98%. For comparison, the USA stands at 78%. This strict criterion has really failed to work and it was all mandatory simply because they refused to consolidate the national debts from the outset.

Greece failed to meet the criteria and was excluded from participating on January 1st, 1999. Eventually, Greece joined the Euro with the help of manipulations by Goldman Sachs on June 19th, 2000 when the drachma was fixed at 340.75.

This tour here in Europe is most interesting for the concerns are rising and there is a clear flight from Italian debt. Some of the most conservative portfolios in Europe have raised their exposure to the dollar from 5% to 30% which was attributed to the significant rally in the Dow since December. We even have central banks buying gold in search of diversification and a hedge against the uncertainty on the horizon come May. Needless to say, we have selected Rome for this year’s midterm WEC for this is the center of political attention behind the curtain.

Peak in Investment Grade Corporate Debt Matures by 2021

Armstrong Economics Blog/Interest Rates

Re-Posted Mar 2, 2019 by Martin Armstrong

We have a very interesting crisis building in addition to the political chaos we see coming in 2020. By the time we reach 2021, we will have over $2 trillion in investment grade corporate debt maturing. This is going to present some very interesting problems. Up to now, we have advised our corporate clients to borrow at these rates and lock it in for 30 to 100 years. The bulk of corporations, who we do not advise, funded themselves short-term. With about $2 trillion maturing by 2021, they will end up pushing interest rates higher from there onward.

GDP Release: 4th Quarter Growth 2.6%, 2018 Annualized 2.9%, 2018 Yearly Real GDP 3.1%…

February 28, 2019

The Bureau of Economic Analysis, BEA, finally released the fourth quarter growth rate estimate for 2018. The 4th quarter growth result at 2.6% exceeded expectations, and shows the U.S. economy is growing stronger than almost all economic forecasts.

WASHINGTON DC – In the fourth-quarter, U.S. gross domestic product grew at an annualized rate of 2.6%, according to the latest data from the Bureau of Economic Analysis.

Thursday’s report beat expectations, with consensus economists polled by Bloomberg looking for growth to slow to 2.2% during the final three months of the year. The domestic economy grew at a pace of 3.4% in the third quarter and 4.2% in the second quarter.

Despite the softening in GDP in the fourth quarter, overall growth in 2018 was solid. Real GDP grew at a pace of 3.1% in 2018, measured from the fourth quarter of 2017 to the final quarter of 2018. This represented a stronger pace of annual growth than the 3% targeted by the Trump administration. (read more)

The professional political class and corporate financial media are once again trying to talk down the strength of the U.S. economy. However, the Main Street economy is powering through despite their efforts.

There is a visible connection between the Wall Street multinationals and the financial media; both are riddled with anxiety over Trump’s economic policies that favor Main Street over Wall Street and it shows in the media coverage. I digress.

“Consumer spending continued to grow solidly and, most encouragingly, business investment growth recovered sharply after a dip in the third quarter. Despite big external headwinds and financial market volatility in the fourth quarter, U.S. firms are not retrenching sharply on capex. Labor market strength and ongoing fiscal stimulus should see domestic demand expanding by enough to keep GDP growth above potential in 2019, despite a rising drag from net trade.”

— Brian Coulton, Fitch Ratings.

“Business investment was a big positive surprise, with nonresidential spending soaring 6.2% on the back of a 6.7% jump in equipment spending and a honking 13.1% increase in intellectual property products.”

The rate of import goods, a deduction from GDP, slowed down between the third and fourth quarter and consumer spending was higher than anticipated. That’s good news, but that’s not the whole story….. for Main Street it gets even better.

The current inflation rate (PCE index) was once again measured at 1.6%. However incomes are rising faster than inflation. This leads to more “disposable income”:

Disposable personal income increased $218.7 billion, or 5.7 percent, in the fourth quarter, compared with an increase of $160.9 billion, or 4.2 percent, in the third quarter. (TABLE 8)

BEA: During 2018 (measured from the fourth quarter of 2017 to the fourth quarter of 2018), real GDP increased 3.1 percent, compared with an increase of 2.5 percent during 2017.

The Full Picture: Business investment into Main Street USA continues to increase. Manufacturing jobs and durable good employment in Main Street continues to increase. Wages continue to rise. Inflation on most consumer goods remains low. Disposable income is growing, which means more consumer spending. More consumer spending means higher rates of economic growth and an expanding economy.

MAGAnomics is working.

The Decline in Quality is Part of the Cycle

Armstrong Economics Blog/Ancient Economies

Re-Posted Feb 28, 2019 by Martin Armstrong

QUESTION: Hi Marty,

Wanted to ask you if you are noticing the same thing as me regarding the ‘quality’ of goods and services these days and if this is history repeating itself again, such as the fall of the Roman empire?

To explain, I am noticing that the quality of the goods and services I buy whether durables or consumables is terrible and only getting worse. Nothing is built to last (such as tools, electronics, even vehicles), and the quality of consumables such as food and services is b-grade at best and it is hard to find alternatives.

I live in Australia and just about everything is made overseas, such as China. I bought a simple axe from a hardware store and it lasted 3 weeks. Had it replaced and it lasted 3 more weeks. Went back to see if I could find one made in Australia and could not find any.

…

Rents are expensive but landlords treat you like your scum, not to mention insurance companies.

Car registration is expensive and yet the quality of our roads is terrible.

…

Economists often say competition is good but they don’t seem to recognize how the quality of our produced goods and services is suffering a result.

I delivered some building materials to a client one day and he proceeded to tell me how he had a fancy door made and shipped from China for less than $1700, but that to have the same door made locally, he was quoted $6400. I proceeded to then tell him, that is ok for you as you have saved money, but are you aware that every time we buy stuff from China, China’s mountain of Australian dollars gets bigger and bigger, and the only place they can spend those Australian dollars is back here in Australia, and so is it any wonder that Chinese investors are buying up our real estate? The mans’ face went WHITE!!!

Are you noticing the same thing and are you able to draw a parallel between now and other historical times?

DW

ANSWER: Both the quality of goods and services declined during the 2nd century (post-180 AD), and society began to decline overall even morally. An interesting view is that of an outsider looking in. The author of this interesting quote is the famous 10th-century Arab geographer and historian Abu al-Hasan al-Mas’udi (c. 896–956AD) of Baghdad. He reflected upon what unfolded in Europe, expressing the grim reality in the early Middle Ages through a foreigner’s eyes. In outlining the peoples of the world for his contemporaries, an Arab geographer of the day described Europeans as having “large bodies, gross natures, harsh manners, and dull intellects . . . those who live farthest north are particularly stupid, gross and brutish.” He described the fall of Rome, and in describing western civilization, he effectively used similar concepts that the classical historians like Herodotus and Tacitus had once used to describe the barbarian world outside of European civilization.

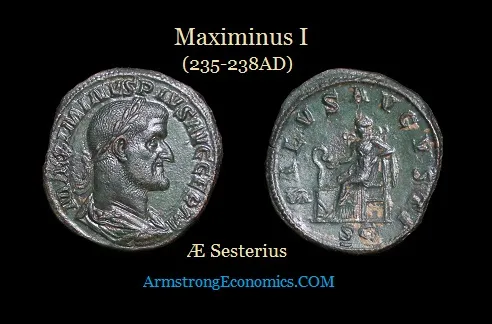

The sequence of events leading up to such drastic changes begins with high taxes and hunting the rich as we are witnessing today. Maximinus I declared all private wealth belonged to the States which was just one more step to the left from Bernie Sanders, Elizabeth Warren, and AOC. Once you do that, the result is the hoarding of wealth and that ends up contracting investment creating an economic death spiral. Education declines and regulation rises as the government seeks more power. The overall trend creates a precipitous drop in quality of life, and all the very reasons for the rise of civilization are then reversed and the trend moves from concentration to separation. This is the overall general scheme as to the reasons why Rome fell.

Keep in mind that the Dark Ages were about 600 years. So we need not worry about this complete collapse in our lifetime. Nevertheless, we are experiencing the early stages of the decline and fall of Western Civilization. The government pensions will create the same trend of fragmentation and turning government employees against the people. We will see the split of the European Union and the same in Canada as well as Australia. The United States will also split as some regions will reject the socialist regions and their attempts to subjugate their beliefs to their own.

If Rome’s sheer size made it difficult to govern because centralized government always fails. This contributed to the ineffective and inconsistent leadership which only served to magnify the problem as we are witnessing today as politics also has become highly polarized. Being the Roman emperor became a highly risky position during the 2nd and 3rd centuries. Civil war became commonplace as people made attempts to take power or to separate. This would thrust the empire into chaos, which we will begin to experience after 2020. The Praetorian Guard—the emperor’s personal bodyguards—assassinated and installed new sovereigns at will, and once even auctioned the spot off to the highest bidder who was Didius Julianus (193AD). There were two rival bidders but Julianus won paying 25,000 sestertii per man, which was the high bid and he was duly declared Emperor. However, the Praetorians were not loyal to him and he was beheaded on June 2nd after a reign of only 66 days.

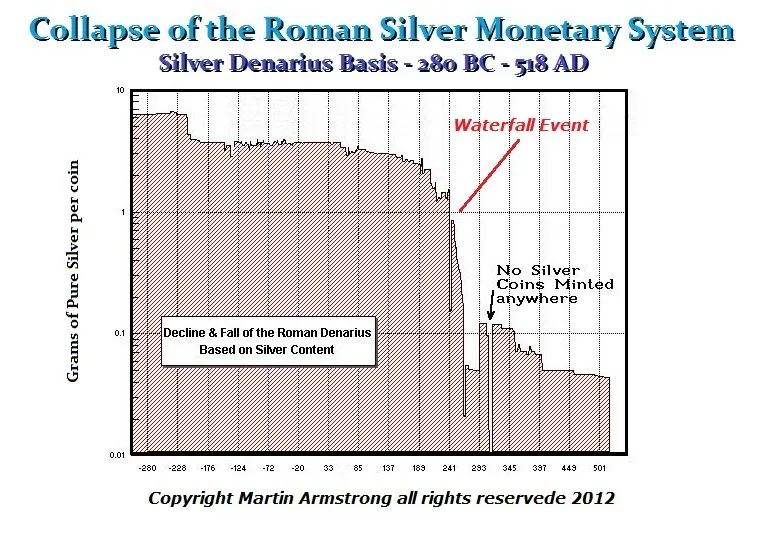

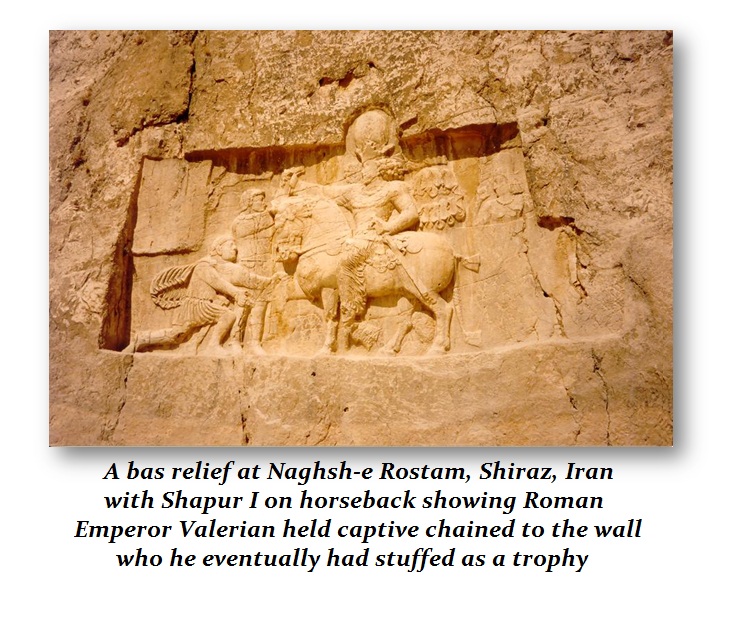

The Praetorian Guard became the same as we have today with the Deep State, illustrated in the FBI, CIA, and NSA all conspiring to overthrow Trump. This political chaos also extended to the Roman Senate as it has currently in modern times. The Senate became a cesspool of corruption that failed to temper the excesses of the emperors due to its own widespread corruption and incompetence (i.e. gridlock). As the situation worsened, civic pride waned and many Roman citizens lost trust in their leadership. Trajan Decius (249-251AD) was the first Roman Emperor to be killed in battle with the Barbarians. That had a great impact on the confidence of the people in government. They suddenly saw themselves as vulnerable. Then, in 260 AD, the Roman Emperor Valerian I (253-260AD) was captured and kept as a slave to the Persian king. That was the final straw, and we see the collapse of the Roman Monetary System within 8.6 years.

The Praetorian Guard became the same as we have today with the Deep State, illustrated in the FBI, CIA, and NSA all conspiring to overthrow Trump. This political chaos also extended to the Roman Senate as it has currently in modern times. The Senate became a cesspool of corruption that failed to temper the excesses of the emperors due to its own widespread corruption and incompetence (i.e. gridlock). As the situation worsened, civic pride waned and many Roman citizens lost trust in their leadership. Trajan Decius (249-251AD) was the first Roman Emperor to be killed in battle with the Barbarians. That had a great impact on the confidence of the people in government. They suddenly saw themselves as vulnerable. Then, in 260 AD, the Roman Emperor Valerian I (253-260AD) was captured and kept as a slave to the Persian king. That was the final straw, and we see the collapse of the Roman Monetary System within 8.6 years.

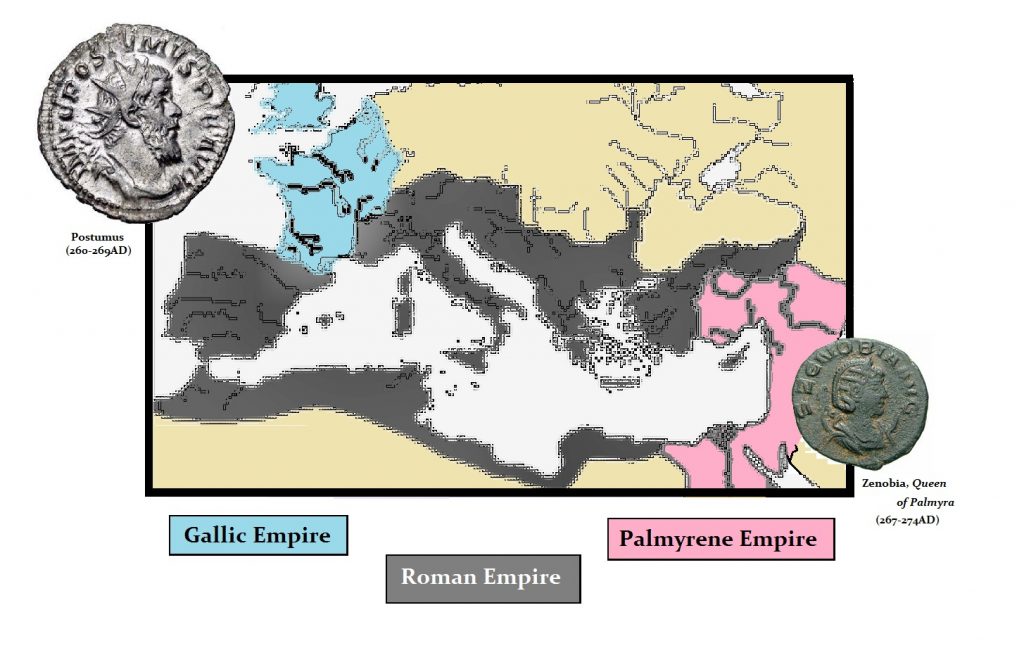

The Barbarian attacks on Rome partially stemmed from a mass migration caused by the Huns’ invasion of Europe in the late fourth century. As the Huns moved West, the barbarians were compelled to invade. Once they saw that Rome was vulnerable following the capture of Valerian, the invasions began in mass. This led to the Roman Empire dividing into three regions. Postumus (260-268 AD) led the rebellion creating the Gaulic Empire (Britain-France-Spain) and in the East Zenobia carved out her Empire based in Syria.

We are simply following the very same pattern in the same order. History repeats simply because human nature never changes. We would always like to think we are smarter and different. That has never proven to be anything more than a preferred delusion.

The Public Pension Crisis is Our Undoing

Armstrong Economics Blog/Pension Crisis

Re-Posted Feb 27, 2019 by Martin Armstrong

QUESTION: Mr. Armstrong; Thank you for explaining the difference between a public employee pension and those we have in the real world. The fact that the bulk of these people never contributed to a pension was shocking. How is this going to be resolved?

GH

ANSWER: It will not end well. Government employees have the defined-benefit (DB) while we get the defined-contribution (DC) plans. Most state and local government employees, actually 87% of those working full time, participate in a defined benefit (DB) pension plan. They contribute NOTHING but are guaranteed a pension on top of what they earned, plus free healthcare for life. The vast majority of those in government have NEVER had to save anything. They are there now demanding that our futures be stripped. We are to be taxed until we die, and upon death, they want what is left.

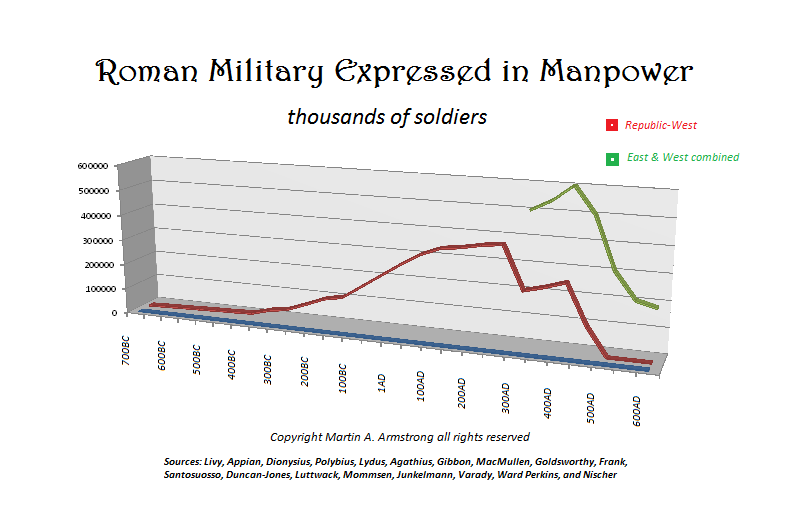

This situation cannot end nicely. It is the same way that Rome collapsed. When the government could no longer afford to pay the army, it began sacking Roman cities that opposed their general. They turned inward and cannibalized their own cities, weakening the entire empire, thereby allowing the barbarians to come through the gates. We have followed the very same mistakes as Rome. This is just how empires always end. We are no different.

How can someone working for the government negotiate their own pension? This entire system is flawed and we are paying the price of civil unrest.

Warren Buffett Loses Billions

Armstrong Economics Blog/Understanding Cycles

Re-Posted Feb 27, 2019 by Martin Armstrong

QUESTION: It is no secret that you went head to head against Warren Buffett in his silver manipulation. He is having a very bad year with his buy and hold value strategy. It looks like without making billions on the side manipulation of commodities, he is no better a fund manager than anyone else. Care to comment on his strategy?

WD

ANSWER: The Warren Buffett strategy of value investing and buy & hold is entirely dependent upon the direction of the market. The Warren Buffett strategy is a long-term value investing approach passed down from Benjamin Graham’s school of value. “Buffett is considered to be one of the greatest investors of all time. His investing strategy, value, and principles can be used to help investors make good investment decisions.” This is all the propaganda. It applies to an economy that is in a long-term inflationary trend that is really left over from the Great Depression days.

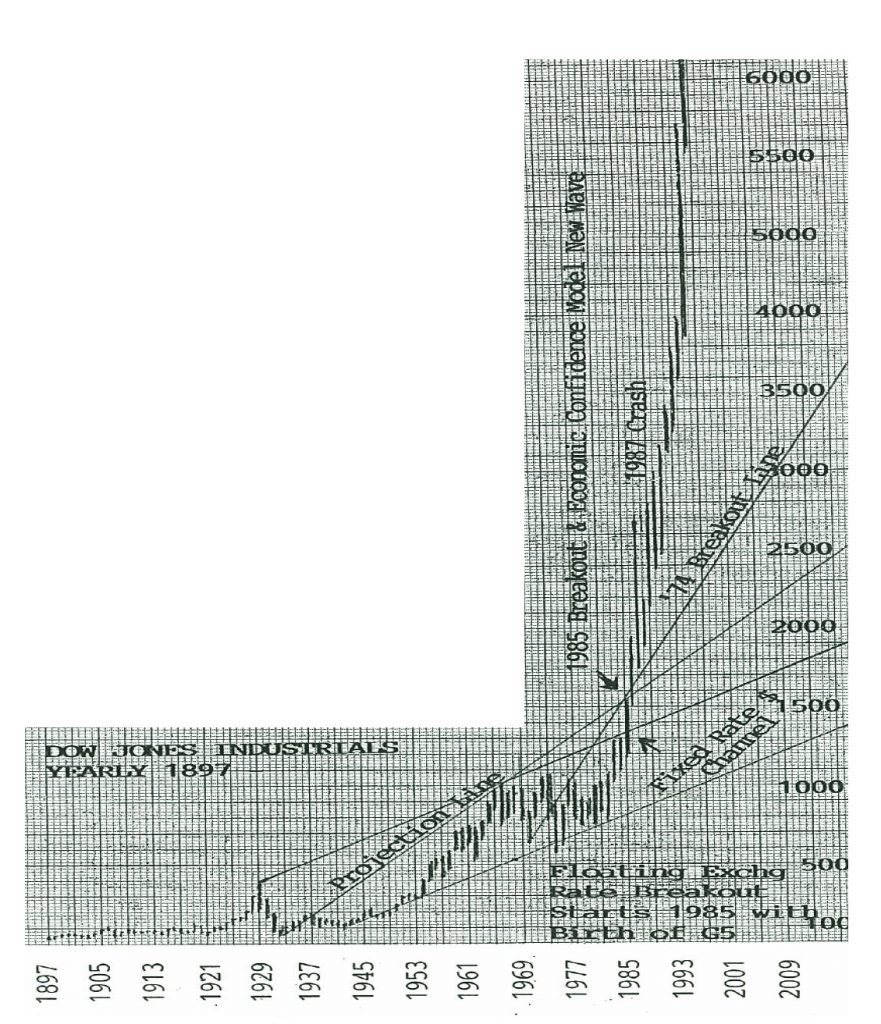

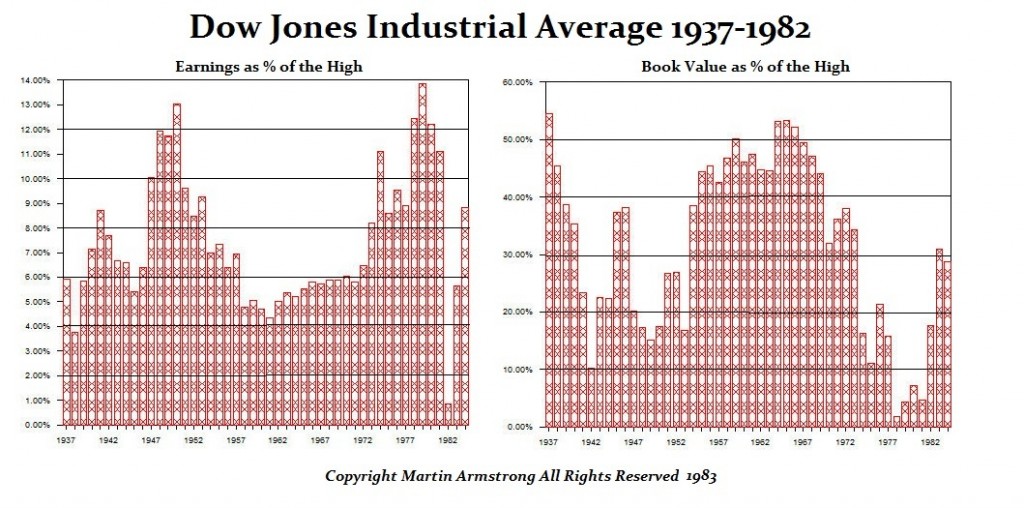

I was blamed for the takeover boom because I was advising a lot of the takeover players around the world. I simply showed clients the chart on the Dow in terms of book value and that the historic low that took place in 1977. I merely illustrated that you could buy a company, sell its assets, and double or triple your money because the market was so underpriced going into the end of a Public Wave. This Private Wave began in 1985 and that was the breakout of the market.

I was blamed for the takeover boom because I was advising a lot of the takeover players around the world. I simply showed clients the chart on the Dow in terms of book value and that the historic low that took place in 1977. I merely illustrated that you could buy a company, sell its assets, and double or triple your money because the market was so underpriced going into the end of a Public Wave. This Private Wave began in 1985 and that was the breakout of the market.

Anyone who simply bought stocks in 1985 made a fortune. Warren Buffett famously avoided investing in technology stocks. Nevertheless, he had bought Big Blue, then sold Apple and Oracle. He was so old school brick & mortar that he really missed the technology shift.

His buy & hold strategy fails because it ignores cycles. Anyone who bought stocks in 1985 and just held as the Dow rose from 1,000 to 21,000 beat even Warren Buffett. He takes positions in companies and cannot flip when the business cycle turns. He lost $4.3 billion in a single day. That is not a fund manager in my book.

Buffett did not believe the rally as most others going into 2018. For years, Buffett was building up its cash rather than investing. He began to invest during the third quarter, actually buying the high since the NASDAQ peaked in August, the S&P 500 in September, and then the Dow on October 3. He bought some banks like JPMorgan Chase and Oracle for the first time.

Obviously, his timing was not very good and his strategy of buy and hold does not fare very well in a decline.

Funds Management & Trading – Behind the Curtain

Armstrong Economics Blog/Basic Concepts

Re-Posted Feb 26, 2019 by Martin Armstrong

QUESTION: Hello

I read all your blogs and prescribe to your market reports. I will now attend my first event in Rome. For me it all makes sense.

My questions is, which you must have gotten before, why don’t you offer a fund that is based on Socrates, so that we all your followers could invest in it.

Best regards

PaB

ANSWER: Yes, I get that question/request all the time. We are in negotiations with a government wealth fund that wants, not just to use the model, they want to open it up to accepting money to manage for individuals. The most critical thing to me is SECURITY. Before I could ever endorse any fund, there are basic questions of who controls the money and who makes the trading decisions. All the studies have shown that they can have a fantastic model and still lose money because human emotions will override trading decisions more often than not. It takes conviction (experience) to trade for others. People can claim to follow our model, but do they? Will they pull the trigger, get too greedy, or tremble at the thought of buying a falling knife? It is not always the model you are signing up for. It is the emotions of the trader behind the model that plays a very big role in decision making.

I was interviewed by a journalist in Munich. She knew I have been the largest strategic adviser in the world. When I testified before Congress, I had the equivalent of 50% of the national debt in assets under contract for advisory services. Her question was how could I step in during a crisis and make decisions that so many jobs and lives relied on? I told her I never thought of that. I just handled the crisis, saw the problems and acted. She told me she had interviewed people in other fields who were renowned for their skills. She explained to know a brain surgeon who was one of the best. He had to quit when he began to realize that the slightest mistake could cause the patient to not survive or become paralyzed. Before he thought about that and just acted, he was the best in his field. She explained to me that this was the same pattern that was common in all the various people she had interviewed. I found that very interesting.

There is generally over $1 trillion in the room at a WEC. The last one in Orlando had 37 countries represented. To this day, they still do not teach hedge fund management, currency hedging, or anything that deals with the risks of the real world. I help some of the biggest wealth funds in the world that are trying to help society survive the chaos. I help multinational companies survive the foreign exchange machinations and I run around the globe meeting with central banks. I do these things because I hope to change things for the better insofar as illustrating that we are all connected globally. This runs counter-trend to politics where people think they can elect one person to create jobs or whatever domestically. They will preach always taxing the rich. But the rich can leave. The wage earners cannot export his labor to a more favorable jurisdiction. The larger the government, the lower the economic growth, because the average person is left with a diminishing pot of disposable income.

These are my goals to help turn the tide in the big picture. Nothing will ever grow in a garden by just constructing a fence. You have to plant seeds. Politics has to change. Dr. James McHenry, one of Maryland’s delegates to the Convention to create the US Constitution, wrote in his notes that were first published in The American Historical Review, vol. 11, 1906 (p. 618) which recorded the exchange of words with Benjamin Franklin. It read: “A lady asked Dr. Franklin, ‘Well Doctor what have we got a republic or a monarchy?’ ‘A republic,’ replied the doctor, ‘If you can keep it.’” While Franklin and Thomas Jefferson are my two most respected Founding Fathers, the extent of their knowledge of the history of Rome was colored by Edward Gibbon’s Decline and Fall of the Roman Empire published in 1776 and Franklin had even met with Gibbon reading passages prior to its publication. Their misguided view of the fall of the Roman Republic was colored by Cicero who supported the oligarchy led by Cato. Julius Caesar was cheered by the people and the oligarchs fled Rome. Cicero painted Caesar as a dictator when that was a political office which even he had held. It was this misinterpretation of history that led to the establishment of a Republic rather than a Democracy.

I greatly appreciate all the emails asking me to return to funds management. Been there, done that. I still have trouble sleeping more than three hours straight because I was an international hedge fund manager. I was even named “Hedge Fund Manager of the Year,” along with many other things from “Economic of the Decade” to “Foreign Exchange Forecaster of the Year.” Socrates is the ONLY such system that covers the entire world and it has taught me so much over my life. It has enabled me to see the connections that otherwise would be far too complex to explore and record personally for there are far too many variables in play. Socrates is the ONLY system that can even write an original analysis in any market no less the fact that it does so on over 1,000 instruments worldwide providing objective analysis in areas that nobody else even covers.

I am not 25 and trying to make mountains of money. Fortunately, I have the luxury of not needing money in my life to survive. The more you make, the more you lose your personal freedom. Making billions does not change your lifestyle. That is money you cannot spend personally. As they say, it does not buy love, but it also attracts people who are not your friends. You will find yourself standing in the middle of a crowded room, and even if you are the center of attention, you are very much alone. So there is a balance. You want to be comfortable to support your family and enjoy this gift of life. Go too far, and you lose that as you become more and more isolated because of the money. I have been the target of corrupt courts, evil bankers who trade against their own clients, and court-appointed receivers who seize the company and stop its publication at the direction of the CFTC and SEC who are on a short leash held by the bankers. I believe they even tried to kill me. I was in a coma for a few days, but to their shock, I survived.

Mountains of money are really just monopoly money for power-plays like buying companies etc.. You can fly around the world 1st class and stay in the best hotels every night for a year and you will not spend $1 million. Yes, you can buy things like art or houses. But you become a slave to your money. You do not own it. It dictates your life.

So from a personal perspective, I do not need money. I am trying to pass on what I have learned. Civilization is constructed by the accumulation of knowledge. So I have no intention of going back to fund management. That is a 7-day a week job, on call 24 hours a day. I will do my best to find someone and some organization I can trust before I would ever make any recommendation. There are already too many people claiming to use Socrates to raise money. Remember one thing: they can claim anything. It is also the integrity and experience of the trader to follow a model free of his own emotions.

Supreme Court Did Not Rule on Civil Asset Forfeiture

Armstrong Economics Blog/Rule of Law

Re-Posted Feb 25, 2019 by Martin Armstrong

The US Supreme Court ruled UNANIMOUSLY (9-0) that the Constitution’s ban on Excessive Fineswithin the Eighth Amendment, is being reported incorrectly that this is a case against these outrageous Civil Asset Forfeitures – SORRY – Not True! This is a case that can be distinguished EASILY from a Civil Asset Forfeiture because here there was a crime to which Timbs plead guilty. In Austin v. United States, 509 U. S. 602 (1993), however, the Court held that civil in rem forfeitures fall within the Clause’s protection when they are at least partially punitive. Therefore, the confiscation of Timbs’ car was a blend of Civil Asset Forfeiture and a fine making it punitive.

There was no evidence that the car was used in a crime and he had purchased the car with money that traced to insurance – not a crime. So do not get you hopes up that this is changing any Civil Asset Forfeiture. In such cases the action is In Rem so they are not accusing you of a crime nor is it a pure fine. They are claiming that the money is guilty – not you. They have confiscated money because a dog smelled marijuana on your bag so they get to take everything from you. Because they are not charging you with some crime, it is NOT punitive. In this case, it is punitive because Timbs plead guilty to a crime.

However, the ruling effectively means states and local municipalities cannot use fines as a mechanism for raising revenue, something many local governments do. I remember when my father took a local judgeship in Cinnaminson NJ . The politicians told him they want him to fine everyone the maximum. This was back in the 1960s. My father refused and quit. Governments use fines to raise revenue for decades. It has never been about protecting the public. It is always about lining their own pockets. In this respect, the Timbs v Indiana decision is important. There have been studies that show governments seize property more from the poor communities knowing that they lack the understanding of the law and there are no lawyers willing to defend them when they cannot get paid. These studies show that 65% of civil assets forfeiture target the poor.

The hope going around is that Supreme Court’s decision will make it easier to fight such seizures under Civil Asset Forfeiture. Ginsburg noted that the Supreme Court has, at the federal level, found civil forfeiture actions are covered by the Excessive Fines Clause “when they are at least partially punitive.” With incorporation of the Excessive Fines Clause at the state level, the same standard should now apply in the state context too.

The entire proposition for civil asset forfeiture is based upon the ancient tradition of ‘deodand’ which is derived from the Latin phrase ‘deo dandum,’ and means “given to God.” In ancient times, the object that caused the death of someone was forefeited to pay for their funeral. The King of England, in desperate need of money, replaced God with himself. The Supreme Court upheld Civil Asset Forfeiture in 1974 writing:

At common law the value of an inanimate object directly or indirectly causing the accidental death of a [416 U.S. 663, 681] King’s subject was forfeited to the Crown as a deodand. 16 The origins of the deodand are traceable to Biblical 17 and pre-Judeo-Christian practices, which reflected the view that the instrument of death was accused and that religious expiation was required. See O. Holmes, The Common Law, c. 1 (1881). The value of the instrument was forfeited to the King, in the belief that the King would provide the money for Masses to be said for the good of the dead man’s soul, or insure that the deodand was put to charitable uses. 1 W. Blackstone, Commentaries *300. 18 When application of the deodand to religious or eleemosynary purposes ceased, and the deodand became a source of Crown revenue, the institution was justified as a penalty for carelessness.

CALERO-TOLEDO v. PEARSON YACHT LEASING CO.(1974)

The real argument has yet to be made that the King merely usurped the position of God for money and that violates the First Amendment prohibiting any law be written that violates religion and this the practice could not have survived the American Revolution.

The case is Timbs v. Indiana and it held a fairly obvious holding that the Eighth Amendment applies to the states as well through the Fourteen Amendment which was created following the Civil War, which was in part over State’s right that was centered on the Slavery issue because removing slaves was really economically undermining the Southern Economy. Thus, the Civil War was really over this issue of State Rights and were they really entitled to separate from the Union.

The Supreme Court Justice I held the most respect for was Justice Scalia because he was a strict constructionist and often ruled against the government. In a famous response to a letter, he wrote: “I cannot imagine that such a question could ever reach the Supreme Court. To begin with, the answer is clear. If there was any constitutional issue resolved by the Civil War, it is that there is no right to secede.”

Indeed, Scalia was really talking about the fact that Congress then passed the Fourteenth Amendment which held that really no State had any rights that were contrary to the Federal Constitution. The Fourteen Amendment held in the NEGATIVE that there were any separate State right to the contrary of the Constitution and then Congress passed the Fourteenth Amendmentwhich clearly held that all the rights, privileges, and immunities contained in the Federal Constitution applied to the states as well.

This Amendment was actually created by extortion. It was ratified in 1868 against the opposition of the succeeding President Andrew Johnson following Lincoln’s assassination. Johnson was a southerner and former slave owner who Congress even brought impeachment against because he objected to how the Northern States were treating the Southern States. The extortion took place that the Southern States were denied a right to representation in Congress UNLESS they agreed to the both the Thirteenth & Fourteenth Amendments.

Since then, there have been many cases that step by step held that each and every right, privilege, and immunity applied to the States through this Amendment. Therefore, it should be no surprise that the decision on this holding alone had to be unanimous.

Fourteenth Amendment

Section 1.

All persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the state wherein they reside. No state shall make or enforce any law which shall abridge the privileges or immunities of citizens of the United States; nor shall any state deprive any person of life, liberty, or property, without due process of law; nor deny to any person within its jurisdiction the equal protection of the laws.

…

Section 5.

The Congress shall have power to enforce, by appropriate legislation, the provisions of this article.

The case, Timbs v. Indiana, started with a lawsuit from Tyson Timbs, who pleaded guilty in Indiana to drug dealing and conspiracy to commit theft. After he pleaded guilty, the courts ordered him to forfeit a Land Rover SUV, valued at $42,000, that Timbs had bought with his dad’s life insurance policy. Timbs argued that the seizure was essentially an excessive fine, because it was more than four times the $10,000 maximum fine he could see from his drug conviction under state law. That was the legal question and it involved then the question of whether the Eigth Amendment applied to the States.

A trial court and the Court of Appeals of Indiana sided with Timbs, but the Indiana Supreme Court ruled that the Eighth Amendment doesn’t apply to the states. The US Supreme Court overturned the Indiana Supreme Court’s decision which was self-serving.

Justice Ruth Bader Ginsburg, adds another layer of legal protection for property rights since she delivered the opinion of the Court, in which ROBERTS, C. J., and BREYER, ALITO, SOTOMAYOR, KAGAN, GORSUCH, and KAVANAUGH, JJ., joined. However, GORSUCH, J., filed a concurring opinion. THOMAS, J., filed an opinion concurring in the judgment.

Justice Thomas concurred in the Judgment but stated he disagreed with how the court arrived at that judgment.

“I agree with the Court that the Fourteenth Amendment makes the Eighth Amendment’s prohibition on excessive fines fully applicable to the States. But I cannot agree with the route the Court takes to reach this conclusion. Instead of reading the Fourteenth Amendment’s Due Process Clause to encompass a substantive right that has nothing to do with “process,” I would hold that the right to be free from excessive fines is one of the “privileges or immunities of citizens of the United States” protected by the Fourteenth Amendment.”

JUSTICE GORSUCH, issued only a concurring opinion which is different from concurring in the Judgment.

The majority faithfully applies our precedent and, based on a wealth of historical evidence, concludes that the Fourteenth Amendment incorporates the Eighth Amendment’s Excessive Fines Clause against the States. I agree with that conclusion. As an original matter, I acknowledge, the appropriate vehicle for incorporation may well be the Fourteenth Amendment’s Privileges or Immunities Clause, rather than, as this Court has long assumed, the Due Process Clause.

Indiana attempted to claim that Civil Asset Forfeiture is not protected by the Eighth Amendment. Justice Ginsberg wrote for the Court:

As a fallback, Indiana argues that the Excessive Fines Clause cannot be incorporated if it applies to civil in rem forfeitures. We disagree. In considering whether the Fourteenth Amendment incorporates a protection contained in the Bill of Rights, we ask whether the right guaranteed—not each and every particular application of that right—is fundamental or deeply rooted. Indiana’s suggestion to the contrary is inconsistent with the approach we have taken in cases concerning novel applications of rights already deemed incorporated. For example, in Packingham v. North Carolina, 582 U. S. ___ (2017), we held that a North Carolina statute prohibiting registered sex offenders from accessing certain commonplace social media websites violated the First Amendment right to freedom of speech. In reaching this conclusion, we noted that the First Amendment’s Free Speech Clause was “applicable to the States under the Due Process Clause of the Fourteenth Amendment.” Id., at ___ (slip op., at 1). We did not, however, inquire whether the Free Speech Clause’s application specifically to social media websites was fundamental or deeply rooted. See also, e.g., Riley v. California, 573 U. S. 373 (2014) (holding, without separately considering incorporation, that States’ warrantless search of digital information stored on cell phones ordinarily violates the Fourth Amendment). Similarly here, regardless of whether application of the Excessive Fines Clause to civil in rem forfeitures is itself fundamental or deeply rooted, our conclusion that the Clause is incorporated remains unchanged.

With Justice Samuel A. Alito writing for the majority in McDonald v. Chicago (2010) reasoned that rights that are “fundamental to the Nation’s scheme of ordered liberty” or that are “deeply rooted in this Nation’s history and tradition” are appropriately applied to the states through the Fourteenth Amendment.

The Court held: “Exorbitant tolls undermine other constitutional liberties,” Ginsburg wrote. “Excessive fines can be used, for example, to retaliate against or chill the speech of political enemies.” She added, “Even absent a political motive, fines may be employed ‘in a measure out of accord with the penal goals of retribution and deterrence,’ for ‘fines are a source of revenue,’ while other forms of punishment ‘cost a State money.’”

Because Timbs was not a pure civil forfeiture case, we have not overturned civil forfeiture laws, where police can seize a person’s property without even proving the person was guilty of a crime. They will easily distinguish this saying this is not a fine as in the case of Timbs.

The Illinois Pension Crisis – Giving The Pensioners All State Assets

Armstrong Economics Blog/Pension Crisis

Re-Posted Feb 25, 2019 by Martin Armstrong

The new proposal in Illinois is for the state to transfer its assets so that they are owned, not by the people, but by the state employees. These proposals will never solve the problem because no one will look at the issue long-term. If they hand ownership to state employees they still run out of money. Who then fixes the infrastructure? The final step will be to hand the tax collectors to the pensions. Then we have civil war — state employees v the people

Capitalism – Oligarchies – Socialism

Armstrong Economics Blog/Economics

Re-Posted Feb 24, 2019 by Martin Armstrong

COMMENT #1: Hey Marty, I’ve never written you in this vein, but (always extremely talented) rich guys saying “Let the chips fall, free market capitalism” are gonna get washed away by this wave and we both know it. When the mass of people don’t even own a vegetable plot despite working their rears off for the dream, you know socialism is here however bad (Marxist) it is. If “capitalism” can’t offer a life (a living wage and a damn plot to park your ass on, not mountains of debt and stress, unless you happen to be born with a certain set of Republican talents) then “capitalism” is out however great it really and truly is. I will never mention politics again but revert to philosophy which is where we really live, and the only thing I really know anyway.

RF

COMMENT#2: Are you blind, Mr. Armstrong?

Don’t you see, that wealth equality is going out of hands?

It cannot be, that a 8 people control (Oxfam 2017) as much wealth as 50% of earth’s population and it get’s more extreme each year. All life is one and it is a responsibility of the heart to share. Capitalism has failed as the majority is not benefitting anymore from it.

REPLY: You are confusing capitalism with oligarchies. Disposable income has been declining because of taxes. Under Marxism, we pay between 300 and 800 times more than previous historical periods of taxes. The Roman Empire had taxes that would rise from 1% to 7% — not 50%+. ALLRepublics collapse into oligarchies because once one person pretends to represent many, they will NEVER put the interests of the many before themself. The lack of term limits means these politicians need money to sustain their position and therein allows the oligarchy to grow with power and influence.

CAPITALISM is the freedom to decide your own fate — not that oligarchies get to own everything. Under a Greek Democracy, only the head of the household voted. They were the Congressman representing everyone in that house. Under SOCIALISM, income taxes were invented meaning every person had to account to the government for what they earned. Women, who didn’t previously vote, suddenly were entitled to vote because they were being held accountable for their individual earnings and government began passing laws to protect people which then dictated things such as abortion or whatever.

So do not confuse an oligarchy with capitalism. They’re on opposite sides of the table.

As for the disparity in wealth, I volunteered in Washington to convert Social Security to a wealth fund during the ’90s. The Democrats would not vote for it because they wanted to change the fund manager when they came into power. The wealth disparity is NOT created by income but by investment. The government regulations restrict investments for the private citizen. The reason there are hedge funds offshore is very simple. We are over-regulated, so a fund manager who complies with the SEC goes to jail with the CFTC. You cannot hire a fund manager to make the decisions for you, so you have to decide between all the various investments yourself. Hedge fund managers make all those decisions but they cannot raise money domestically.