Armstrong Economics Blog/Reports and DVDs

Posted Dec 10, 2019 by Martin Armstrong

COMMENT #1: Hi, Marty if you can, let the readers know if the “mother of all financial crisis” is the big bang.

N

COMMENT #2: Wow. I am left speechless. I think your title Repo Crisis is misleading. This is just the staging ground. It takes someone in the international arena to understand the implications of this going forward.

Thanks for making this an updating service.

Bill

REPLY: Perhaps I should have named this report “The Mother of all Financial Crises.” The Repo Crisis is just part II in the lead-up to Big Bang that nobody seems to grasp is already unfolding. This is the Sovereign Debt Crisis on steroids. Whatever they could have done wrong, they have done with absolute precision. The projected losses for institutions I have laid out will range from 40% to 60% of assets. This time, whoever is caught holding will not be bailed out this time around. This is the combination of the 1998 Liquidity Crisis and the 2007-2009 Financial Crisis. So hang on to whatever you can grab ahold of. You will need it for this one.

Where to Go?

Armstrong Economics Blog/Opinion

Re-Posted Dec 10, 2019 by Martin Armstrong

QUESTION: Hi Mr Armstrong,

I have been a subscriber for several years and I appreciate your work. You mentioned that when the dust settles there will be pockets in the US that are safe. Can you elaborate where they will be? Also if your child was planing on majoring in finance in college next year, would you steer them away or have them specialize in something like forensics since there will be a mess to sort out? Or would you steer them to a different major or no college at all?

Thanks again for everything you do

BV

ANSWER: It is still too early to forecast which areas will be best specifically. In general, the major regions will be split politically between left and right. There will be stark differences politically between California v Texas and Florida for example. You certainly do not want to be in any state that is out of control with respect to taxes and police abuse. Most people would never guess, but the state that abuses the law the most is Iowa. The percentage of drivers who have been given speeding tickets is 23.2%. That is a stunning percentage of the population. Indeed, Iowa wrote 148,755 tickets in 2016, which was a lot given the population compared to 712,000 tickets written by New York. Additional states where the percentage of people who have been given speeding tickets over 20% are Wisconsin (20.2%), Ohio (20.5%), Nebraska (20.8%), Wyoming (21.3%), South Carolina (22.7%), and North Dakota (23.1%).

We have states that have been funding themselves with traffic fines for all sorts of things. A friend’s wife was ticketed for looking at Google maps on her phone while at a red light. She went to court to prove she was not texting. The judge ruled for the state, as they are instructed to do, and fined her by saying she is not even allowed to look at he phone. So if she had a paper map, that would have been OK. So this is what we call legal persecution for monetary gain.

The Hunt for Money – No Amount is Too Small

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Dec 10, 2019 by Martin Armstrong

COMMENT:

You may already know this but in case you don’t: this is a prime example of the ‘war on cash’.:

Yesterday I walked into my sisters bank (Santander) in the local town in England, a quite affluent town not somewhere deprived. I handed over and politely asked to deposit a mere £200 (that’s two hundred) and I was told: ‘You cant do that anymore because of government regulations, you cant deposit cash into someone else’s bank account no matter how small.’ I was told it has been in place since last April!.

That should be a wake up call for a lot of people but most people don’t know, it hasn’t been discussed publicly anywhere at all, only bank employees seem to know about it.

How long before they do an India and get rid of popular notes overnight without telling anyone?

HO’N

REPLY: I tried to buy a cash card to send to a friend and was told I cannot do that. They would sell me a card only in my name. Governments are hunting cash on every level right down to the smallest amount. It is also ILLEGAL to mail cash in the United States.

The Mother of all Financial Crises

Armstrong Economics Blog/Reports and DVDs

Re-Posted Dec 9, 2019 by Martin Armstrong

COMMENT: Sir,

While taking a break from reading the Repo Report, I came across these words written by Albert Einstein before he passed away

“Not one statesman in a position of responsibility has dared to pursue the only course that holds out any promise of peace…” he wrote. “For a statesman to follow such a course would be tantamount to political suicide. Political passions, once they have been fanned into flame, exact their victims.”

I fear we are going to crash and burn as you have said

Keep up the good work

DK

REPLY: That is a very good quote. It is so true. All the disinformation circulating around about this Repo Crisis one must question can they really be that stupid? This is really the Mother of all Financial Crises which will impact everything it touches. This will make the 2007-2009 financial crisis look like a trial run.There is no politician who will stand up and talk about this crisis nor will they dare to even ask pertinent questions for fear what will be revealed.

This is why this report does not end with this report alone. We will update it next year as everything unfolds. So it is more like a subscription to this catastrophe.

European Banks to be Prohibited from Dealing in Repo?

Armstrong Economics Blog/Interest Rates

Re-Posted Dec 5, 2019 by Martin Armstrong

QUESTION: Mr Armstrong,

I have great respect for your work.

Can you explain how the Fed’s QE fits into the cycle of things. It seems to me that their interference in the markets is disrupting/altering the cycle. For example, the latest Fed purchases of T-bills every month in the amount of $60.

Who are they buying from? I assume Inv Banks, Comm Banks and hedge funds, and now these entities, instead of having low yielding bills on their books have zero coupon cash, which they then seek yield and put into the shares markets. It seems pretty clear and appears to extends the cycle. Can money printing just cause the 8.6 yr cycle for instance to extend to say a harmonic of that, 17.2 or 25. 8?

ANSWER: No. The Repo Crisis is on time. Our forecast for the start of the Liquidity Crisis was after Labor Day in September. The Fed is trying to prevent short-term rates from rising. They are not engaging in Quantitative Easing for the sake of “stimulating” the economy.

Things are getting bad and the rumor behind the curtain is that European banks will be prohibited from participating in repo for year-end. That is how bad things are getting.

So the cycle appears to be coming on time. All the implications are far too great to cover in a blog, which is why I have created a a report on the repo crisis that is around 150 pages

Premiere of The Forum (Davos)

Armstrong Economics Blog/Opinion

Re-Posted Dec 3, 2019 by Martin Armstrong

I attended the premiere of The Forum last night and got to meet those “elite” they spin such conspiracy theories about. Putin will be the keynote speaker at the next session in 2020. Interestingly, the film will be released to the general public on the turning point of the ECM – January 18th, 2020.

Most people have no idea that the World Economic Forum, which Nigel Farage said our World Economic Conference is the alternative, is more like a convention. They employ 800 people and they try to stand politically in between. It was founded by Klaus (Charles) Schwab.

Most people have no idea that the World Economic Forum, which Nigel Farage said our World Economic Conference is the alternative, is more like a convention. They employ 800 people and they try to stand politically in between. It was founded by Klaus (Charles) Schwab.

Klaus’ vision was to create a forum where world leaders can meet each other and create a bond. The conspiracy theories that paint these meetings as the place where they decide what the world will do for the next year is really nonsense. These people are not in control of anything and as the world turned nuts in 2019, the leaders of Germany, France, and the US all declined to attend.

It began with the model being the Chamber of Commerce meeting in the United States. Klaus took it one step further and tried to bring business and government together. As events unfolded, it grew into an annual meeting which then people wanted to be seen as being apart of it.

The film is the first to show the behind the scenes of Davos.

Legarde & Green Bonds

Armstrong Economics Blog/Europe’s Economic History

Re-Posted Dec 2, 2019 by Martin Armstrong

QUESTION: Marty; Why is Legarde pitching Euro Green Bonds when they lose money?

JL

ANSWER: If she can use the climate change nonsense to shame Germany into agreeing to issue Eurobonds, it would be a step to eliminate the refusal to issue a single European debt. If Legarde can sell that issue, then it will restructure Europe’s debt position

William Koch & Ancient Coins

Armstrong Economics Blog/Ancient History

Re-Posted Nov 26, 2019 by Martin Armstrong

QUESTION: I understand that the Koch brothers bought ancient coins. Is there any truth to that?

WJ

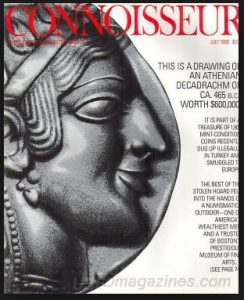

ANSWER: Oh, yes. William Koch was involved in a very famous case involving the Athenian decadrahms. There was a hoard discovered in Antalya by a television repairman and two other people back in 1984. They found a hoard of 2000 ancient silver coins with a metal detector. The hoard contained the rare Athenian decadrachms, which were produced as a commemorative 10-drachma coin. There were only 7 previously known examples. The Elmali Hoard contained 14 of them and became known as the “The Hoard of the Century.” The first one sold for $600,000 dollars, easily breaking the old record. The billionaire, William Koch of Boston, bought 1,800 of the coins for $3.5 million dollars. The Turkish Government knew that the treasure had been smuggled out of the country, but after it was taken across the border they didn’t have the slightest knowledge of its whereabouts. The treasure disappeared.

Based on the evidence, the Turkish Government started legal proceedings in Boston. The judge gave an important interim judgment in Turkey’s favor. Koch lost the hoard to Turkey

Britain GDP Has been declining ever since joining the EU

Armstrong Economics Blog/BRITAIN

Re-Posted Nov 25, 2019 by Martin Armstrong

REQUEST:

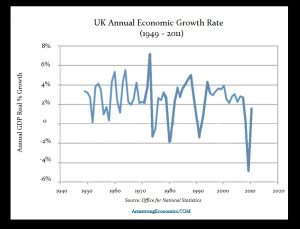

Hi Martin, I trust you are well. Would you post the chart you showed of how the UK has performed since joining the EU? I’ve been ploughing through your emails but am unable to find it. In short, I want to show my partners son the chart, who is a vehement ‘remainer’. Ie, evidence that the Uk would be better off leaving the EU.

Thanks for your help,

Cheers

Charlie

The Hunt For Taxes – Sell & Leave Before It is too late?

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Nov 24, 2019 by Martin Armstrong

QUESTION: Dear MR. Armstrong,

As a long time subscriber to your basic level Socrates,I’m very grateful for the guidance I’ve received.I have a question. In the hunt for taxes my Canadian government just assessed me over $80,000.00 for unreported income. I pay my taxes Mr Armstrong, the Canadian government pulled my bank records and although what I said was verified by those records, they refused to accept them! Even my tax lawyer was astounded.Now a difficult question for me.I’m retired and have no income presently.But I do own my on home.To pay off the CRA I’m considering getting a Reverse Mortgage on my home.They charge 6% monthly on the unpaid settlement so if I can get the RM at say 5% and use the extra to buy gold, perhaps over 5 years I can beat this burden.Would you recommend this strategy to your Mother or what else can I do.

Best Regards,

RW

ANSWER: Perhaps that is all you can do. The tax authorities are pulling those tactics far more often because they are broke and it will get far worse. I strongly advise to get a retirement visa from Thailand. You may have to just change your domicile to get away from this hunt for taxes that will continue to get worse. You are already hit. They will usually shift the burden of proof to you and just assume everything you have belongs to them. This is part of the economic tyranny we face.

It really is best to sell fixed assets in countries with aggressive tax agencies so they cannot take your home. Another thing they do, like the USA, is to cancel your passport if you owe them more the $50,000. We are economic slaves. We have truly lost all our freedoms.

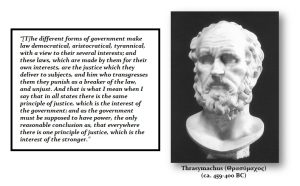

I do not know what else to say, You are dancing with the devil and the rule of law has vanished. Justice died with the beginning of direct taxation embracing the income tax and Marxism. Justice is indeed just the will of the government.