Posted originally on the conservative tree house on July 14, 2022 | sundance

The “Producer Price Index” (PPI) is essentially the tracking of wholesale prices at three stages: Origination (commodity), Intermediate (processing), and then Final (to wholesale). Today, the Bureau of Labor and Statistics (BLS) released June price data [Available Here] showing another 11.3% increase year-over-year in Final Demand products at the wholesale level.

Overall, the wholesale inflation rate is being driven by energy prices. The June calculation shows exactly that problem with energy prices embedded in goods driving 10% of the price increase. However, there is some good news in the short-term for July and August, as the intermediate and raw material costs are leveling off temporarily. Unfortunately, that raw material price plateau is almost certainly the result of a drop in demand.

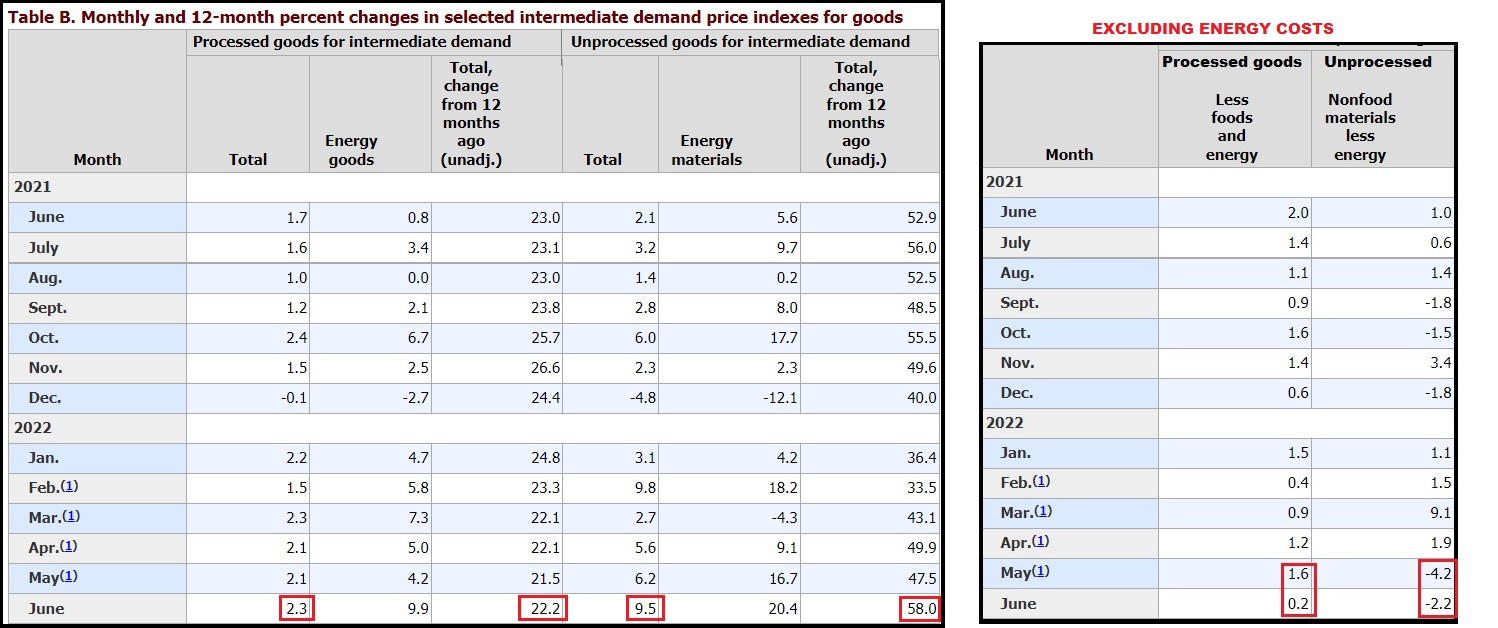

CTH has modified Table-A and Table-B to take out the noise.

The June inflation rate for final demand goods (2.4%) is driven mostly by higher energy prices (10%). Energy costs are passed along through every stage of the supply chain contributing to an overall wholesale price increase of 2.4% in June, 11.3% year-over-year.

Notice the slight drop in final demand services; that is important. What we are seeing is a contraction in the service economy overall, as the service sector -which includes restaurants- cannot pass along the scale of energy price increase to customers. People are changing their spending habits – service demand overall is dropping.

Additionally, the producer price index gathers data from inside the supply chain, backwards from the final stage (wholesale) into the intermediate stage (various processing) and also raw material prices. Here is where things are getting interesting, and now I can make some direct forward predictions.

I modified Table-B so you can see how the supply chain for goods is responding to both: (A) energy prices, and (B) consumer spending. You can click on the graphic to expand the image and spend some time on it if needed.

You can see from the left side of modified Table-B that both levels of intermediate goods were heavily impacted by energy prices. “Intermediate” processed goods rising 2.3% in June, 22.2% year-over-year. Intermediate unprocessed goods (raw materials) rose 9.5% in June, 58.0% year-over-year.

However, if you subtract the massive June energy costs, you will note the intermediate price of nonfood processed goods significantly dropped to 0.2% in June. And if you subtract the energy costs, you will notice the raw material prices for nonfood durable goods actually declined 2.2% in June.

Here’s what is going on…

The inflationary impact of Joe Biden’s Green New Deal energy program is running into the inability of consumers to pay for the price increases it creates. That is what is causing the demand side drops in retail economic activity on Main Street. We all know this.

As a result of these high prices, there is less internal demand within the supply chain for both goods and services. Inventories are climbing and the demand for raw materials to produce durable goods is now declining. Subtract the energy costs and nonfood prices are dropping. The decline is a raw material demand outcome.

June energy prices were extremely high. That’s driving the current PPI price outcome at all stages; but behind that issue is low manufacturing activity.

Remember, two months ago we said food prices would plateau in July and August. This PPI report shows the entry into that plateau. However, there is a problem on the horizon that is not measured in this data.

The high energy costs to farmers (fertilizer, diesel, oil, energy, etc.), a cost already seeded (forgive the pun) is right now in the fields…. waiting…. sitting somewhat dormant and ignored by the statisticians… but that higher origination price is growing and lurking….

When the farming harvests take place, those higher field costs will enter the supply chain again and end up finding their way, via wholesalers and supermarkets, to your fork. Big Ag is going to maximize this opportunity.

Farmers will not be the ones benefitting.

♦ For the next two months the Consumer Price Index and Producer Price Index will show inflation stability and possibly even price declines.

Those reports will come out in August (for July) and September (for August) and will give the impression that inflation has moderated, and the Fed has been successful. However, in/around Sept and October the harvest cost will hit the stores. At that point, energy prices -already high- will take a backseat to the rate of inflation driven by massive increases in food prices.

Oct, Nov and December, all the way through the winter, will be painful at the grocery stores and supermarkets. Also, restaurants this fall and winter, are going to get hit hard as their suppliers start to deliver food at much higher prices. Those people in the food service industry need to prepare now for what is looming.

Everything I just described above is happening at the same time as consumer demand for durable goods and non-essential services is dropping. The current economic activity on Main Street is tepid at best. Housing values have peaked along with rents.

Every element of the U.S. economy is now entering a phase where success or failure in a Main Street business is directly connected to the customer being able to afford the product or service.

Two-thirds of our Gross Domestic Product (GDP) is driven by consumer spending. Our borders are open, our wages are flat, our prices are high, our discretionary spending is contracting. Our manufacturing and service driven economy will contract, and we are two months away from food stability, prices, affordability and potentially scarcity, being the primary focus of everyone.

FUBAR

Prepare your affairs accordingly.