Posted originally on the conservative tree house on October 13, 2022 | Sundance

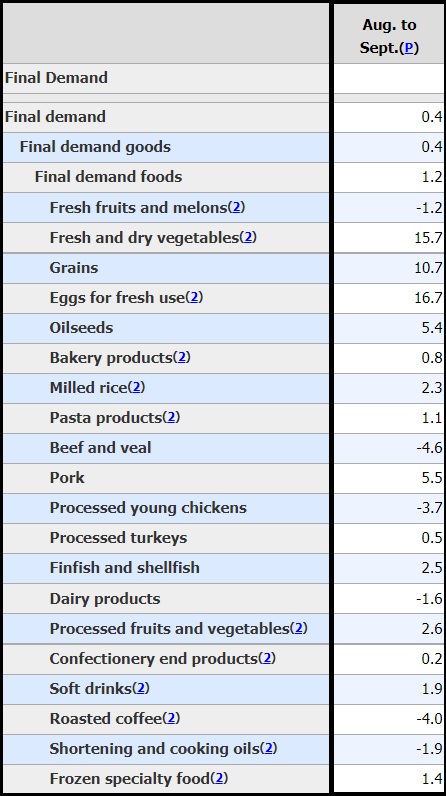

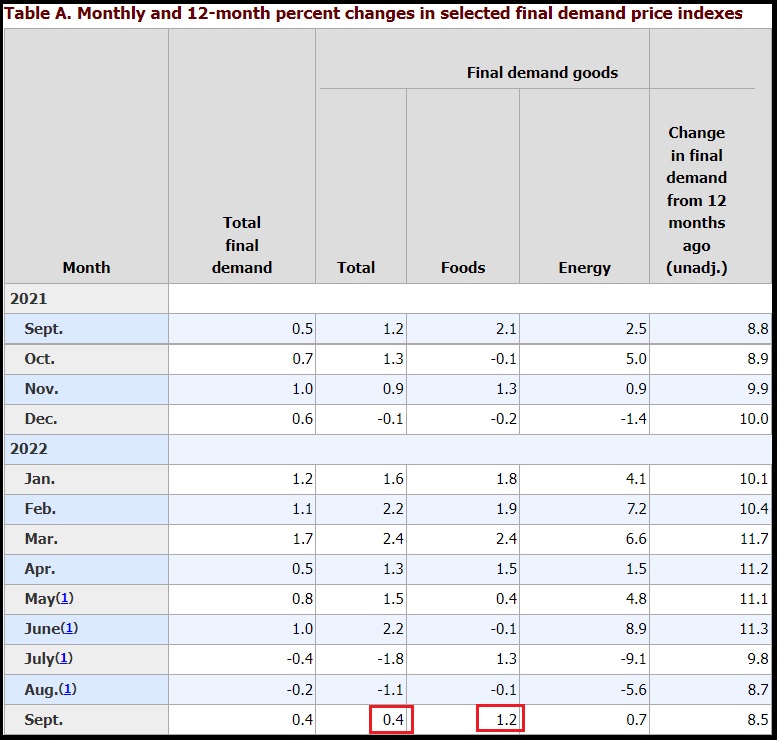

The Bureau of Labor and Statistics (BLS) released the September wage report [DATA HERE] delivering worse economic news for workers.

Real wages are dropping at a historic rate as inflation continues to rise and as a result wages buy less.

[BLS] “Real average hourly earnings decreased 3.0 percent, seasonally adjusted, from September 2021 to September 2022. The change in real average hourly earnings combined with a decrease of 0.9 percent in the average workweek resulted in a 3.8-percent decrease in real average weekly earnings over this period.” (link)

REAL WAGE CHART:

As the Biden economic/energy policy and Federal Reserve monetary policy merge together, the economy shrinks. As the economy shrinks, fewer goods and services are purchased. As less consumer goods are purchased, employment hours drop. As employment hours drop, wages decline.

Declining wages combined with increased inflation forms the perfect storm against middle-class and working-class families. This dynamic means lowered income and higher prices for essential goods and services like food, fuel, energy and housing. It’s not difficult to see why this is happening.

The declining wage rates, and the more substantive drop in real wage rates due to massive inflation, are specifically hitting the lower tier of the working class harder. Yet despite this, Biden is intent on importing even more economic migrants to put even more downward pressure on wages for the working class.

These are very real outcomes of policy. Working class Blacks and Latinos will feel this even more, yet this is the special interest group that Democrats claim to support. The reality is exactly opposite from the narrative sold by the Biden administration.

The Democrats know this. These outcomes are not accidental; they are a feature not a flaw in their policy. This is why they need to keep spending to retain the ruse.

There’s no way around this. Despite the pundit and financial class selling a counter-narrative, home prices will crash, and unemployment will go up. I know this is directly against the current talking points, but the statistical reality is clear.

CTH was the first place who said a year ago that home sales will plummet, that is starting to happen right now. There’s no way for it not to happen, the big picture tells us why.