A “negative yield curve“; a pending “economic recession“. These are the obtuse and ridiculous proclamations of the Mainstream Corporate Media today. So let’s take a moment to discuss how stunningly -intentionally- disconnected they are.

Always remember, there are trillions of dollars at stake; and these media entities have a vested interest in maintaining the Wall Street position, adverse to Main Street USA.

First the “negative yield curve” aspect; where long-term bond rates (returns on investment) are lower than short-term rates (returns). As Reuters proclaims:

“A key bond market metric turned negative for the first time since 2007 on Wednesday, sending stocks tumbling”…

I must admit, I actually started laughing out loud when I first read that proclamation. Allow me to introduce a radical concept in economics: “supply and demand” !

The long-term borrowing rate for return on investment dropped momentarily lower than the short-term borrowing rate of return on investment because massive numbers of foreign investors were rushing to buy long-term U.S. bonds. Wait… what? Yes, a ‘negative yield curve’ is what happens when everyone wants to buy bonds in your long-term economy.

There weren’t enough long-term bonds to fill the demand of those who wanted to purchase them. Ergo, the return rate of interest dropped because there was no need to have an incentive to sell them…. everyone wants them.

So the yield drops, because the U.S. doesn’t need to incentivize the sale… because everyone is lined up to buy them. See how that works?

Do lines of people wrapping all around the world trying to get to the U.S.A Bank and buy U.S. treasury bonds sound like the USA economy (underlying the bond) is weak or in trouble?

It’s OK to laugh out loud.

No, really, it’s ok.

Yes, Alice, it’s true. The financial media would have you believe that customers lined-up around the building to purchase your products means your business is about to close because of a lack of customers. THAT my friends is the stupidity of it.

The U.S.A economy is so strong, so healthy, and forecast to remain so with such intensity, that everyone wants to purchase dollars because it is the world’s highest predicted rate of return for investment….. And somehow the media can spin that into a bad thing.

No, really. That’s the narrative of today.

Now let’s look at the second stupid “A looming recession“:

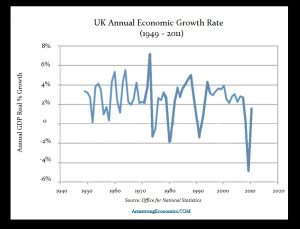

First, a “recession” is two consecutive quarters of negative GDP growth. That’s how you define a recession. So to start a recession you need need one quarter of negative GDP growth right? Well, duh, it hasn’t happened, and there is not a single economist who is predicting a negative Third Quarter growth rate (July, Aug, Sept., ’19).

First Quarter GDP growth was 3.1%. [Beating all expectations] Second Quarter GDP growth was 2.1%. [Again, beating all expectations]… and somehow the Third Quarter is suddenly going to be negative growth? It’s OK to laugh again.

So how does CNN et al “warn of a looming recession” when there’s not a single economist forecasting a negative GDP for the third quarter? Well, they make shit up that’s how.

Think about it…. if the economy was contracting, people would not be getting hired right? Employers would be laying people off right? Businesses would be selling off assets right? Wages would be dropping right?

Do you see any of these things happening?

No? Why not?

Because it ain’t happening, that’s what !!!

The U.S. economy is not shrinking. Main Street is strong, and getting stronger.

Go back to point #1, would the world be rushing to buy dollars if the U.S. economy was on the precipice of collapse? Think about it.

Now, that said, there are some economies that are shrinking; and they all have something in common. The manufacturing export dependent nations are in trouble because President Trump is starting to limit their access to their most desired customers, the USA. And President Trump is telling companies that operate in those export nations that it would be in their best interests to come to the United States to make their goods.

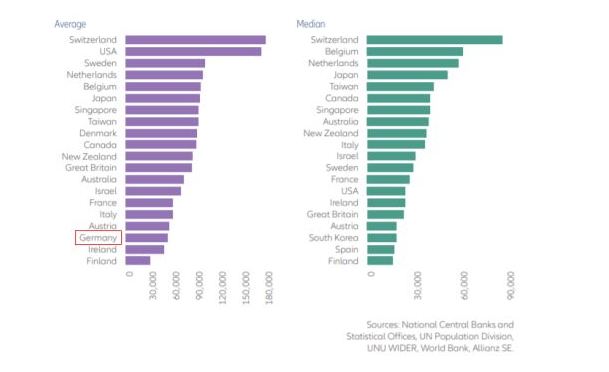

Germany, the economic engine for the EU, is a manufacturing export dependent nation, and it is contracting. China is a manufacturing export dependent nation and their manufacturing is contracting. But the U.S. is strong, because we are not dependent on exports. In fact the U.S. consumes more than 80 percent of what we produce; we are a self-sustaining economy.

Our U.S. economic strength is why Asian and European investors are rushing to buy dollars (US Bonds); and why the U.S. treasury doesn’t need to provide high yield rates as incentives to buy them (hence the negative yield curve).

Stop me when any of the U.S. economic data has even the slightest implication of a slowdown, or “looming recession”.

Our last jobs report showed 164,000 new jobs created in July (yeah, like two weeks ago). In addition 363,000 people moved from part-time to full-time employment… does that sound like a weak economic outcome? Current blue-collar wage growth is in excess of 3.4%, and current overall U.S. worker income is growing at a rate exceeding 5.4%.

Does any of that sound like what you see just before a “looming recession”?

(BEA Data Source – Link)

(BEA Data Source – Link)

Every actual data result exceeds expectations.

Every measurable KPI in the U.S. economy beats every forecast.

Show me data that supports this “looming recession” claim. Guess what; you can’t because it is a manufactured bucket of nonsense. Abject stupidity created in the basement of media narrative engineers and pushed into the U.S. mainstream talking points in an effort to create something that doesn’t exist. You know the word for that? “Gaslighting” !

Why?

Why are the financial pundits doing this?

Because the engine for the U.S. economy is the U.S. consumer. The Wall St./Media pundit goal is to erode consumer confidence, instill fear, and hopefully get people to sit on those high wages…. thereby creating a self-fulfilling prophecy.

This my friends is the battle behind Wall Street -vs- Main Street.

There are trillions of dollars at stake.