QUESTION: Marty; You warned that there would begin a cash shortage and real rates would rise in the private sector starting in September after Labor Day. Ok, it’s about 15 days past that marker and Repo rates have gone completely nuts hitting 10% forcing the Fed to intervene. They were calling it Armstrong’s revenge here in the dealing room. It certainly appears the Fed has lost control of short-term rates as you warned. Is this the start of the chaos you have warned about?

GD

ANSWER: It’s not my revenge, it’s fiscal mismanagement. Look, this is the chaos we have coming and sorry, it is the beginning, not the end. It’s not even a fluke or a blip. So get used to it. Indeed, the Fed has lost control of short-term rates. Trump can jawbone all he wants for zero to negative rates. Sorry! The free markets are showing something else lies in wait.

The Repo Rate reached a high of 10% by about 9 am just before the stock market opened. The fed funds rate was testing the Fed’s upper limit. The Fed was forced to intervene I believe for the first time since the 2008 crisis.

On Tuesday, the Fed offered $75 billion through its facility and received $53 billion of demand from borrowers who swap AAA Treasury holdings for cash at minimal rates. On Wednesday, the Fed again offered the same $75 billion facility and received this time $80 billion in bids.

Overnight financing (REPO Rate) is a basic function which holds the economy together. Those who trade on leverage rely on the REPO market (Broker-dealers, hedge funds, and institutional). It is rarely written about for it is not generally seen by the public. The events of the past few days is a clear warning sign of what I have been yelling about which is on the horizon. The central banks are TRAPPED and in Europe, they have destroyed their bond market with more than $15 trillion and perhaps up to $17 trillion in negative-yielding bonds ($1 trillion is corporate).

Before the 2007-2009 crisis, the Repo Rate was actually the only financial instrument which paid a rate of return that could become NEGATIVE under normal market conditions. NEGATIVE Repo Rates can happen when there is a shortage of cash or particular collateral security, like negative-yielding bonds, are put up to borrow against. Therefore, trying to borrow against a negative-yielding bond can present a crisis. The standard Repo contracts, such as the Global Master Repurchase Agreement (GMRA), have been drafted under the implicit assumption that general collateral (GC) Repo Rates would only ever be positive.

What has transpired is the buyers of these negative bonds have been simply traders. They have not bought this stuff to actually hold to maturity. They have been happy to trade them assuming rates would continue lower so it would be a bond rally. We are looking at SERIOUS credit risk once again but instead of the time bombs being mortgage-backed securities, this time it will be negative-yielding bonds issued by governments. The bond markets have been converted into a child’s game of musical chairs. When the music stops, someone will be left holding negative-yielding bonds that will only be salable at even deeper discounts of perhaps as great as 50% in a few years.

About 30% of the bonds issued by governments and companies worldwide are trading at negative yields which is now about $17tn of outstanding debt. This unprecedented reversal of normal practice has raised profound questions about the outlook for bonds. This is seriously impacting core holding for institutional investors.

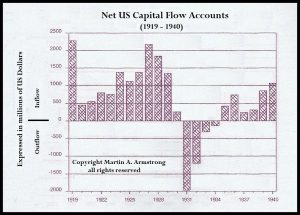

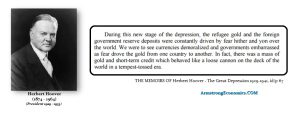

The interest rate risk that negative-yielding bonds carry is beyond unbelievable. It is totally artificial supported only by punters. The financial system simply doesn’t work with negative rates and this is also contributing to shortages of cash for Repo markets. A slight rise in interest rates will create a massive debt crisis and if you undermine the bond market, that is what creates great depressions. Negative yields have been confined to places outside the USA and the intervention of the Fed implies they are not prepared to allow negative rates to undermine the US economy as they have done in Europe.

Unlike the 2008 crisis where the time bombs were private debt, Tuesday’s abrupt rise in short-term rates wasn’t obvious that the financial system was in trouble because sovereign debt is assumed to be AAA and risk-free. Not sure whoever started that huge lie.

Nevertheless, we have a convergence of forces which are creating the perfect financial storm on the horizon. Immediately, corporate tax payments are due so corps have less cash to sell overnight. Then there are big Treasury auctions as deficits continue to rise for governments always borrow, yet never pay off the debt as if this can continue without end.

I have been warning that we are headed into a major financial crisis that will be a liquidity event which involves government – not simply the private sector as was the case in 2008. So buckle-up. I have been warning this is something NOBODY has ever witnessed before and if Socrates was actually alive, he would be screaming bloody-murder by now. The Institutional Bond Report will be going out to all our Institutional Clients. Those who have been thinking about joining our Institutional client base can purchase a copy $3,500