Tag Archives: glazier’s fallacy

Repo Crisis – Best Kept Secret Ever!

Armstrong Economics Blog/Interest Rates

Re-Posted Nov 29, 2019 by Martin Armstrong

COMMENT: Marty; I want to thank you for a great conference. It is clear you are the only true institutional adviser. Our board is very impressed. The FT reported that there is still no single factor that caused the dislocations in the repo market in mid-September. You are the only one who explains the event authoritative.

Thanks

JG

ANSWER: Nobody will talk publicly. Everyone is scared to death of starting a panic. This is the BEST kept secret I have ever seen in my career. The real test comes at year-end when banks typically step back from the repo market so that their balance sheets are smaller for December 31 regulatory calculations. We will see what really happens then on the chaos scale of 1 to 10. I find it really funny how there are articles calling it the new QE to where the Fed is clandestinely buying T-Bills through repo. This really seems to be an orchestrated effort at disinformation. It is hard to say if the people who make this up are deliberate agents of the government hired to keep people looking in the wrong direction.

The Rising Tension in Europe for Civil Unrest

Armstrong Economics Blog/Civil Unrest

Re-Posted Nov 27, 2019 by Martin Armstrong

QUESTION: Hello!

More and more people in western Europe are talking about the coming civil war between the Muslims/Arabs and the Europeans. Guillaume Faye has even written a book about it. I personally believe that it will break out between 2025 and 2050 and that it will start in France. Me and my friends are looking for some place to go before it starts. We are looking at eastern Europe. Have your computer anything on this coming civil war?

Thank you for your hard work.

IR

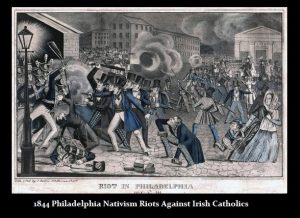

ANSWER: Economics is at the root of the crisis. In 1844, tensions rose and there were gun battles on the streets in Philadelphia against the Irish Catholics. This occurred in the middle of a depression from the Panic of 1837 with the sovereign debt defaults by states. Religion was involved to some extent, but the argument became that the Irish immigrants were taking the jobs and were willing to work for less.

In this case, the refugees get handouts from the state and then the state raises taxes on the citizens. This still is fueling the tensions and there is indeed a risk of civil conflicts and separatist movements. This is also the period where we should expect more anti-establishment parties rising because people are losing their lifestyles thanks to the career politicians who have created an economic catastrophe.

William Koch & Ancient Coins

Armstrong Economics Blog/Ancient History

Re-Posted Nov 26, 2019 by Martin Armstrong

QUESTION: I understand that the Koch brothers bought ancient coins. Is there any truth to that?

WJ

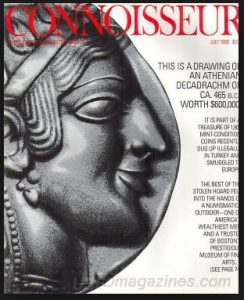

ANSWER: Oh, yes. William Koch was involved in a very famous case involving the Athenian decadrahms. There was a hoard discovered in Antalya by a television repairman and two other people back in 1984. They found a hoard of 2000 ancient silver coins with a metal detector. The hoard contained the rare Athenian decadrachms, which were produced as a commemorative 10-drachma coin. There were only 7 previously known examples. The Elmali Hoard contained 14 of them and became known as the “The Hoard of the Century.” The first one sold for $600,000 dollars, easily breaking the old record. The billionaire, William Koch of Boston, bought 1,800 of the coins for $3.5 million dollars. The Turkish Government knew that the treasure had been smuggled out of the country, but after it was taken across the border they didn’t have the slightest knowledge of its whereabouts. The treasure disappeared.

Based on the evidence, the Turkish Government started legal proceedings in Boston. The judge gave an important interim judgment in Turkey’s favor. Koch lost the hoard to Turkey

Britain GDP Has been declining ever since joining the EU

Armstrong Economics Blog/BRITAIN

Re-Posted Nov 25, 2019 by Martin Armstrong

REQUEST:

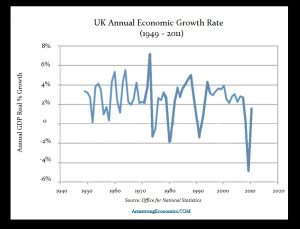

Hi Martin, I trust you are well. Would you post the chart you showed of how the UK has performed since joining the EU? I’ve been ploughing through your emails but am unable to find it. In short, I want to show my partners son the chart, who is a vehement ‘remainer’. Ie, evidence that the Uk would be better off leaving the EU.

Thanks for your help,

Cheers

Charlie

The Hunt For Taxes – Sell & Leave Before It is too late?

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Nov 24, 2019 by Martin Armstrong

QUESTION: Dear MR. Armstrong,

As a long time subscriber to your basic level Socrates,I’m very grateful for the guidance I’ve received.I have a question. In the hunt for taxes my Canadian government just assessed me over $80,000.00 for unreported income. I pay my taxes Mr Armstrong, the Canadian government pulled my bank records and although what I said was verified by those records, they refused to accept them! Even my tax lawyer was astounded.Now a difficult question for me.I’m retired and have no income presently.But I do own my on home.To pay off the CRA I’m considering getting a Reverse Mortgage on my home.They charge 6% monthly on the unpaid settlement so if I can get the RM at say 5% and use the extra to buy gold, perhaps over 5 years I can beat this burden.Would you recommend this strategy to your Mother or what else can I do.

Best Regards,

RW

ANSWER: Perhaps that is all you can do. The tax authorities are pulling those tactics far more often because they are broke and it will get far worse. I strongly advise to get a retirement visa from Thailand. You may have to just change your domicile to get away from this hunt for taxes that will continue to get worse. You are already hit. They will usually shift the burden of proof to you and just assume everything you have belongs to them. This is part of the economic tyranny we face.

It really is best to sell fixed assets in countries with aggressive tax agencies so they cannot take your home. Another thing they do, like the USA, is to cancel your passport if you owe them more the $50,000. We are economic slaves. We have truly lost all our freedoms.

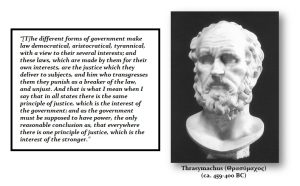

I do not know what else to say, You are dancing with the devil and the rule of law has vanished. Justice died with the beginning of direct taxation embracing the income tax and Marxism. Justice is indeed just the will of the government.

The Repo Crisis

Armstrong Economics Blog/Reports and DVDs

Re-Posted Nov 19, 2019 by Martin Armstrong

QUESTION: Marty; The goldbugs are back and claiming the Repo Crisis is MMT and this is again just printing money endlessly to cover up a major banking crisis in the USA so buy gold of course. You said at the WEC cocktail party this would happen because these people never understand the world economy. Is this because they are so fixated on the dollar crash to make gold viable?

Thanks for a great WEC. It was your best ever!

HN

ANSWER: Of course, they will call this Quantitative Easing and Modern Monetary Theory. They are biased and in favor of gold, which makes them incapable of being real analysts. First, you must establish a base method of inquiry which cannot begin with a predetermined conclusion that all paper money is evil and gold is the only real money. Because they begin with this PRESUMPTION, they only look at things to support that predetermined outcome. They fail to provide the reason or support their proposition with historical evidence. They never provide any collective investigation that would put their expectations in question.

The Fed is NOT engaging in QE nor is it engaging in MMT. The Fed is standing in the middle because banks do not trust banks. The crisis is by NO MEANS in the United States. They also fail to grasp why the dollar is the world’s reserve currency, the hoarding of dollars globally, or what this crisis is even about. They interpret any increase in the quantity of money as inflationary. We have had more than 10 years of QE in Japan and Europe with no inflation, which proves their theory is WRONG. They will never address that reality and instead constantly argue gold will rally with QE.

I will do a special report on the Repo Crisis because it just seems people are using this crisis to sell nonsense and outright bullshit. They are so far off the mark about the cause of this crisis, as always, and it would be funny if they were not misleading people into risking their entire life savings. The banks won’t talk to each other and the central banks are living in absolute terror that the truth will come out and the world will just go nuts.

I always seem to be in the middle of every crisis. Not sure how this happens. I get calls asking me what have I heard because nobody will talk among themselves but somehow they come to me to ask what I have heard. I am writing the report now because it just seems imperative to explain the real cause that the press will never print. Nobody will talk and the central banks cannot dare utter a single word about the source of the crisis for fear of creating a political crisis. Even the heads of states are being left in the dark. Trump has called for negative interest rates because he does not understand the crisis because nobody is talking. All they can do is pray at the foot of their bed every night to PLEASE let this crisis pass. Sorry, your prayers will not be heard.

Understanding the Repo Crisis

Armstrong Economics Blog/Banking Crisis

Re-Posted Nov 15, 2019 by Martin Armstrong

COMMENT: Marty, thank you for a great conference. The comments out there on the liquidity crisis have been just domestically focused. Thank you for keeping my eyes focused on international events and your analysis about the crisis at Deutsche Bank

GH

REPLY: The raid on Deutsche Bank in Germany back in September over the money laundering probe of Danske Bank, which is the biggest lender in Denmark, contributed to the sudden collapse in confidence. The governments are desperate for money and they are hunting it on a global scale. Deutsche Bank served as a correspondent bank to Danske’s Estonia branch. That is where the latest money laundering is alleged to have occurred. The banker there in the Estonia branch of Danske, Aivar Rehe, was found dead by police there in Estonia. He had been previously questioned by prosecutors and was considered to be THE key witness in the money laundering probe. As always, just like Jeffrey Epstein, his death was declared to be a suicide. This is standard whenever they need to cover something up. Boris Berezovsky suddenly commits suicide being very remorseful for making billions I suppose. Anyone who could expose things others do not want always seems to commit suicide.

The crisis in liquidity is that American bankers will NOT lend to Europe. Because of the European Banking Crisis, banks just do not trust banks. Nobody knows who will be standing after a failure at Deutsche Bank. The Fed has had to step in to be the neutral lender NOT because of a crisis in the USA, but because of the collapse in confidence in Europe’s banking system as a whole. Stay alert – this is just getting started.

Gold & the Future

Armstrong Economics Blog/Gold

Re-Posted Nov 13, 2019 by Martin Armstrong

QUESTION: Mr. Armstrong; First I want to thank you for your conference. It was my first time and I was impressed when your daughter asked how many people attended prior sessions. The number of people standing beyond 10 years was impressive. I spoke with one who had been at your 1987 WEC. He said you not only called the crash and the day of the low, but you said gold would rally only $25 and resume its decline. Now we have people still preaching how gold will rally because of the credit crisis they seem to lack the understanding of how it is unfolding. I just finished reading the Hoarding Dollars report. It is really outstanding.

Do you see these people preaching the end of the world so buy gold as just a broken record? I looked at the 1987 move. You were correct. Gold rallied begrudgingly and then resumed its decline. What will it take to make gold sustainable?

WK

ANSWER: The 1987 Crash was a FOREX crisis caused by the G5 trying to manipulate the dollar down. The rally in gold from 1985 to 1987 was simply because of the decline in the dollar. When the G5 tried to stop the decline in the dollar with the Louvre Accord in February 1987, the dollar continued to decline and that was the tipping point. The talk was that the central banks were impotent and could no longer control the economy. We are approaching that same moment in time, but it may flip back the other way. The collapse in confidence is concentrated in central banks OUTSIDE the United States. Eventually, that will migrate to the US and then we will see gold rally when people wake up and see that governments are lost.

Gold Standard & the Never-Ending Fantasy

Armstrong Economics Blog/Gold

Re-Posted Nov 12, 2019 by Martin Armstrong

QUESTION: Do you think it is remotely possible for any return to a gold standard? I believe these arguments are not realistic.

DR

ANSWER: The fringe fantasy of a return to the gold standard just never dies. If we did not have vast unfunded liabilities and rising socialism to contend with, then such a possibility of a partial backing is possible. But to back the currency by gold, even say 1%, the restraints upon government would be unbelievable. First and foremost, politicians could not run with all sorts of promises. Bernie and Warren would be outlawed. We are so far away from any possible fixed exchange rate it is laughable.

There is so much that would have to change politically and economically for any form of a fixed exchange rate system, no less one backed by gold or anything that would be limited. You simply have to comprehend that even attempts to fix the currencies have blown up like the pound in the ERM crisis and the Swiss-euro peg. There is just so much more to this than some fictional return to a gold standard. Bretton Woods collapsed because they fixed the dollar to gold. You cannot fix even gold and silver to an unchanging ratio.