Cashless Global Currency

Re-posted from the Canada Free Press By Dr. Ileana Johnson Paugh —— Bio and Archives—July 23, 2020

Money greases the wheels of exchange, and thus makes the whole economy more productive. The idea that everything should be cashless is problematic for so many reasons. Bartering is a good under certain circumstances and societies, but it relies on what Keynesian economists call a “double coincidence of wants,” making it less desirable than cash.

Cash is easier because it is a convenient medium of exchange, sometimes free from government prying eyes, a unit of account for quoting prices, and a store of value as long as the trust in government is not eroded and inflation is low.

From the people’s perspective, cash is freedom

Cash is lightweight, can have large denominational value, does not spoil, and is thus better than commodity money, i.e., cigarettes, bullets, chocolate, jewelry, gold coins, pelts, furs, soap, etc.

From the government’s perspective, it is easy to see why they would want a cashless society. Banning cash under the guise of it being infected by disease, of controlling money laundering of criminals and drug lords, and routing all of our income, every last penny through the banking system helps them better control everything we do, freezing accounts at will, while taxation becomes so much easier, including payments to Obamacare insurance and any financial penalties an individual is required to pay. It enables governments to track with 100 percent accuracy everything we buy and sell, everything we own, and everything we do.

From the people’s perspective, cash is freedom, but the leftist mainstream media is attacking it with pathetic excuses such as cash is physically dirty, expensive, potentially criminal, and obsolete 19th century technology, happily promoting the “war on cash.”

The media’s opposition sees the “war on cash” as another form of population control when people’s accounts can be raided and their owners classified as potential domestic terrorists, or denied healthcare, travel, education, and other services if they are marked with a “digital star.”

The issues with a cashless society are too many to mention them all:

Cashless Global Currency

- Total control by the state or its proxy

- Savings could result from not using special paper, printing, ink, labor, and metal alloys but then those in the trade would become unemployed

- If an attack occurs on the Smart Grid and there is no power, there are no financial transactions possible without some cash, a substitute, or barter

- In the event of a national disaster, i.e., earthquake, tsunami, hurricane, tornado, power outages, transactions can be made by cash, commodity money, or barter

- An EMP attack or intense solar flares would make cash or one world currency worthless and people will resort to theft

- A cashless or global currency would give banks extraordinary power with no cap on interest rates or their control

- Cashless transaction will always be traceable and thus the person’s location

- One world currency in a cashless market would eliminate exchange rates, currency trading futures, eliminate a substantial sector of the job market and thus revenues

- Black markets and illegal activities would be eliminated, and everyone will be forced to pay taxes on every penny

- Children under 18 would be excluded from holding credit cards and thus excluded from financial transactions without cash; no more grandma cash gifts, lawn mowing money, or rainy-day cash savings in a jar

- Prostitution will have to be legalized and client’s names become public record

- Billions of Muslims would lose hawala transactions which are based on cash

- Conducting monetary policy about money stock will be altered as cash disappears and one world government such as the U.N. would have to do it

- Labor will be purchased and sold with electronic credits and debits

- How would the value of one world currency be decided? Will it be tied to gold, silver, platinum, or some other precious metal or decided arbitrarily by the United Nations?

- The destabilization of economies via counterfeit currency between countries would be eliminated as a tactic of war if only one currency exists

- What would cyber attacks do to a single grid of digital money?

- What would happen to third world nations that are not so electronically wired and depend heavily on cash and barter? How could they possibly make transactions in digital money?

- Would there be electronic counterfeit of digital currency across the globe and who would police it?

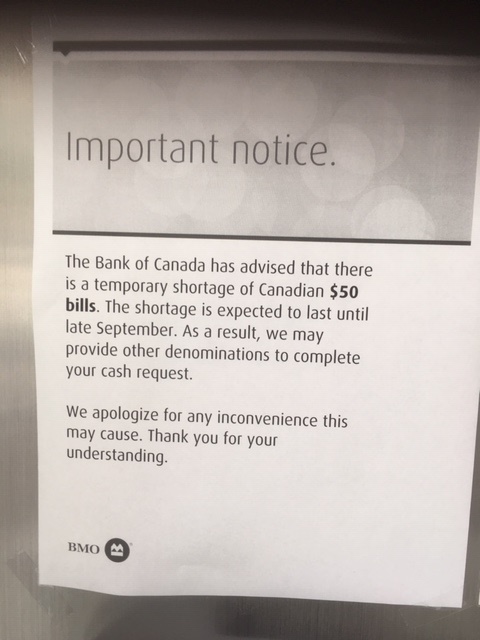

Yet “The Bank of International Settlements is getting headlines again because of its direction of central banks to go cashless.”