QUESTION: I have been following your blog for a number of years, public and private. I read the blog concerning “European Politics.” In it you state the capital flight will be a contagion. I understand what the influx of European capital will have on the DOW and S&P, but much less certain of the duration of the impact and contagion. My question is two part; 1) what impact will the contagion have on the US Dollar and how do you expect the US Fed to react interest rate wise and 2) duration of equities move up – short-lived or longer-term trend is your friend.

Thanks

CF

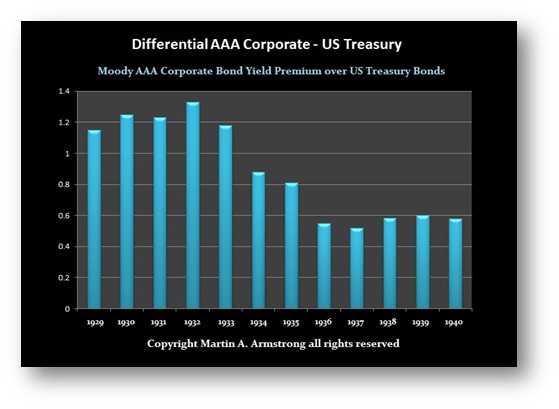

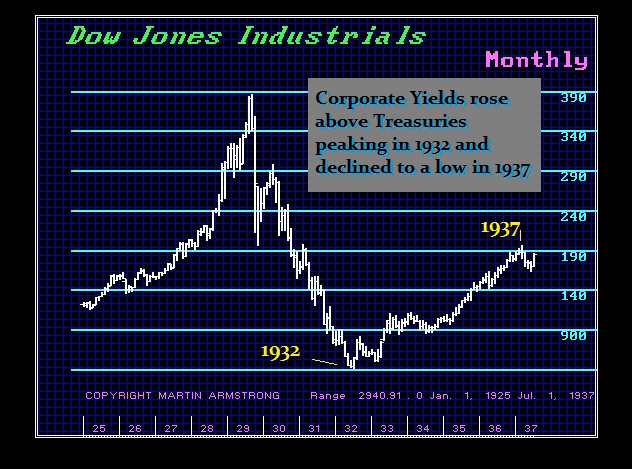

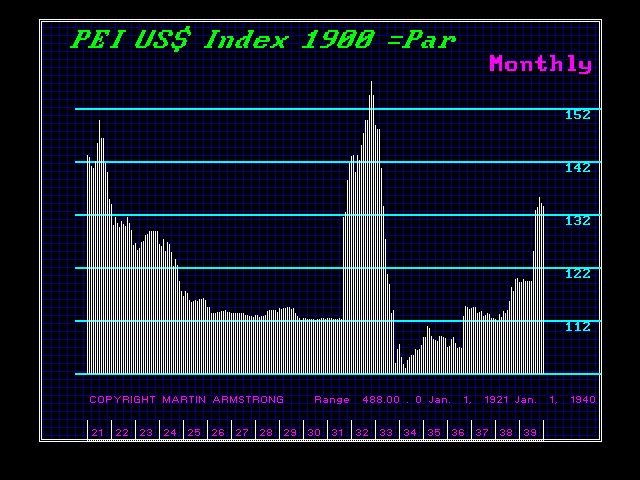

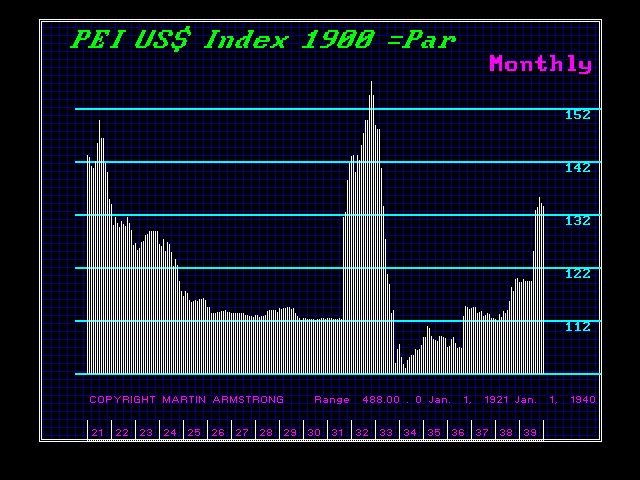

ANSWER: The contagion will last probably 2 years at best. There was such a contagion during the Great Depression. That is what Milton Friedman used to criticize the Fed. All this gold came to the USA pushing the dollar higher, but the Fed refused to monetize it. The backing of gold behind the dollar doubled between 1929 and 1931.

This time we are on a floating exchange rates system so the Fed cannot sterilize the capital inflows as it did during the Great Depression imposing austerity as Germany demand today. Today, the capital inflows are targeting the equities because the interest rates are artificially low. If the stock market explodes, the Fed will be criticized by Congress for creating asset inflation and creating a bubble with low-interest rates.

Unlike the Bank of Japan and the European Central Bank, the US bond market is the only thing trading. The Fed is not trapped as are the other central banks. At some point, the Fed will be obligated to raise rates to fight against the asset bubble, but that will then attract even more capital and push the BoJ and ECB over the edge.

Keep in mind that ONLY a rising dollar compel monetary reform in the USA. During 1934 Roosevelt devalued the dollar and in 1985 they created the G5 to stage an organized group to manipulate the dollar lower. All those people touting gold will rally and the dollar will crumble are clueless. A lower dollar will increase corporate profits and reduce trade deficits. ONLY a higher dollar will break the monetary system.