Tag Archives: Panics

Armstrong Economics, Three PRIVATE BLOGS Explained

Armstrong Economics Blog/Socrates

Re-Posted Feb 23, 2019 by Martin Armstrong

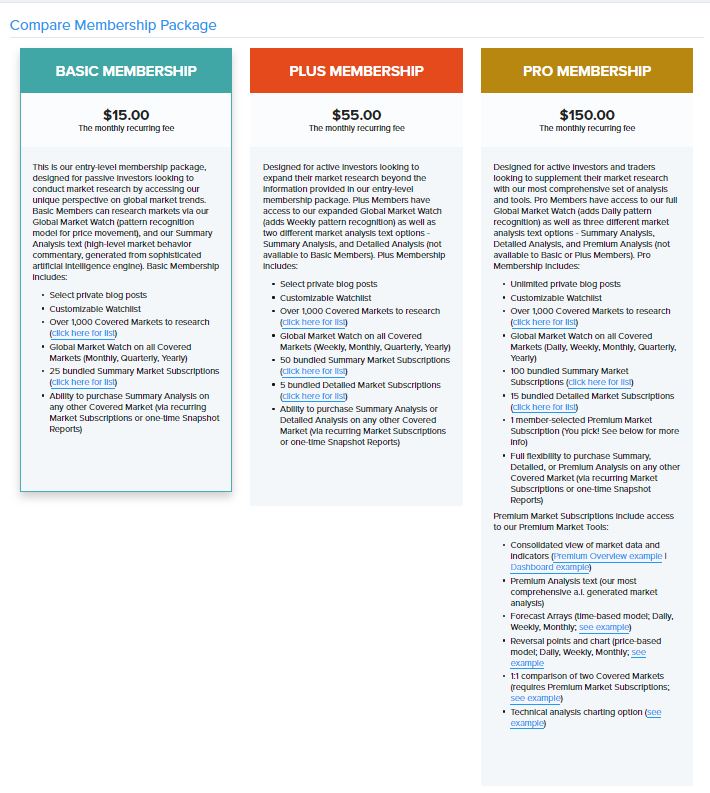

We have created three separate membership options for the Socrates Platform(www.Ask-Socrates.com) which are intended for three separate audiences. First, we have the BASIC Membership service at $15 per month which is intended for the average person who is interested in the broader term with respect to trends and not interested in short-term trading back and forth. Then we have the Plus Membership which provides short-term forecasting for the investor. The third level is the Pro Membership where reversals and arrays are available to access on over 1,000 markets worldwide (requires Premium Market Subscription or Snapshot Report). This is intended for active traders rather than investors who tend to be more position oriented (see comparison).

Then on top of all of this, we have our Institutional Level of service which includes hedging models among other information. While we try to target a version for everyone, it is difficult. The main goal has been to bring the ONLY FULLY FUNCTIONING Artificial Intelligence computer in the world focused on financial markets and global economy, proven over time, to the general public. This is free of personal bias. All of the market analysis (with exception of private blog post commentary) is written by the computer – not analysts. This inspires confidence for everyone knows there is no hidden agenda and there is no conflict of interest. The computer does not own property, mines, manufacture, and beside the fact that it cannot be bribed, it has not national patronage either.

I personally apologize for doing just one blog on Friday for the Pro Version. It is just that there are specific Reversals given so it is not designed to a general investor – we will create a broader view version over the weekend after closings. This is the difference between the three versions of the Socrates Platform, and corresponding private blog posts that are tailored to the three different groups of people we are servicing.

WE HAVE NOT YET COMPLETED THE NEW RELEASE OF SOCRATES

We are still working to finalize various aspects, including adding some additional features and forecasting modules over time. When we are finished with this initial rollout, we will make the formal announcement. Thank you.

Germany Brags It Has Record Surplus

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Feb 23, 2019 by Martin Armstrong

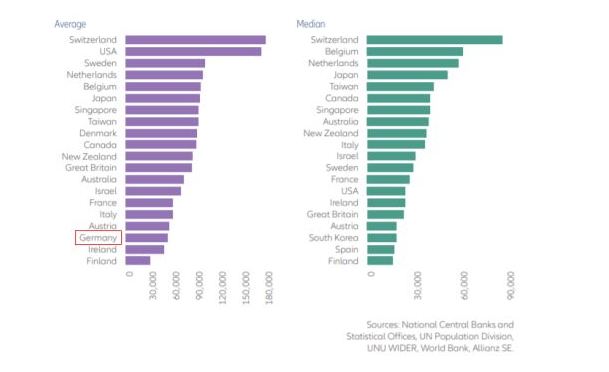

The entire AUSTERITY policy of Germany is really oppressing its people to the point that their assets rank nearly the lowest in Europe and below that of even Italy. A German earning just $75,000 annually ends up in the 50% tax bracket. The economics of Europe is really reducing the standard of living and this is really behind the Yellow Vest uprising. Germany has imposed its AUSTERITY economic philosophy upon the whole of Europe.

The entire AUSTERITY policy of Germany is really oppressing its people to the point that their assets rank nearly the lowest in Europe and below that of even Italy. A German earning just $75,000 annually ends up in the 50% tax bracket. The economics of Europe is really reducing the standard of living and this is really behind the Yellow Vest uprising. Germany has imposed its AUSTERITY economic philosophy upon the whole of Europe.

This is coming to a head with the clash over the Italian budget. This May we will see major elections in Europe and there is a rising tide against austerity. We are holding our WEC in Rome this year May 3-4, because this is an EXTREMELY IMPORTANT turning point for the entire world. The stock market rally in the USA from December was driven by capital pouring into the USA as Europeans bought what the Americans were selling. While retail participation is still at 50% of 2007 levels, brokerage houses are reporting that clients have record high cash in their account post-2009.

The impact of the May elections will set the tone not just for Europe, but for the entire world.

Why 50 Million Chinese Homes are Empty

Chicago – Where More People are Retired than Paying into Government Pensions

Armstrong Economics Blog/Pension Crisis

Re-Posted Feb 22, 2019 by Martin Armstrong

Over 80% of government pension funds are completely funded by the government with no employees paying into the funds. This reflects why governments are coming after the people and extorting more taxes under the threat of seizing your home and throwing you in prison. For 169 governmental bodies in Chicago, the numbers reveal the crisis. In Chicago, there are thousands of more retired state employees collecting pensions than active workers who are paying into it the pension funds. As reported, in a small suburban district known as the Arlington Heights Park District, there are 432 retirees collecting from that district’s pension fund with only 103 active employees paying into it. These shortfalls are expected to be funded by taxpayers.

What is happening in Chicago is indicative of the crisis engulfing Western governments as a whole. These people always counted on an increasing supply of taxpayers. But the birthrate has dropped as well as the marriage rate. The Democrats handed students to the bankers, removing all their rights to bankruptcy, and universities kept raising prices because funding for students would always be there. With over 60% of students now unable to find employment with the degrees they paid so dearly for, the future looks very bleak. They cannot buy homes because of their chronic debts. Marriage is declining and the under-30 generation has a majority that is not interested in even having children. There is a huge rise in VEGANISM as well.

The number of babies born in the United States continues to fall dramatically. The birth rate made a new record low during 2017, dropping 7% in a single year, according to the Centers for Disease Control and Prevention. Preliminary numbers for 2018 show that the decline has continued. The 1950s were called the “Baby Boom” when women had an average of 4.7 children in their lifetime. That has collapsed on a worldwide basis to 2.4 children per woman last year, and this decade is being called the great “Baby Bust.”

The global warming crowd should be ecstatic. They have reduced the human population growth by about 50%. The crisis now is there will be a shortage of taxpayers to fund their grand projects along with governments. Socialism cannot possibly survive when we exist to feed those in government who particularly never contributed to their own pensions

The Pension Crisis is Starting to Explode

Armstrong Economics Blog/Pension Crisis

Re-Posted Feb 21, 2019 by Martin Armstrong

At the current federal minimum wage of $7.25 per hour, working 40 hours per week, 52 weeks per year, yields an annual income of only $15,080. This is below the annual poverty line. It also reflects something that most people are unaware of — in Illinois, there are more than 19,000 retired teachers who get OVER $100,000 per year in their pension. According to the latest data, nearly 1.5 in ten federal employees are eligible to retire RIGHT NOW, and in five years the number will hit three in 10 or about 30%. The Housing and Urban Development Department in the federal government has the highest rate of employees eligible to retire right now of any major agency in government, which stands at a shocking 24%.

Under U.S. law, there are two broad types of retirement plans: defined-benefit (DB) and defined-contribution (DC) plans. The Defined-benefit plan has been mostly abandoned in the private sector because they were rapidly revealing how they failed to work. The DB plan use to come with a gold watch and ensured you some level of benefit for the rest of your life. This was all part of how to prevent another Great Depression. Typically, your employer would invest part of your compensation in the plan based on some formula. In some cases, you, the worker, might have added more money to the pot. The employer was required to send your defined benefit each month or quarter to a fund. Typically, this was in the form of a fixed-dollar amount, sometimes with periodic cost-of-living adjustments. That scheme ran into trouble that set standards for private-sector pension plans and defined their tax benefits under federal law because government wanted a piece of the action due to income taxes.

Most state and local government employees, actually 87% of those working full time, participate in a defined benefit (DB) pension plan. They contribute nothing but are simply guaranteed a pension on top of what they earned. These plans typically provide pensions based on members’ years of service and average salary over a specified period before retirement. On top of that, most members also receive cost-of-living adjustments that help maintain the purchasing power of their benefits during retirement. In the private sector, where defined contribution (DC) or 401(k)-style plans dominate, only 19% of full-time workers belong to DB plans. This is the real PENSION CRISIS. Government workers generally contribute nothing and demand tax increases to fund their pensions.

The DC plans emerged when the DB plans were showing signs of economic stress. The handwriting was on the wall. As taxes rose, the standard of living declined and governments wanted to regulate pensions to prevent too much money going into tax-free vehicles. The 401K is a kind of defined-contribution plan (as are various types of IRAs/Keogh/SEP plans, etc.) which emerged under the DC plan structure. Government regulations govern who puts money into the plan and how much. Typically, it’s you and your employer. Your employer also has to give you some reasonable investment options, but it’s up to you to use them wisely. Good luck. Most people have discovered nothing but losses. The advice for the general public has been biased, subject to conflicts of interest, and fragmented. This is because we have fragmented agencies (i.e. SEC & CFTC). The CFTC is regarded as the unqualified regulator. The lawyers there are the people who generally are turned down by the SEC. But the real crisis is that the regulations under the SEC and CFTC are exactly opposite. If you managed money under one agency’s rules, you went to jail under the other. This resulted in the development of offshore hedge funds where you paid a manager to make all the decisions, whereas domestically, a manger in stocks could not also advise on commodities. This resulted in conflicts of interest and has seriously harmed average people in understanding how to manage their own 401K.

Therefore, regulations have prejudiced the private sector while the public sector is predominantly under DB plans where government workers have no decisions they confront. This stark difference is coming to a head. Before 2032, there will be more people on retirement from government than actual workers. Taxes have NOWHERE to go but up dramatically because nobody is willing to look at reform. The new Modern Economic Theory is their answer — just print.

Alexandria Ocasio-Cortez & the New Democratic Socialists Call it a Victory to Lose 25,000 jobs

Armstrong Economics Blog/The Hunt for Taxes

Re-Posted Feb 20, 2019 by Martin Armstrong

In addition to Elizabeth Warren running in 2020 on a platform of imposing a 3% wealth tax on all assets annually, Bernie Sanders has also thrown in his hat to run for President. We also have people who actually wanted Alexandria Ocasio-Cortez to run for President arguing the 35 year age minimum was not fair. Other Democrats are starting to get really nervous for the big companies they count on for big bucks are starting to run away. Alexandria’s push for higher taxes to fund her Green New-Deal is giving a lot of Democrats deep concern about their funding. How can they justify outlawing air travel? Even Hillary counted on the bankers to line her pockets to take the presidency. They are not going to be there for Alexandra, Warren, or Sanders.

On the other is freshman Rep. Alexandria Ocasio-Cortez, who on Friday declared victory when Amazon announced it was having second thoughts about opening in Queens. Former New York Mayor Michael Bloomberg, demonstrated to the world that he too is either completely braindead, or pandering to the socialists. Bloomberg said that Amazon doesn’t really need any more tax breaks. He seems to be joining Alexandria against Governor Cuomo and New York Mayor de Blasio and Cuomo. Amazon announced it would NOT build in New York City after the attack it has received from Bloomberg and Ocasio-Cortez. You would think that at least Bloomberg would realize if one city offers a significant lower tax rate than New York, it is called COMPETITION!

On the other is freshman Rep. Alexandria Ocasio-Cortez, who on Friday declared victory when Amazon announced it was having second thoughts about opening in Queens. Former New York Mayor Michael Bloomberg, demonstrated to the world that he too is either completely braindead, or pandering to the socialists. Bloomberg said that Amazon doesn’t really need any more tax breaks. He seems to be joining Alexandria against Governor Cuomo and New York Mayor de Blasio and Cuomo. Amazon announced it would NOT build in New York City after the attack it has received from Bloomberg and Ocasio-Cortez. You would think that at least Bloomberg would realize if one city offers a significant lower tax rate than New York, it is called COMPETITION!

How 10% of the People Can Make a Difference & Real Estate’s Role

Armstrong Economics Blog/Politics

Re-Posted Feb 20, 2019 by Martin Armstrong

QUESTION: Dear Marty,

First I would like to thank you for all the help you provide especially for us little guys.

I’m from Barcelona, and happily attended the release of “The forecaster” when you were there a few years ago.

I’m under 30 and working my butt off trying to save what I can while paying rent with my partner on a smallish 50m flat (which has become prohibitevely expensive for young local people as rents are at all time highs).

Following your recomendations I’ve put my small savings into movable assets (US and European equities).

With regards to the chart you posted on Spanish Real Estate I was surprised to see the price still so near the bottom of the Housing Crisis. I live in Barcelona and prices are in most cases near or at all time highs for most of the city neighborhoods (of course in € nominal prices wich have dropped quite a bit in $ terms) but as you move away from the city the recovery has been more modest to say the least.

In Barcelona price increses are mostly due to foregneirs moving in and maybe also because people here don’t ussually invest in the stock market but instead put savings into RE (despite the housing bubble people have a big chunk of retirement savings into real estate).

RE is not cheap to say the least but I’m wondering wether I should contract a 30y fixed mortgage and buy a house. My biggest fears are two:

– If long term mortgages dry up I may find out in mkt to mkt loss positions on the house as prices might collapse.

– If the economy declines I have the risk of maybe being fired but still chained to a mortgage.

I fear the later specially since my father has been recently notified that he is going to get fired. The company he works for has decided to fire all employees who are up to 13y!!! close to retirement age (and will probably replace 1/4 of the workforce with cheaper labor).

Given the above do you think it’s still a good time to buy in the big Spanish cities like Barcelona using a fixed mortgage or that you might be better off renting and waiting for the collapse.

Thank you

A.

ANSWER: Barcelona is one of the most beautiful cities in Europe. It is even one of the best places to live. In terms of local earning power, yes, rent in Barcelona is high. In terms of international value, they are cheap, which is why you have so many foreign investors who have poured into your city. Even economically, Barcelona is extremely productive and this was in part behind the reason for the separatist movement. It also had its own history of separatist movements from the Roman Empire (see Maximus 409 AD).

You have noticed the foreign buyers. As the euro drops, the value of property will look cheaper to a foreign investor than domestic. If you stay in the city proper region, this will have an international bid based on currency. In real terms, of course, the property will decline in value. However, this is more of a short-term trend. We all need a place to live. If you can buy with a FIXED rate mortgage, then you will be better off and certainly do not do floating rates. The risk with banks remains that they will stop lending on property as loans turn bad and political turmoil unfolds. Soon it will be an issue of whether Spain will stay in the euro, or whether the euro even exists. The property in the rural area will always be cheaper. So it depends upon what your personal goals might be. Rural property where you have a bit of land and can grow some food is not a bad hedge. But it has been getting cold even in Spain, a country that normally supplies Europe with food during the winter.

We will be heading into a currency crisis. Tangible assets are the way to survive. The biggest problem with real estate is that you cannot take it with you. So keep that in mind. We need a place to live so that is the bottom line. You do not want all your wealth in one asset. You are young enough to survive the major government reset. That will happen. I remain hopeful that if enough people understand the causes behind this crash, then we can make a difference and push back against tyranny.

Make no mistake about it. Government will ALWAYS act in its own self-interest to survive. There has NEVER been a single government that has EVER admitted it is wrong. They must always suppress the people to survive. Remember one thing: even in the USA, there were only three presidents who ever won slightly more than 60% of the popular vote. So, about 10% of the people really decide the fate of nations. We do not have to convince 100% or even 50%. We just need that 10% to make a difference.

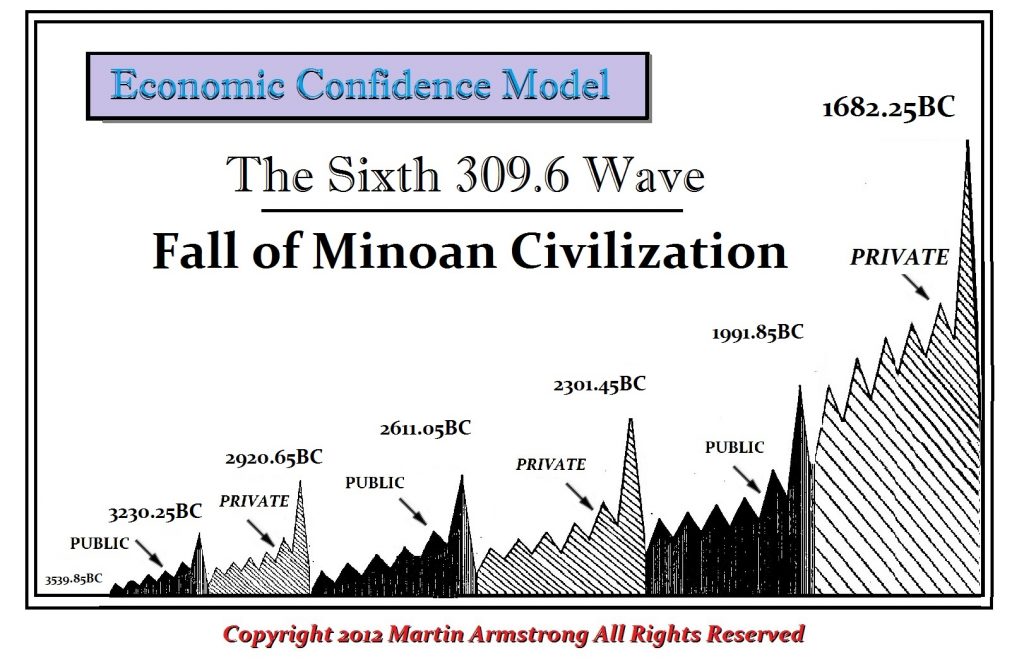

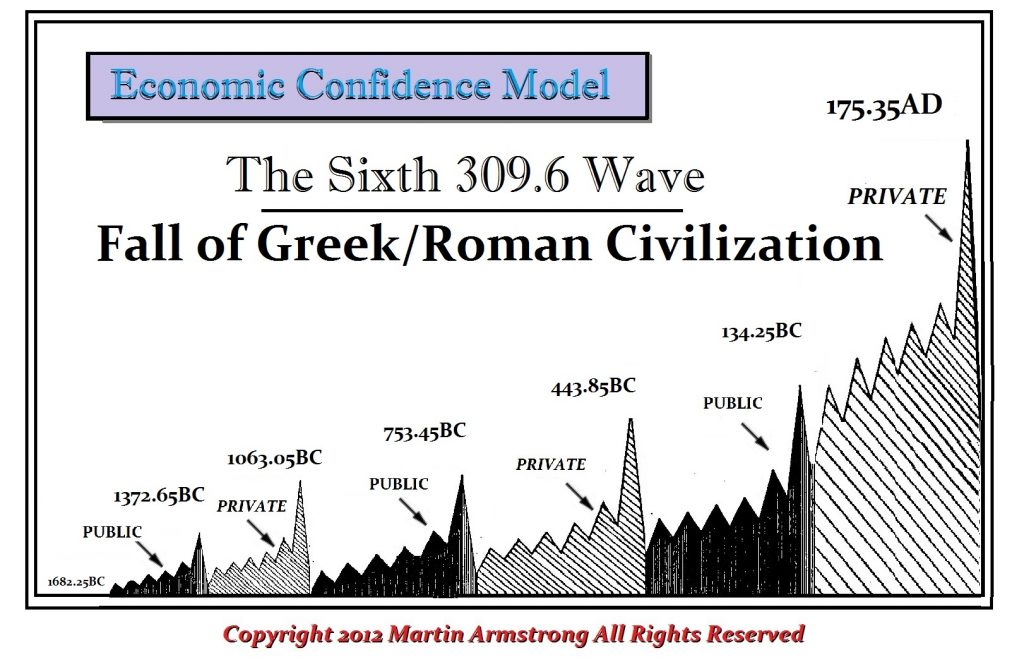

Explaining the Fall of Western Society As We Know It

Armstrong Economics Blog/ECM

Re-Posted Feb 18, 2019 by Martin Armstrong

QUESTION: Western Civilization will collapse by 2032.

I didn’t expect such a strong comment from you.

Specifically, what does this mean?

On the level of ancient Rome? Followed by the dark ages or just mediocrity and the rise of the East?

GVH

ANSWER: There is a serious risk that after 2032, this will be very much like the fall of Rome. Nonetheless, it is my personal hope that is we understand that risk, we can avert it and move to a new type of wave formation and learn from the past just once. At the lower threshold of risk lies that reality whereby at the very minimum we are looking at the collapse of centralized governments as took place in 1989 with communism. That will result in greater separatist movements and the breakup of national states as we know it today. The USA could break into four main regions. Britain would find it too splits and Scotland, as well as Wales and Ireland, revert back to their origins. The idea of centralized power in Europe will fail. There are even separatist movements in Germany beginning to rise with Bavaria against the north.

The fall of Rome moved back into a separatist trend. Even when Rome fell, that barbarians were imitating Roman traditions. They began to issue coins in the name of the East Emperor just to try to pretend that they were the rulers of the West.

Eventually, gold vanished from the money supply for nearly 600 years. It did not reappear until 1232 with the first coin being issued in Brindisi. This was issued in order to conduct trade with Byzantine and Arabs.

So what the computer is showing is the rise in civil unrest and the risk of war. Just look at what took place at the State of the Union – there is no UNION. This nonsense the Democrats have engaged in has fired the first shot that will be heard around the world. They opposite absolutely everything that Trump says or does and when the political tide switches, the Republicans will do the same to them. It is over. There is no common ground or going back.

This is part of what the computer is forecasting – the collapse of governments as we have known. NEVER before has anyone dared to say that the president was not “their” president. We always accept the winner even when it was someone we voted against. That acceptance no longer exists. Furthermore, we are looking at the collapse of socialism the same as communism. Both were derived from Karl Marx. They are both unsustainable economically. The pension system is collapsing. Just look at Illinois as an example. The state, provincial, and municipal levels of government cannot create money. All they can do is raise taxes to force people to pay state employees that were promises endless money for life.

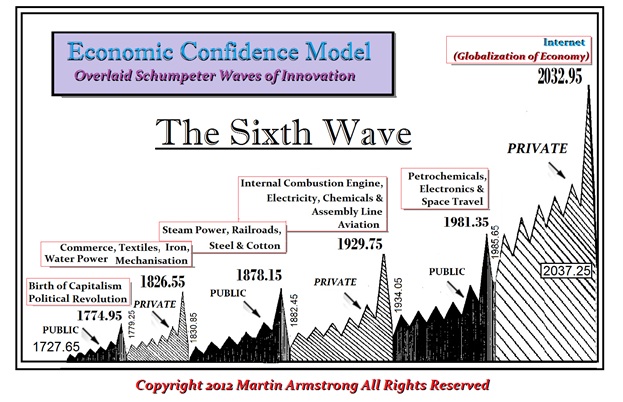

Where Does the Collapse of 2032 Come From?

Armstrong Ecomonics Blog/ECM

Re-Posted Feb 18, 2019 by Martin Armstrong

QUESTION #1: Thank you for choosing to live the strength of your convictions – especially through the terrible dark days of your solitary confinement. Thank you for all that you are doing for those of us who choose to watch, think and learn.

QUESTION #1: Thank you for choosing to live the strength of your convictions – especially through the terrible dark days of your solitary confinement. Thank you for all that you are doing for those of us who choose to watch, think and learn.

For over a decade I have been reading that China will replace the US as the world power in 2032 – not the early 30s or the decade of the 30’s, but that exact year. How is it that sources such as the Economist have been predicting this year as the year of change for such a long period of time? It looks like your computer is saying the same thing, when you state that “Western society will crumble by 2032.” What information is causing so many disparate reputable sources to cite this specific year?

K

QUESTION #2: It seems very odd that many others are starting to claim 2032 is the turning point. A friend of mine works at a magazine in London who has used that 2032. I asked him if they relied on your work. He smiled and just said they can’t mention you for political reasons. What is that about? Do you know?

DP

ANSWER: The computer projects 2032. It is not my opinion or premonition. How they justify 2032 from an “opinion” perspective is beyond me. I do not believe anyone can give such a date with conviction from any current economic theory. It is strange that they will not cite our work. I think they fear repercussions from the governments that stick their foot into everything. Yet, governments are monitoring this perhaps out of their own self-interest. Shutting me up will not stop the clock from ticking.

I have no idea how it is possible to arrive at such a date off the top of your head. Even if you look at economics, the crisis begins 2020/2021. The year 2032 is by no means the beginning of the process, but rather the end.